Table Of Content

What Is SoFi Automated Investing?

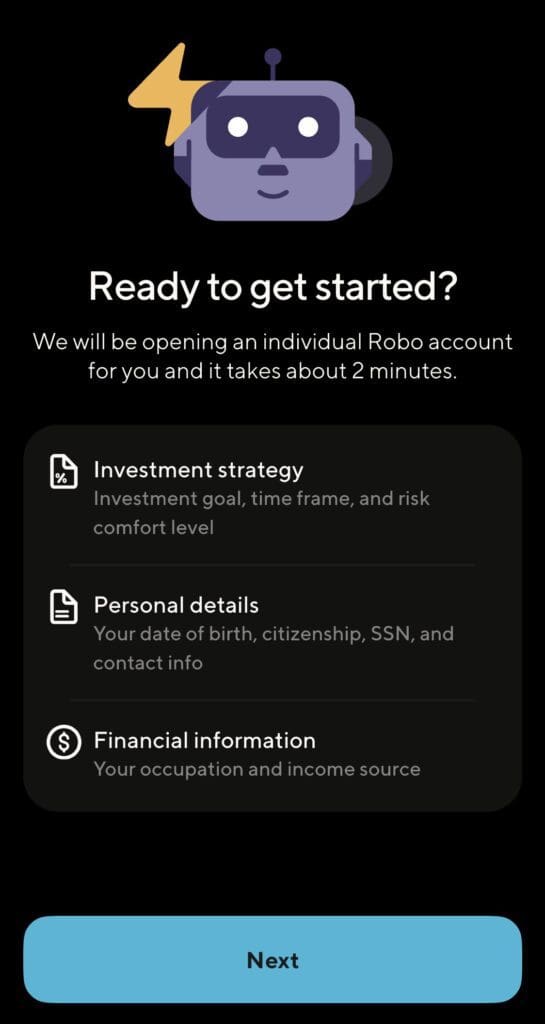

SoFi Automated Investing is a robo-advisory platform designed for hands-off investors who want diversified, goal-based portfolios without managing every detail themselves.

It automatically builds and rebalances a portfolio of low-cost ETFs based on your risk profile and financial goals — whether you're saving for retirement, a home, or general wealth accumulation.

Key aspects of SoFi Automated Investing:

No advisory fees: Unlike many robo-advisors, SoFi doesn’t charge annual management fees, which makes it ideal for beginner investors or cost-conscious savers.

Diversified portfolios: It invests your funds across a mix of ETFs in stocks and bonds, tailored to your personal risk tolerance and time horizon.

Automated rebalancing: As markets shift, SoFi automatically adjusts your portfolio to maintain your original asset allocation.

Access to financial planners: Even though the service is automated, SoFi includes free access to certified financial planners, which can be valuable if you need human support.

SoFi’s Robo-Advisor: Features For Passive Investors

SoFi’s automated investing platform is designed for hands-off investors who want to grow their wealth with minimal effort. Here’s how it delivers value through automation, personalization, and expert support:

-

Start With a Goal-Based Portfolio Setup

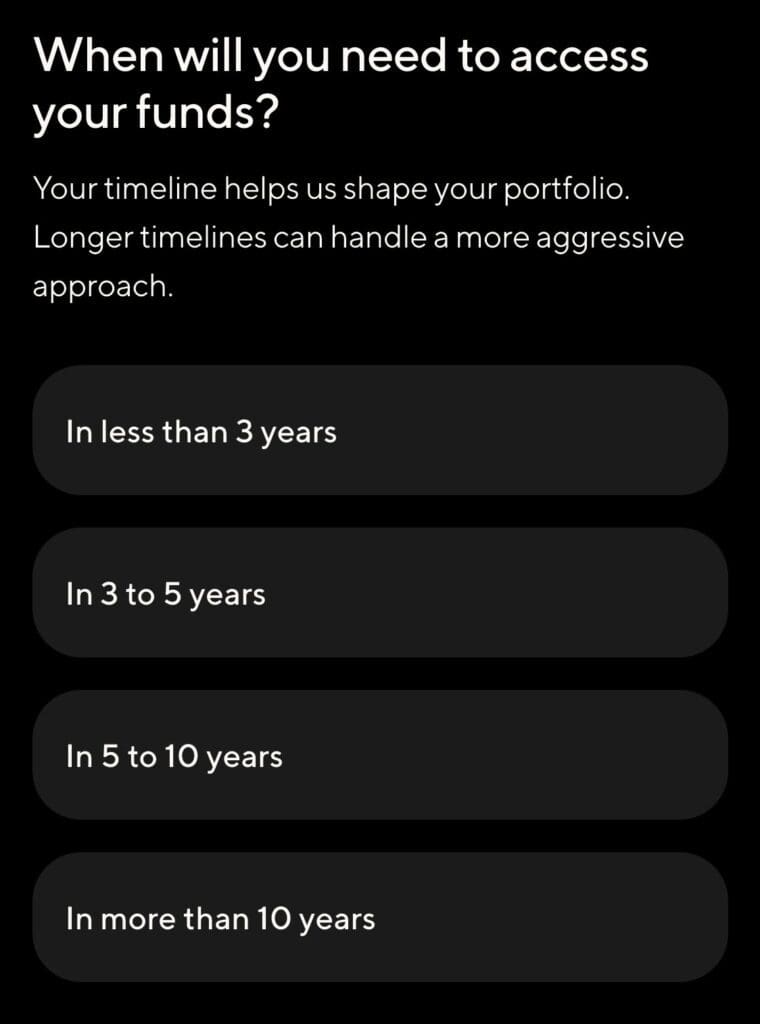

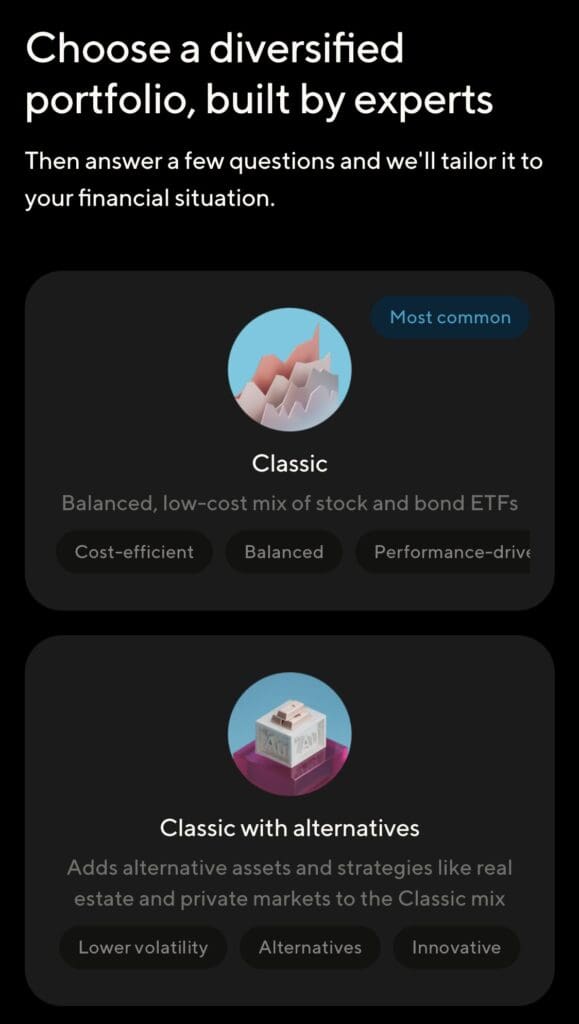

SoFi begins by learning about your financial goals and risk tolerance to create a custom ETF portfolio that matches your needs.

You’ll answer a few questions about your timeline and comfort with risk — whether you're investing for retirement, a house, or general growth.

Based on your answers, SoFi builds a portfolio of stock and bond ETFs tailored to your goals — e.g., more equities for long-term growth.

This personalized setup ensures your portfolio stays aligned with your milestones without constant oversight.

-

Get Broad Diversification Using Low-Cost ETFs

SoFi spreads your money across multiple ETFs, giving you exposure to different asset classes while keeping fees low.

Your funds are invested in U.S. stocks, international stocks, real estate, and bonds — helping manage risk through diversification.

ETFs are selected for their low fees, which helps you retain more of your returns over time.

If U.S. markets dip, holdings in global or bond ETFs may help offset potential losses — enhancing portfolio stability.

-

Stay on Track With Automatic Rebalancing

Your portfolio won’t drift off course, even when markets get volatile — SoFi handles the rebalancing automatically.

If stocks outperform bonds and your risk level changes, SoFi will rebalance your holdings back to your target mix.

This ensures your investments stay within your desired risk range without you needing to make manual changes.

Rebalancing happens behind the scenes, keeping your strategy consistent through market ups and downs.

-

Reinvest Dividends for Compound Growth

Rather than paying out dividends in cash, SoFi reinvests them — helping your investments grow faster over time.

Any dividends earned from ETFs are automatically reinvested, buying more shares and compounding your growth.

This strategy is especially powerful in retirement accounts like IRAs where gains grow tax-deferred.

Over time, reinvested dividends can significantly increase your total returns without additional contributions.

-

Access Human Advisors — for Free

Even though it’s an automated service, SoFi gives you access to real human financial planners.

You can book a session with a CFP to ask about your portfolio, adjust your goals, or get help during big life changes.

This hybrid model combines low-cost automation with expert guidance — without charging you advisory fees.

For example, if you're expecting a child or changing jobs, an advisor can help you shift your strategy to match.

SoFi Automated Investing: Limitations

While SoFi Automated Investing is beginner-friendly and cost-effective, it has certain limitations that may not suit all investor needs.

No Tax-Loss Harvesting: Unlike platforms like Wealthfront or Betterment, SoFi doesn’t offer automated tax-loss harvesting, which can reduce taxable gains in non-retirement accounts.

Limited Portfolio Customization: You can’t choose or swap out specific ETFs, which restricts more advanced investors from tailoring portfolios to niche strategies or preferences.

Fewer Advanced Planning Tools: While it includes human advisor access, SoFi’s platform doesn’t offer deep financial planning tools, calculators, or simulations for complex goals.

Basic Account Type Selection: It supports standard individual, joint, and retirement accounts but doesn’t include custodial, trust, or business accounts — which limits its broader use cases.

Alternatives for SoFi Automated Investing

Here are a few automated investing alternative platforms if you’re looking for more customization, tax strategies, or advanced tools.

Betterment: offers tax-loss harvesting, smart rebalancing, and multiple portfolio strategies (including socially responsible investing). It is great for users seeking detailed goal tracking and tax optimization.

Wealthfront: Provides robust automation with features like daily tax-loss harvesting, direct indexing, and financial planning tools powered by AI.

Fidelity Go: Backed by a trusted brand, Fidelity Go charges no fees for balances under $25,000 and offers actively managed portfolios above that level.

Charles Schwab Intelligent Portfolios: Requires a $5,000 minimum but includes a wider array of ETFs and built-in tax-loss harvesting — at no advisory cost.

Acorns: Best for micro-investors, Acorns rounds up spare change from purchases and invests it automatically, though it charges a flat monthly fee.

Rovo Advisor | Annual Fees | Minimum Deposit |

|---|---|---|

Wealthfront | 0.25% | $500 |

Betterment | 0.25%

$4 monthly for $0 – $20K balance, 0.25% annually for $20K – $1M balance, 0.15% annually for $1M – $2M balance, 0.10% annually for +$2M balance | $10 |

Acorns | Monthly: $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

| $0 |

Schwab Intelligent Portfolios | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | $5,000 |

Vanguard Digital Advisor® | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | $100 |

E*TRADE Core Portfolios | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| $500 |

Merrill Guided Investing | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | $1,000 |