|

| |

|---|---|---|

Seeking Alpha Premium | TradingView Premium | |

Price | $299 ($24.90 / month)

No monthly subscription | $432 ($23.98 / month) |

Best Features | ||

Our Rating |

(4.6/5) |

(4.6/5) |

Read Review | Read Review |

Compare Stock Research & Analysis Features

In this breakdown, we’re putting Seeking Alpha Premium and TradingView Premium head-to-head.

Whether you’re into expert stock picks or proven rankings, we’ll show you which platform gives you more power to level up your investing game.

-

Stock Screening Tools

After reviewing both TradingView Premium and Seeking Alpha Premium, we found that each platform offers strong screening capabilities, but with different strengths.

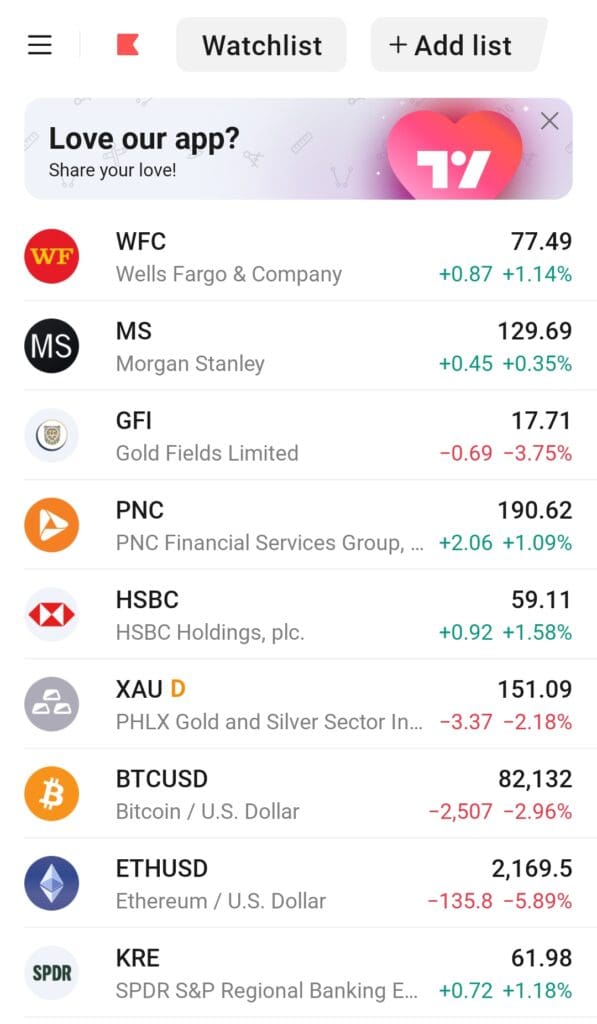

TradingView Premium shines with its real-time data and customizable screening options for stocks, ETFs, bonds, and cryptocurrencies. It's also one of the best screeners for stock options.

Its powerful filters allow users to search by technical indicators, valuation ratios, and growth metrics, making it ideal for technical traders.

On the other hand, Seeking Alpha Premium excels with its advanced stock screener, which includes Quant Ratings and Factor Grades. It enables users to filter stocks by valuation, growth, and profitability.

While Seeking Alpha's screener focuses on fundamental analysis, TradingView's screening tools cater more to active traders and those requiring real-time data.

-

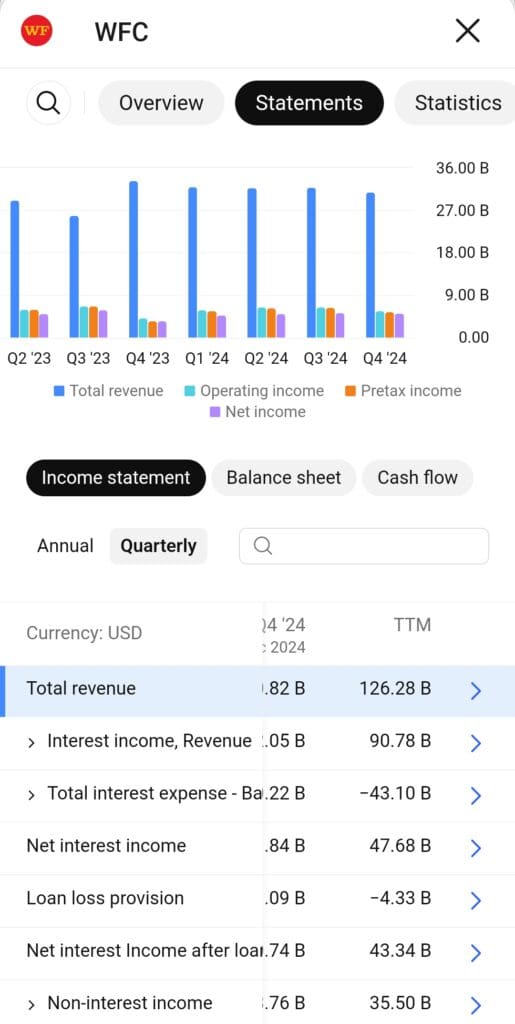

Fundamental Analysis Tools

When it comes to fundamental analysis, Seeking Alpha Premium outperforms TradingView Premium.

Seeking Alpha provides a wealth of detailed financial data, including income statements, balance sheets, cash flow reports, and earnings call transcripts, all accessible in interactive charts.

The platform also offers proprietary Quant Ratings and Factor Grades for in-depth stock analysis, alongside analyst ratings and comprehensive research articles.

TradingView Premium, while offering enhanced fundamental analysis tools, such as income statements and earnings reports, doesn't provide the same level of depth or expert commentary.

For investors focusing on research and analysis, Seeking Alpha Premium stands out with its extensive library of expert-driven content.

-

Stock Picks & Recommendations

In our review, Seeking Alpha Premium clearly leads in stock picks and recommendations.

The platform's Quant Ratings system ranks stocks from Strong Buy to Strong Sell based on data-driven algorithms, and it also offers access to curated lists of top-rated stocks, ETFs, and dividend stocks.

This makes it easier for investors to find high-quality picks based on solid research.

TradingView Premium, in contrast, does not provide curated stock picks or expert recommendations.

It focuses on technical analysis, providing powerful charting and screening tools, but lacks the stock advisory services that Seeking Alpha Premium offers.

-

Market Sentiment Analysis

When we compared market sentiment analysis, TradingView Premium provides a superior offering.

The platform has a robust social trading community where users can share trade ideas, scripts, and strategies.

Additionally, it integrates breaking news, sentiment tracking for crypto, and social features that allow traders to interact and share their market insights in real-time.

Seeking Alpha Premium, while providing a news dashboard and unlimited access to expert articles, does not have the same level of social features or sentiment tracking tools.

Its market sentiment analysis is more focused on financial data and earnings reports, without the social trading angle that TradingView offers.

-

Portfolio Analysis & Alerts

Seeking Alpha Premium excels in portfolio analysis, offering detailed health checks, risk warnings, and dividend safety scores, helping investors monitor their portfolio’s performance and stability.

The platform also provides real-time alerts for price changes, earnings revisions, and news updates, which is highly useful for long-term investors looking for fundamental insights.

On the other hand, TradingView Premium offers unlimited alerts and second-based execution, making it ideal for active traders who need real-time execution.

While both platforms offer valuable portfolio tracking features, Seeking Alpha Premium’s in-depth analysis of portfolio health gives it an edge for long-term investors.

-

Technical Analysis Options

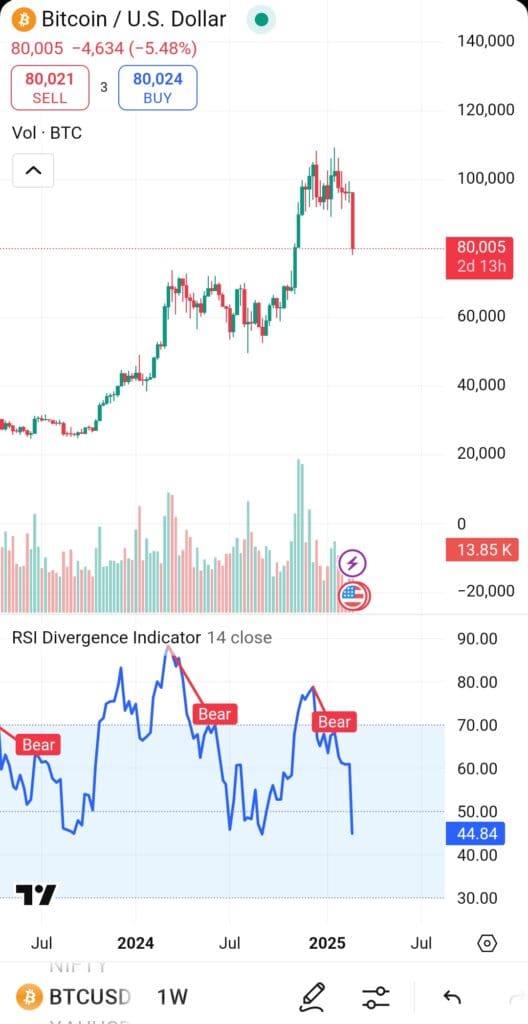

After reviewing the technical analysis tools of both platforms, TradingView Premium stands out for its advanced charting and technical features.

With over 400 built-in indicators, the ability to apply indicators on indicators, and support for multiple timeframes, TradingView is the ideal app for serious technical traders.

The platform also offers Supercharts, auto chart pattern recognition, and multi-chart layouts for detailed market analysis.

While Seeking Alpha Premium offers basic stock charts and limited technical analysis features, it lacks the advanced charting tools and customization options that TradingView Premium provides.

For those who rely heavily on technical signals, TradingView Premium is the go-to choice.

-

ETF, Bonds & Fund Analysis Tools

When it comes to ETF, bonds, and fund analysis, Seeking Alpha Premium offers a solid set of tools, including top ETF rankings based on performance, sector exposure, and risk.

However, for bond investors, Seeking Alpha lacks the in-depth analysis tools that TradingView Premium provides.

TradingView offers a bond screener with advanced filtering options such as yield-to-maturity (YTM) and coupon rates, while its ETF screener offers detailed performance tracking and expense ratio comparisons.

Although Seeking Alpha Premium is good for ETF screening, TradingView Premium offers more comprehensive tools for both bonds and ETFs.

Which Investors May Prefer Seeking Alpha Premium?

Seeking Alpha subscription is worth it for investors prioritizing in-depth fundamental analysis and expert-driven research. It suits:

Dividend Investors: Access to dividend safety scores, payout history, and top-rated dividend stocks for income-focused portfolios.

Long-Term Investors: Comprehensive stock analysis, portfolio health checks, and risk warnings make it perfect for monitoring long-term investments.

Fundamental Analysts: The platform's detailed financials, earnings data, and valuation models are designed for those who rely on company fundamentals.

DIY Investors: Seeking Alpha Premium offers unlimited access to expert articles and stock comparisons, which is ideal for self-directed research.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

Which Investors May Prefer TradingView Premium?

TradingView Premium subscription is perfect for traders seeking advanced charting tools and real-time market analysis. It suits:

Active Traders: Unlimited alerts, second-based execution, and advanced charting make it ideal for day traders and scalpers.

Technical Analysts: The platform's powerful charting features, multi-timeframe analysis, and over 400 indicators are designed for detailed technical analysis.

Algorithmic & Quant Traders: With Pine Script® automation and webhook alerts, TradingView Premium allows custom strategy development and execution.

Crypto Traders: The platform’s advanced crypto screener and real-time data tracking make it a great choice for digital asset traders.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Trading View Essential | $14.95

$108 ($9 / month) if paid annually | 30-day free trial |

Trading View Plus | $29.95

$180 ($14.95 / month) if paid annually

| 30-day free trial |

Trading View Premium | $59.95

$432 ($23.98 / month) if paid annually | 30-day free trial |

Trading View Expert | $119.95

$1,199 ($99.95 / month) if paid annually | N/A |

Trading View Ultimate | $239.95

$2,399 ($199.95 / month) if paid annually | N/A |

Bottom Line

Seeking Alpha Premium excels in providing deep fundamental analysis, expert stock recommendations, and dividend insights, making it ideal for long-term and dividend-focused investors.

On the other hand, TradingView Premium stands out for its advanced charting, real-time alerts, and automation, making it the top choice for active traders and technical analysts.