Seeking Alpha Premium

Annual Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

Seeking Alpha Premium is an upgraded version of the platform designed for investors who want deeper stock research, expert insights, and advanced financial tools.

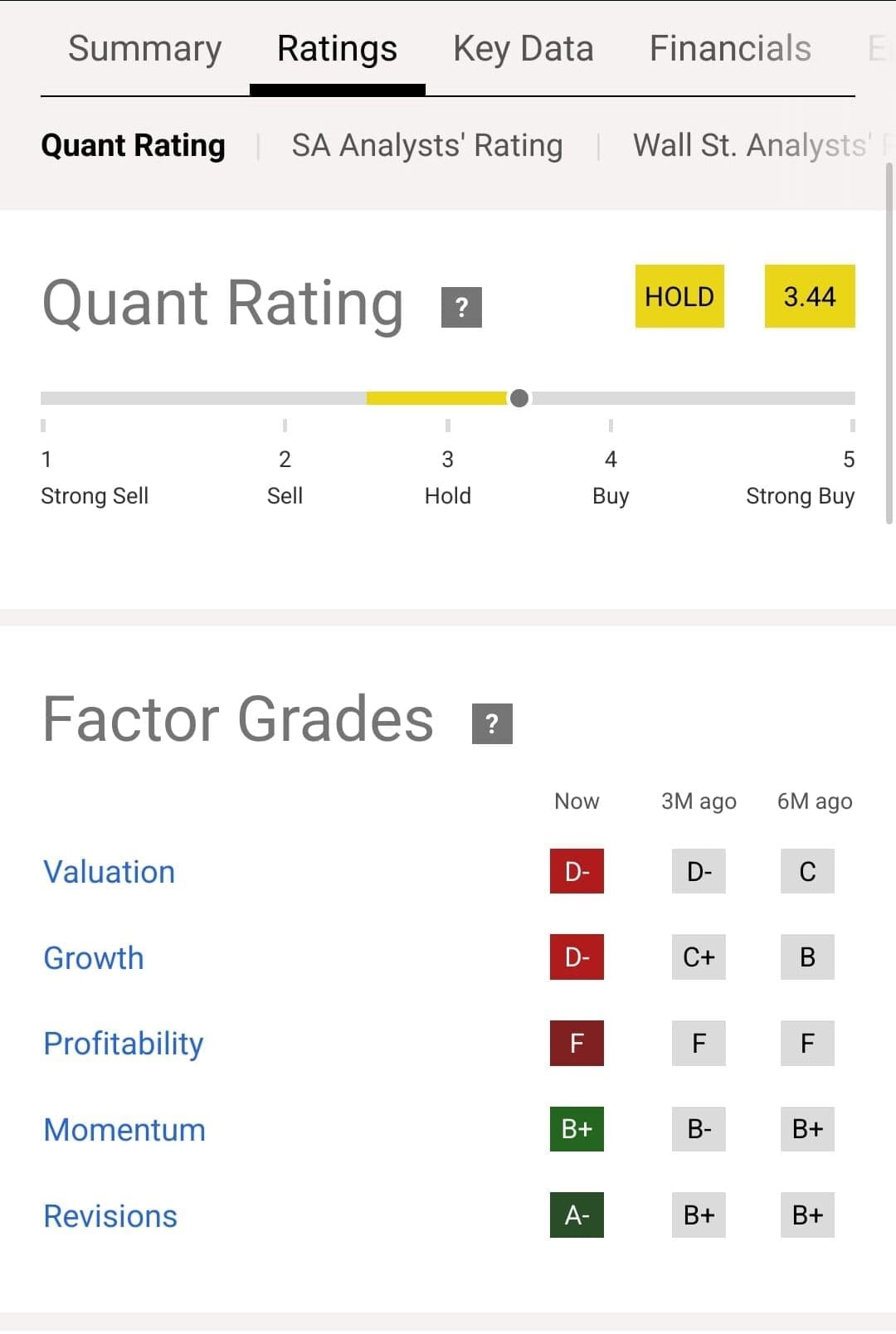

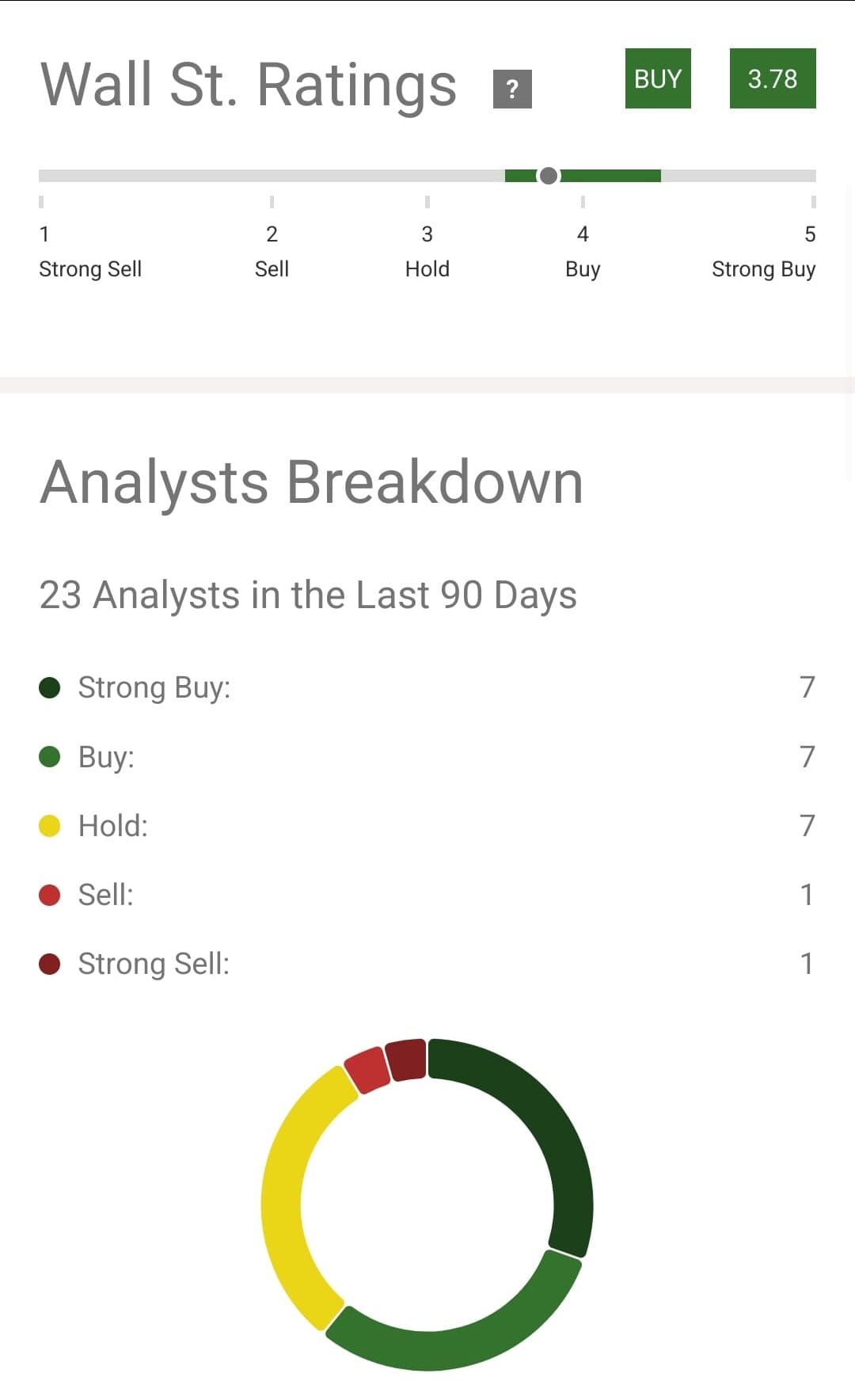

One of the standout features of Seeking Alpha Premium is its Quant Ratings system, which ranks stocks based on valuation, growth, profitability, and momentum. The Portfolio Health Check also provides valuable risk assessments, helping investors make better portfolio decisions.

Additionally, the stock screener offers powerful filters to find top-performing stocks and ETFs. Investors can also compare stocks side by side, access historical earnings call transcripts, and receive real-time stock alerts for their portfolio.

However, there are some limitations. It lacks real-time stock prices, mutual fund or bond research, advanced charting tools, and options trading analysis,

- Quant Ratings system

- Portfolio Health Check

- Stock & ETF screener

- Top stock rankings

- Compare stocks side-by-side

- Unlimited premium articles

- Real-time portfolio alerts

- Earnings call transcripts

- Dividend safety ratings

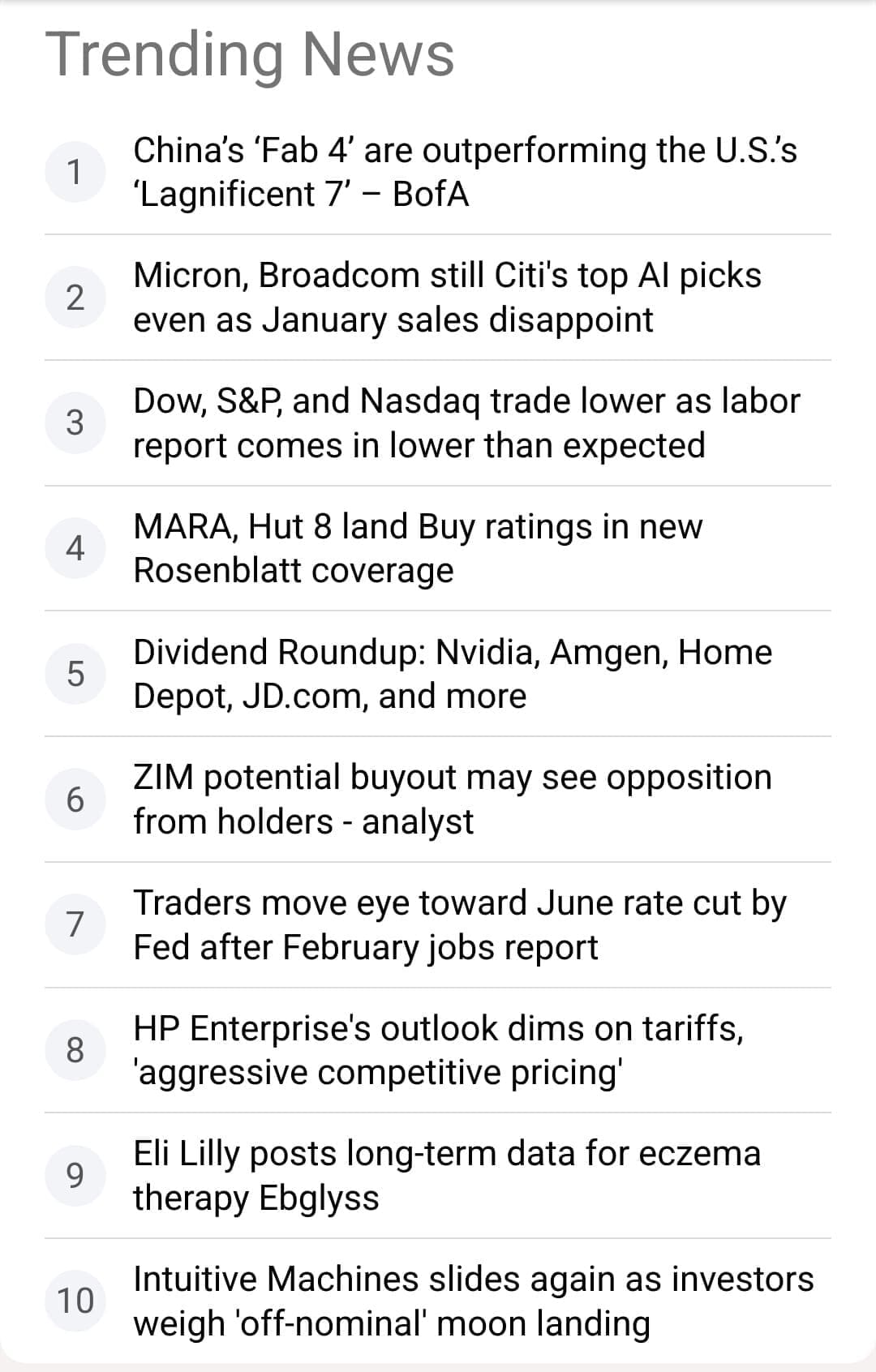

- Market news dashboard

- Author performance tracking

- Stock valuation models

- Data-driven stock ratings

- Comprehensive stock research

- Advanced stock screener

- Dividend stock insights

- Portfolio risk analysis

- No real-time stock prices

- Limited technical analysis

- No mutual fund research

- No options trading tools

- Inconsistent article quality

Pricing: Seeking Alpha Premium vs PRO vs AlphaPicks

Seeking Alpha Premium is the mid-tier subscription offering deeper stock research compared to the free version while remaining more affordable than the high-end Seeking Alpha Pro.

[elementor-template id=”195727″]

Alpha Picks, a separate stock-picking service, provides monthly handpicked stock recommendations based on Quant Ratings, making it ideal for passive investors.

How To Research Stocks With Seeking Alpha Premium?

Seeking Alpha Premium offers a comprehensive set of stock & ETF research tools designed to help investors make data-driven investment decisions:

-

Quant Ratings & Factor Grades for Every Stock

We tested Seeking Alpha’s Quant Ratings to assess how they help investors make stock decisions.

This proprietary system analyzes stocks based on valuation, growth, profitability, momentum, and EPS revisions, ranking them from Strong Buy to Strong Sell.

Unlike traditional stock ratings, which rely on analyst opinions, the Quant Ratings use data-driven algorithms to identify potential opportunities.

For investors, this means having a data-backed ranking system that helps filter stocks without emotional bias.

The Factor Grades offer deeper insight by grading each stock’s fundamentals, financial health, and growth potential on an A+ to F scale.

-

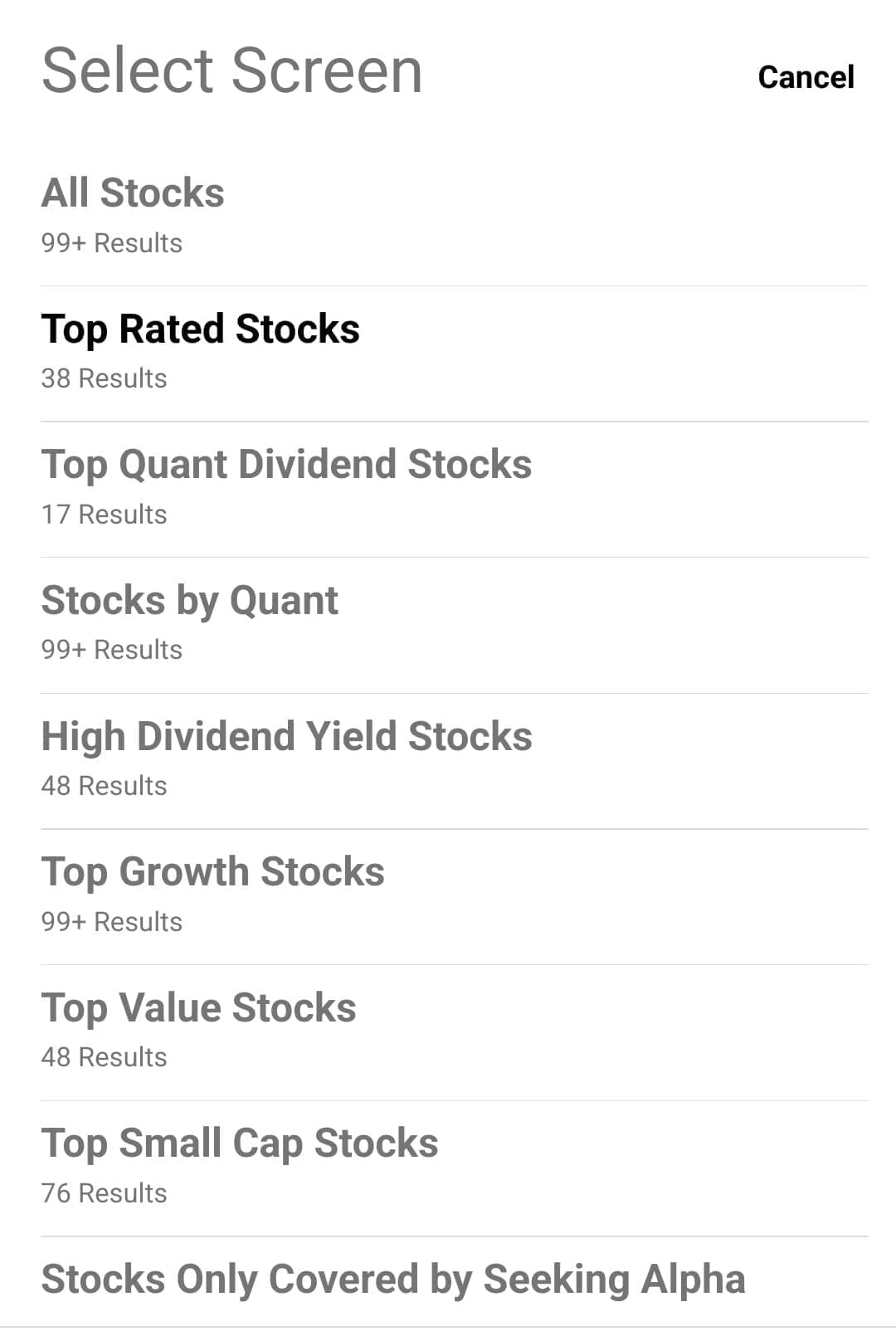

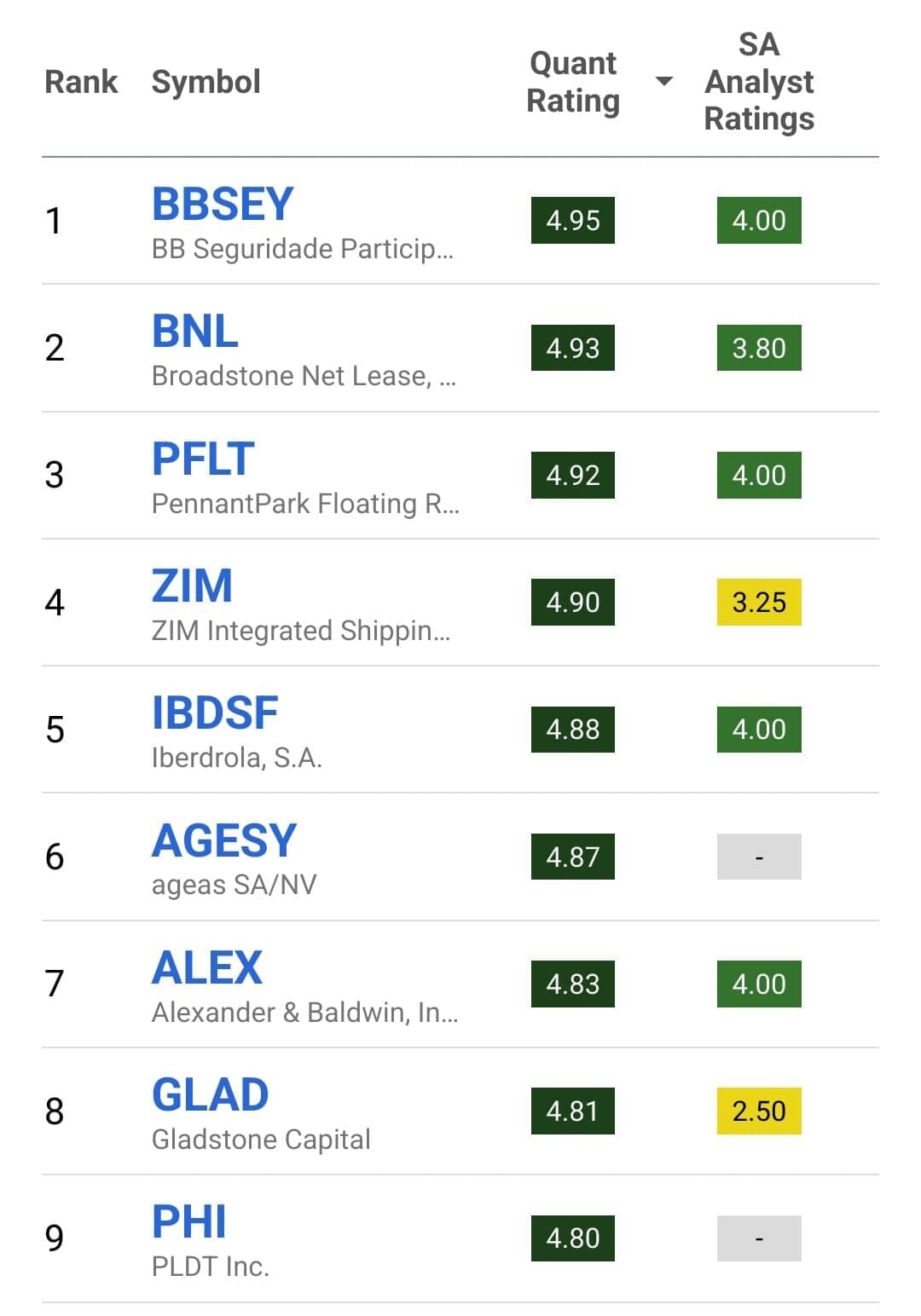

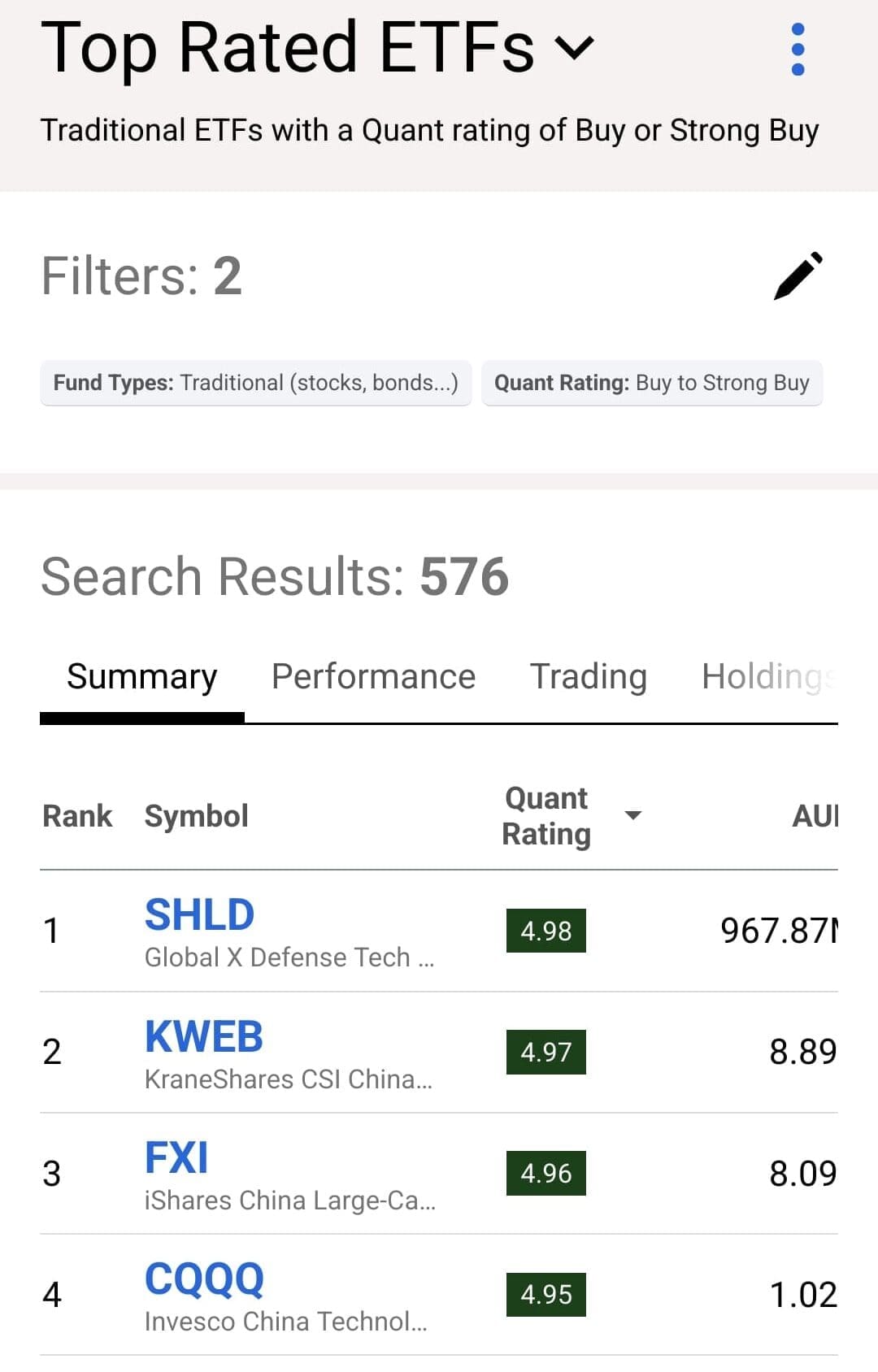

Top Stock & ETF Rankings

With Seeking Alpha Premium’s stock and ETF rankings, premium users get access to curated lists of top-rated stocks, categorized into groups such as Top Growth Stocks, Top Value Stocks, Top Dividend Stocks, and Top Small-Cap Stocks.

For investors, this feature helps filter through thousands of stocks to find ones that match their investment goals.

We found it especially useful for dividend investors, as the Top Dividend Stocks and Yield Monsters lists highlight companies with strong dividend growth and sustainability scores.

We also tested the Top ETF rankings, which group ETFs based on performance, sector exposure, and risk.

While the lists are a great starting point, they do not replace deep ETF analysis tools like those offered by Morningstar.

-

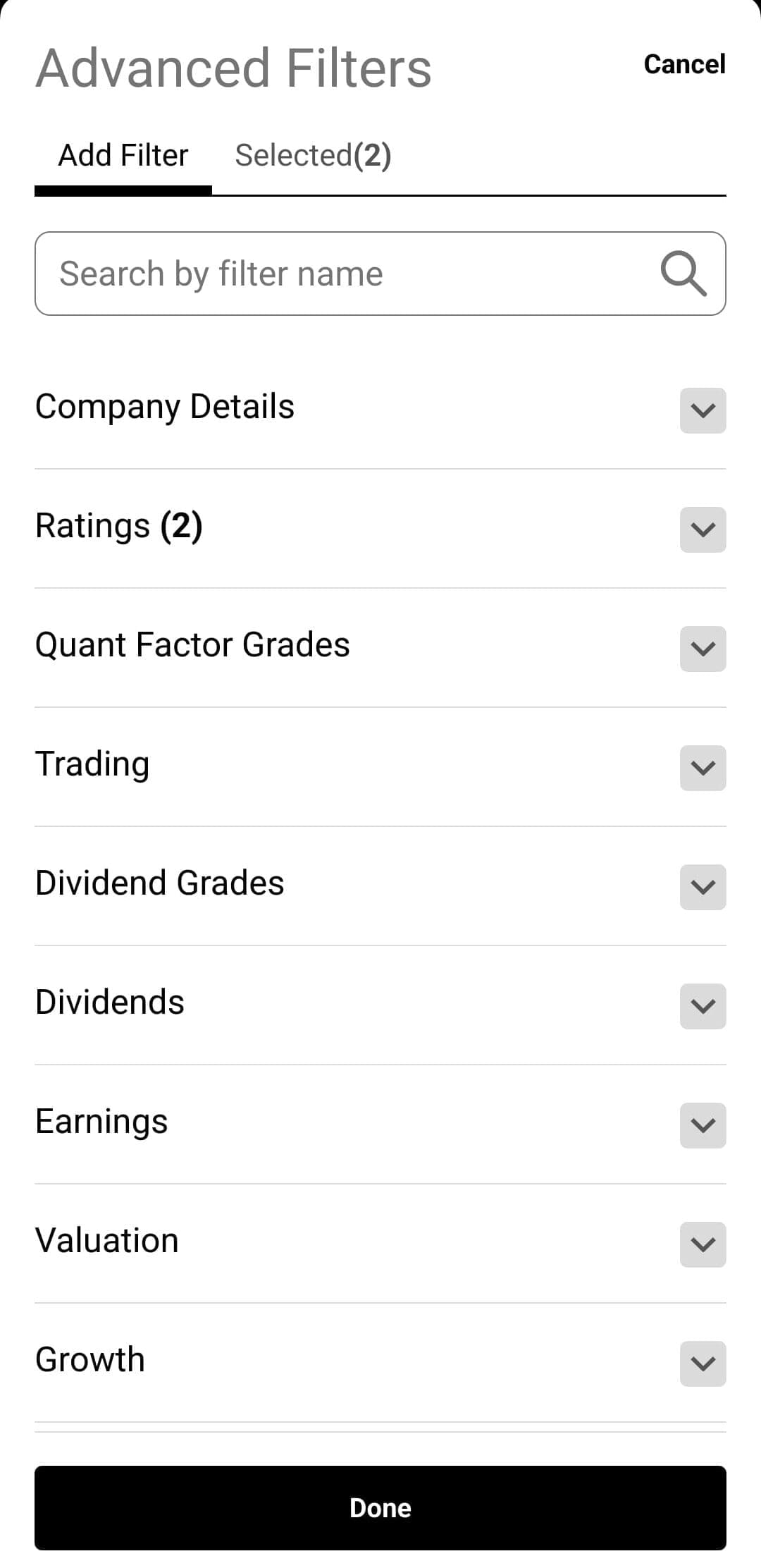

Advanced Stock & ETF Screener

Unlike the Basic plan, which offers only basic filters, Premium users get access to customizable stock screening based on valuation, growth, profitability, dividends, and momentum.

One standout feature is the ability to filter stocks using Quant Ratings, allowing investors to instantly find Strong Buy-rated stocks based on performance metrics.

For investors, this tool helps narrow down investment opportunities quickly. Whether looking for high-growth stocks, undervalued companies, or dividend-paying stocks, the screener makes research more efficient.

We tested various filters and found that the Factor Grades and Quant Ratings significantly speed up stock and ETF selection compared to manually analyzing financial statements.

However, while the screener is a great stock research tool, it does not replace full technical analysis platforms like TradingView for chart-based strategies.

-

Fundamental Analysis Tools & Research Tools

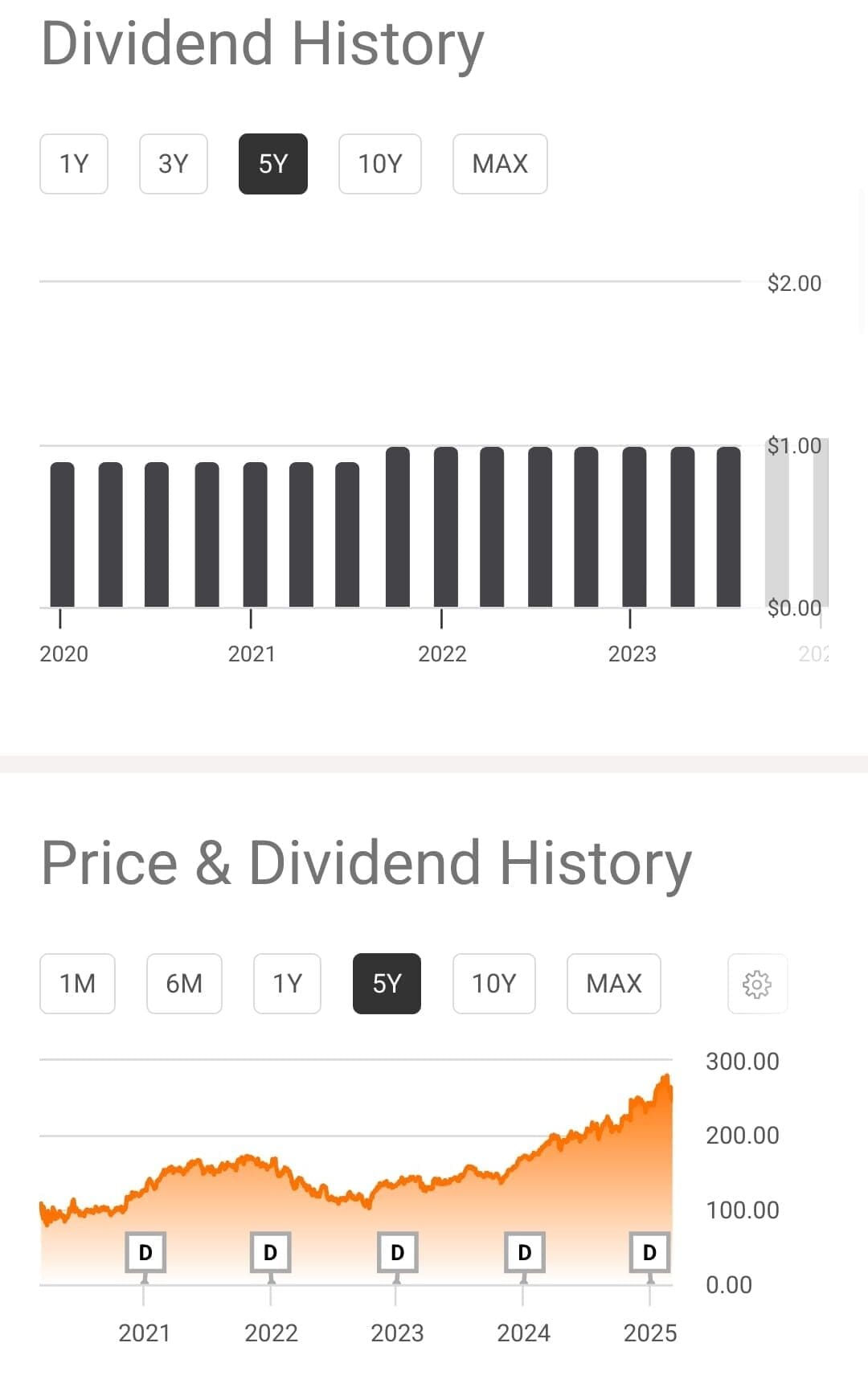

Seeking Alpha Premium provides detailed stock financials, earnings data, forecasting tools, dividend analysis and more.

Premium users can access full financial statements, including income statements, balance sheets, and cash flow reports, all presented in interactive charts and tables for easy comparison.

The earnings section offers historical earnings data, EPS forecasts, and earnings surprises, allowing investors to analyze trends and assess company performance over time.

Dividend investors benefit from dividend history, payout ratios, and safety scores, which help evaluate dividend sustainability.

Forecasting tools include analyst revenue and earnings projections, along with company valuation metrics, such as P/E ratios, PEG ratios, and price-to-book comparisons.

All data is displayed in visually intuitive charts, enabling users to quickly interpret trends and compare stocks.

How To Analyze Stocks & Portfolio Performance?

Stock analysis is super important for investors before getting a buy or sell decision. Here are what you can find with Seeking Alpha Premium:

-

Portfolio Health Check & Warnings

We tested Seeking Alpha Premium’s portfolio health check to see how well it helps investors monitor risk and performance.

Premium users receive detailed insights into their holdings, including risk warnings, dividend safety scores, and fundamental strength.

The system flags stocks that may have overvaluation concerns, declining earnings, or weak fundamentals, allowing users to take action before performance drops.

We found this tool especially useful for long-term investors and dividend seekers, as it provides insights into portfolio diversification, income stability, and potential red flags.

However, unlike robo-advisors or stock advisors, it does not provide automatic rebalancing recommendations—users still need to make their own decisions based on the data.

-

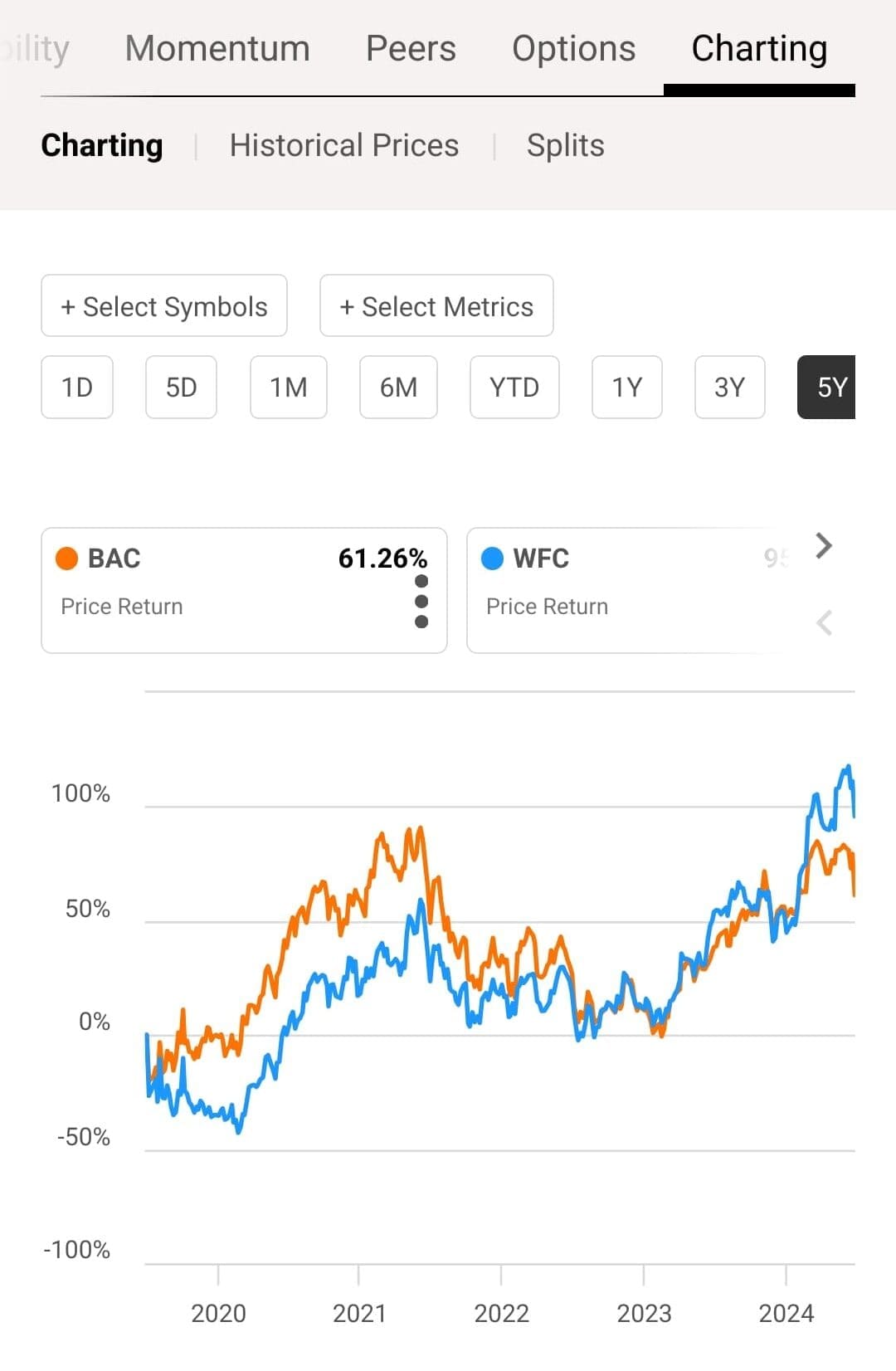

Compare Stocks Side-by-Side

With Seeking Alpha Premium’s stock and funds comparison tool, users can compare up to six stocks side by side, viewing key metrics such as valuation, growth, profitability, momentum, and EPS revisions in a single table.

For investors, this is a major time-saver. Instead of toggling between multiple stock pages, users can quickly compare financial metrics, stock ratings, and quant grades in one view.

During our testing, we used the tool to compare tech stocks, and it clearly showed how companies differed in earnings growth, profit margins, and valuation multiples.

However, while the comparison tool is great for fundamental analysis, it does not offer technical chart overlays or price movement comparisons, which some traders may prefer.

-

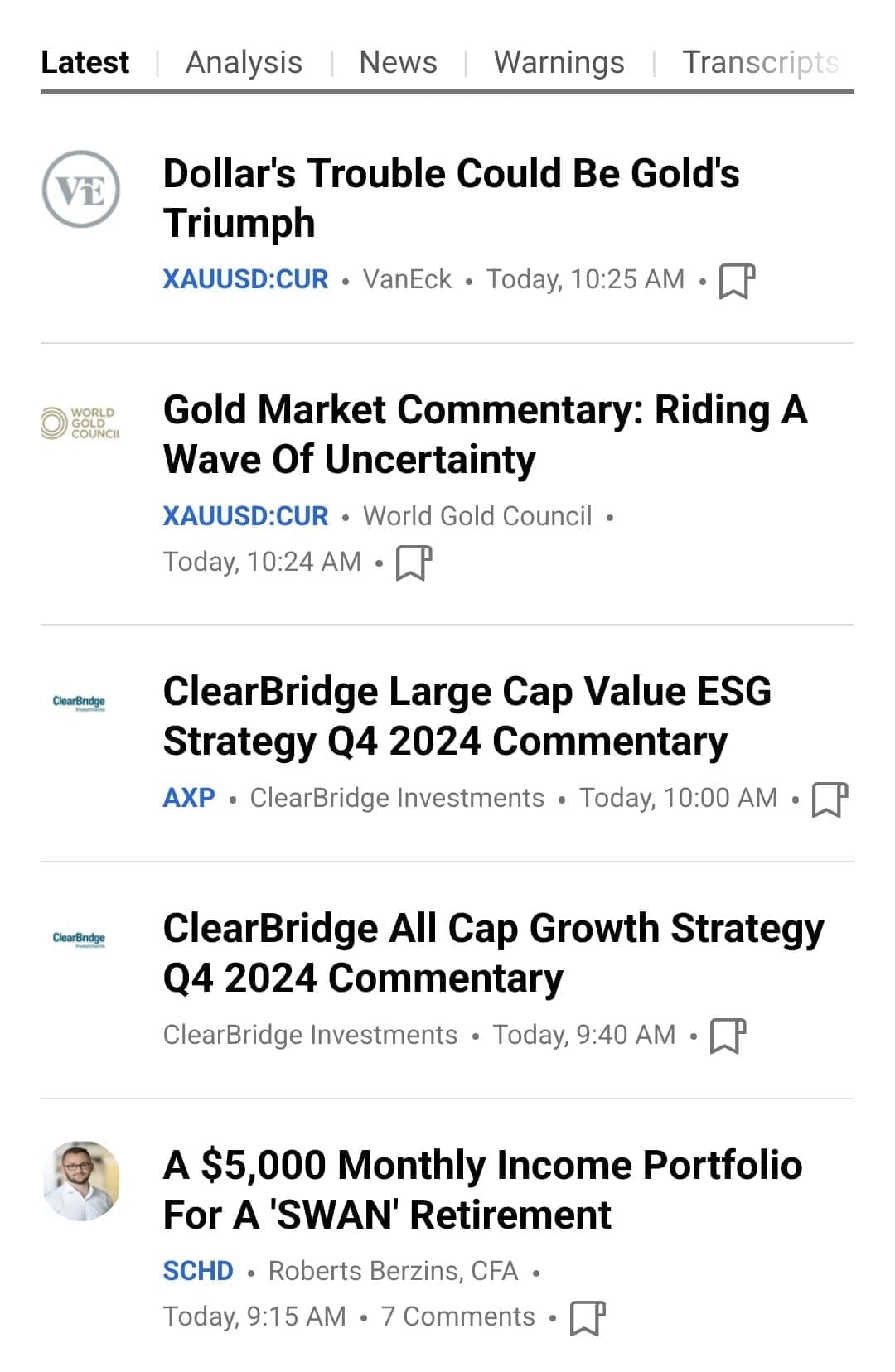

Unlimited Access to Premium Articles & News

Unlike the Basic plan, which limits access to free articles, Premium unlocks expert investor content, allowing users to read in-depth stock analysis, investment ideas, and market insights from professional analysts and experienced traders.

For investors, this means having access to detailed stock reports, earnings breakdowns, and sector outlooks that aren’t available elsewhere.

The ability to search for articles based on themes, sectors, or stock symbols makes it easy to find relevant insights quickly.

From our testing, we found that Premium articles cover a wider range of U.S. stocks than major investment banks, which can help investors identify undervalued stocks, growth opportunities, and market trends.

However, because articles are contributed by different authors, the quality varies, so users may need to cross-check analysis.

Seeking Alpha Premium Plan vs. Competitors: Worth the Price?

Compared to competitors like Morningstar Investor, Zacks Premium, and Motley Fool Stock Advisor, Seeking Alpha Premium stands out with Quant Ratings, Factor Grades, and deep stock analysis.

[elementor-template id=”197569″]

While Motley Fool focuses on curated stock picks, Seeking Alpha Premium offers a broader data-driven research approach.

Morningstar excels in mutual fund and ETF analysis, while Zacks provides a mix of fundamental and earnings-driven stock rankings.

Additional Features & Tools

Beyond its core stock analysis and research tools, Seeking Alpha’s Premium plan includes several additional features that help investors stay informed and track market trends:

- Advanced Portfolio Monitoring & Alerts: Provides real-time notifications on stock movements, earnings revisions, and risk warnings, helping investors track portfolio performance and potential red flags.

- Unlimited News Dashboard & Market Insights: Offers unrestricted access to breaking news, analyst upgrades/downgrades, and macroeconomic trends, keeping investors informed on major market events.

- Unlimited Earnings Call Transcripts & SEC Filings: Grants full access to historical earnings call transcripts and financial reports, allowing investors to analyze company performance and management insights.

- Market News & Economic Calendars: Includes earnings calendars, dividend payout schedules, and key economic event updates, helping investors plan around major market-moving events.

- Dividend Stock Analysis & Ratings: Provides detailed insights into dividend safety, payout ratios, and long-term sustainability, making it easier to find reliable income stocks.

- Author Performance Tracking: Lets users track top-performing Seeking Alpha contributors, helping investors identify analysts with strong track records.

- Stock Valuation Models: Includes fair value estimates and valuation metrics, giving investors insights into whether a stock is overvalued or undervalued.

Limitations: What Seeking Alpha Premium Lacks?

While Seeking Alpha Premium offers a wide range of stock research tools, it does have some limitations:

-

Limited Technical Analysis & Charting Features

Seeking Alpha focuses heavily on fundamental analysis, which is great for long-term investors but lacks tools for technical traders.

The stock charts are basic, with no support for advanced indicators or multiple charts for the same view, and this is crucial for traders who rely on chart patterns and price action strategies.

-

No Mutual Fund or Bond Research

Seeking Alpha is primarily focused on stocks and ETFs, which means mutual fund and bond investors are left out.

If you're looking for detailed fund rankings, bond ratings, or credit risk analysis, you won’t find them here.

-

Limited Customization & Data Exporting

Seeking Alpha Premium does not provide in-depth options trading analysis, such as options chains, implied volatility metrics, Greeks (Delta, Theta, Vega, Gamma), or strategy backtesting.

For investors who trade options, having access to open interest data, probability calculations, and risk-reward scenarios is crucial.

Who Will Find Seeking Alpha Most Valuable?

Seeking Alpha Premium is designed for investors who want in-depth stock research, expert insights, and data-driven ratings. Here’s who may benefit the most:

- Fundamental Analysts: Those who prioritize deep company research, earnings call transcripts, and SEC filings will find Seeking Alpha’s financial data and stock grades valuable.

- Dividend Investors: The platform offers dividend safety scores, payout history, and rankings of top dividend stocks, helping income-focused investors find stable, high-yielding companies.

- Self-Directed Investors: Investors who prefer DIY research will find unlimited access to expert articles, financial data, and earnings transcripts useful for stock selection.

- ETF Investors: The ETF analysis and rankings allow users to evaluate fund performance, sector exposure, and risk metrics, helping them choose the right funds.

What Types of Investors/Traders Won’t Like Seeking Alpha?

While Seeking Alpha Premium offers strong fundamental research tools, it may not meet the needs of every investor. Here’s who may not find it ideal:

- Active & Day Traders: The platform does not offer real-time stock prices, Level 2 data, or advanced charting tools, making it less useful for short-term trading.

- Technical Traders: Lacks technical indicators, pattern recognition, and price action tools that traders use for market timing and trend analysis.

- Investors Who Want Analyst Ratings: You'll need the SeekingAlpha Pro plan to get analyst ratings.

- Mutual Fund & Bond Investors: Does not provide in-depth mutual fund research or bond ratings, unlike platforms like Morningstar.

FAQ

No, Seeking Alpha does not offer a dedicated desktop app. However, it has a fully functional web-based platform and a mobile app for iOS and Android.

Yes, but it is delayed rather than real-time. Active traders may need a brokerage account or platform like Interactive Brokers for live extended-hours data.

Yes, but customization is somewhat limited. You can filter stocks based on Quant Ratings, valuation, growth, and momentum, but there are fewer options than dedicated screeners like Finviz Elite.

No, Seeking Alpha does not offer backtesting tools. Traders who need historical strategy testing may prefer platforms like Portfolio123 or TrendSpider.

No, there is no option to download stock data or export financial models to Excel or other formats. Bloomberg Terminal and FactSet provide these capabilities.

No, Seeking Alpha does not sync with brokerage accounts for direct trading or portfolio import, unlike platforms like Yahoo Finance or Zacks Premium.

How We Rated Premium Investing Analysis & Research Tools

At The Smart Investor, we evaluated premium investment research platforms based on their advanced features, data depth, and overall value compared to other paid alternatives. Each platform was rated based on the following key aspects:

- Advanced Fundamental Analysis Tools (20%): We assessed the depth of financial data, historical reports, earnings forecasts, and valuation models. Platforms that provided institutional-grade insights, DCF analysis, customizable financial models, and access to premium analyst reports scored higher.

- Advanced Technical Analysis Features (20%): We reviewed the availability of real-time charting, advanced indicators, custom scripting, and AI-driven pattern recognition. Platforms that offered backtesting tools, automated trading strategies, and integration with third-party software received better ratings.

- Stock Screener & Premium Filters (15%): A high-quality screener is essential for pro investors, so we evaluated customization depth, real-time filtering, and AI-driven stock discovery. Platforms offering pre-built expert screeners, backtesting capabilities, and sector-specific analytics scored the highest.

- Portfolio Tracking & Advanced Alerts (10%): We rated platforms on their ability to provide real-time performance tracking, portfolio rebalancing tools, and tax optimization insights. Platforms with smart alerts, AI-driven risk assessments, and brokerage integration ranked higher.

- Ease of Use & Customization (15%): We assessed how well premium platforms balance advanced capabilities with user-friendly interfaces. Those offering custom dashboards, API access, and seamless multi-device usability received better ratings.

- Pricing (20%): We considered how the plan's pricing compared to other premium plans and what benefits traders/investors get. Is it worth it overall?