Acorns | Stash | |

Monthly Fee | $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

| $3 – $9

$3 for Stash Growth plan, $9 for Stash+ plan |

Account Types | Brokerage, Retirement | Brokerage, Retirement |

Savings APY | 1.00% – 3.00% | N/A |

Minimum Deposit | $0 | $1 |

Best For | Robo Advisor, Young Traders, Crypto Investing | Younger, Novice Investors & Traders |

Read Review | Read Review |

Acorns vs Stash Finance Investing Features

Acorns operates as a robo-advisor that simplifies the investing process by rounding up everyday purchases to the nearest dollar and investing the spare change.

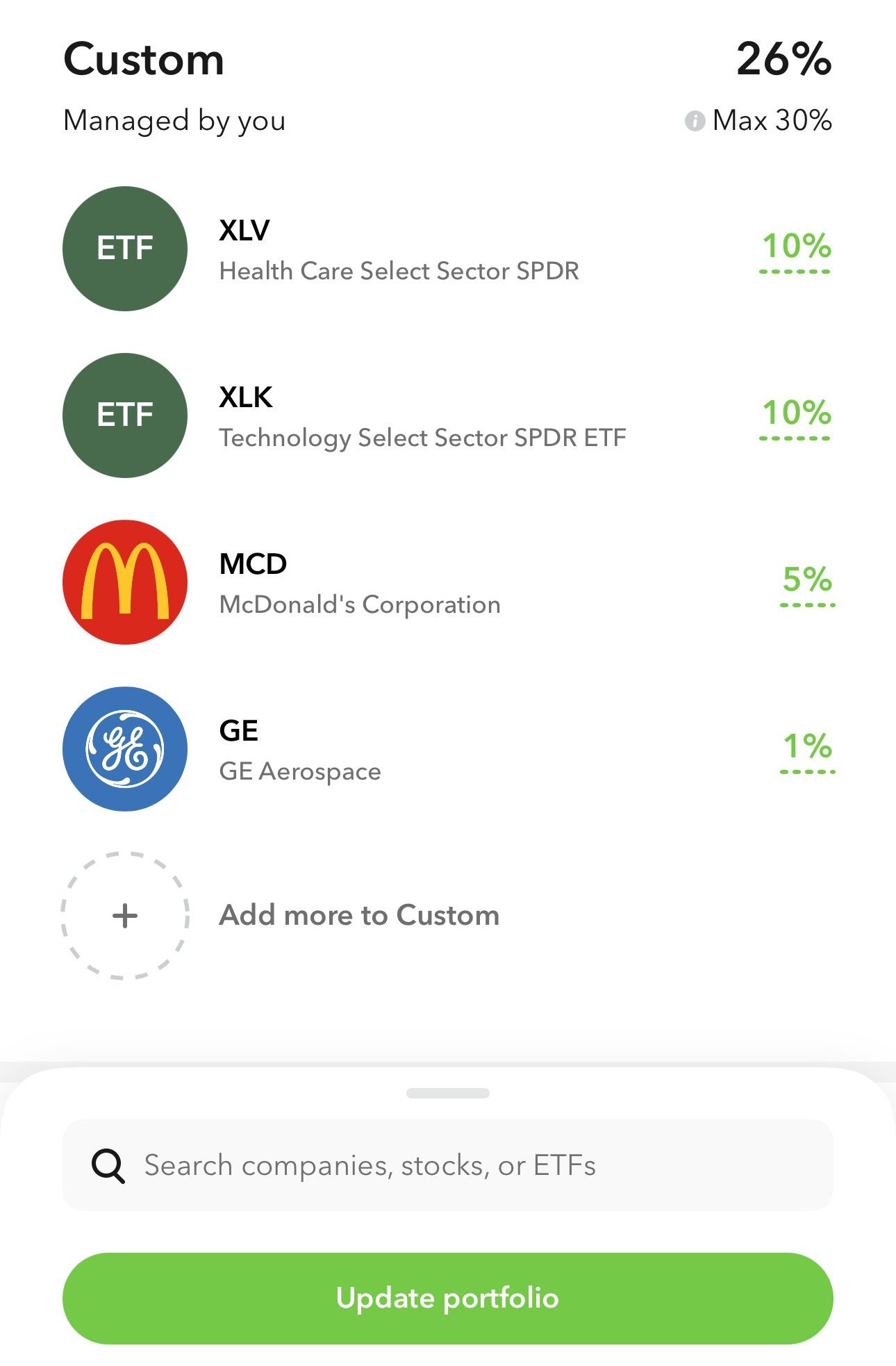

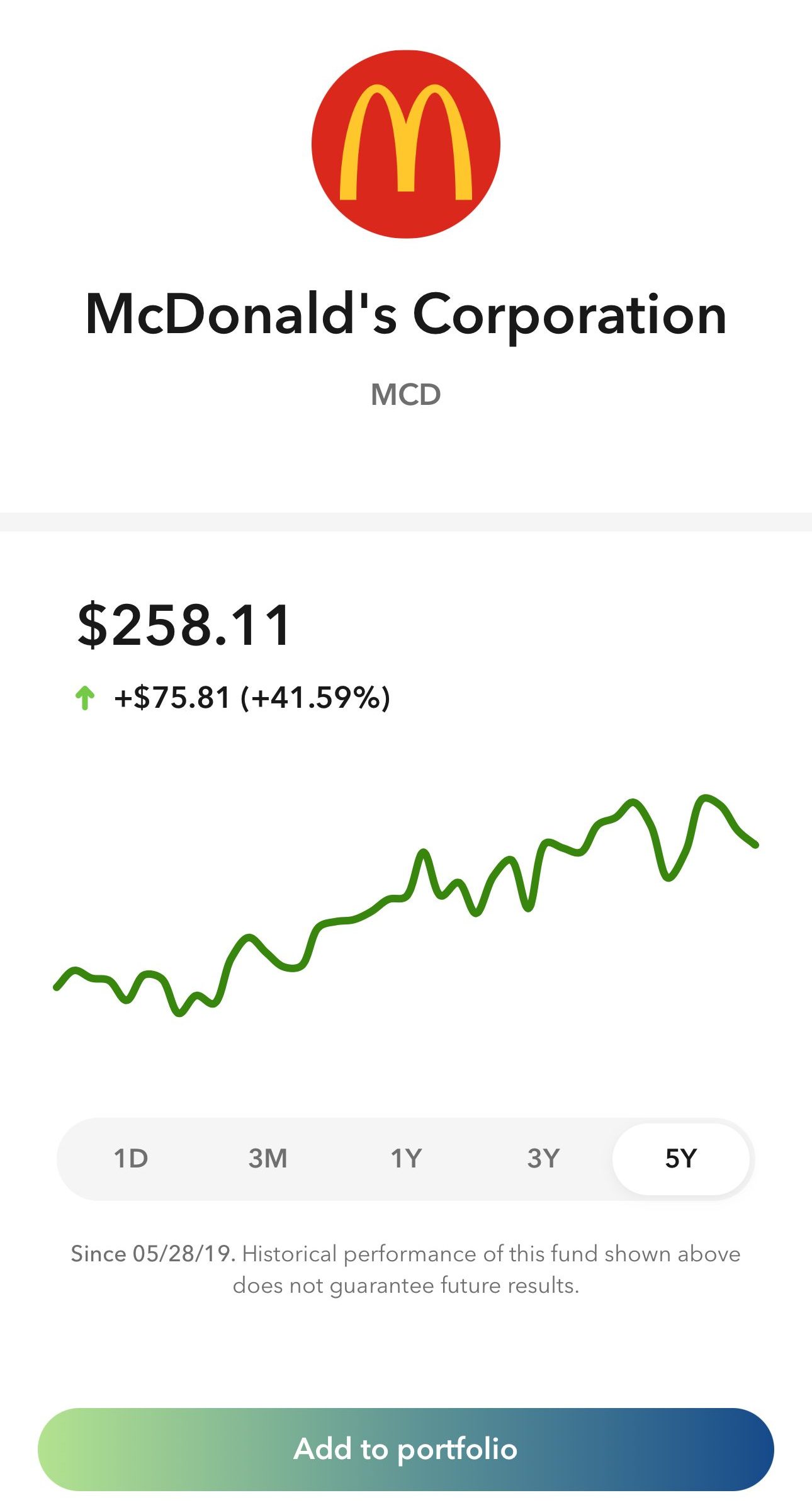

Investors can add stocks and other assets to their portfolio manually, while custom portfolio can make up to 50% of your total Acorns Invest portfolio.

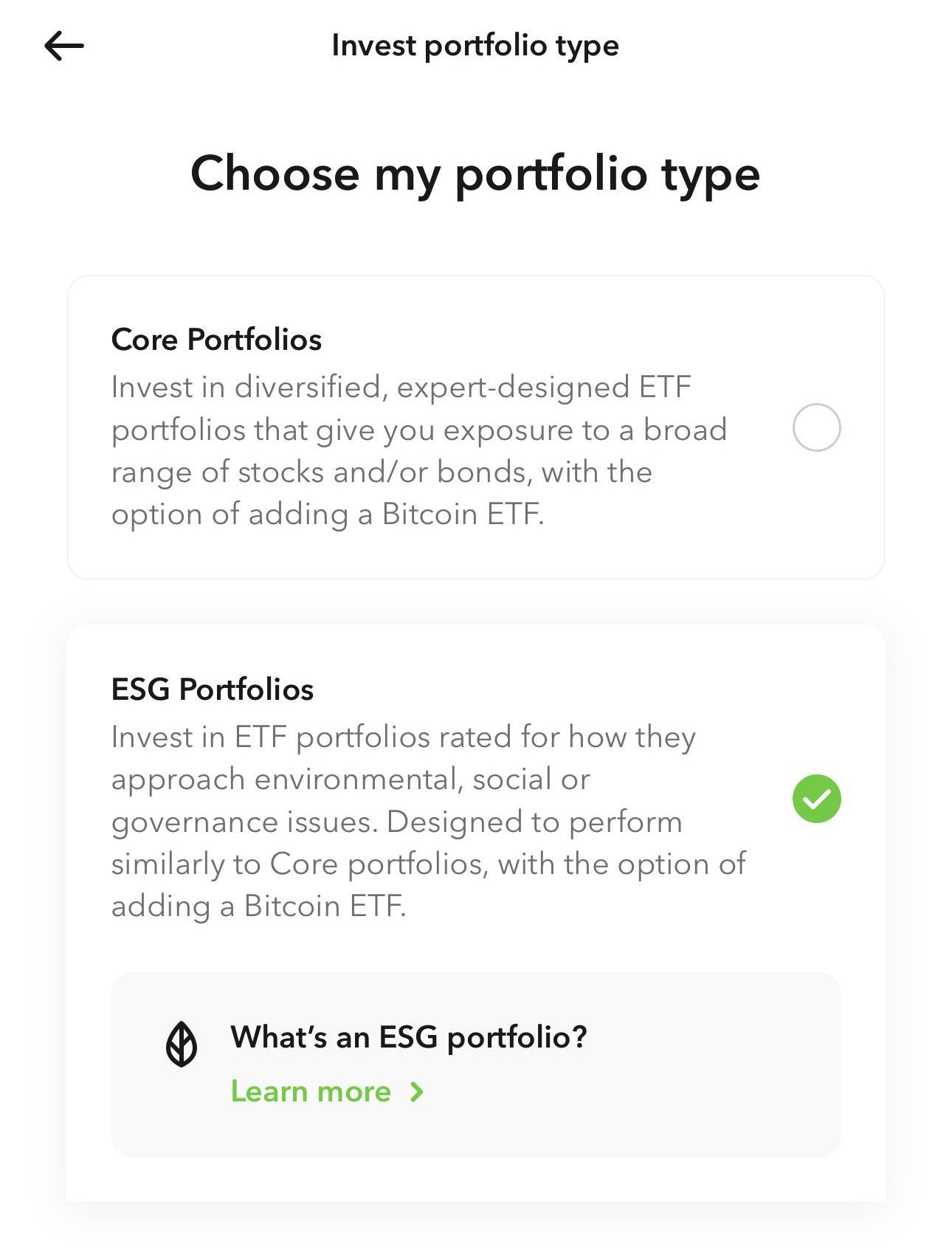

Acorns offers three subscription levels. Each level includes various features, such as diversified ETF portfolios, Bitcoin-linked ETFs, and live Q&A with financial experts at higher plans.

The platform also integrates banking services, enabling users to invest spare change in real-time with their Acorns debit card.

In contrast, Stash combines both automated and self-directed investing, offering more flexibility in how users manage their investments.

It allows for fractional share investing and provides access to over 4,000 stocks and ETFs. Stash also has subscription plans: Growth and Stash+.

These plans include features such as personalized investment portfolios, retirement accounts, Stock-Back cards that reward users with stock for their purchases, and guidance from registered investment advisors.

Stash’s Smart Portfolio automatically adjusts investments based on risk tolerance and goals. Both platforms don't support advanced trading features or a wide variety of asset options like bonds or mutual funds.

Acorns | Stash | |

|---|---|---|

Investing Options | 100+ stocks, +40 ETFs (Up to 7,000 assets with automated investing) | 4,000 stocks, ETFs and REITs |

Investing Types | Stocks, ETFs, Crypto, Fractional Shares | Stocks, ETFs, REITS and Fractional Shares |

Automated Investing | Yes | Yes |

Paper Trading | No | No |

Tax Loss Harvesting | No | No |

IPO Access | No | No |

-

Self Investing Options

Stash is our winner when it comes to self-investing options, as it offers many more options compared to Acorns.

Stash excels in areas that make investing accessible and straightforward, particularly for beginners and younger investors.

Stash's self-investing and trading options are geared towards beginner investors who appreciate guidance and simplicity in managing their investments.

It supports a wide range of ETFs and nearly 4,000 stocks and fractional shares. Additionally, Stash provides access to REITs, which are not available on Acorns.

With Acorns' you can also access fractional shares. This platform provides fractional shares for new purchases and reinvested dividends. Your custom portfolio can make up to 50% of your total Acorns Invest portfolio.

Investors can choose from over 100 stocks and more than 40 ETFs, which means less options compared to Stash.

While Acorns allows some level of customization—such as adding a Bitcoin-linked ETF and selecting individual stocks at the Premium account level—its primary appeal is in its automated, set-it-and-forget-it approach.

-

Automated Investing

Acorns is our winner when it comes to automated investing and simplicity.

Acorns ETFs offer exposure to over 7,000 different assets, reducing risk compared to trading individual stocks.

The platform automatically constructs and oversees your portfolio according to your risk tolerance and financial objectives, investing your funds into top-rated Exchange Traded Funds (ETFs), which are professionally designed portfolios.

These portfolios often include shares in top-performing companies like Apple, Amazon, Google, and Berkshire Hathaway, offering exposure to successful businesses.

They also include ETFs managed by professionals at leading firms such as Vanguard and BlackRock, ensuring high-level expertise and robust management.

Stash's robo-advisor, known as Smart Portfolio, offers a streamlined and user-friendly approach to automated investing.

One of the standout features of Stash’s robo-advisor is its use of thematic ETFs, which makes it easy for users to understand their investments.

For example, users can choose from themes like “Blue Chips” for established companies or “Delicious Dividends” for dividend-paying stocks.

Smart Portfolio automatically rebalances investments to maintain the desired asset allocation and optimize returns. Additionally, it includes features like auto-investing, where users can set recurring contributions, and round-ups, which invest spare change from everyday transactions.

-

Banking Options

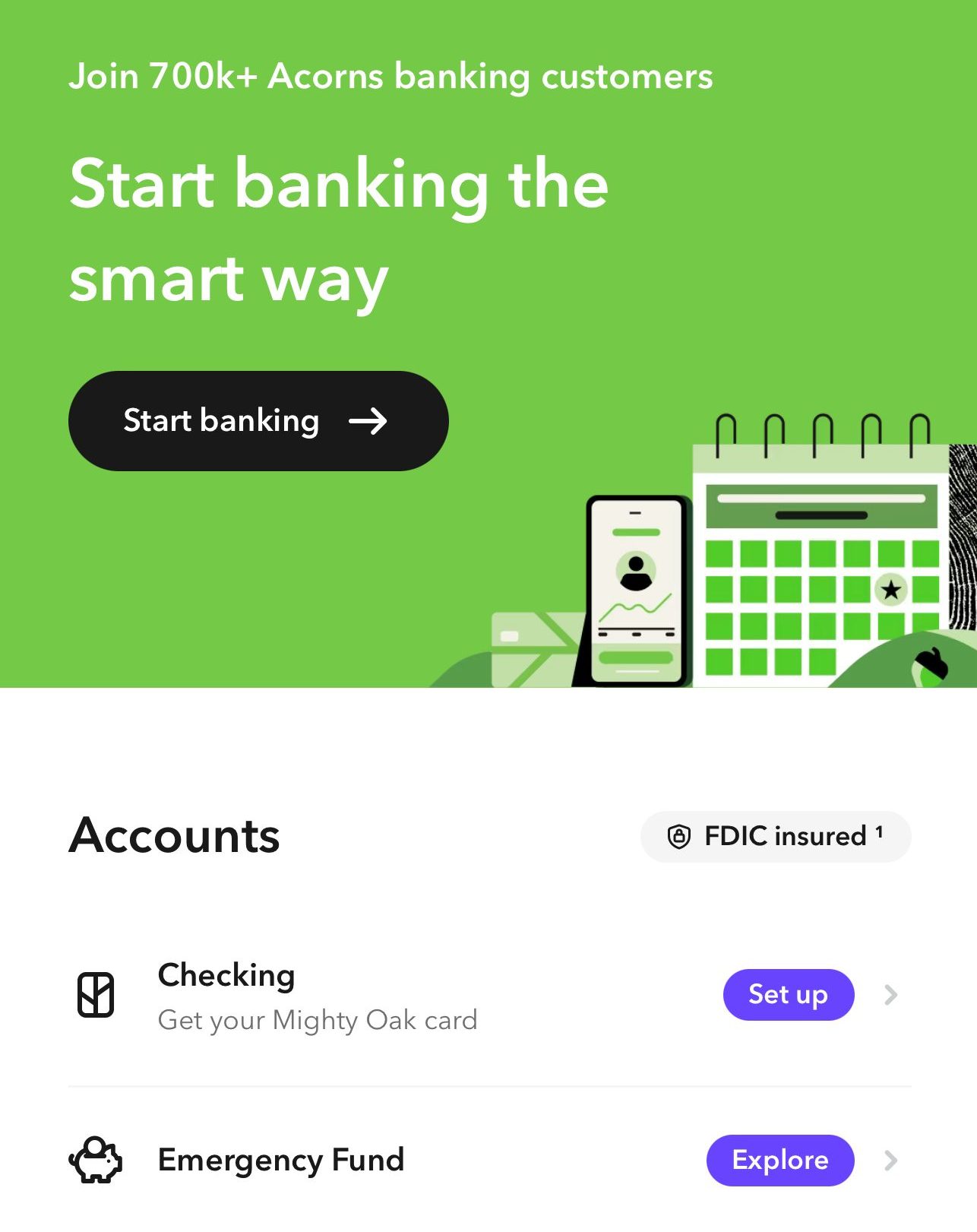

When it comes to banking options, Acorns is our winner due to high savings rates and nice cash management features.

Acorns offers cash management through its Mighty Oak debit card, simplifying banking with features like Paycheck Split for automatic investing from each paycheck and Early Payday for accessing funds up to two days early.

Real-Time Round-Ups® allows regular investment of spare change from purchases. The account has no hidden fees, minimum balance requirements, or overdraft fees and provides access to over 55,000 fee-free ATMs within the AllPoint network.

Banking services are provided by nbkc bank, with FDIC insurance up to $250,000. Acorns also offers an Emergency Fund account with a high APY of 5.00% and supports automatic recurring contributions, promoting consistent saving habits.

Stash | Acorns | |

|---|---|---|

Savings APY | N/A | 1.00% – 3.00% |

The Stash banking service includes a checking account with no hidden fees, no minimum balance requirements, and early payday access.

This account is paired with a Stock-Back® Card, a unique debit card that rewards users with fractional shares of stock based on their spending.

Additionally, Stash banking provides budgeting tools and automatic round-up investments.

-

Fees

There is no clear winner when it comes to fees, as both Acorns and Stash offer no trading commissions, but each of them charges a monthly subscription fee for the whole account.

Acorns | Stash | |

|---|---|---|

Monthly Fee | $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

| Monthly $3 – $9

$3 for Stash Growth plan, $9 for Stash+ plan |

As we can see, Stash is a bit less expensive – but the differences are quite minor.

-

Retirement Accounts

Acorns is better for those seeking a fully automated retirement investing experience, while Stash offers more flexibility and educational support for users who want to actively manage their retirement portfolios.

Acorns provides retirement accounts through its “Later” feature, offering traditional, SEP, and Roth IRAs. The platform automates the investing process by creating a diversified portfolio of ETFs based on the user's risk tolerance, age, and financial goals.

Stash, on the other hand, offers traditional and Roth IRAs as part of its Stash Growth and Stash+ subscription plans.

Bottom Line

Acorns excels in automated investing, ideal for those who prefer a hands-off approach. It automates portfolio management and investment through features like Round-Ups.

Conversely, Stash is better suited for those who want to pick specific stocks and conduct their own research. It offers more flexibility and control over investment choices.

Choosing between Acorns and Stash depends on whether you value automation and simplicity (Acorns) or prefer greater control and a wider variety of investment options (Stash).

Compare Acorns Side By Side

Acorns excelling in automated investing and checking accounts, while M1 Finance is better for self investing and borrowing options.

While Robinhood caters to traders and advanced investors, Acorns focuses on automated investing and banking. Here's our full comparison.

Wealthfront and Acorns offer advanced automated investing options, appealing investing features, and banking options. Here's our comparison: