Table Of Content

Gold isn’t just shining — it’s surging. In early 2025, Google Trends showed a 60% spike in searches for “how to buy gold”, matching gold’s price rally past $3,000/oz.

But here’s the catch: the more interest gold gets, the more scams pop up. From fake bars sold online to shady dealers pushing overpriced coins, buyers need to tread carefully.

Before You Buy: How to Identify the Safest Gold Dealers

Buying gold can be a great long-term move — but only if you’re buying from the right source. With gold scams on the rise, it’s critical to separate legit dealers from risky ones.

Whether you're shopping online or in person, use these checkpoints to protect yourself:

-

BBB Accreditation & Strong Reviews

Look for dealers accredited by the Better Business Bureau (BBB) and carrying an A+ rating. Also, check Google, Trustpilot, and even Reddit for consistent reviews.

Be wary of sellers with a flood of recent 1-star ratings or unresolved complaints.

-

Clear Buyback Policy

Legit dealers don’t just sell — they’ll also offer to buy back your gold.

A solid buyback program suggests they stand behind the authenticity and quality of what they sell.

-

Multiple Secure Payment Options

Credit cards, wire transfers, and even crypto are commonly accepted by reputable dealers.

Avoid those that insist on payment by gift card, money order, or pressure you into wiring money to unknown accounts.

-

Insurance & Secure Shipping

Online purchases should come with insured shipping and discreet packaging. You should receive a tracking number and delivery confirmation for every order.

-

Check Certifications

Top dealers often sell gold that’s certified by trusted institutions like:

LBMA (London Bullion Market Association)

COMEX-approved refiners

ISO-certified mints

If a coin or bar is from a well-known mint (e.g. Royal Canadian Mint, Perth Mint), you’re typically in good hands.

-

No High-Pressure Sales Tactics

Pushy reps urging you to “act fast” or buy rare coins instead of bullion are a red flag. Safe dealers let you take your time.

-

Visible Contact Info & Real Address

If you can’t find a business address or working phone number, walk away.

Online vs. In-Person Gold Buying: Which Is Safer?

Each method has pros and cons — and safety depends on the specific seller, not just the format.

That said, online gold buying offers more transparency, reviews, and competitive pricing. But you must use trusted websites.

In-person buying can feel more secure for first-timers, but risks include cash-only sales and fewer consumer protections.

Feature | Online Buying | In-Person Buying |

|---|---|---|

Price Transparency | High (live updates) | Often limited or vague |

Consumer Reviews | Readily available | Hard to verify |

Payment Security | Credit card, wire, crypto | Often cash-based |

Physical Inspection | Not possible pre-purchase | Yes |

Risk of Scams | Low with trusted sites | Medium if buying from individuals |

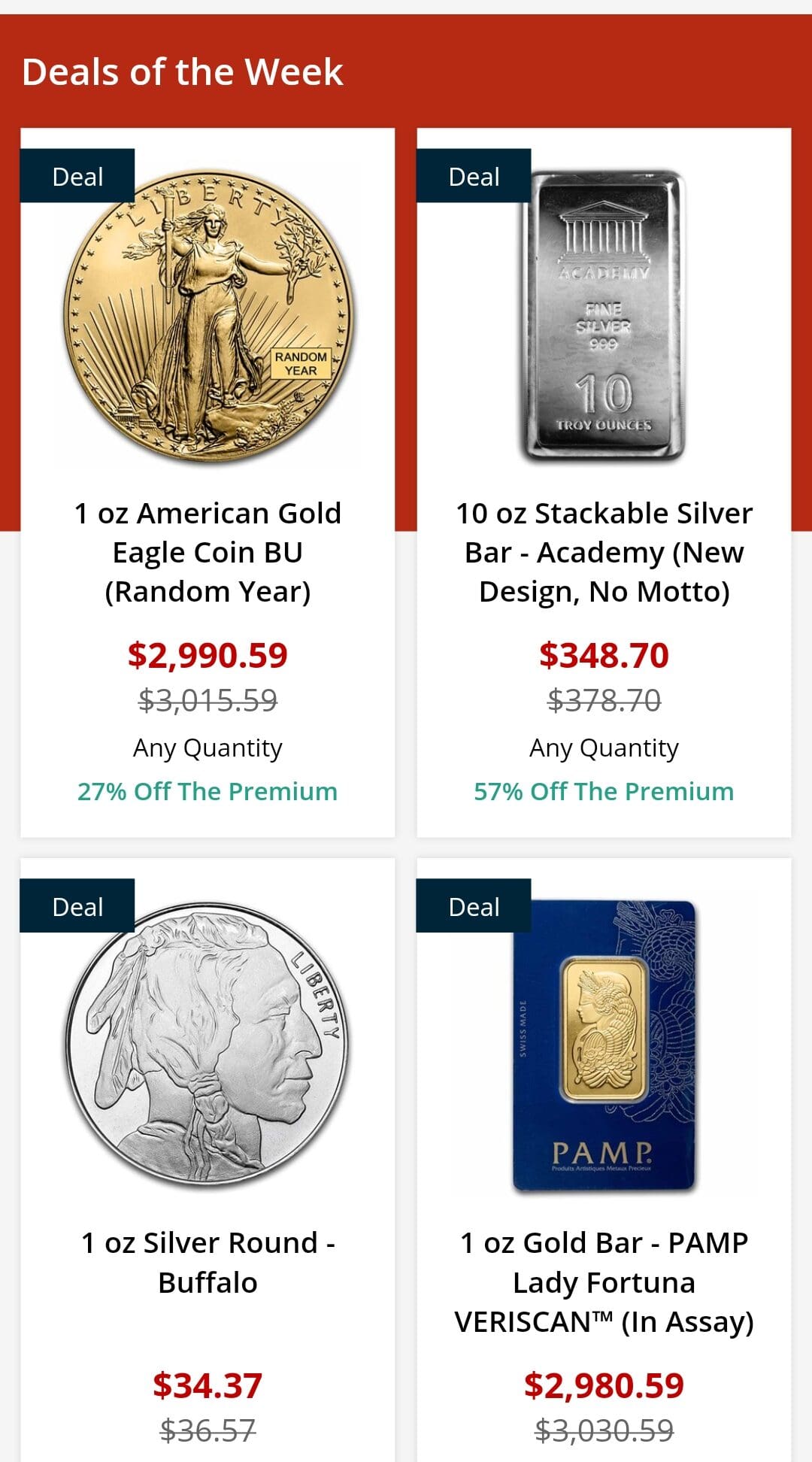

Trusted Websites for Buying Gold Online

Buying gold online can be fast, secure, and surprisingly affordable — if you stick with reputable dealers.

Below are five well-known platforms that consistently earn high marks for pricing, service, and delivery:

JM Bullion

JM Bullion is a top-rated U.S. dealer offering a wide range of gold and silver bullion with real-time pricing.

They offer free shipping on orders over $199, accept various payment methods (including crypto), and have thousands of strong customer reviews on Trustpilot.

Their interface is beginner-friendly and includes price charts and education tools.

SD Bullion

Known for its competitive pricing and regular deals, SD Bullion is a trusted name among serious gold buyers.

They offer a wide selection of bullion products, fast shipping, and robust insurance policies.

Their website is straightforward, and they regularly run promotions like discounts or free shipping.

APMEX

One of the largest online precious metal dealers, APMEX offers extensive product options, including coins, bars, and rare collectibles.

Their platform includes a “Portfolio Tracker” to manage your holdings, and they back all shipments with full insurance. APMEX also runs a loyalty program for frequent buyers.

Money Metals Exchange

This platform is especially appealing to new investors. They provide educational materials, competitive pricing, and automatic monthly purchasing plans.

Their site emphasizes transparency and even features a vaulting service for secure storage.

How to Avoid Fake Gold: Spotting Counterfeits

With gold prices soaring, counterfeit products have become more convincing — and more common. Fake coins and bars often look real but are made of cheaper metals. Here’s how to spot them:

Check Weight and Dimensions

Real gold has a very specific weight and size. Use a scale and calipers to confirm accuracy against mint specifications.Use a Magnet

Gold isn’t magnetic. If your gold sticks to a magnet, it’s likely fake or mixed with base metals.Look for Red Flags in Appearance

Blurry designs, rough edges, or missing details on coins and bars can signal a fake.Sound Test (Ping Test)

Gold has a distinct ringing sound when tapped. Counterfeits often sound dull or flat.Ask for Documentation

Real gold often comes with a certificate of authenticity or is sealed in an assay card.Avoid Deals That Seem Too Good to Be True

Deep discounts on gold are usually a red flag. Always compare prices with spot value.

FAQ

It’s risky because scammers can easily sell fake gold. These platforms offer limited protection, so it’s safer to stick with professional, vetted dealers.

Check the coin’s weight, diameter, and purity stamp. You can also use tools like a magnet or gold verifier to confirm it’s genuine.

Yes, counterfeiters often copy real markings. Don’t rely on stamps alone — always verify weight, purity, and source.

Some are, but many don’t offer guarantees or authenticity certificates. Do your research and test any gold you buy from a pawn shop.

Premiums cover minting, distribution, and dealer costs. Coins often have higher premiums due to design, collectibility, or demand.

Only if the dealer offers a return window. Policies vary, so always read the fine print before buying.