|

| |

|---|---|---|

SD Bullion | Money Metals Exchange | |

Min. Investment | $0 | $0 |

Established | 2012 | 2010 |

Storage Fees | 0.29% – 0.39%

Starts at $9.99. 0.29% annual fee for gold amd platinum products, 0.39% for silver | 0.39% – 0.59%

$96 for assets up to $15,999 0.59% for assets between $16,000 and $99,000 0.49% for assets between $100,000 and $999,999 0.39% for assets over $1 million |

Coin & Bar Selection | Extensive, global mints | Strong, includes rare options

|

Payment Methods | Cards, PayPal, Wire, eCheck, Crypto | Card, Wire, Crypto, ACH |

Pricing Transparency | Transparent, clearly displayed

| Transparent, clearly displayed

|

Best For | Low-cost bulk buying | Gradual savings, monthly plan |

Our Rating |

(4.3/5) |

(4.2/5) |

Read Review | Read Review |

Customer Satisfaction: Who Ranks Higher?

SD Bullion comes out ahead in overall customer ratings. It holds a 4.3 on Trustpilot from over 2,600 reviews and a 4.5 on Consumer Affairs, compared to Money Metals' 3.3 and 4.7 respectively.

[elementor-template id=”203456″]

Both have A+ BBB ratings, but SD Bullion’s consistency and higher Trustpilot score give it the edge in terms of reputation and reliability among users.

[elementor-template id=”203483″]

SD Bullion vs. Money Metals: Buying Precious Metals

When it comes to purchasing physical metals, both dealers offer a large selection, but SD Bullion takes the lead.

Their catalog includes fractional gold, unique silver options, and platinum/palladium products, with pricing among the lowest online.

Where SD Bullion excels is in flexibility. It accepts credit cards, checks, wire transfers, e-checks, and crypto—offering a 4% discount on some methods.

It also features 10-second spot price updates and locks in your price at checkout, regardless of payment method.

Money Metals, while more limited in payment options (especially with a 4% card fee and 2% crypto fee), does offer a Monthly Savings Plan—ideal for dollar-cost averaging into metals. However, it does not ship internationally or provide live chat support.

In short, both dealers are strong overall, but SD Bullion offers better flexibility, especially for active investors looking to take advantage of price dips or alternative payment methods.

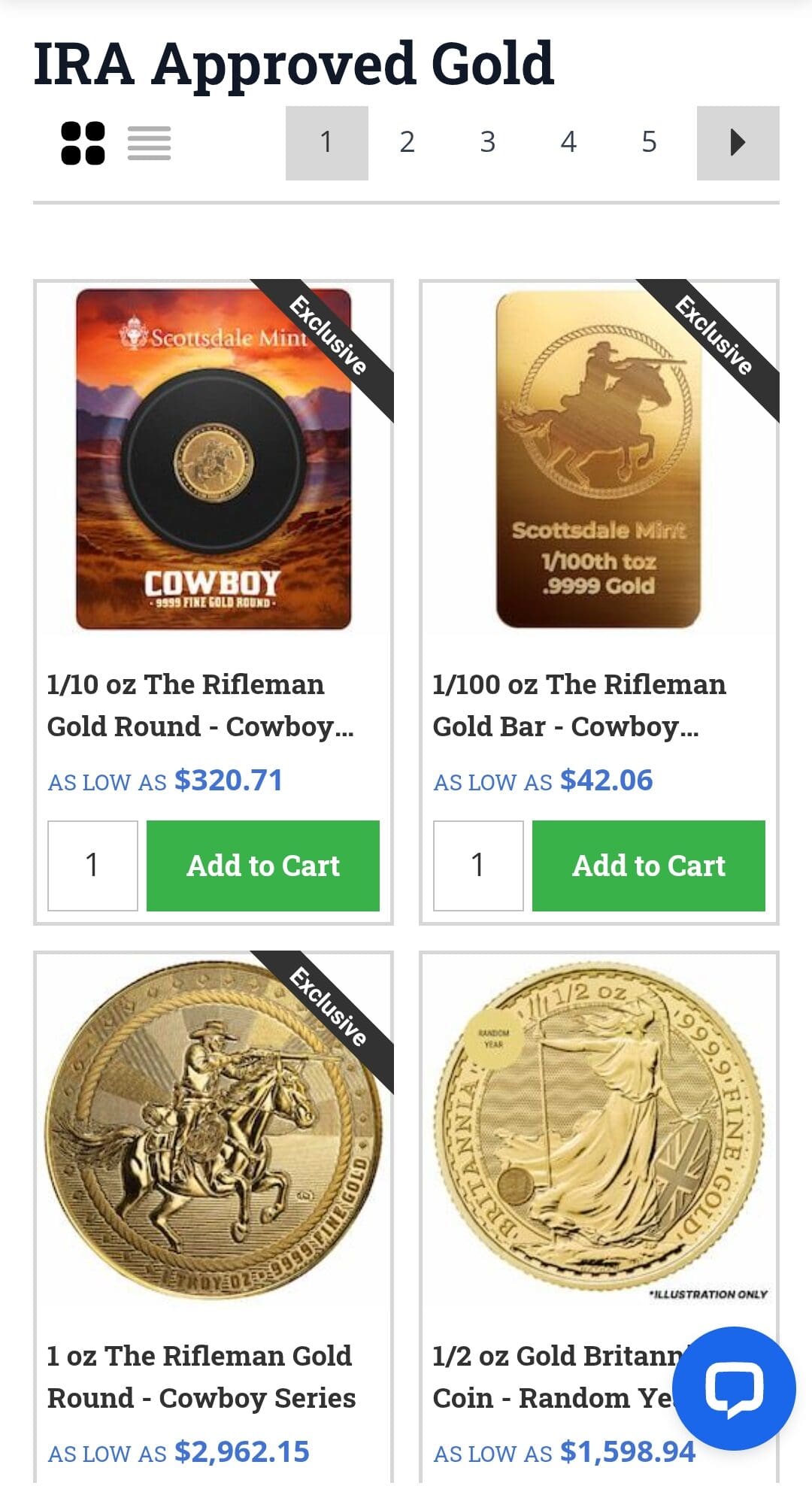

IRA Investing: SD Bullion vs. Money Metals Exchange

We picked SD Bullion for its broader custodian support, flexible funding options, and free 3-month storage. That said, the differences are not massive—Money Metals is still a trustworthy alternative.

Both companies provide investors with an entry point into precious metal IRAs. SD Bullion helps you open a self-directed IRA through multiple custodians, including Kingdom Trust, New Direction Trust, and Equity Institutional.

Once set up, investors can fund accounts through rollovers or direct contributions and choose from a wide range of IRA-approved coins and bars.

Money Metals Exchange also partners with a custodian to help set up IRAs, but your choices are more limited—typically to one recommended custodian.

Their vault storage is IRS-approved and insured, but fees are not disclosed publicly and are calculated based on asset value.

SD Bullion stands out for transparency in the process and flexibility. For example, their buyback program has clear minimums and relatively fast turnaround times.

They also provide three months of free storage, which gives new IRA investors some breathing room to get started.

Money Metals does a fine job with its IRA services and is great for long-term savers—especially when combined with their monthly savings plan.

However, SD Bullion’s range of custodians, clear product catalog, and easier setup process make it our top choice.

Final Verdict & Summary

SD Bullion is our winner across all major categories: ratings, direct gold and silver purchases, and Gold IRA services.

While Money Metals Exchange is still a quality dealer with excellent offerings, SD Bullion consistently provides better flexibility, wider selection, and more investor-friendly features across the board.

FAQ

SD Bullion ships internationally to select countries, while Money Metals Exchange only ships within the U.S., limiting options for global buyers.

SD Bullion provides IRA setup assistance via partnered custodians. Money Metals also offers support, but mainly refers to a single partner.

Both dealers insure shipments fully. If your package is lost or damaged, you’ll be reimbursed for its full value once the issue is verified.

Both offer segregated, fully insured storage through their own depositories. Assets are protected against loss, theft, or damage.

Both dealers have buyback programs. SD Bullion allows you to sell metals back at spot rates if minimums are met; Money Metals offers a quote-based system.