| ||

|---|---|---|

Yahoo Finance Gold | Seeking Alpha Premium | |

Price | $479.40 ($39.95 / month) | $299 ($24.90 / month)

No monthly subscription |

Best Features | ||

Our Rating |

(4.6/5) |

(4.6/5) |

Read Review | Read Review |

Seeking Alpha vs. Yahoo Finance: Compare Top Features

In this comparison, we’ll examine Yahoo Finance Gold and Seeking Alpha Premium's features and tools.

We’ll help you figure out which platform delivers the best value for stock research, market analysis, and investment strategies.

-

Stock Screening Tools

Yahoo Finance Gold stands out with its Smart Money Screener, which tracks institutional money, and the Top Holdings Screener, which lets users monitor hedge fund positions.

Additionally, it offers 50+ technical chart patterns, real-time alerts, and a robust stock & ETF screener.

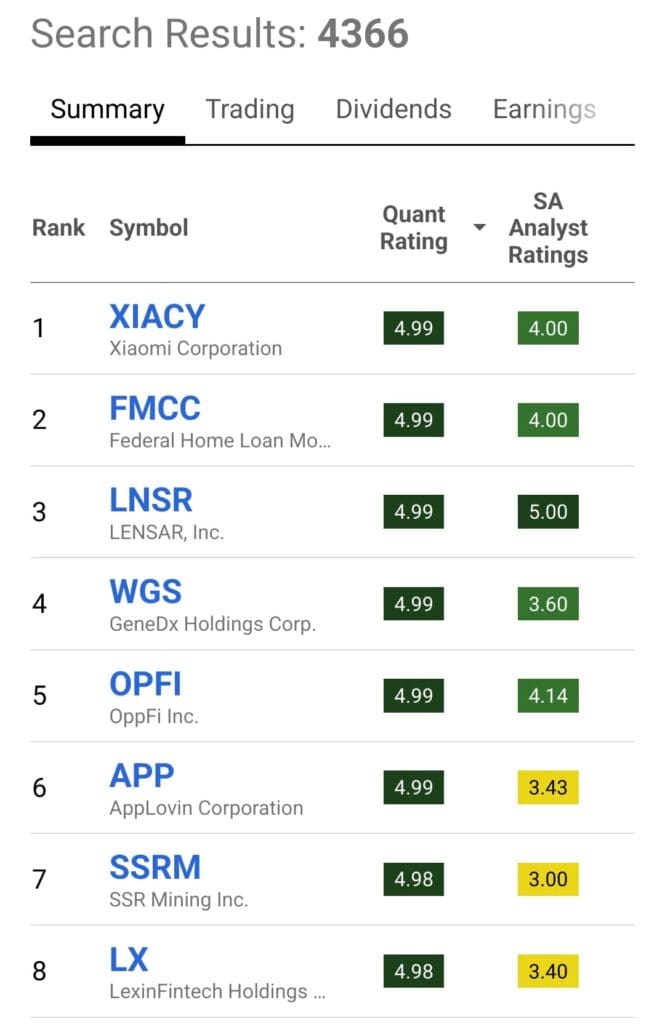

Seeking Alpha Premium, on the other hand, provides an advanced stock & ETF screener that is highly customizable, allowing filters based on factors like growth, momentum, valuation, and dividends.

Both tools excel in providing valuable stock ideas, but Yahoo Finance Gold leans more towards institutional-focused data, while Seeking Alpha Premium offers a broader range of filters for individual stock investors.

-

Our Winner

Yahoo Finance Gold offers more specialized institutional tracking, while Seeking Alpha Premium provides greater customization for individual stock screening.

-

Fundamental Analysis Tools

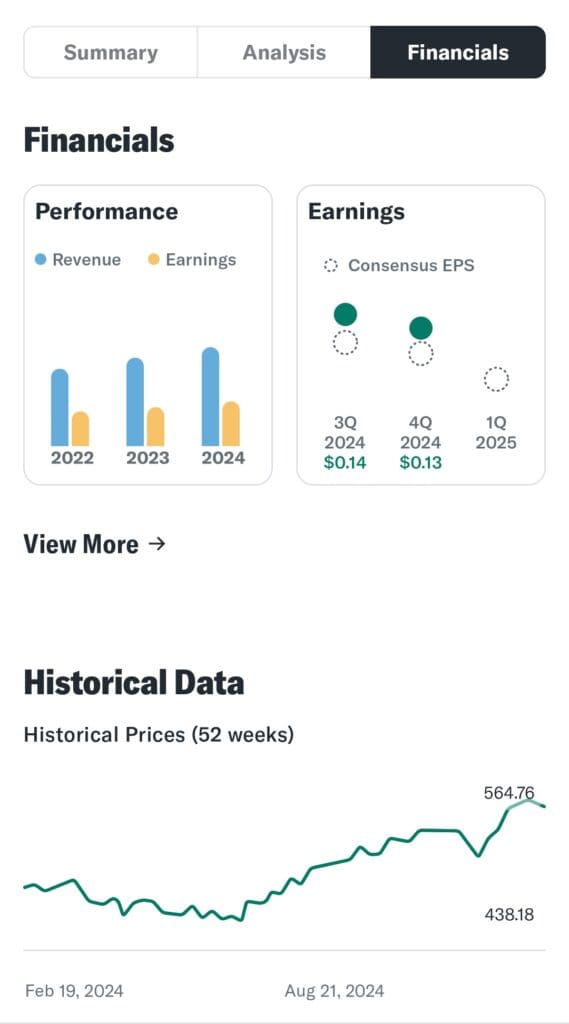

In terms of fundamental analysis, Yahoo Finance Gold provides extensive historical data with 40 years of financial statements, offering a deep dive into a company’s long-term performance.

It also gives access to Morningstar stock ratings and Argus Research, which are valuable for assessing fair value and financial health.

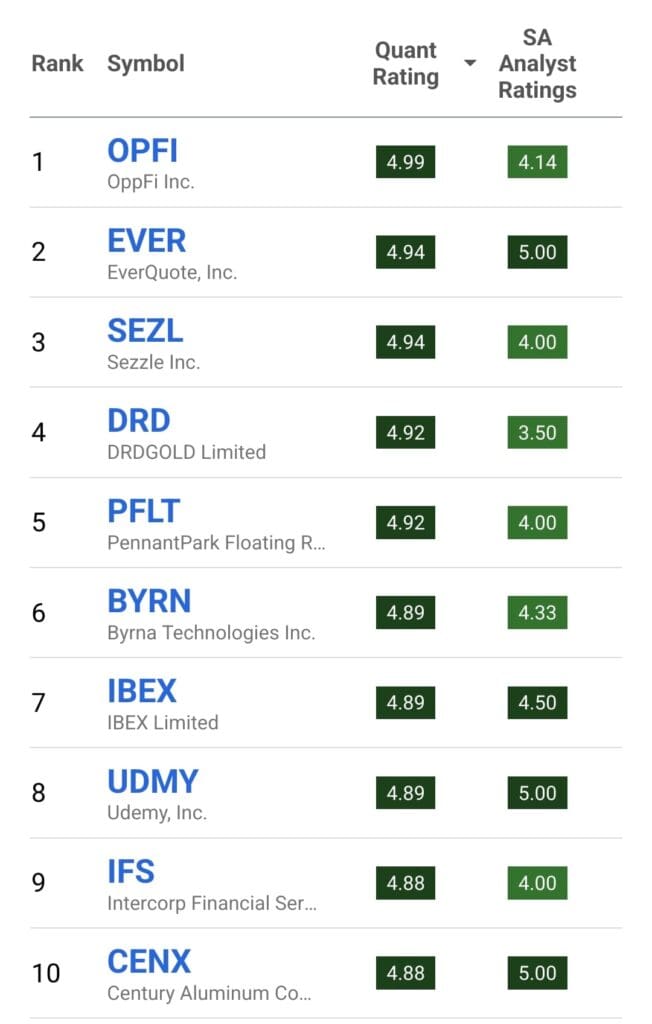

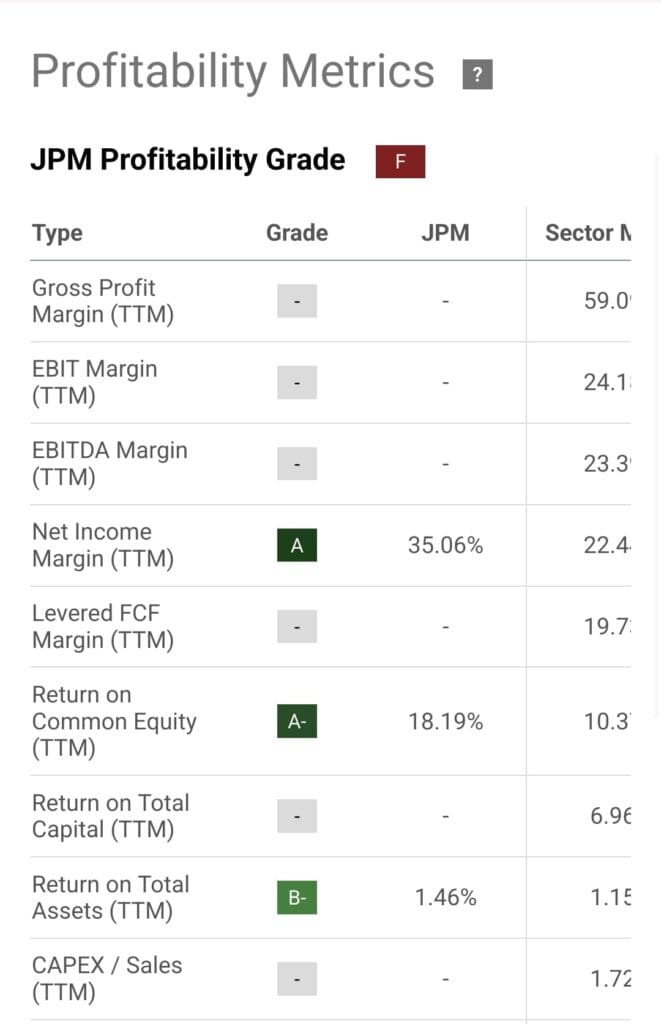

Seeking Alpha Premium, however, brings its Quant Ratings system, which evaluates stocks based on growth, valuation, profitability, and momentum.

This system, coupled with unlimited access to premium articles, earnings call transcripts, and detailed financial statements, makes Seeking Alpha Premium highly effective for data-driven stock research.

-

Our Winner

Seeking Alpha Premium’s Quant Ratings and real-time articles provide superior tools for ongoing stock research, while Yahoo Finance Gold is better for historical data and stock ratings.

-

Stock Picks & Recommendations

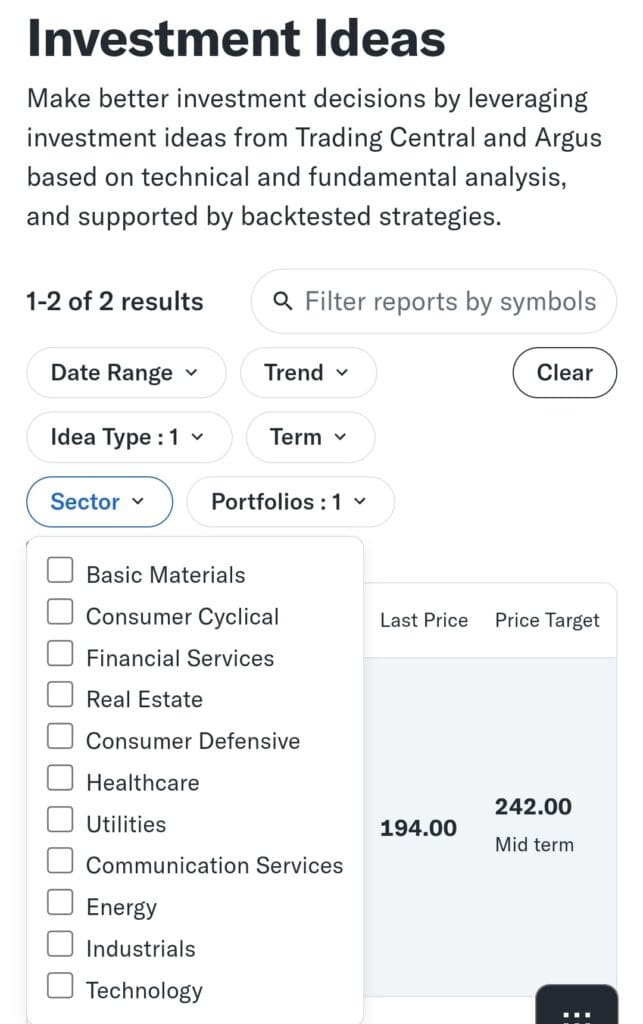

Yahoo Finance Gold’s Personalized Trade Ideas feature, based on stock momentum and technical indicators, provides tailored stock picks for users.

Additionally, it offers insights from Morningstar and Argus Research, making it great for investors who value expert-backed recommendations.

On the other hand, Seeking Alpha Premium offers its Quant Ratings system and unlimited access to expert investment ideas, which categorize stocks into growth, value, and dividend opportunities.

-

Our Winner

Seeking Alpha Premium provides a more comprehensive stock picking system with data-driven recommendations, while Yahoo Finance Gold shines with personalized suggestions backed by expert analysis.

-

Market Sentiment Analysis

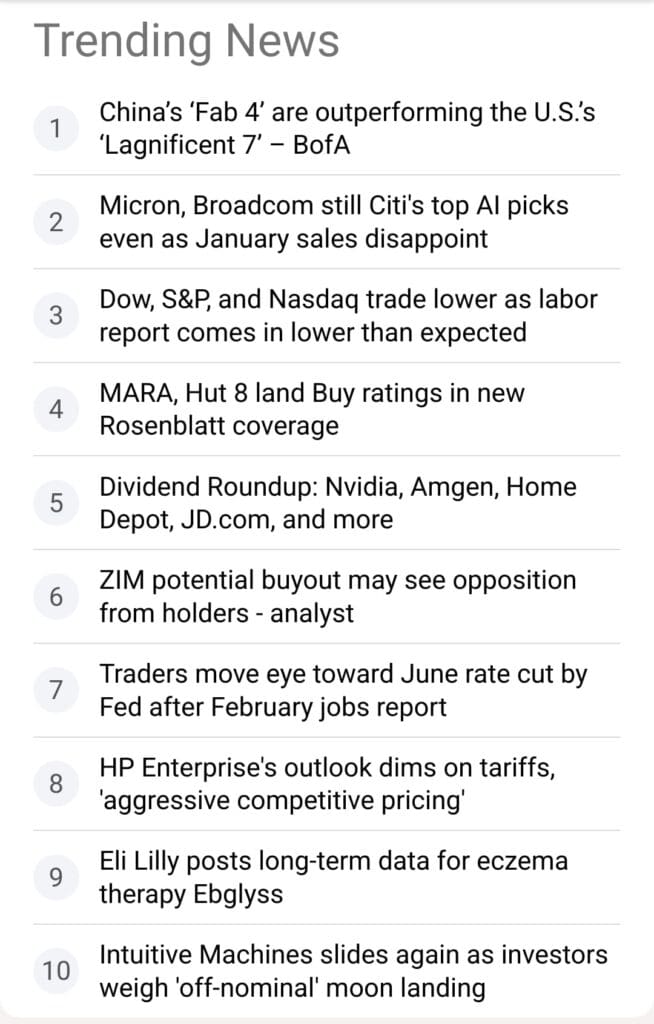

Seeking Alpha Premium, however, goes a step further with a comprehensive news dashboard, unlimited access to premium articles, and even author performance tracking, which allows users to assess the quality of advice based on track records.

Additionally, Seeking Alpha includes community-driven content and user discussions, which can influence sentiment and provide diverse perspectives on stocks.

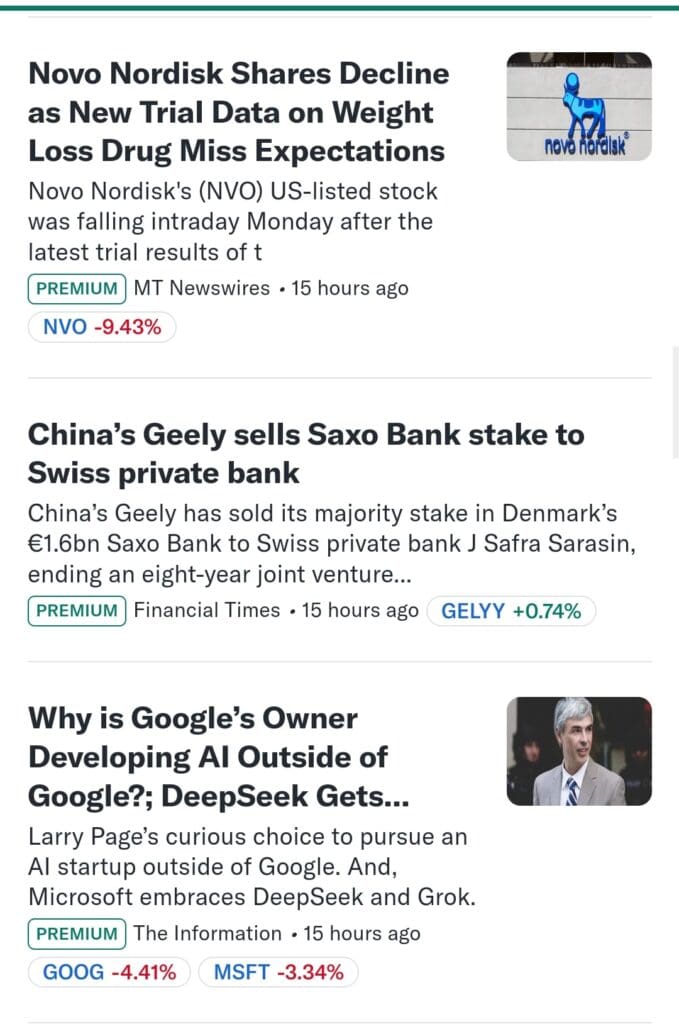

Yahoo Finance Gold’s Premium Newsfeed offers access to top-tier financial journalism, including sources like the Financial Times and The Information, ensuring users stay up-to-date with market-moving news.

However, it lacks social trading features.

-

Our Winner

Seeking Alpha Premium offers more dynamic market sentiment analysis with community features and expert article tracking, while Yahoo Finance Gold provides robust news coverage but lacks social features.

-

Portfolio Analysis & Alerts

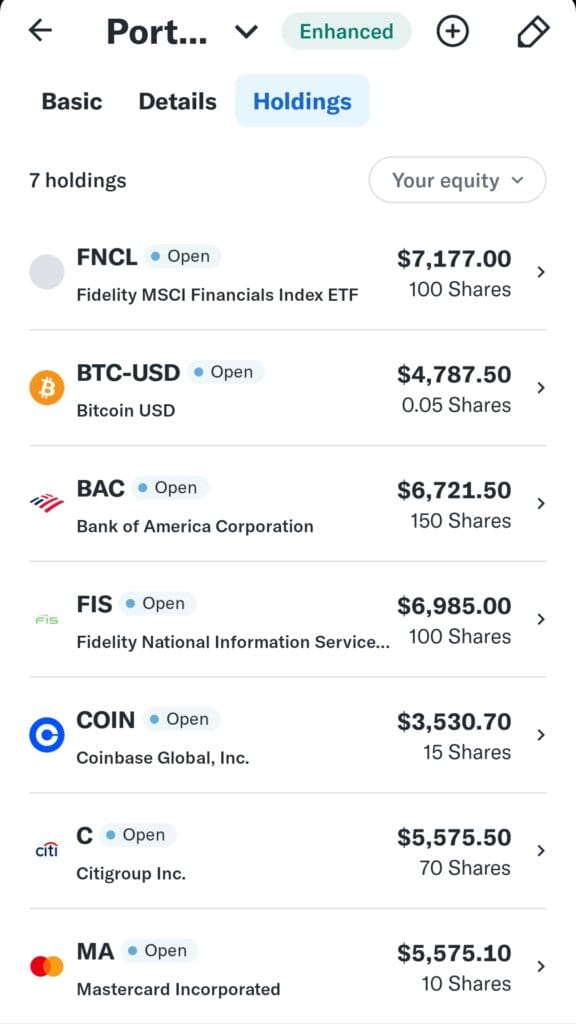

Both platforms offer robust portfolio analysis tools. Yahoo Finance Gold gives users detailed portfolio performance analysis, helping track returns, sector allocation, and volatility exposure.

Additionally, users can set alerts for technical patterns, price movements, and analyst ratings.

Seeking Alpha Premium provides portfolio health checks with warnings for overvaluation and weak fundamentals, along with dividend safety scores.

While both provide useful portfolio tracking, Yahoo Finance Gold offers more advanced real-time alerts and deeper sector-level insights.

-

Our Winner

Yahoo Finance Gold offers more comprehensive portfolio analysis and real-time alerts.

-

Technical Analysis Options

Yahoo Finance Gold excels in this area, offering over 50 technical chart patterns, custom annotations, and real-time alerts for key market events. Its tools make it ideal for technical traders who need pattern recognition and event tracking.

Seeking Alpha Premium provides basic charting features but lacks advanced technical analysis tools like customizable indicators or pattern recognition, which are crucial for technical traders.

-

Our Winner

Yahoo Finance Gold outperforms Seeking Alpha Premium with its advanced charting tools and technical pattern recognition.

-

ETF, Bonds & Fund Analysis Tools

In terms of ETF, bond, and fund analysis, Yahoo Finance Gold provides a stock & ETF screener with both technical and fundamental filters, though it lacks in-depth coverage of bonds and mutual funds.

Seeking Alpha Premium, on the other hand, offers detailed ETF analysis, ranking funds based on performance, sector exposure, and risk metrics.

However, neither platform provides deep bond or mutual fund research, leaving specialized tools like Morningstar or Zacks better suited for that analysis.

-

Our Winner

Seeking Alpha Premium excels with comprehensive ETF analysis, while Yahoo Finance Gold offers basic ETF screening without advanced bond or mutual fund tools.

Which Investor Types May Prefer Seeking Alpha Premium?

Seeking Alpha subscription is worth it for investors seeking in-depth stock research and data-driven insights. Here's who will benefit most:

Data-driven investors: The Quant Ratings and Factor Grades provide valuable stock ratings based on data, helping investors filter stocks efficiently.

Dividend investors: With dividend safety ratings and payout history, Seeking Alpha Premium helps investors find reliable income stocks.

Long-term fundamental analysts: The platform offers detailed financials, earnings data, and valuation metrics, making it ideal for deep research.

ETF investors: Access to top-rated ETFs and performance metrics makes it easier to evaluate and choose the right funds for your portfolio.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

Which Investor Types May Prefer Yahoo Finance Gold?

Yahoo Finance Gold is worth it for investors who require deep financial data, technical analysis, and institutional tracking. Here's who benefits most:

Institutional investors: The Smart Money Screener and Top Holdings Screener allow users to track hedge funds and institutional purchases.

Technical traders: With 50+ technical chart patterns, event annotations, and real-time alerts, this plan caters to active traders.

Long-term investors: Access to 40 years of historical data and financial statements provides valuable insights for long-term research.

Stock analysts: The inclusion of Morningstar ratings and Argus Research stock picks offers expert-backed recommendations for fundamental analysis.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

Bottom Line

Seeking Alpha Premium excels with its data-driven Quant Ratings, in-depth stock research, and dividend analysis tools, making it ideal for fundamental analysts and dividend investors.

Yahoo Finance Gold stands out for its institutional tracking, advanced technical analysis, and access to 40 years of financial data, perfect for long-term and technical traders.