|

| |

|---|---|---|

SD Bullion | Goldco | |

Min. Investment | $0 | $15,000 / $25,000

$15,000 for cash purchases / $25,000 for gold IRA |

Established | 2012 | 2006 |

Storage Fees | 0.29% – 0.39%

Starts at $9.99. 0.29% annual fee for gold amd platinum products, 0.39% for silver | $100 – $150

Non-Segregated: $100 | Segregated: $150 per year . Estimated annual fee. |

Coin & Bar Selection | Available in multiple weights | Limited to IRA-approved sizes |

Payment Methods | Cards, PayPal, Wire, eCheck, Crypto | Bank transfer, card (with guidance)

|

Pricing Transparency | Real-time spot price updates | Prices not shown online

|

Best For | Budget-conscious buyers, small orders | IRA-focused buyers making large, guided purchases |

Our Rating |

(4.3/5) |

(4.7/5) |

Read Review | Read Review |

Customer Satisfaction: Who Ranks Higher?

Goldco leads when it comes to customer satisfaction. With a near-perfect 4.8 rating on Trustpilot and Google, plus thousands of 5-star reviews on BBB and Consumer Affairs, Goldco consistently earns praise for its responsive support and transparency.

[elementor-template id=”203484″]

SD Bullion also scores well — especially for pricing and product selection — but its Trustpilot rating is slightly lower at 4.3, and its Sitejabber score (3.3) pulls its average down.

[elementor-template id=”203456″]

While both are trusted dealers, Goldco has the edge in ratings based on volume and consistency of positive reviews.

Buying Precious Metals Online: Who Does It Better?

When it comes to buying physical gold and silver, SD Bullion is the better choice for most investors.

SD Bullion clearly caters to hands-on buyers. It offers a massive range of metals including gold, silver, platinum, palladium, and even copper — ideal for investors and collectors alike.

Fractional sizes are available, and buyers benefit from transparent spot pricing, real-time price locks, and frequent deals.

Shipping is free on orders over $199, and storage is optional but affordable through the SD Depository.

Goldco, while highly reputable, is more selective in its direct product line — focused solely on IRA-approved gold and silver. There’s a $15,000 purchase minimum and fewer customization options.

While Goldco excels in customer service and offers guidance, investors looking to place smaller or varied orders may feel limited.

SD Bullion also supports multiple payment options including crypto, which adds more flexibility. Goldco accepts standard payments but does not offer online checkout or detailed product pricing on its website — requiring a consultation for most orders.

Overall, SD Bullion is our winner for direct gold and silver purchases due to its product variety, lower prices, and flexible order minimums.

Which Is Better for Gold & Silver IRAs?

Goldco is the winner for Gold and Silver IRAs due to its deep specialization, higher transparency, and robust support throughout the rollover and investment process.

hey make the rollover process seamless, have high-quality IRA-approved metals, and provide extensive educational resources to help new investors understand the process.

Goldco clearly outlines its fees — $50 to set up, $80 for annual maintenance, and storage fees from $100–$150 — giving investors confidence in the costs upfront.

The Buyback Guarantee also offers long-term liquidity assurance.

SD Bullion also provides a solid IRA setup process, working with multiple custodians like Kingdom Trust and New Direction Trust. It offers a good selection of IRA-approved metals and secure storage through SD Depository, with free storage for the first three months.

However, its IRA fee structure is vague, requiring customers to inquire directly. While customer service is solid, it lacks weekend support and live chat, which could slow down time-sensitive decisions.

For investors with at least $25,000 to invest and a focus on retirement diversification, Goldco’s clarity, expertise, and reputation make it the stronger option.

Summary: Who Wins Where?

Both are excellent dealers, but if your goal is to open or roll over a Gold IRA, Goldco is the better fit. If you’re buying metals directly and want the most affordable prices and flexibility, SD Bullion is your go-to.

In this head-to-head comparison:

Ratings: Goldco wins with higher scores across Trustpilot, Google, BBB, and Consumer Affairs.

Direct Purchase: SD Bullion takes the lead for physical gold/silver purchases thanks to low prices, more selection, and no minimums.

Gold & Silver IRA: Goldco is the stronger choice, offering more experience, fee transparency, and investor support.

FAQ

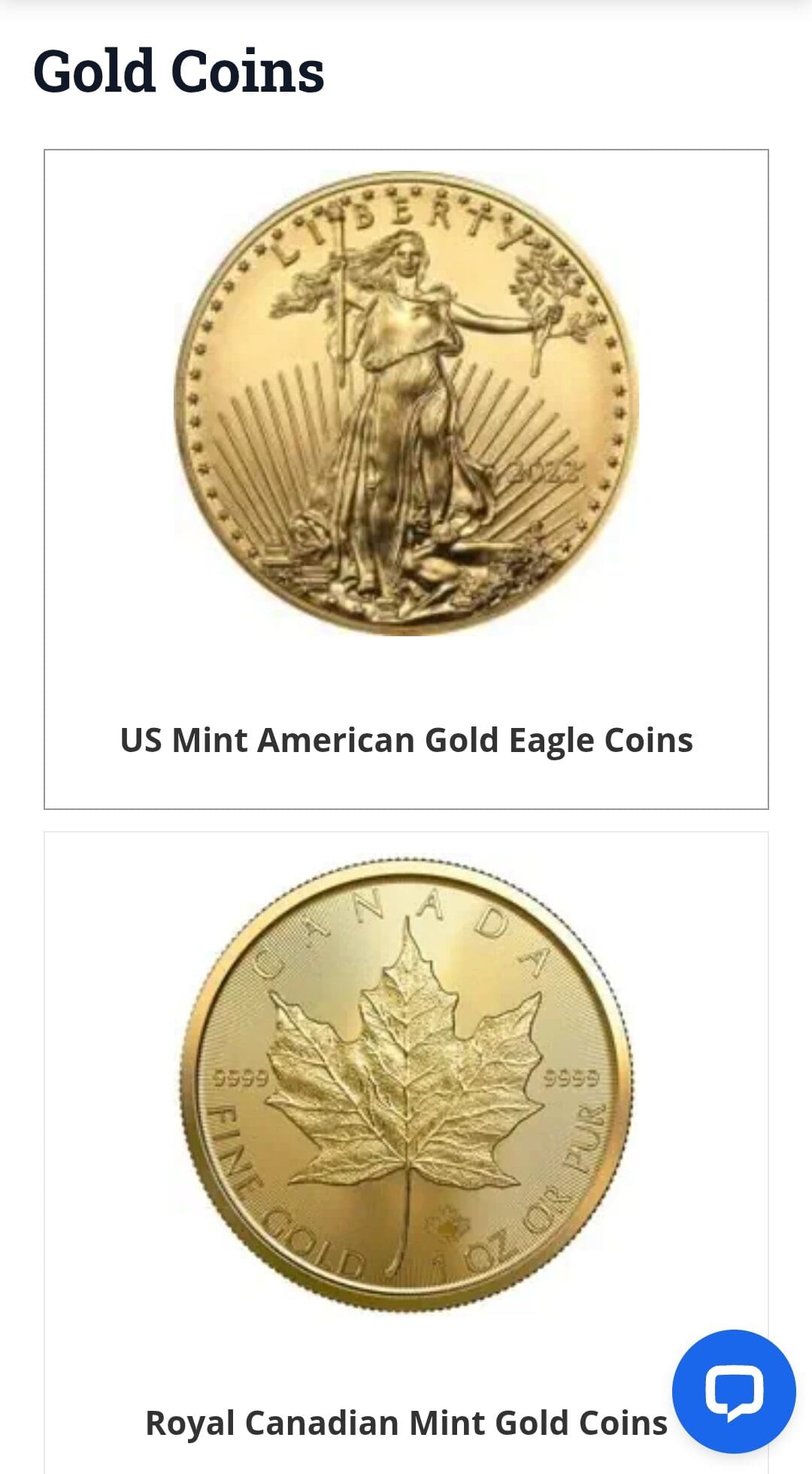

SD Bullion carries international coins like Canadian Maple Leafs. Goldco focuses on U.S. and IRS-approved global coins for IRA use.

Goldco offers multiple options and some flexibility. SD Bullion primarily uses its in-house SD Depository for storage.

Neither SD Bullion nor Goldco offers a dedicated mobile app. Both operate through their mobile-optimized websites for browsing and support.

You can roll over funds from Roth IRAs into a precious metals IRA, but both dealers rely on third-party custodians to manage the account type.