SoFi Invest

Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- FAQ

SoFi Invest is a beginner-friendly investment platform designed for hands-off and casual investors who want an easy way to buy stocks, ETFs, and alternative assets without paying commissions.

It offers a user-friendly experience, making it ideal for those new to investing or looking for an all-in-one financial platform.

For those who prefer automated investing, SoFi’s Auto Pilot robo-advisor manages portfolios with no management fees, a major advantage over competitors.

Investors can also access Certified Financial Planners (CFPs) for free, recurring investments, and a 1% IRA contribution match for retirement savers.

However, SoFi lacks advanced trading and research tools, mutual funds, and tax-loss harvesting.

Can I buy cryptocurrency on SoFi Invest?

No, SoFi stopped offering cryptocurrency trading in 2023, but you can invest in crypto-related ETFs or Bitcoin futures ETFs.

Can I open a custodial account for my child on SoFi Invest?

No, SoFi does not offer custodial accounts (UTMA/UGMA) for minors. Parents looking for investment accounts for kids

should consider alternatives like Fidelity or Charles Schwab.

Is SoFi Invest good for day trading?

No, SoFi lacks advanced trading tools, direct market routing, and real-time analytics, making it unsuitable for active day traders.

Can I invest in real estate through SoFi Invest?

Yes, SoFi offers real estate-backed funds and REITs, but it does not allow users to directly buy physical properties or individual real estate investments.

Pros | Cons |

|---|---|

Commission-free stock trading | Limited research tools |

Fractional shares | No tax-loss harvesting |

Access to IPOs | No mutual funds |

1% IRA contribution match | Basic trading platform |

Free CFP access | Low APY on Uninvested cash |

User-friendly platform | No futures or forex trading |

Banking & investing integration |

SoFi Invest Features I Mostly Liked

Here are the key features that I found most appealing in SoFi Invest:

-

Commission-Free Trading (Stocks, ETFs, and Fractional Shares)

Trading stocks and ETFs on SoFi Invest is straightforward, and the zero-commission structure keeps costs low.

The fractional shares option is particularly useful for investors who don’t want to buy a full share of expensive stocks like Apple or Amazon.

If you’re just starting out or prefer a hands-off approach, this platform does a great job of making investing accessible.

However, SoFi Invest doesn’t support mutual funds, individual bonds, or international stocks.

More advanced traders might find the research tools lacking, and there are no advanced order types like stop-loss or trailing stop orders.

-

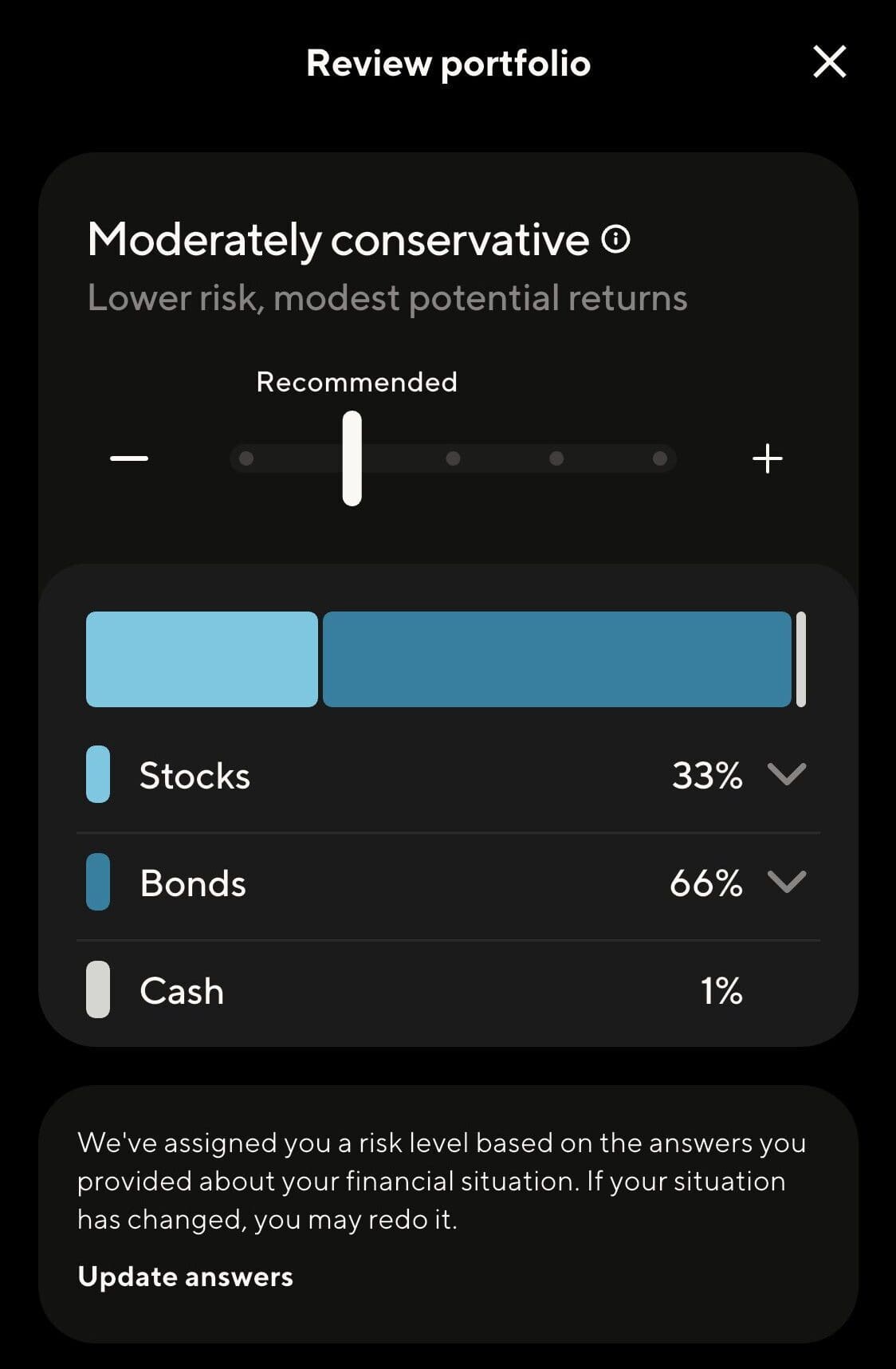

SoFi Automated Investing (Robo-Advisor)

SoFi’s robo-advisor is designed for those who prefer a hands-off investment strategy.

After answering a few questions about risk tolerance and goals, the system builds a custom portfolio of ETFs for you.

The service includes automatic rebalancing, and there’s no management fee, which is a major plus. The platform allows users to choose between different portfolio themes, such as socially responsible investing or alternative assets.

For those who want a simple way to grow their wealth without actively managing investments, it’s a solid option.

The inclusion of access to certified financial planners at no extra cost adds value, especially for beginners unsure of where to start.

However, the robo-advisor doesn’t offer tax-loss harvesting, requires $50 minimum to get started, and portfolio customization options are fairly limited.

-

IRA Matching & Retirement Accounts

SoFi stands out by offering a 1% match on IRA contributions—a rare feature in the industry.

This means if you contribute $7,000, SoFi will give you an extra $70. That’s essentially free money for retirement savers.

Setting up an IRA is easy, and users can choose between Traditional, Roth, SEP, and Rollover IRAs

You can opt for either an actively managed IRA or an automated one through the robo-advisor. This makes it a great choice for people looking to build long-term wealth while keeping fees low.

However, SoFi’s retirement accounts don’t offer as many investment choices as competitors. There are no individual bonds or mutual funds, and portfolio options are mostly limited to ETFs.

-

Alternative Investments

SoFi Invest has been expanding into alternative investments, giving investors exposure to real estate, venture capital, and private credit through interval funds.

This is great for those looking to diversify beyond traditional stocks and ETFs. One of the most interesting options is The Cosmos Fund, which lets accredited investors gain exposure to SpaceX stock.

The interval fund model allows for flexibility – investors can redeem shares at set intervals, rather than daily, reducing some of the liquidity risks tied to private investments.

However, alternative investments typically come with higher fees and less liquidity than traditional assets. Some funds require a minimum investment, making them inaccessible for casual investors.

-

Cash Management Integration (Uninvested Cash & APY on Savings)

SoFi integrates banking and investing seamlessly, allowing users to move funds between SoFi Invest and SoFi Checking/Savings with ease.

One drawback we noticed is that uninvested cash in brokerage accounts earns just 0.01% APY, which is extremely low compared to competitors offering 3% + on idle cash.

However, if you link a SoFi Checking or Savings account (especially with SoFi Plus), you can earn a much higher APY, currently around up to 4.50% for SoFi members with direct deposit.

The ability to instantly transfer cash between SoFi’s banking and investing platforms makes it convenient, particularly for those using recurring deposits.

Additional Investing Tools Worth Mentioning

SoFi Invest offers a couple of additional features for investors, which can have a significant impact:

-

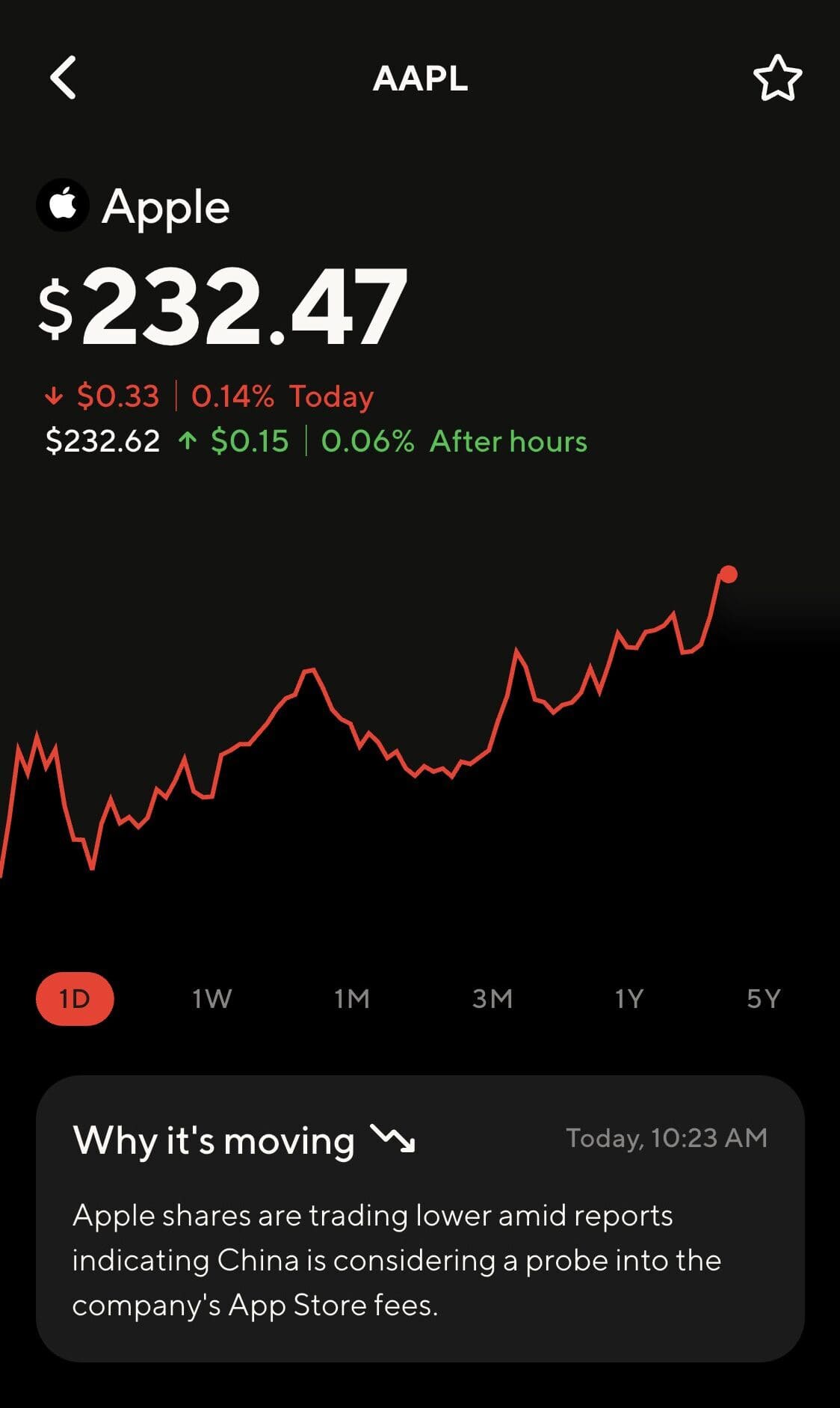

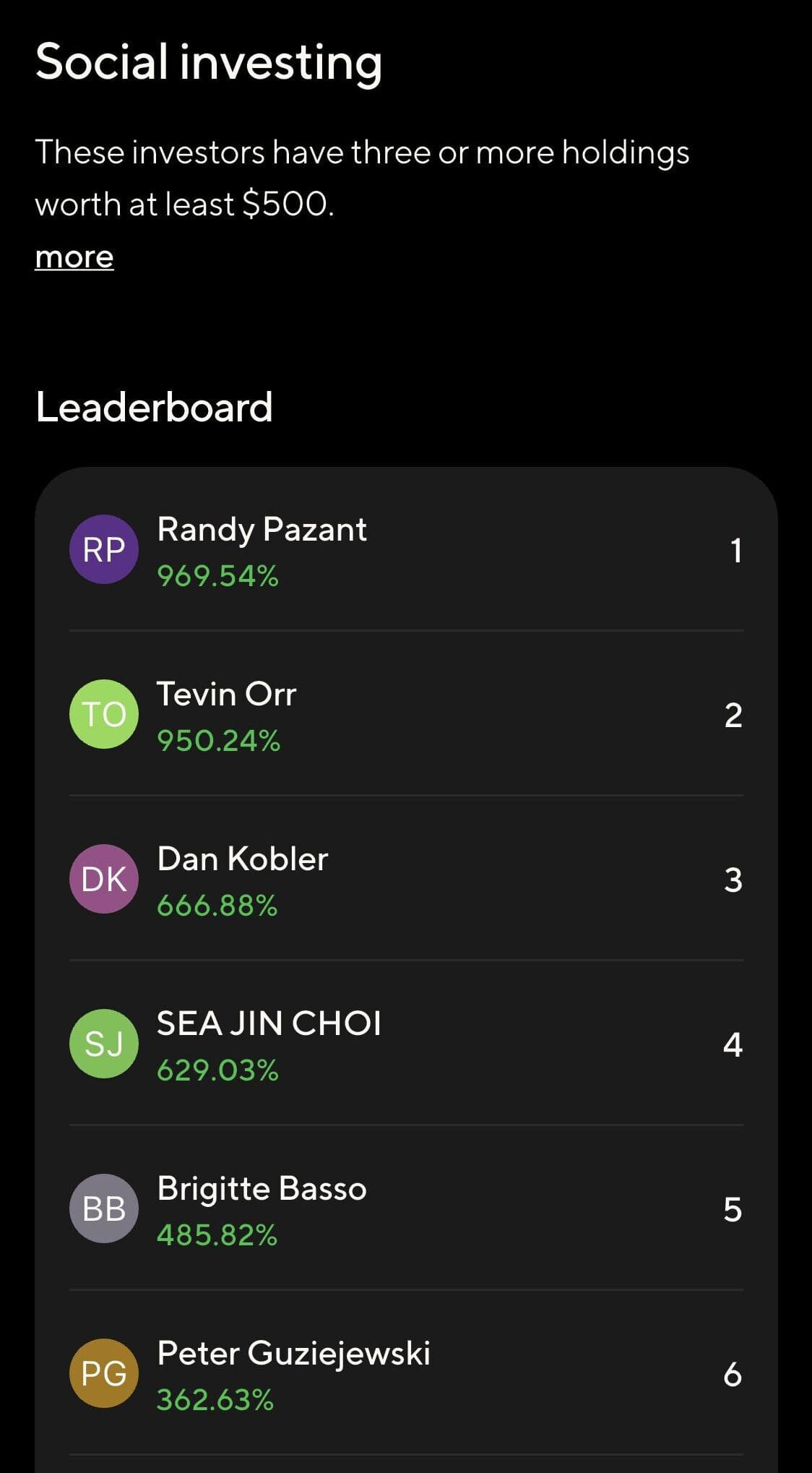

Social Investing & Market Sentiment Insights

SoFi Invest includes social investing features that let users see what stocks and ETFs are popular among SoFi members. This allows investors to get a sense of market trends and what others are trading in real time.

While this doesn’t replace traditional research, it can be useful for idea generation and understanding investor sentiment.

Unlike platforms like eToro, SoFi doesn’t offer full-on copy trading.

-

Stock & ETF Watchlists

SoFi Invest includes a watchlist feature that allows users to track stocks and ETFs they’re interested in. Investors can monitor price changes, market performance, and key metrics without having to purchase the asset.

This is especially useful for researching potential investments and staying informed about market trends.

The platform provides basic company information, including price history, market cap, and dividend yield, but lacks advanced tools like stock screeners or detailed fundamental analysis.

-

Talk To Certified Financial Planner (CFP) For Financial Advice

Unlike most brokers, SoFi gives all users free access to financial planners.

You can schedule a one-on-one call to discuss investment strategies, budgeting, and retirement planning.

Regular SoFi Invest members egular SoFi Invest et one free session with a CFP, while Plus members can schedule multiple consultations throughout the year for continuous financial planning support.

-

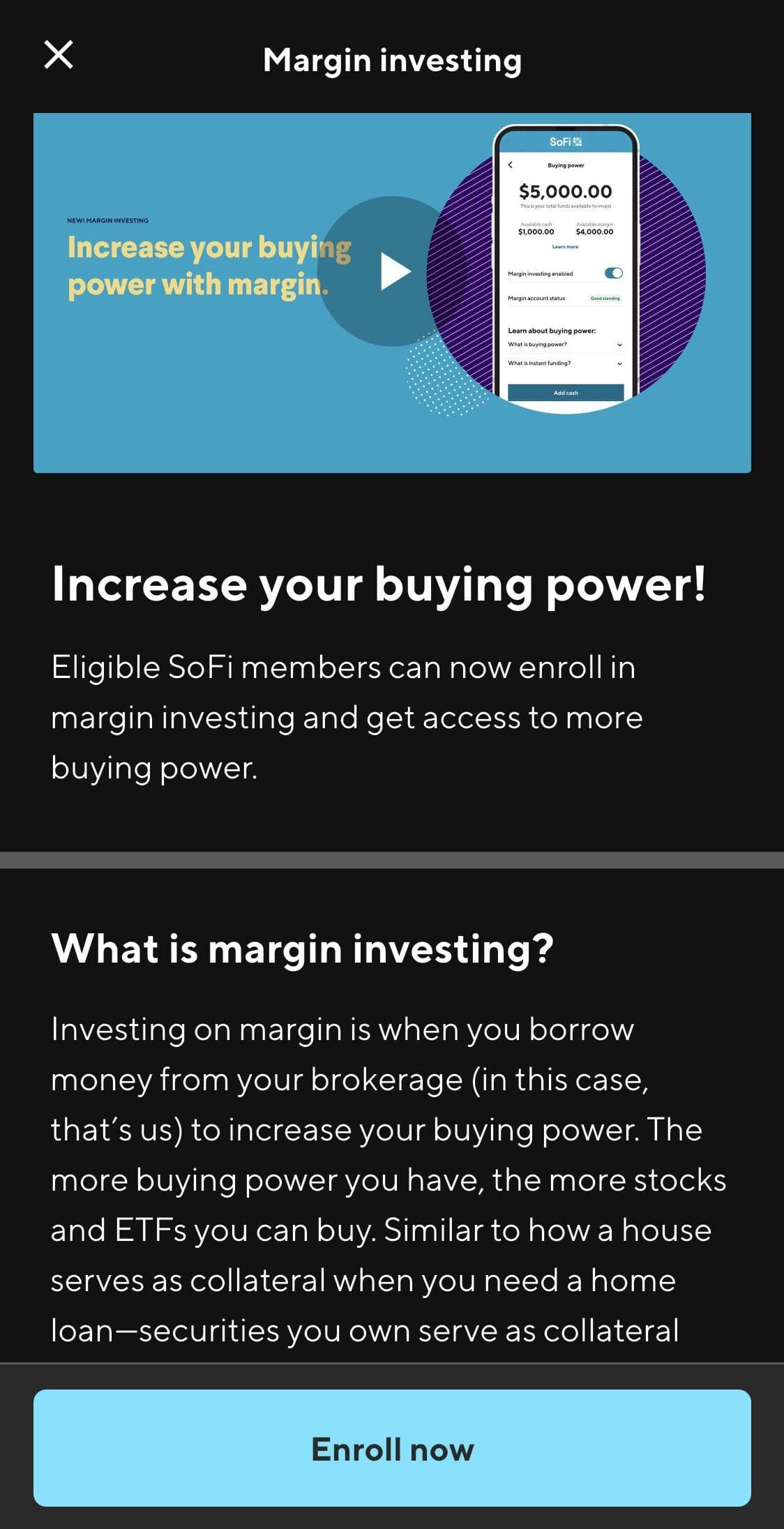

Margin Trading

If you want to leverage your investments, SoFi allows margin trading, meaning you can borrow up to 50% of your portfolio’s value to buy more stocks.

The process is easy—you just need to meet the $2,000 account minimum. SoFi makes tracking interest rates and repayments simple, and if the market rises, margin trading can boost potential returns.

Margin trading is risky, especially for beginners, so we don't recommend it if you are not an expert.

If your investments lose value, SoFi may sell your stocks to cover losses (a margin call). Also, SoFi interest rate is higher than competitors like Interactive Brokers or Schwab.

-

IPO Investing – Get in Early on New Companies

One of SoFi Invest’s most exciting features is its IPO investing access. Most brokerages require high account balances or net worths to participate in IPOs, but SoFi lets you invest with no minimums.

You’ll receive notifications about upcoming IPOs, and if you’re eligible, you can request shares before they hit the public market.

But keep in mind that IPOs can be risky and volatile, and there’s no guarantee you’ll get shares. Selling within 120 days may come with restrictions or extra fees.

-

Recurring Investments & 1% For SoFi Plus Members

SoFi Invest allows users to set up automatic recurring investments in stocks, ETFs, and retirement accounts, helping them build wealth over time through dollar-cost averaging.

This feature is perfect for investors who want to stay consistent without manually making trades. You can choose weekly, biweekly, or monthly contributions, making it easy to stick to an investment plan.

SoFi Plus members get an additional 1% match on their recurring deposits, meaning every $1,000 invested earns $10 in rewards points, which can be redeemed for additional investments.

How's SoFi Invest Platform Experience?

SoFi Invest’s app and website provide a smooth experience, with an intuitive design that makes trading easy. The app allows users to place trades, check their portfolio, and set up recurring deposits in just a few taps.

The interface is modern and visually appealing, and features like watchlists and real-time notifications help investors stay updated.

The web platform is equally simple to use, offering straightforward navigation and quick access to research tools.

But, keep in mind that advanced traders may find the platform too basic, as it lacks detailed charts, in-depth stock analysis tools, and research reports.

The app also doesn’t offer customizable watchlists or stock screeners.

SoFi Invest Limitations: Where It Falls Short

While SoFi Invest is a great platform for beginners and passive investors, it has some clear limitations compared to larger brokerage firms like Fidelity, Charles Schwab, and E*TRADE.

Many of these drawbacks come from its simplified approach, which makes investing easy but lacks advanced tools, research, and investment choices.

Here are four key areas where SoFi Invest could improve:

-

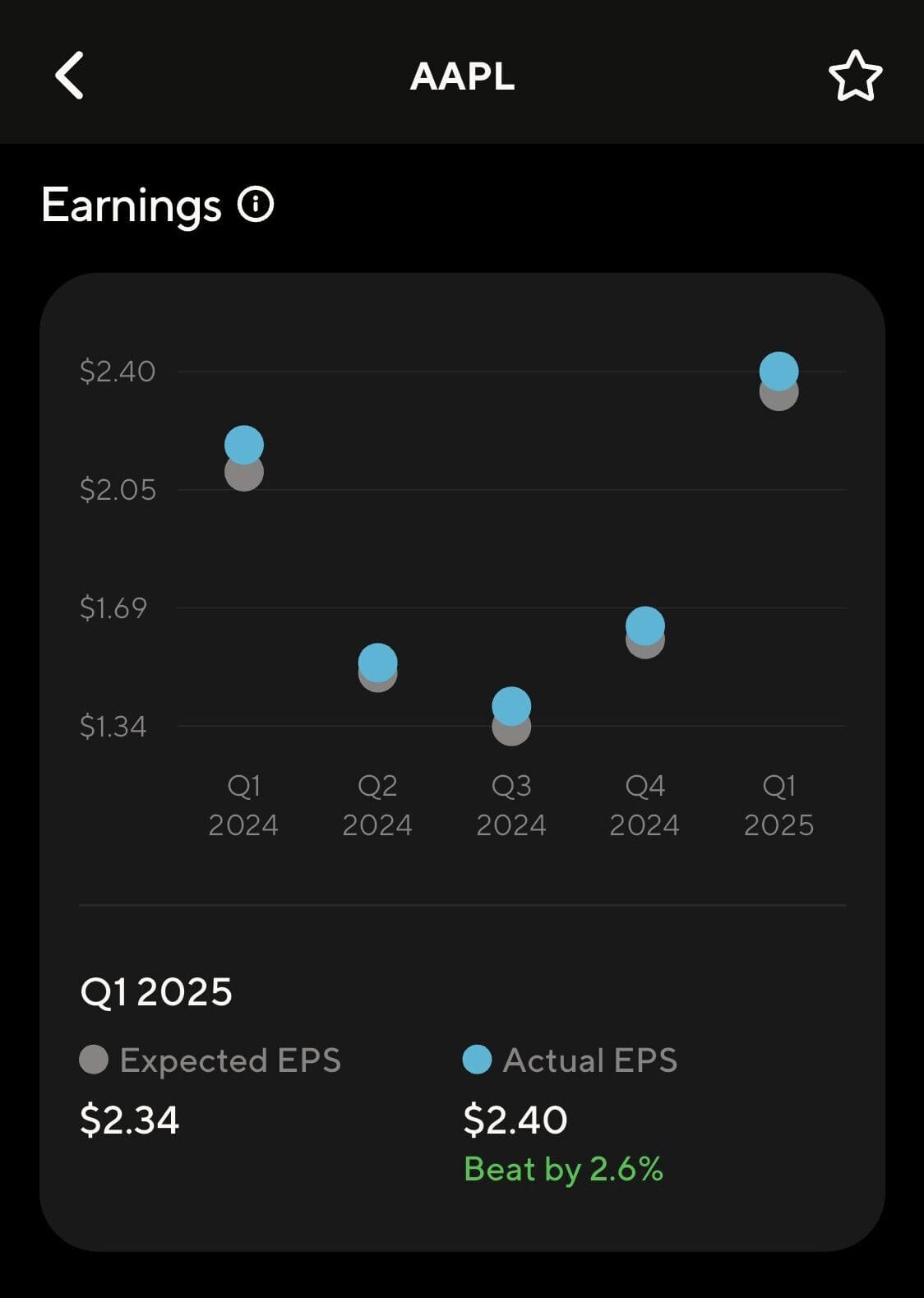

Limited Research & Stock Analysis Tools

SoFi Invest lacks in-depth stock research, which is a major downside for investors who like to analyze stocks before buying.

There are no stock screeners, valuation metrics, or technical indicators, making it harder for users to evaluate investments.

Advanced traders looking for fundamental or technical analysis will likely find SoFi’s research tools too basic.

For example, there is no advanced statistics or financials you can find on other platform:

-

No Mutual Funds or Bonds

While SoFi offers stocks, ETFs, and some alternative investments, it doesn’t provide mutual funds or individual bonds.

This is a major limitation compared to firms like Vanguard or Fidelity, which offer thousands of mutual funds and bond options.

Mutual funds are great for long-term investors who want professionally managed portfolios, and bonds are a key part of diversified retirement planning.

-

No Advanced Trading Platform for Active Traders

SoFi Invest lacks a dedicated trading platform with advanced charting, Level 2 data, and direct market routing.

Competitors like E*TRADE, thinkorswim (Schwab), and TradeStation offer highly customizable platforms with advanced screeners, options analytics, and algorithmic trading tools.

SoFi only supports basic market and limit orders, making it unsuitable for day traders, swing traders, or those who need real-time, in-depth market data.

For example, creating the following chart is not an option with SoFi Invest:

-

Low Interest on Uninvested Cash

SoFi’s uninvested cash earns just 0.01% APY—basically nothing.

Many investment platforms now offer higher interest on uninvested cash, allowing users to earn passive income when they’re not actively trading.

Unless users manually transfer their cash to a SoFi Savings account, their idle funds are losing value due to inflation.

Who is SoFi Invest Best For?

SoFi Invest is ideal for beginners, passive investors, and those seeking an easy-to-use, low-cost platform with automated and IPO investing:

- Beginner Investors – SoFi’s easy-to-use platform, no account minimums, and commission-free trading make it a great choice for those new to investing. The fractional shares feature allows beginners to invest in high-priced stocks with as little as $5.

- Hands-Off Investors (Robo-Advisor Users) – Those who prefer a fully automated approach will benefit from SoFi’s Auto Pilot robo-advisor, which builds and manages portfolios with no management fees. Automatic portfolio rebalancing helps maintain a long-term strategy.

- Retirement Savers – SoFi offers Traditional, Roth, SEP, and Rollover IRAs with a 1% IRA contribution match, making it a great option for long-term retirement investors looking to maximize savings.

- SoFi Bank Customers & One-Stop Finance Users – If you already use SoFi Checking & Savings, personal loans, or credit cards, the seamless integration with SoFi Invest makes it a convenient choice for managing all your finances in one place.

FAQ

No, SoFi Invest does not offer joint brokerage accounts for self-directed investing. However, joint accounts are available for automated investing (robo-advisor) and retirement accounts.

Yes, you can transfer stocks into SoFi Invest using an ACAT (Automated Customer Account Transfer) request, but partial transfers aren’t supported—you must transfer the entire account.

Yes, SoFi allows extended-hours trading from 9 AM to 8 PM ET, but it doesn’t support pre-market trading before 9 AM.

Yes, SoFi offers a dividend reinvestment program (DRIP) that automatically reinvests dividends into additional shares of the same stock or ETF.

Withdrawals typically take 1–3 business days to process, depending on your bank and method of transfer.

No, SoFi only offers web-based trading and a mobile app. There is no advanced desktop trading platform like those offered by Schwab or Fidelity.

Review Brokerage Accounts

How We Rated Brokerage Accounts: Review Methodology

At The Smart Investor, we evaluated brokerage account platforms based on their overall value, features, and user experience compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to investors, including fees, trading tools, investment options, and security. Each platform was rated based on the following criteria:

- Fees & Commissions (20%): We prioritized commission-free trading and low-margin rates. The best platforms had zero hidden fees, while others charged for inactivity or withdrawals.

- User Experience & Interface (20%): A clean, easy-to-navigate platform with smooth execution scored highest. Some apps felt outdated or laggy, impacting the experience.

- Trading Tools & Features (30%): We favored platforms with real-time data, smart order types, and special features that support smart investing. Some lacked depth, making it harder for active traders.

- Automated Investing (10%) : The best platforms offered AI-driven portfolios, robo-advisors, and automatic rebalancing. Some lacked automation or charged high fees for managed accounts.

- Investment Options (10%): Platforms with stocks, ETFs, options, crypto, and fractional shares scored highest. A few lacked key asset classes or international access.

- Account Types (5%): The best platforms supported taxable accounts, IRAs, and custodial options. Some lacked flexibility, limiting investment strategies.

- Cash Management & Banking Features (5%): We favored platforms with high-interest cash accounts, debit cards, and seamless banking. Many lacked competitive rates or useful features.