|

| |

|---|---|---|

SD Bullion | Silver Gold Bull | |

Min. Investment | $0 | $0 |

Established | 2012 | 2009 |

Storage Fees | 0.29% – 0.39%

Starts at $9.99. 0.29% annual fee for gold amd platinum products, 0.39% for silver | $225 – $275

$225 for Pooled Storage, $275 for Segregated Storage . Estimated annual fee. |

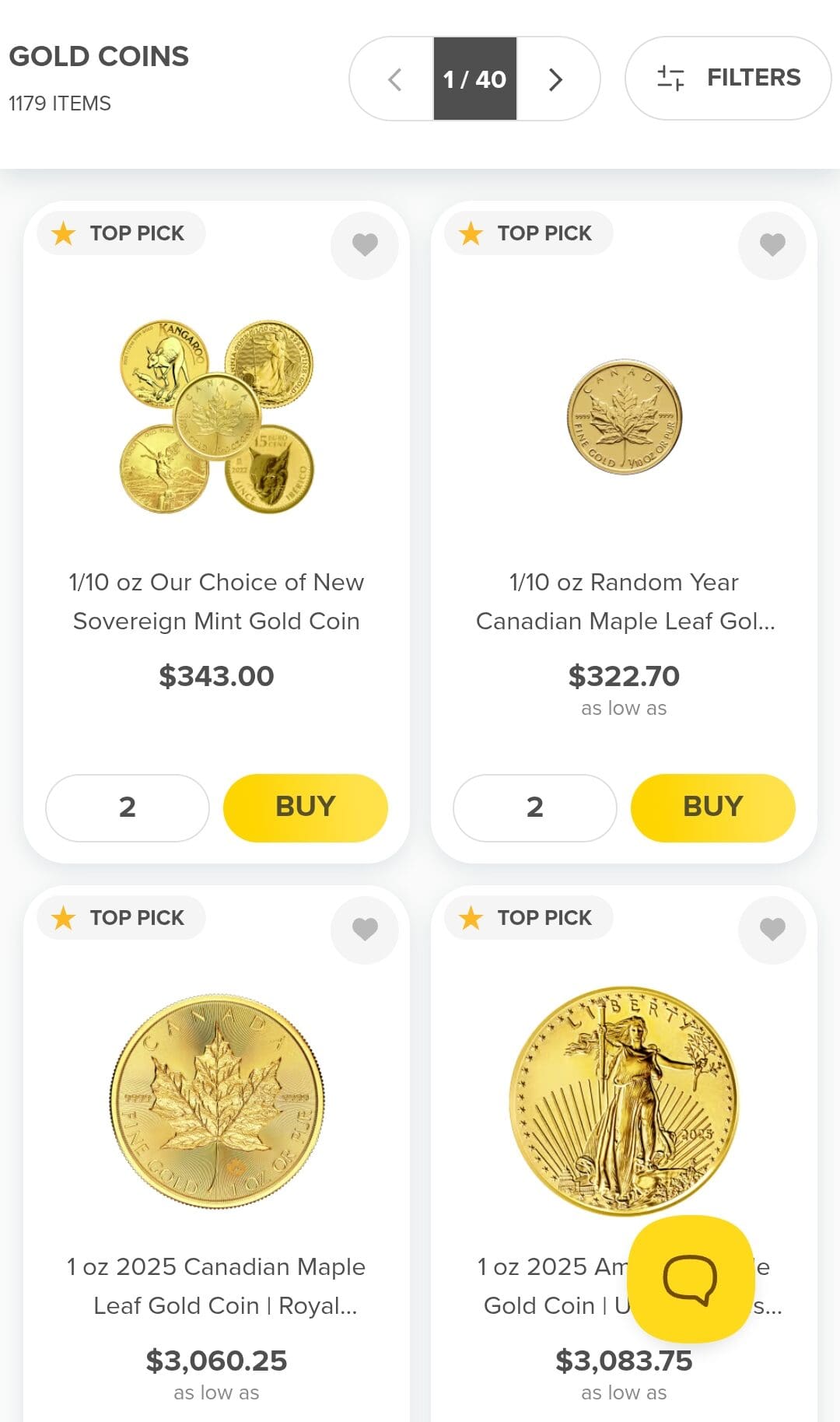

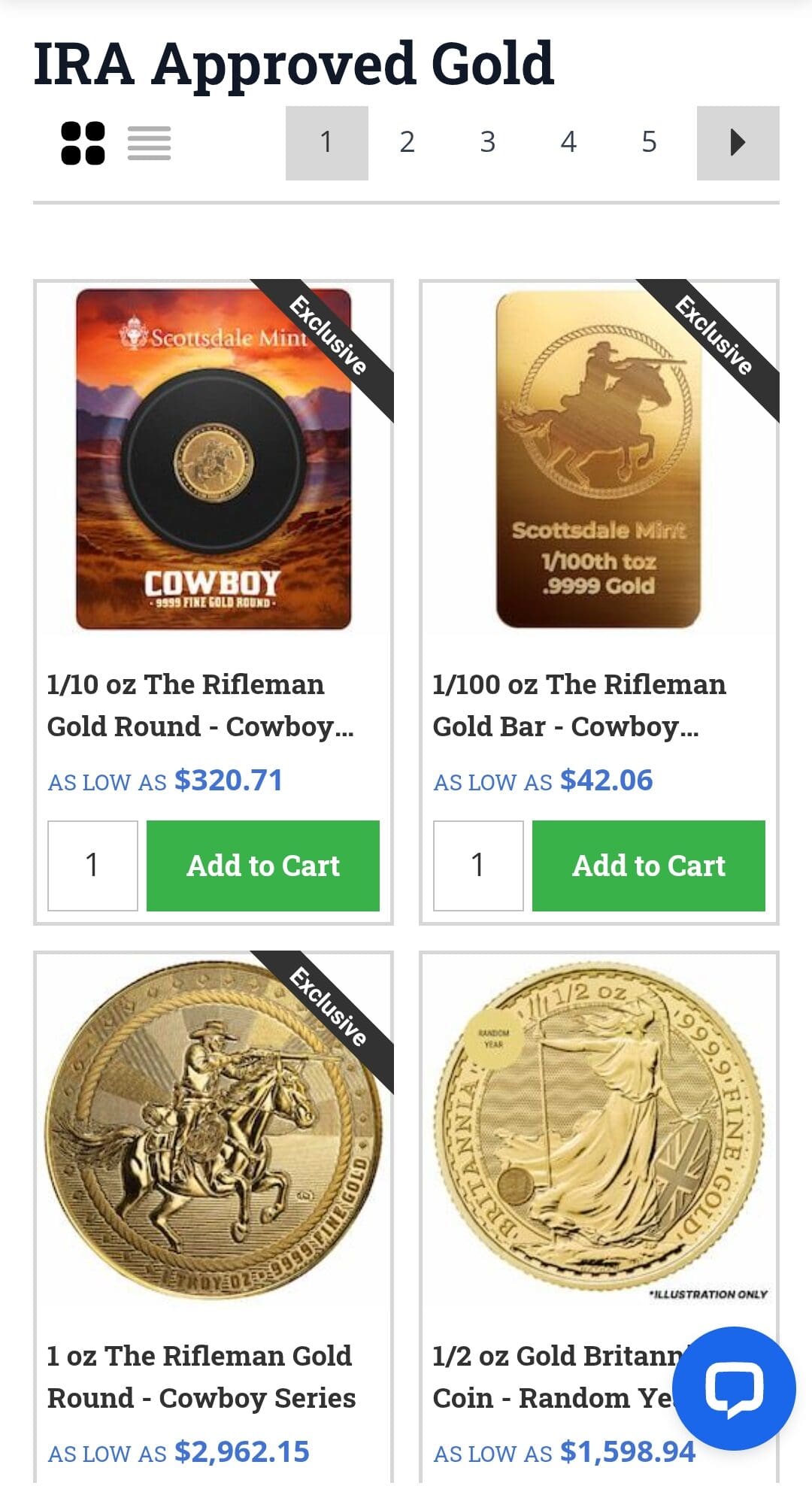

Coin & Bar Selection | Extensive bullion, fractional & novelty | Bullion, collectibles, numismatics, jewelry

|

Payment Methods | Cards, PayPal, Wire, eCheck, Crypto | Cards, PayPal, Wire, eCheck, Crypto |

Pricing Transparency | Yes for products, unclear IRA fees | Yes for products and IRA fees

|

Best For | Low-cost bullion stacking | IRA investors & support access

|

Our Rating |

(4.3/5) |

(4.5/5) |

Read Review | Read Review |

SD Bullion vs. Silver Gold Bull: Which Has Better Reviews?

Silver Gold Bull holds the edge when it comes to customer reviews and trust scores.

[elementor-template id=”203485″]

It boasts a 4.8 rating on Trustpilot with over 4,400 reviews, compared to SD Bullion’s 4.3 across 2,648 reviews. Both have an A+ BBB rating and solid credibility, but Silver Gold Bull’s stronger Trustpilot average and wider volume of praise give it an edge in public perception.

[elementor-template id=”203456″]

While SD Bullion is still highly regarded, its lower Sitejabber rating (3.3 vs. 3.4) and less frequent mentions of standout service tip the scales.

Buying Gold and Silver: Who Comes Out on Top?

When comparing SD Bullion and Silver Gold Bull, both platforms offer a large selection of gold, silver, platinum, and palladium products, as well as reliable storage and buyback programs. But there are a few key differences that could shape your decision:

Where they’re both strong:

Product range: Both dealers offer coins, bars, and rounds across gold, silver, platinum, and palladium.

Free shipping: Orders over $199 come with free insured shipping.

Buyback programs: You can sell metals back to either company at competitive spot prices.

Payment flexibility: Both accept credit cards, bank wires, PayPal, and even crypto.

Where SD Bullion stands out:

Deeper discounts: Bank wires, checks, and e-checks can get you up to 4% off — great for larger orders.

Spot price lock: Your price is locked in at checkout, even if payment clears days later.

Unique products: SD Bullion offers fun formats like silver bullets and fractional bars.

Where Silver Gold Bull stands out:

Price match guarantee: If you find a better deal, they’ll match it — a big win for comparison shoppers.

Live chat & better support: Weekend hours and live chat give you more ways to get help.

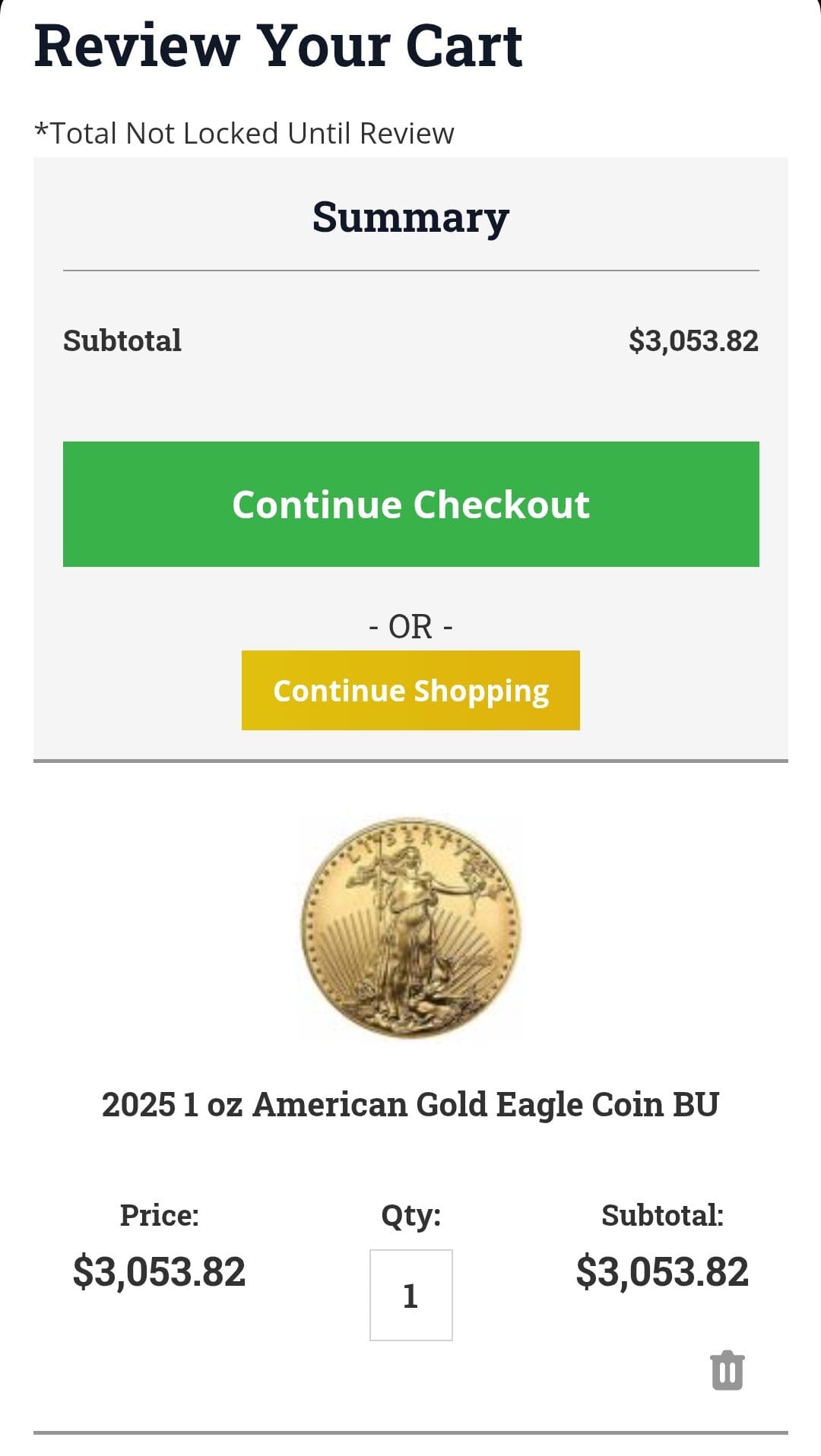

Great website experience: Silver Gold Bull offers one of the most intuitive UI with a great experience for buyers.

If you’re after the lowest price per ounce and fast spot-locking, SD Bullion is the better choice. But if you value strong service and broader inventory, Silver Gold Bull has the edge.

Comparing Gold IRA: SD Bullion or Silver Gold Bull?

Our preferred choice for precious metal IRAs is Silver Gold Bull, thanks to its clearer fee structure, better customer service options, and flexible storage solutions.

Both SD Bullion and Silver Gold Bull can help you open a self-directed IRA using reputable custodians. But Silver Gold Bull takes the lead in a few important areas:

Fee transparency: Silver Gold Bull lists its IRA setup and storage costs clearly, while SD Bullion requires direct inquiry.

Storage options: Silver Gold Bull offers both segregated and allocated storage in IRS-approved vaults. SD Bullion offers secure U.S.-based storage but no international choices.

Support access: Silver Gold Bull provides live chat, IRA-specific support lines, and weekend hours — helpful for retirement-focused investors.

Buyback program: Both companies offer reliable buyback options, though Silver Gold Bull’s higher-rated service may ease the selling process.

Minimum investment: Neither company imposes high minimums for IRAs, making both accessible — but again, fee clarity gives Silver Gold Bull the edge.

In summary, SD Bullion is a solid option, especially for experienced investors who already understand IRA fees.

But for first-timers and anyone who values clear costs and stronger support, Silver Gold Bull is the better IRA partner.

Summary: SD Bullion vs Silver Gold Bull

When it comes to gold dealer performance:

Ratings Winner: Silver Gold Bull — Higher Trustpilot score and broader review base.

Best for Direct Purchase: SD Bullion — Low prices, flexible payments, and real-time price locking.

Best for IRA: Silver Gold Bull — Transparent fees and stronger support make it more IRA-friendly.

Overall, we recommend SD Bullion for budget-conscious buyers and bulk stackers, while Silver Gold Bull is our top pick for retirement savers and those who want full-service support.