Robinhood | Stash | |

Monthly Fee | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold | $3 – $9

$3 for Stash Growth plan, $9 for Stash+ plan |

Account Types | Brokerage, Retirement, Crypto | Brokerage, Retirement |

Savings APY | 1.00% – 4.50%

You’ll earn 0.01% Annual Percentage Yield (APY) as a Robinhood Gold member on your uninvested brokerage cash that is swept to the banks in our program. | N/A |

Minimum Deposit | $0 | $1 |

Best For | Active Traders, Research & Analysis | Younger, Novice Investors & Traders |

Read Review | Read Review |

Stash vs Robinhood: Compare Investing Features

Stash and Robinhood both aim to democratize investing by providing user-friendly platforms that make it easy for beginners to start trading and investing.

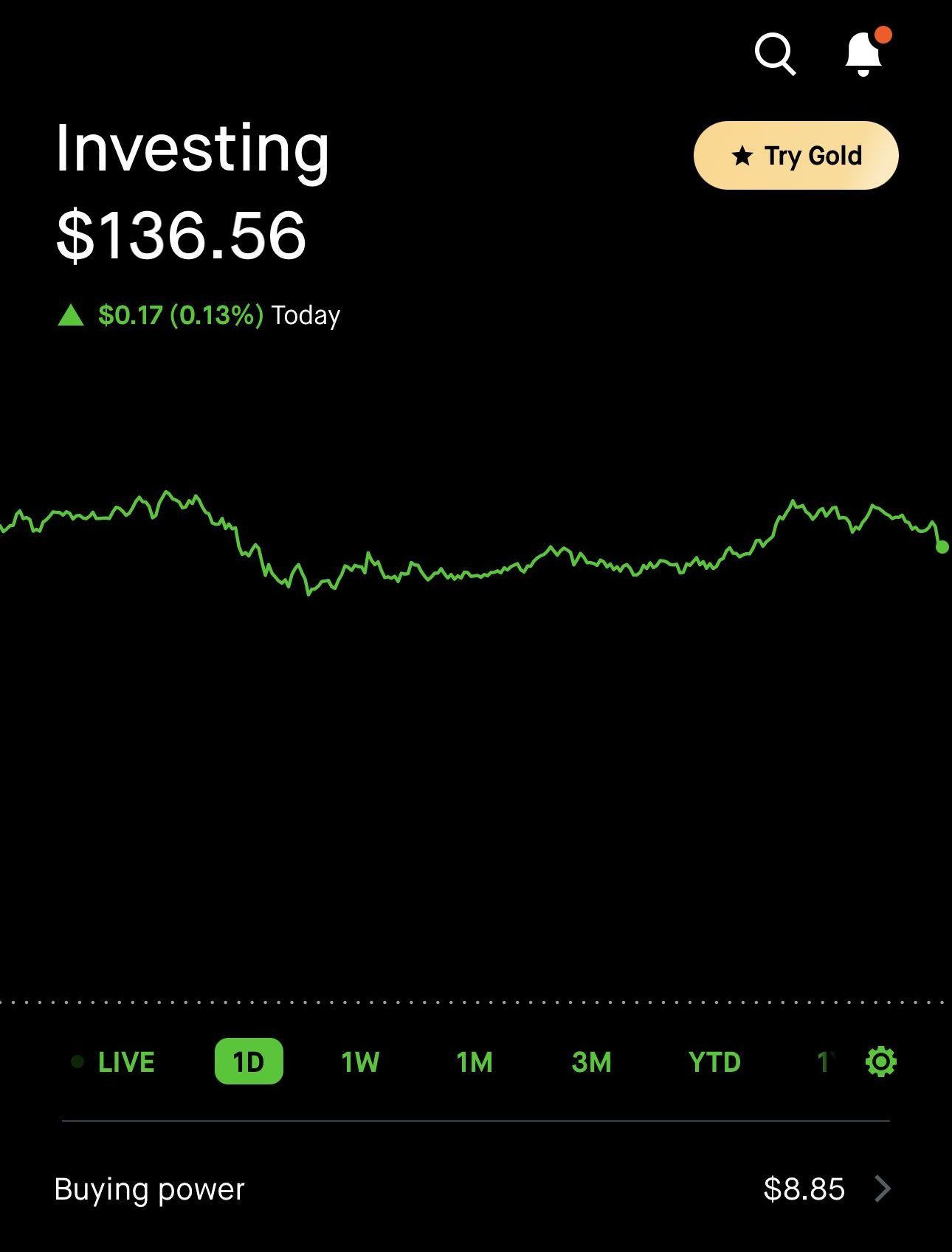

Robinhood offers commission-free trading with a focus on stocks, ETFs, cryptocurrencies and fractional share purchases. While it provides basic tools like charts, news, and analyst ratings, in-depth research is limited.

The Robinhood Gold is a great addition which provides a lot of new features including high savings rates, free instant deposits, Morningstar insights, Nasdaq Level 2 data, 3% IRA matching and generous cash back rewards with its credit card.

In contrast, Stash provides a more comprehensive financial management approach. It offers various account types, including IRAs and custodial accounts, and emphasizes long-term investing and financial planning.

Stash's subscription model includes additional benefits like banking services, retirement management, and life insurance. It also offers an automated investing for hand off approach investors.

Robinhood | Stash | |

|---|---|---|

Investing Options | Over 5,000 securities, most U.S. stocks and ETFs listed on U.S. exchanges | 4,000 stocks, ETFs and REITs |

Investing Types | Stocks, Options, Futures, ETFs, Crypto, Margin, Fractional Shares | Stocks, ETFs, REITS and Fractional Shares |

Automated Investing | No | Yes |

Paper Trading | Yes | No |

Tax Loss Harvesting | No | No |

IPO Access | Yes | No |

-

Self Investing And Trading Options

Robinhood is our winner when it comes to investing and trading.

Robinhood's self-investing platform allows users to buy and sell a variety of assets, including stocks, ETFs, options, and cryptocurrencies. Robinhood also offers options trading and access to futures and commodities.

One of the key areas is its support for technical analysis and custom alerts. Robinhood's improved charting capabilities include moving averages, relative strength index (RSI), and other indicators that help traders analyze stock trends and make informed decisions.

The 24-hour market feature enables users to trade select stocks and ETFs around the clock, providing greater flexibility compared to Stash, which operates within regular market hours.

Trading on margin is another significant feature where Robinhood excels, and it also provides IPO access.

On the other hand, Stash excels in areas that make investing accessible and straightforward, particularly for beginners and younger investors.

It supports a wide range of ETFs and nearly 4,000 stocks and fractional shares. Additionally, Stash provides access to REITs, which are not available on Robinhood.

Stash's self-investing and trading options are geared towards beginner investors who appreciate guidance and simplicity in managing their investments.

-

Fees

There is no clear winner whem it comes to fee as both Robinhood and Stash offer no trading commissions.

However, with Stash you'll need to pay a monthly fee, based on your subsrictpion. With Robinhood, there is an additional fee for Robinhood Gold members.

Robinhood | Stash | |

|---|---|---|

Monthly Fee | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold | Monthly $3 – $9

$3 for Stash Growth plan, $9 for Stash+ plan |

-

Retirement Accounts

When it comes to retirement options, Robinhood is our winner – not because the variety of platforms, but because of the potential benefits customers can get.

With Robinhood, you can choose from a Traditional, Roth, or Rollover IRA. Even with the free version of Robinhood, you get a 1% match on your eligible IRA deposits.

If you upgrade to Robinhood Gold, you get a 3% match on your IRA contributions, meaning you earn 3% on every eligible dollar you put into your IRA each year.

Stash also offers basic retirement options like Traditional and Roth IRAs. Through these accounts, you can invest in a variety of ETFs and REITs.

-

Cash Management And Savings Rates

When it comes to banking options, Stash wins when it comes to money management features and financial planning. However, Robinhood Gold customers can earn higher savings rates which is not available with Stash.

Stash | Robinhood | |

|---|---|---|

Savings APY | N/A | 1.00% – 4.50%

You’ll earn 0.01% Annual Percentage Yield (APY) as a Robinhood Gold member on your uninvested brokerage cash that is swept to the banks in our program. |

The Stash banking service includes a checking account with no hidden fees, no minimum balance requirements, and early payday access.

Stash partner with insurance companies such as Jerry or Lemonads so you can also buy insurance through the platform:

This account is paired with a Stock-Back® Card, a unique debit card that rewards users with fractional shares of stock based on their spending.

Additionally, Stash banking provides budgeting tools and automatic round-up investments.

Unlike Stash, Robinhood lacks checking account features but do offer a high savings rate of 4.00% and rewards credit card that is exclusive for Gold members.

There is 5% cash back if I book travel using the Robinhood travel portal and 3% on all other purchases.

Stash: Which Features Are Unique?

Here are some of the features that investors can find only with Stash:

-

Automated Investing

Stash’s automated investing service is offered through its Smart Portfolio, which is designed to provide a simple, fully managed investment solution.

Investors can choose their risk level, and Stash automatically allocates funds across domestic, international, and bond holdings to match the user's risk tolerance and financial goals.

The Smart Portfolio is rebalanced quarterly, ensuring the portfolio remains aligned with the investor's chosen risk profile.

Robinhood: Which Features Are Unique?

Here are some of the features that investors can find only with Robinhood:

-

Crypto Trading

Robinhood Crypto lets you buy, sell, and store various cryptocurrencies right in the Robinhood app.

You can trade popular coins like Bitcoin, Ethereum, Dogecoin, and more. The best part is, unlike most crypto exchanges, Robinhood doesn't charge any commission fees for these trades.

But keep in mind, you can't transfer your cryptocurrencies to external wallets just yet. This means you can only use your crypto within the Robinhood platform for now.

-

Custom Alerts

Another great feature on Robinhood is the custom alerts. You can set price targets for stocks and then step away from the app. If the prices change, you'll get a notification, so you can check in and take action.

The real benefit is with technical analysis. Robinhood lets you set alerts for technical indicators like moving averages, relative strength index (RSI), and Bollinger Bands.

By setting these alerts, you'll get notified when certain market conditions are met, helping you stay updated on market trends and signals.

Bottom Line

While both platforms aim to democratize investing, their approaches cater to different audiences.

Robinhood is best for traders looking for a fast, easy, and cost-free trading experience with a focus on stocks, ETFs, and cryptocurrencies.

On the other hand, Stash is more suitable for beginners who prefer a more comprehensive financial management tool that offers guidance and a broader range of investment options, as well as trading options.

Compare Robinhood Side By Side

Schwab offers more options for investors, including robo advisors and wealth management, while Robinhood is best for beginners and traders.

Schwab vs. Robinhood: Which Brokerage is Right for You?

Vanguard offers more options for investors, including retirement, robo advisors, and wealth management, while Robinhood is best for traders.

Merrill Edge is best for long-term investments, including retirement, while Robinhood is perfect for active traders who value simplicity.

Merrill Edge vs. Robinhood: Compare Brokerage Account Options

JP Morgan wins when it comes to fundamental investing tools, but Robinhood is better for technical analysis and trading. Here's why:

J.P. Morgan Self-Directed Investing vs. Robinhood : Compare Brokerage Accounts

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners.

Robinhood is an excellent choice for beginner and casual investors, but IBKR is better suited for experienced investors and advanced traders.

Interactive Brokers vs. Robinhood: Compare Brokerage Account Options

Robinhood is best for low-cost platform for various trading needs, including Crypto. Etrade is better for one stop shop, including banking.

While Robinhood caters to traders and advanced investors, Acorns focuses on automated investing and banking. Here's our full comparison.