|

| |

|---|---|---|

Seeking Alpha Premium | Benzinga Pro Basic | |

Price | $299 ($24.90 / month)

No monthly subscription | $367 ($30.58 / month) |

Best Features | ||

Our Rating |

(4.6/5) |

(4.4/5) |

Read Review | Read Review |

Seeking Alpha vs. Benzinga Pro: Compare Top Features

In this article, we’ll compare Seeking Alpha Premium and Benzinga Pro (Basic), focusing on the tools each platform offers for stock research and analysis.

We’ll walk you through their screening capabilities, real-time news coverage, portfolio insights, and research strengths to help you decide which platform aligns better with your investing or trading style.

-

Stock Screening Tools

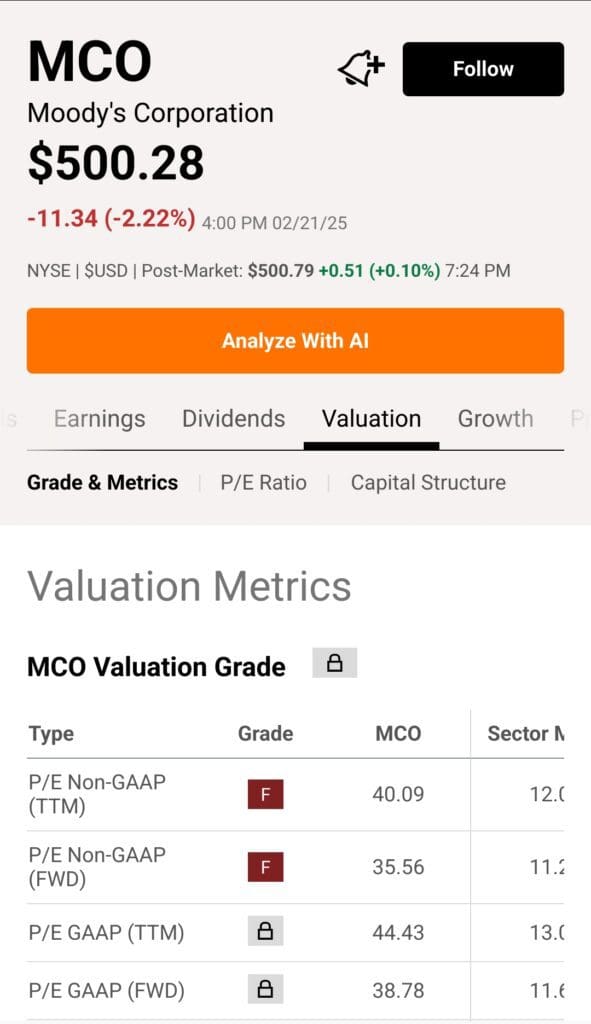

Seeking Alpha Premium excels in stock screening tools, offering an advanced and customizable stock and ETF screener. Users can filter based on valuation, profitability, momentum, dividend yield, etc.

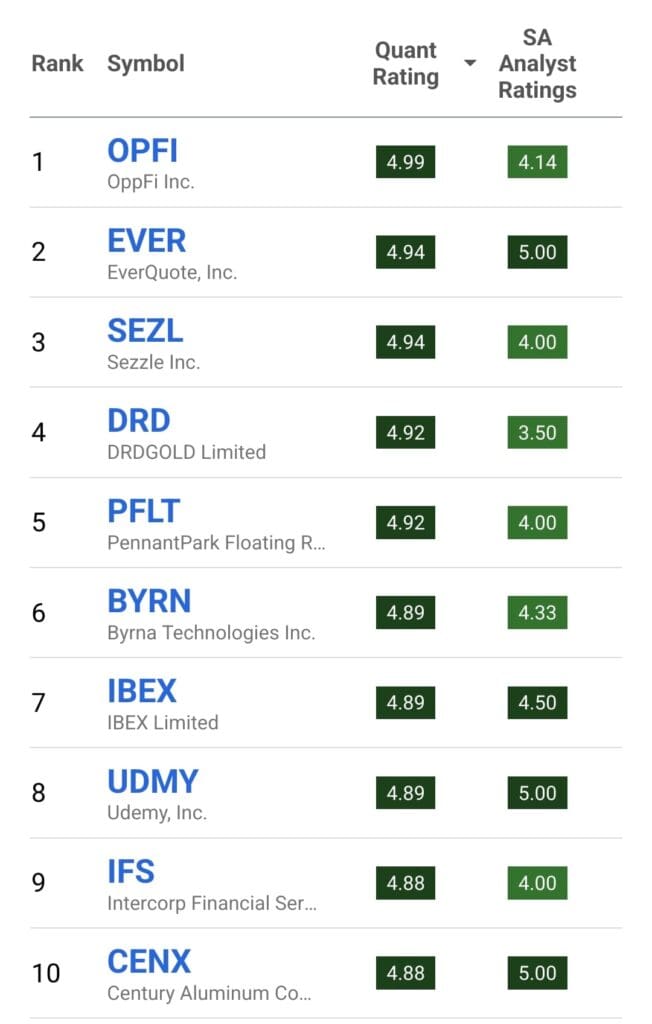

A standout feature is the ability to filter by Quant Ratings and Factor Grades, helping investors easily identify Strong Buy stocks using data-driven criteria. including penny stocks.

In contrast, unlike the Benzinga Pro Essential, the Pro Basic lacks an advanced screener. While it offers charts and key financials, users must search for individual stocks manually or rely on external tools.

This absence significantly limits investors looking to narrow down a universe of stocks by custom criteria or metrics.

-

Fundamental Analysis Tools

Seeking Alpha Premium has in-depth financial data, full earnings reports, valuation models, and detailed dividend analysis.

The platform offers earnings history, forward estimates, and financial statements through interactive charts.

Premium users also access proprietary Quant Ratings, Factor Grades, and unlimited expert articles, which help investors go beyond surface-level data.

Benzinga Pro Basic provides access to some key metrics like earnings data, analyst ratings, and insider trades. However, it lacks depth in financial statement analysis, forecasting tools, and custom valuation insights.

Its articles and news are informative but not as comprehensive or stock-specific as Seeking Alpha’s.

-

Stock Picks & Recommendations

While neither offers classic buy/sell picks in the base plans, Seeking Alpha Premium’s curated stock rankings give it a clear advantage for investors seeking guidance.

Seeking Alpha Premium does not offer traditional stock picks in the basic Premium plan, but users benefit from curated stock rankings—such as Top Growth, Value, and Dividend Stocks—based on Quant Ratings and performance factors.

Benzinga Pro Basic, on the other hand, offers no stock picks, curated recommendations, or proprietary rankings at all.

-

Market Sentiment Analysis

Benzinga Pro Basic has a strong edge in market sentiment and news monitoring. It provides a full real-time newsfeed with earnings updates, analyst ratings, insider activity, and macroeconomic events.

Users can set alerts and monitor stock movers instantly, making it especially useful for news-driven traders.

Seeking Alpha Premium offers a robust news dashboard with macro updates and article-based insights, but it lacks the speed and breadth of Benzinga’s real-time coverage.

Moreover, Benzinga also offers tools like watchlist alerts and economic calendars to track sentiment shifts, which Seeking Alpha doesn’t provide in real-time.

-

Portfolio Analysis & Alerts

Seeking Alpha Premium offers a Portfolio Health Check tool that evaluates users’ holdings based on risk factors, dividend safety, and financial strength.

It flags overvalued or weak stocks and provides grades for diversification and income reliability. While it doesn’t offer automated rebalancing, the insights are useful for long-term investors.

Benzinga Pro Basic, however, lacks any portfolio analysis or performance tracking. Users can only set watchlist alerts but won’t receive detailed diagnostics on their holdings.

-

Technical Analysis Options

Benzinga Pro Basic includes interactive stock charts with basic technical indicators such as momentum, stochastic, volatility, and moving averages.

While each chart is limited to two indicators at a time, it still allows traders to analyze price action, volume, and technical setups. This makes it useful for short-term traders looking for quick insights.

[elementor-template id=”195658″]

On the other hand, Seeking Alpha Premium focuses almost entirely on fundamental analysis. While it offers basic stock charts, it lacks advanced indicators, multi-timeframe analysis, and chart overlays.

-

ETF, Bonds & Fund Analysis Tools

Seeking Alpha Premium includes curated ETF rankings by performance, risk, and sector exposure.

Users can evaluate funds using Quant Ratings and Factor Grades, though the platform lacks detailed bond or mutual fund coverage.

Benzinga Pro Basic offers basic ETF performance data and sector trends, along with updates on ETF news and holdings. However, it doesn’t offer advanced fund metrics or bond analysis either.

Who Should Consider Seeking Alpha Premium?

Investors who value deep research, stock ratings, and financial transparency will benefit most from Seeking Alpha Premium’s feature-rich platform.

Fundamental Analysts: Those who focus on valuation, profitability, and earnings data will appreciate the Quant Ratings and financial statement tools.

Dividend Investors: Premium offers dividend safety grades, payout histories, and curated lists of high-yield stocks.

Self-Directed Investors: DIY investors get unlimited premium articles, stock comparisons, and in-depth insights across thousands of U.S. equities.

ETF-Focused Investors: The platform’s ETF rankings and factor-based evaluations are useful for fund selection and portfolio strategy.

Seeking Alpha subscription is ideal for long-term investors who want reliable data and thorough research to support independent decision-making.

[elementor-template id=”195727″]

Who Should Consider Benzinga Pro?

Investors who trade on headlines, price action, or fast-moving markets may find Benzinga Pro’s subscription real-time data and alerts more useful.

News-Driven Traders: The full real-time newsfeed and earnings updates are ideal for responding quickly to breaking events.

Momentum & Day Traders: Real-time quotes, stock movers, and watchlist alerts support fast decision-making in active markets.

Analyst-Focused Investors: Benzinga’s access to analyst ratings and price targets can help gauge Wall Street sentiment.

Macro Event Followers: Tools like the economic calendar and IPO tracker help traders anticipate and react to major market events.

Benzinga Pro is a better fit for short-term traders who rely on speed, alerts, and news rather than deep analysis.

[elementor-template id=”195658″]

Bottom Line

Seeking Alpha Premium excels in deep stock research, Quant Ratings, and long-term investment insights, making it perfect for fundamental and dividend-focused investors.

Benzinga Pro Basic, on the other hand, dominates with real-time news, fast alerts, and active trading support.

Your choice depends on your strategy—data-driven stock selection or lightning-fast reaction to market events. Both platforms serve distinct investor types with minimal overlap in core strengths.