What Are Stock Alerts and Why Investors Use Them?

Stock alerts are customizable notifications that inform investors of key market events, such as price changes, volume spikes, or technical triggers. These alerts help traders act quickly, especially in fast-moving markets where timing is crucial.

Investors use stock alerts for several reasons:

Stay Informed Without Monitoring Constantly: Alerts free investors from watching the markets all day by pushing notifications directly to email, SMS, or an app.

Catch Trading Opportunities Early: For example, if a stock breaks through a resistance level, a price alert helps you act before the move extends.

Risk Management: Set alerts near stop-loss thresholds or support levels to stay disciplined and avoid emotional decisions.

Track Watchlists Efficiently: Traders tracking multiple stocks can use alerts to manage entry and exit points without missing signals.

-

Types of Stock Alerts & Use Cases

Stock alerts come in various forms, each serving a specific purpose. Choosing the right type helps you respond effectively to market movements.

How to Use Stock Alerts To Maximize Your Investment

Stock alerts can boost your efficiency and timing in the market—if you use them strategically.

Set Entry and Exit Triggers: You can set alerts at your target entry price and your preferred exit level. This way, you avoid buying too early or missing your profit zone. For instance, if you want to buy Tesla at $160 and sell at $185, alerts let you know when those levels hit.

Monitor News-Based Volatility: Platforms like Seeking Alpha and Benzinga let you trigger alerts on earnings dates or press releases. This helps you prepare for sudden moves before or after market hours.

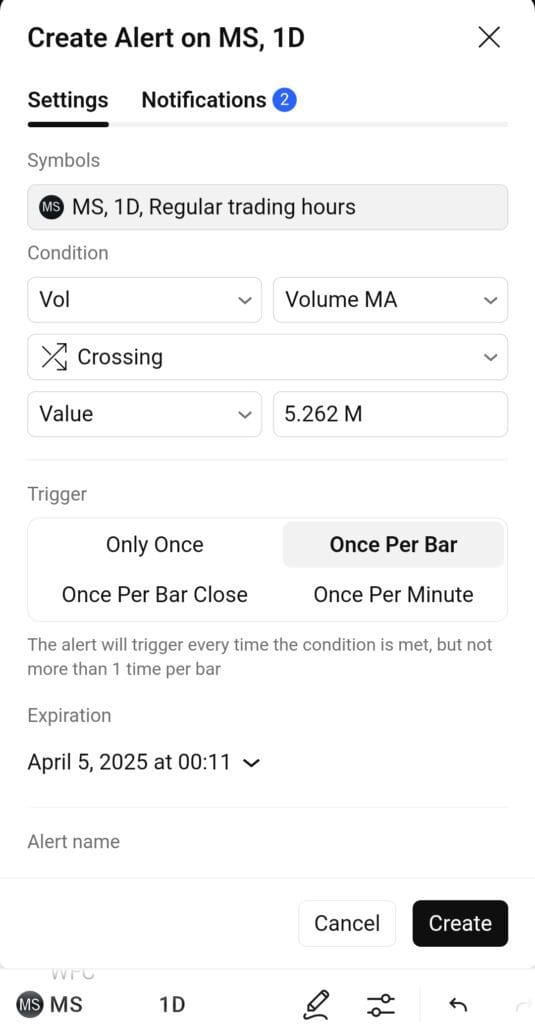

Use Technical Indicators for Alerts: Instead of just price, set alerts based on RSI crossing a threshold or MACD crossovers. For example, TradingView lets you get notified when RSI dips below 30 (oversold territory).

Stay Alert to Unusual Volume: Spikes in volume can signal the start of a trend. Alerting on abnormal volume levels lets you investigate quickly—before the rest of the market catches on.

Also, ensure that your alerts align with your overall strategy. A value investor may need fewer intraday triggers than an active trader who follows momentum setups.

How to Set Up Price Alerts for Stocks

Setting up price alerts helps investors react instantly to key market moves without constantly watching the screen.

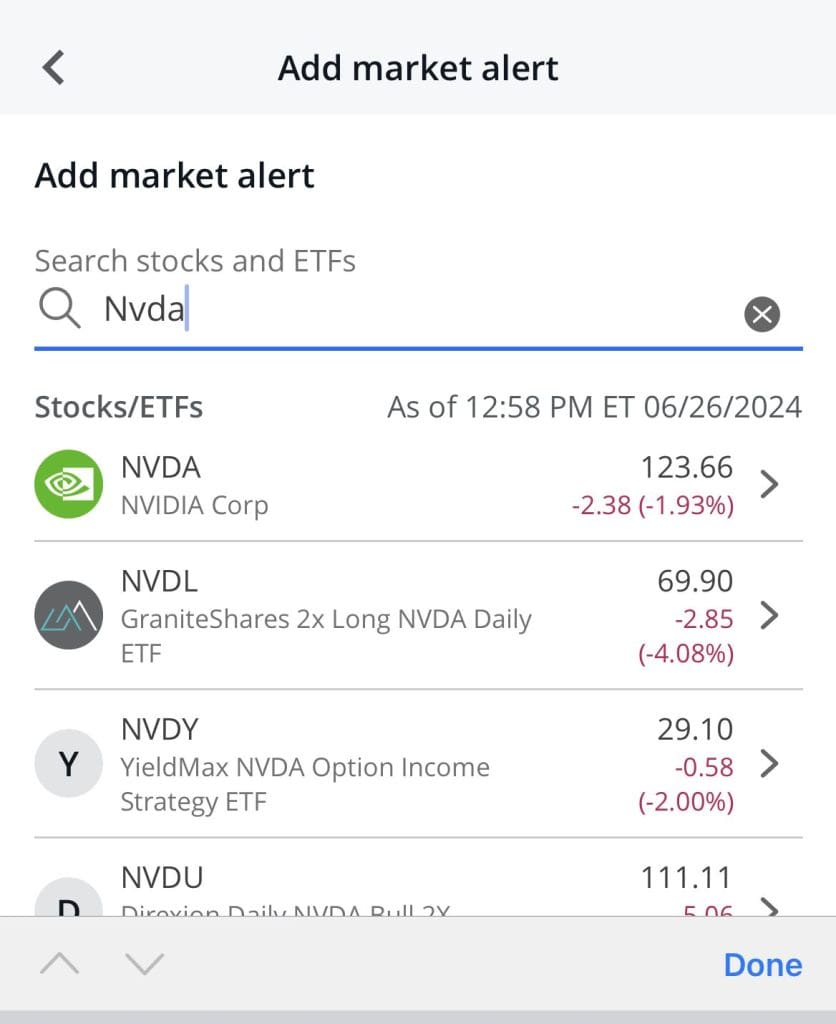

Choose Your Trading Platform: TradingView, Yahoo Finance, and Fidelity Active Trader Pro support price alerts. Log in and navigate to the stock’s chart or quote page.

Select “Create Alert” or Similar Option: Most platforms let you right-click on a chart or tap a bell icon near the stock’s name to begin.

Define the Trigger Price: Enter the exact price you want to be alerted at—either above or below the current price.

Choose Your Notification Method: You can usually receive alerts via push notification, email, or SMS.

Save and Test: Confirm your settings and run a test if the platform allows. This ensures you’re alerted exactly when needed.

Using price alerts allows you to stay reactive during market swings, earnings seasons, or breakouts.

How to Customize Stock Alerts for Your Trading Strategy

Customizing stock alerts ensures they align with your unique trading goals and risk tolerance—whether you're a long-term investor or day trader.

Set Alerts Based on Technical Indicators: Instead of only using price levels, set alerts for RSI, MACD, or moving average crossovers. This is especially useful for momentum and swing traders using platforms like TradingView.

Use Time-Specific Notifications: Customize alerts for pre-market or after-hours moves if you trade based on earnings news or economic data. For example, setting alerts before the CPI release helps short-term traders act fast.

Create Alerts on Multiple Assets: Track your entire watchlist—stocks, ETFs, or crypto—by setting conditional alerts across assets. This is helpful for portfolio managers watching correlations or sector movements.

Limit Alert Frequency: Avoid over-alerting by adding cooldown periods or setting minimum intervals between alerts. This keeps your focus on high-priority trades and prevents decision fatigue.

These adjustments can help you respond with precision, reduce noise, and take advantage of real-time market signals efficiently.

Common Mistakes to Avoid When Using Stock Alerts

While alerts are helpful, relying on them without strategy can backfire. Being aware of common errors can help you stay on track.

Overloading With Alerts: Too many notifications lead to alert fatigue. As a result, you might start ignoring important ones or reacting emotionally.

Setting Alerts Without a Plan: Avoid alerts without knowing your response. For instance, getting a price alert without a target or risk plan may lead to poor entries.

Ignoring After-Hours Moves: Many traders miss opportunities because their alerts only trigger during regular hours. Use platforms that support pre- and post-market alerts.

Failing to Adjust Over Time: Markets evolve, so alerts should too. Revisit your settings regularly—especially after earnings reports or macro shifts.

By staying disciplined and updating your alert settings, you ensure they remain relevant and truly actionable for your trading style.

Platforms for Stock Alerts: Free and Paid Options

Choosing the right platform is essential because alert accuracy and flexibility vary widely. Some services are ideal for casual investors, while others cater to active traders.

TradingView: Offers highly customizable alerts, including technical indicators like RSI, MACD, and volume spikes. The free plan allows a few alerts, while premium plans offer advanced tools.

Thinkorswim by Charles Schwab: Ideal for U.S.-based traders, it provides real-time alerts tied to complex strategies and chart setups.

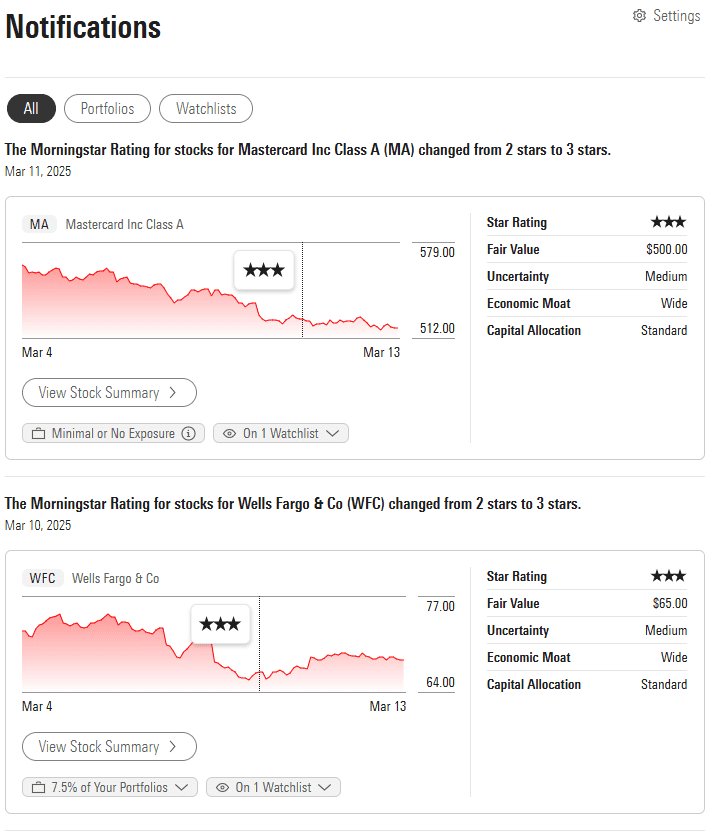

Seeking Alpha Premium: great for fundamental investors. It lets you set alerts for earnings reports, dividend announcements, and valuation changes.

Zacks Premium: Also useful for value-focused investors who want to track analyst revisions, rank upgrades, or earnings surprises.

As a result, your alert experience can shift dramatically depending on the platform's tools, layout, and flexibility.