If you’re into serious stock research, both Seeking Alpha Premium and Pro offer major upgrades.

Premium gives you full access to quant ratings, top stock lists, and earnings tools, while Pro is built for pros — with exclusive analyst ideas, short-selling research, and under-the-radar stock picks.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

What You'll Get On Both Plans?

Here are the key features that both Seeking Alpha Premium and PRO plans include.

These tools serve long-term investors, dividend seekers, and self-directed investors looking for actionable stock research, data-driven insights, and portfolio management capabilities.

-

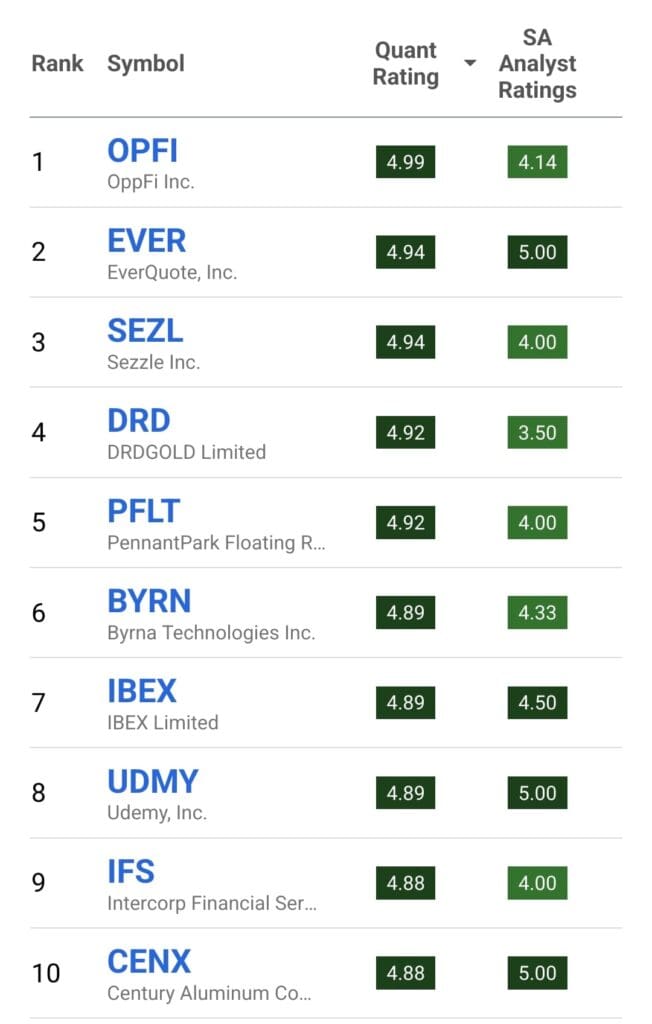

Quant Ratings & Factor Grades

Both Premium and PRO include Seeking Alpha’s Quant Ratings system, which scores stocks based on valuation, growth, profitability, momentum, and EPS revisions, and is one of the leading stock analysis tools in the market.

Each stock also receives Factor Grades (A+ to F) for fundamentals like earnings and financial health.

For example, investors can quickly identify undervalued growth stocks with strong momentum and avoid overpriced companies with weak fundamentals.

-

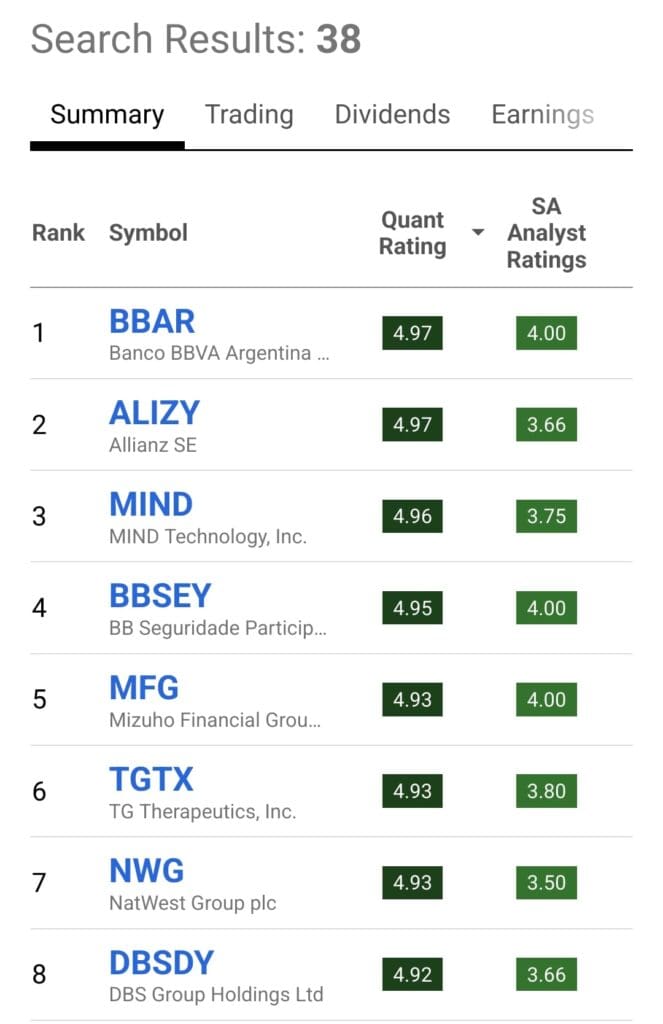

Advanced Stock & ETF Screener

Users on both plans get access to a powerful stock and ETF screener with filters like valuation, dividend yield, profitability, and Seeking Alpha’s proprietary Quant Ratings.

Investors can screen for top-rated dividend stocks or ETFs with strong performance metrics.

-

Top Stock and ETF Rankings

Seeking Alpha Premium and PRO offer curated lists such as Top Growth Stocks, Top Dividend Stocks, and Top Small-Cap Stocks. These lists are built using quant metrics and author insights.

An investor looking for yield can explore “Top Dividend Stocks” to uncover companies with reliable payouts and high dividend safety grades.

-

Unlimited Access to Premium Articles

Both plans unlock Seeking Alpha’s expert-written articles that provide in-depth research, sector outlooks, and investment theses.

This helps with research validation and gaining unique insights.

-

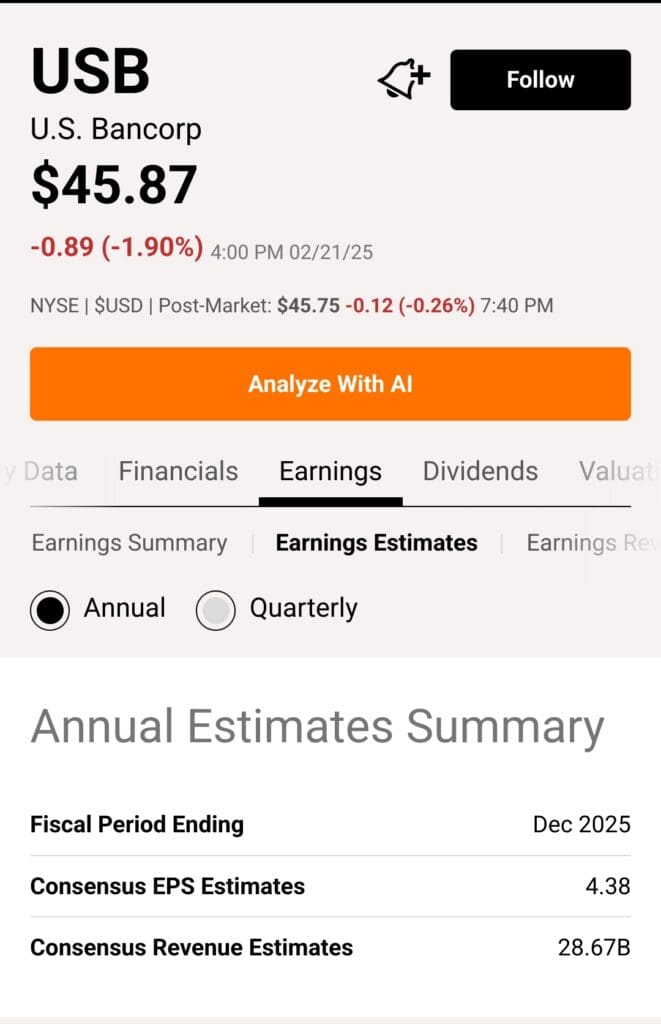

Earnings Reports & Call Transcripts

Subscribers on either plan get full access to earnings call transcripts, helping investors hear directly from company executives. These transcripts offer key insights on management guidance and future plans.

For example, you can review how a company addressed margin pressure during an earnings call before making a buy decision.

-

Portfolio Health Check & Risk Alerts

Both plans offer a Portfolio Health Check that analyzes an investor’s holdings and provides risk warnings. It highlights stocks that may be overvalued, show earnings decline, or have weak fundamentals.

For example, if a portfolio is overweight in speculative biotech stocks, the tool may flag volatility risks and diversification issues.

-

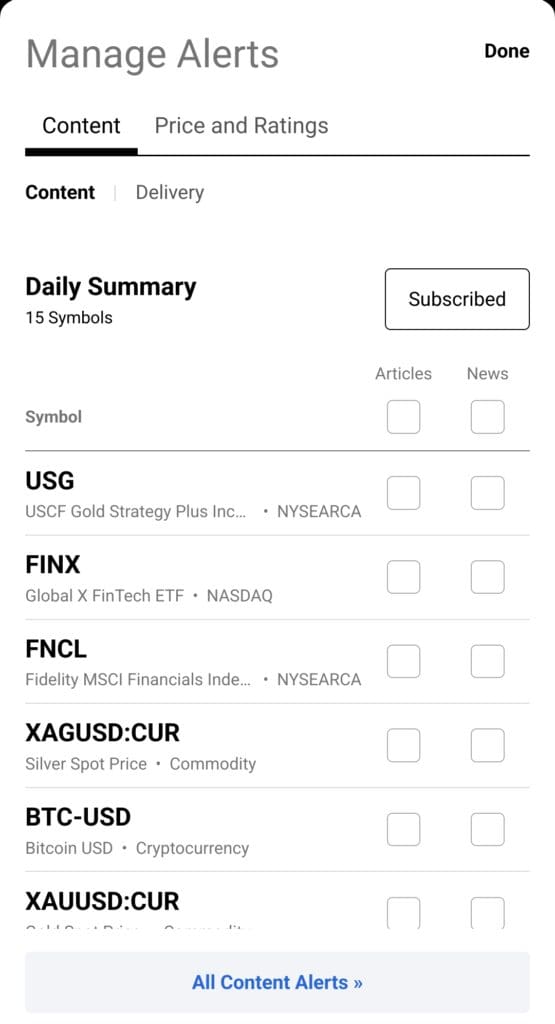

Real-Time Portfolio Alerts

Users receive instant alerts for portfolio changes, such as earnings revisions, analyst upgrades or downgrades, and dividend announcements. These alerts help investors stay proactive.

For example, if one of your stocks gets downgraded due to slowing revenue, you’ll get a heads-up to reassess your position.

-

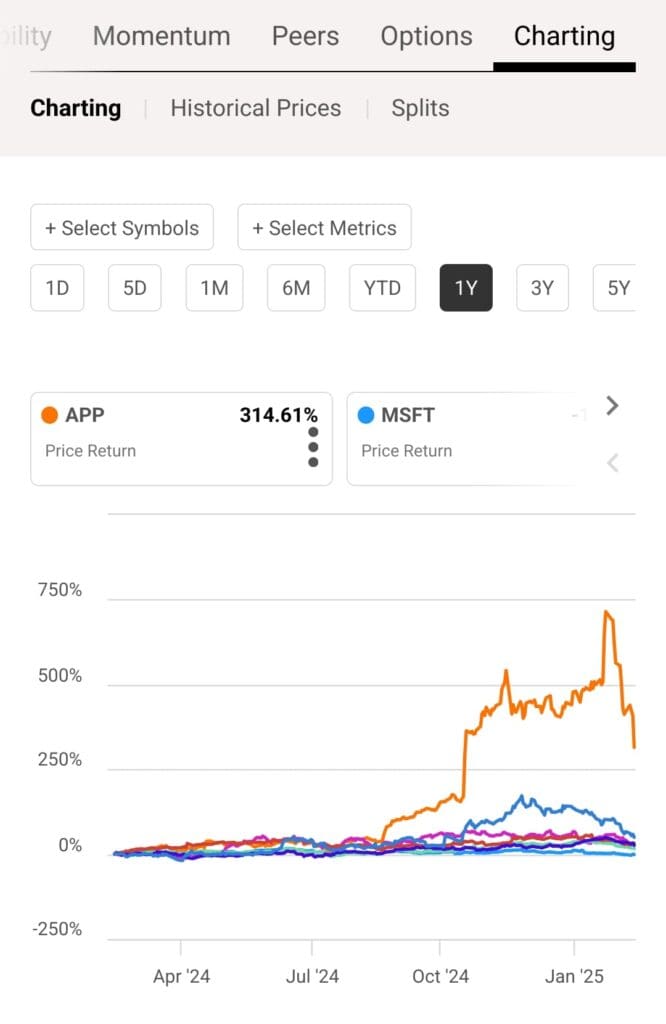

Stock & ETF Comparison Tool

Both plans offer a side-by-side comparison tool, allowing users to analyze up to six stocks or ETFs based on metrics like valuation, profitability, and growth.

For example, you can compare Microsoft vs. Apple vs. Nvidia on earnings revisions, dividend growth, and quant ratings—all in one view.

-

Dividend Safety Scores & Analysis

Premium and PRO users have access to Seeking Alpha’s dividend safety scores, payout ratios, and dividend history. For income-focused investors, this helps assess how sustainable a company’s dividend is.

For instance, a REIT with a high yield but low safety score may be riskier than a lower-yielding utility with top scores.

-

Author Performance Tracking

Subscribers can track how well Seeking Alpha contributors perform over time. PRO and Premium users can follow top authors based on their historical article returns. This helps identify trusted analysts.

For example, if an author’s bullish calls on energy stocks have consistently outperformed, you may choose to follow their future coverage.

-

Additional Tools For Both Seeking Alpha Premium & PRO

Here are some additional features available in both Seeking Alpha Premium and PRO that enhance the overall research and user experience:

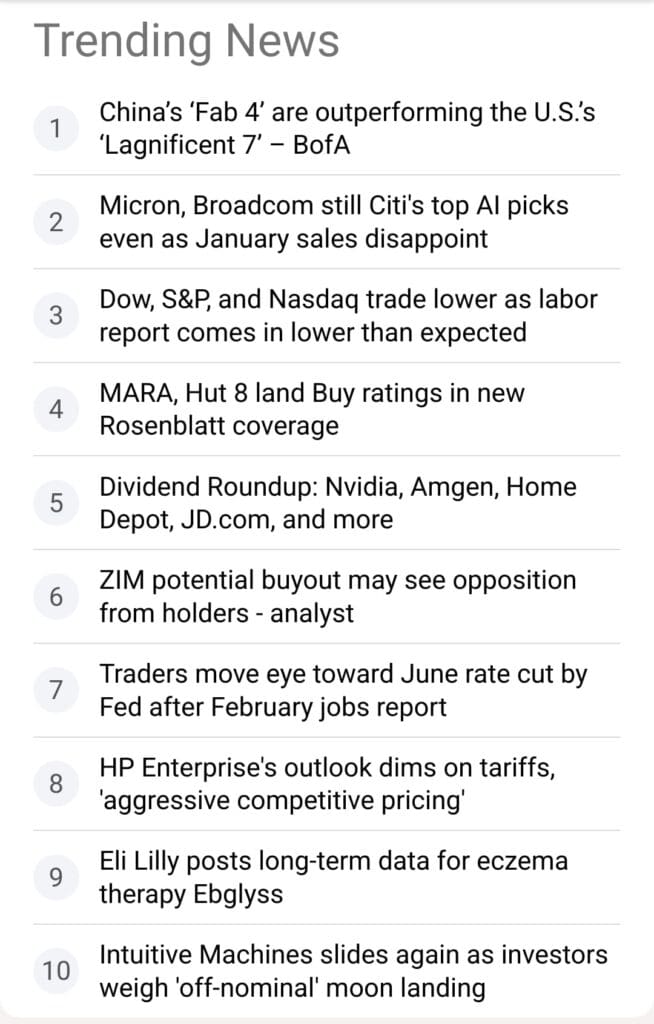

Unlimited News Dashboard Access: Both plans include full access to a customizable news dashboard with real-time updates on sectors, stocks, and economic trends.

Market & Economic Calendars: Users can view earnings schedules, dividend payout dates, Fed announcements, and other key events to plan trades and analysis.

Access to SEC Filings & Press Releases: Investors can review official 10-K, 10-Q, and 8-K reports directly within the platform to validate financial and strategic updates.

Watchlist Alerts for Tracked Stocks: Subscribers receive updates on watchlist stocks, including news, earnings changes, and ratings—helpful for tracking potential buy targets.

Access Across Devices: Both plans support multi-device access, letting investors research or monitor their portfolios seamlessly via desktop, tablet, or mobile.

What You'll Get If You Upgrade To The PRO Plan?

The Seeking Alpha Pro plan is significantly more expensive than the Premium plan, and there’s a reason for that. It’s not just a minor upgrade – it’s a full step into professional-grade research.

Designed for serious investors and fund managers, Pro offers exclusive analyst insights, under-the-radar stock picks, and deep bearish research you won’t find anywhere else.

-

Top Analyst Insights

Seeking Alpha Pro curates stock ideas from its top-performing contributors, offering access to exclusive articles vetted for quality and analyst track record.

This goes beyond general Premium articles by focusing only on expert contributors with consistent outperformance, helping users discover high-quality investment opportunities early.

-

Exclusive Coverage of Underfollowed Stocks

Pro users receive deep research on small- and mid-cap stocks not typically covered by Wall Street. These under-the-radar picks often include high-risk, high-reward opportunities.

Compared to the Basic or Premium plan, this feature provides a valuable edge in discovering hidden gems before the broader market catches on.

-

Short Ideas & Bearish Analysis

Unlike most stock research tools that focus on bullish cases, Pro offers bearish reports and short-selling opportunities. These are written by experienced analysts highlighting overvalued or weak companies.

This helps traders and hedge fund-style investors manage downside risk and spot potential bubbles.

-

Real-Time Upgrades & Downgrades

Pro provides consolidated real-time rating changes from Seeking Alpha Quant Ratings, Wall Street analysts, and platform contributors.

While Basic and Premium offer some alerts, only Pro gives a unified, real-time stream—ideal for tracking sentiment shifts and making timely decisions.

-

Deeper Author Performance Tracking

While Premium users can follow authors, Pro includes detailed performance metrics and historical article returns for each contributor. This helps investors assess credibility before relying on a recommendation.

For instance, users can prioritize insights from analysts with a proven track record in specific sectors.

-

Who May Prefer the Seeking Alpha Premium Plan?

Investors who want advanced research tools, dividend insights, and comprehensive stock data without paying institutional-level prices may prefer Premium.

Fundamental-Driven Investors: Premium’s Quant Ratings, earnings data, and valuation tools help users identify quality stocks based on key financial metrics and long-term growth.

Dividend Income Seekers: Dividend safety scores, payout ratios, and top-yield stock rankings make it ideal for those building a stable income portfolio.

Self-Directed Researchers: Investors who want to dive into unlimited premium articles, call transcripts, and side-by-side stock comparisons will find great value.

ETF-Focused Investors: ETF rankings and sector breakdowns help users evaluate funds based on performance, exposure, and dividend potential.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

-

Which Investor May Prefer the Seeking Alpha Pro Plan?

Investors who want exclusive research, expert-curated stock picks, and short-selling ideas will find Seeking Alpha Pro more aligned with their needs.

Institutional or Professional Investors: Pro is ideal for fund managers or analysts looking for curated insights, undercovered stock ideas, and top contributor research.

Opportunistic Growth or Value Investors: Those searching for high-conviction, underfollowed stocks not widely discussed on Wall Street benefit from the platform’s exclusivity.

Active Portfolio Managers: Real-time alerts, short ideas, and upgrades/downgrades help managers act quickly on changing fundamentals and sentiment.

Hedge-Fund Style Traders: With bearish reports and downside risk analysis, Pro suits traders using long/short strategies or targeting overvalued stocks.

Seeking Alpha Premium vs Pro: Which Is Best?

Seeking Alpha Premium is perfect for self-directed investors who want full access to ratings, rankings, and research at a fair price.

But if you're managing large sums, want expert-curated stock ideas, or use short strategies, Pro delivers the exclusive tools and insights you’ll actually use. It’s more expensive—but also far more exclusive.