Charles Schwab | Fidelity | |

Monthly Fee | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

|

Account Types | Brokerage, Retirement, Wealth Management | Brokerage, Retirement, Wealth Management |

Savings APY | 0.05% | 3.89%

|

Minimum Deposit | $0 – $500,000

$0 for brokerage account, $5,000 for Schwab Intelligent Portfolios, $25,000 for Schwab Intelligent Portfolios Premium, $500,000 for Schwab Wealth Advisory | $0 – $2M

No minimum for Fidelity Go® and brokerage, $500,000 for Fidelity® Wealth Management, $2 million for Fidelity Private Wealth Management®

|

Best For | Active Traders, Retirement, Robo Advisor | Technical Traders, High Net Worth, Financial Planning |

Read Review | Read Review |

Schwab vs. Fidelity: Compare Features

Schwab and Fidelity are great options for long-term, cost-conscious investors thanks to their low fees, wide selection of low-cost funds, and solid retirement planning tools.

Their platforms are ideal for hands-off investors who want to build wealth gradually. Here's a comparison of their investing features:

Fidelity | Schwab | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | Full Access To Almost Any Asset |

Investing Types | Stocks, Options, ETFs, Bonds & CDs, Mutual Funds, Money Market Funds | Stocks, Options, Futures, ETFs, Bonds & Fixed Income, Forex,Mutual Funds, Money Market Funds |

Automated Investing | Yes | Yes |

Paper Trading | No | Yes |

IPO Access | Yes | Yes |

Dedicated Advisor | Yes | Yes |

Tax Loss Harvesting | No | Yes |

-

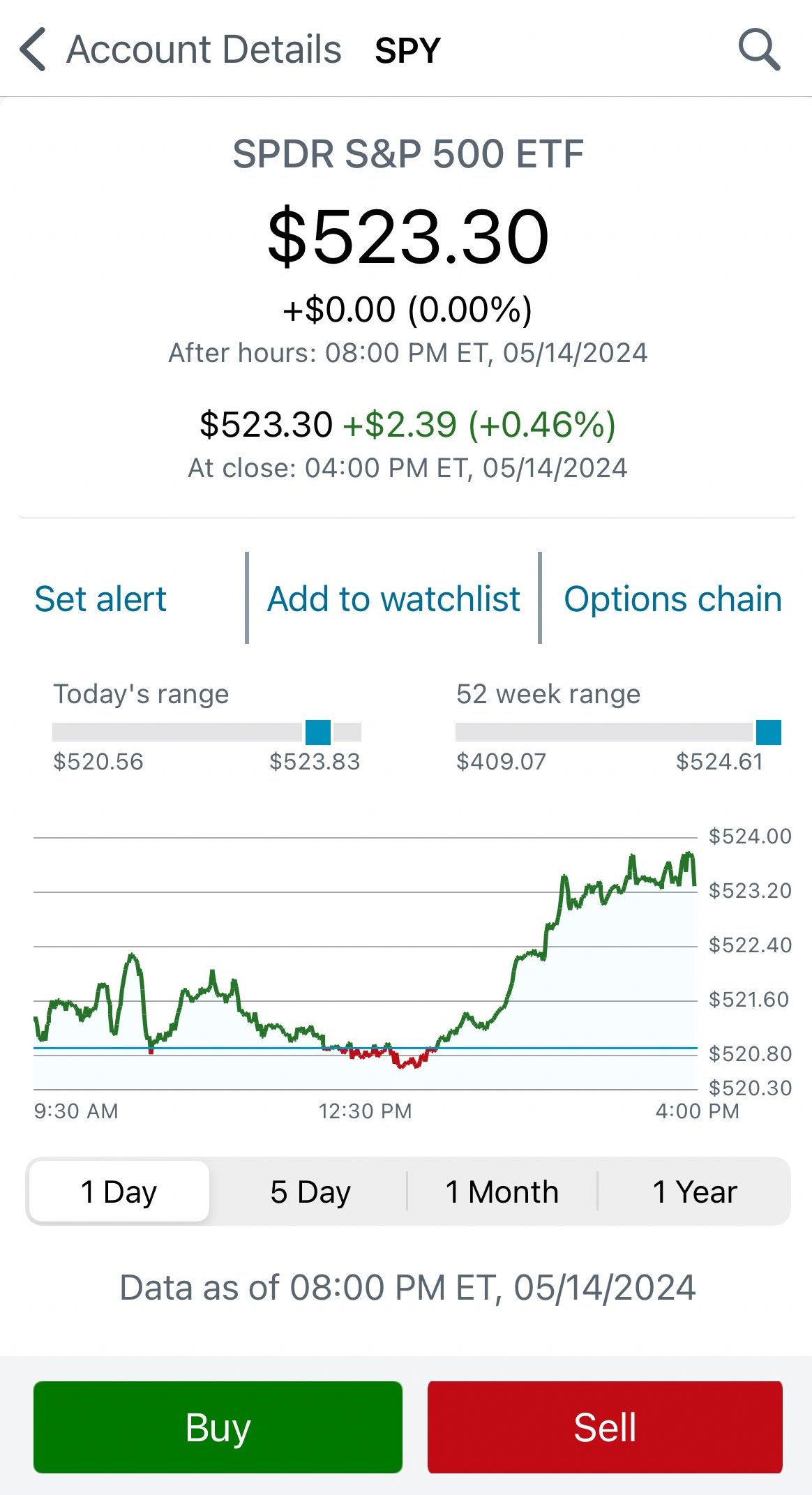

Self Investing And Fundamental Analysis Options

Fidelity is our winner in self-investing, but the difference is insignificant.

Fidelity also excels in providing a broad array of investment options, along with sophisticated research tools and analytics.

Investors can access in-depth financial statements, analyst ratings, earnings reports, and valuation metrics for individual companies.

On the other hand, Schwab stands out with its research tools, giving you insights from their team and expert commentary.

You can get real-time alerts, use stock screeners, and explore plenty of educational resources to boost your trading strategies.

Investors can also buy fractional shares, practice trading with Schwab Paper Money, and access IPOs.

-

Trading Options And Technical Analysis Tools

Both Schwab and Fidelity offer powerful trading apps.

Fidelity offers good charting capabilities through its Active Trader Pro software, allowing users to customize charts with a wide range of technical indicators, such as moving averages, Bollinger Bands, MACD, and RSI.

Fidelity also provides advanced drawing tools that allow users to add trendlines, Fibonacci retracements, and other visual aids to their charts, helping to identify key support and resistance levels

The Thinkorswim platform is designed for active traders, providing extensive trading options and advanced tools. It offers real-time market data, helping you analyze stocks, options, futures, and forex.

Thinkorswim also has great charting features, allowing you to create custom charts with various indicators, making it ideal for traders seeking deeper market insights.

-

Robo Advisor And Automated Investing

If you need a robo advisor, both Schwab and Fidelity, offer great options.

Schwab’s Intelligent Portfolios provide a flexible robo-advisory experience with no management fees and over 80 low-cost ETFs.

If you prefer a mix of automated technology and human advice, you can do it for a monthly fee. Then, Schwab’s Personal Advisor adds professional financial guidance to the robo-advising service.

Fidelity’s robo-advisor, Fidelity Go, is designed for investors seeking a hands-off approach with simplicity and low fees.

Fidelity Go offers a straightforward, tiered pricing structure with no advisory fees for accounts under $25,000 and a modest 0.35% fee for larger balances.

-

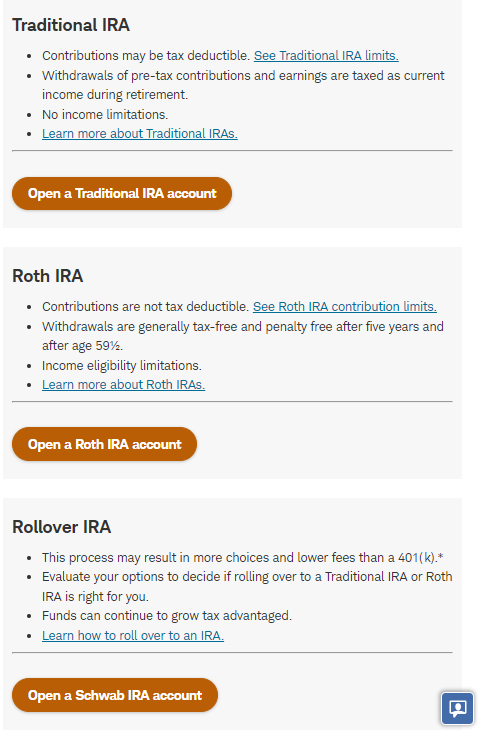

Retirement Accounts

Fidelity is our top choice if you're focused on retirement investments, particularly planning, as its services are highly geared toward retirement-focused strategies.

It is widely recognized for its comprehensive suite of retirement products, making it a go-to platform for retirement planning.

Fidelity also excels in providing access to professional advice, allowing investors to consult with dedicated advisors to tailor retirement plans that include strategies for tax efficiency, estate planning, and more.

Schwab offers a variety of retirement accounts, including traditional, Roth, rollover, SEP, and Simple IRAs. This is particularly useful for small business owners and those needing flexible options.

They also have Schwab Personal Choice, a self-directed retirement brokerage account.

-

Fees

When it comes to fees, Schwab seems to be a bit more affordable.

Fidelity and Schwab offers commission-free trading on most stocks and ETFs and low fees on other investment options.

Schwab | Fidelity | |

|---|---|---|

Fees | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

|

For those who need a robo advisor, Fidelity Is actually free for a small portfolio of up to $25,000, while Schwab Intelligent Portfolios remains free, for any amount managed

-

Cash Management And Savings Rates

Schwab is our winner when it comes to cash management due its various banking options.

Schwab | Fidelity Cash APY | |

|---|---|---|

Savings APY | 0.05% | 3.89%

|

Fidelity’s Cash Management Account stands out for its flexibility and comprehensive features. For those looking for pure savings, Fidelity offers the FDIC Insured Deposit Sweep Program, but the rates are not so competitive.

Schwab shines in cash management too. Their Investor Checking account has no monthly fees, unlimited ATM fee reimbursements worldwide, and no foreign transaction fees.

You can easily pay bills, deposit checks through your phone, and receive real-time transaction alerts, although the interest rate on uninvested cash is pretty low.

-

Wealth Management Options

Both Fidelity and Schwab offer great options for those who need wealth management plan.

Schwab’s Wealth Advisory service offers personalized investment strategies created by certified financial planners, focusing on your long-term goals.

For those with larger portfolios, Schwab Private Client Services and Schwab Private Wealth Services provide dedicated access to a financial advisor for customized advice and planning tailored to your situation.

Fidelity offers two main tiers of wealth management services: Wealth Management and Private Wealth Management.

- Wealth Management, designed for clients with a minimum of $500,000 in investable assets, provides a dedicated advisor to develop a customized financial plan covering retirement, estate planning, tax strategies, and investment management.

- Private Wealth Management is for clients with at least $2 million in managed assets or $10 million in total assets with Fidelity.

Bottom Line

Overall, Fidelity may be a better option for investors and retirement, but the differences are not significant.

Both brokerages offer great options for traders, plans for wealth management, and sophisticated auto-investing platforms.

Fidelity vs. Competitors: How Does It Stack Up?

Fidelity excels in investment options, wealth management, and retirement planning. Webull trading platform is one of the most fascinating we've seen.

Both platforms have great options for investors, but Fidelity excels in comprehensive retirement planning and cash management options

Interactive Brokers vs. Fidelity: Which Brokerage Suits Your Investing Style?

Fidelity is our winner due to its investment options, research tools, advanced trading features, and excellent retirement planning services.

J.P. Morgan Self-Directed Investing vs. Fidelity : A Side-by-Side Comparison

Fidelity has more investing options, cheaper robo-advisor, and more banking options. Merrill is better for Bank of America customers.

Fidelity in retirement planning and personalized wealth management, while E-Trade stands out with its research tools and competitive savings rates

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners

Fidelity is our choice due to its better retirement options and more extensive trading app. But, the differences are insignificant.

How Schwab Compares to Other Online Brokers

Schwab offers more options for investors, including robo advisors and wealth management, while Robinhood is best for beginners and traders.

Schwab provides broader tools and analysis options for long-term, value investors, while Interactive Brokers is more suited to active traders.

Schwab vs. Interactive Brokers: Which Brokerage is Right for You?

Schwab is our pick for long-term investors, wealth management, or retirement. E-Trade may be better for traders and cash management.

While Vanguard appeals to buy-and-hold investors, Schwab’s platform is designed for those who want to engage actively with the market.

Schwab surpasses JPM self-directed in most categories, including self-directed investing, robo advisory, and technical analysis.

Schwab vs. J.P. Morgan Self-Directed: Which Brokerage Is Best?

Schwab is our winner for investors and traders. However, the differences between brokerages are not significant. Here's our comparison: