Webull | Stash | |

Monthly Fee | $0

May be charge specific fees for trading such as stock options, futures, transfers etc

| $3 – $9

$3 for Stash Growth plan, $9 for Stash+ plan |

Account Types | Brokerage, Retirement | Brokerage, Retirement |

Savings APY | 5.00% | N/A |

Minimum Deposit | $0 | $1 |

Best For | Advanced Traders, Active Investors | Younger, Novice Investors & Traders |

Read Review | Read Review |

Webull vs Stash: Compare Investing Features

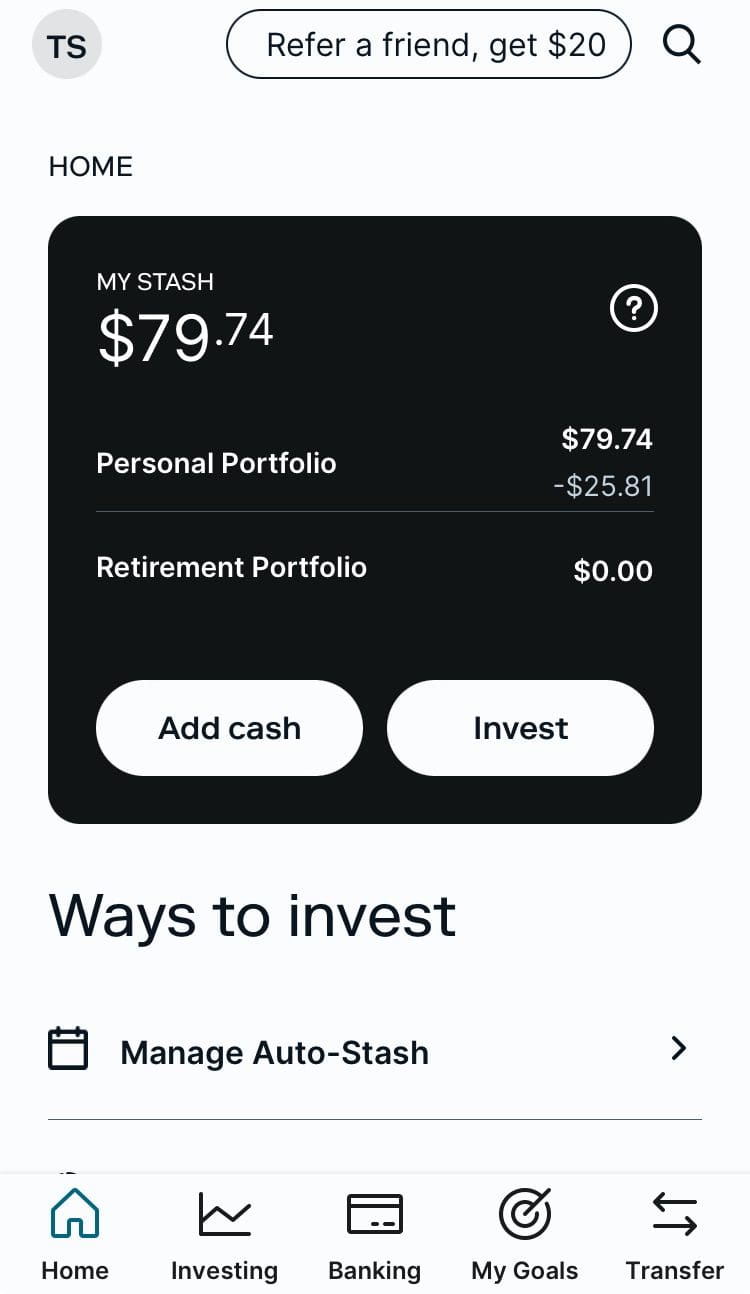

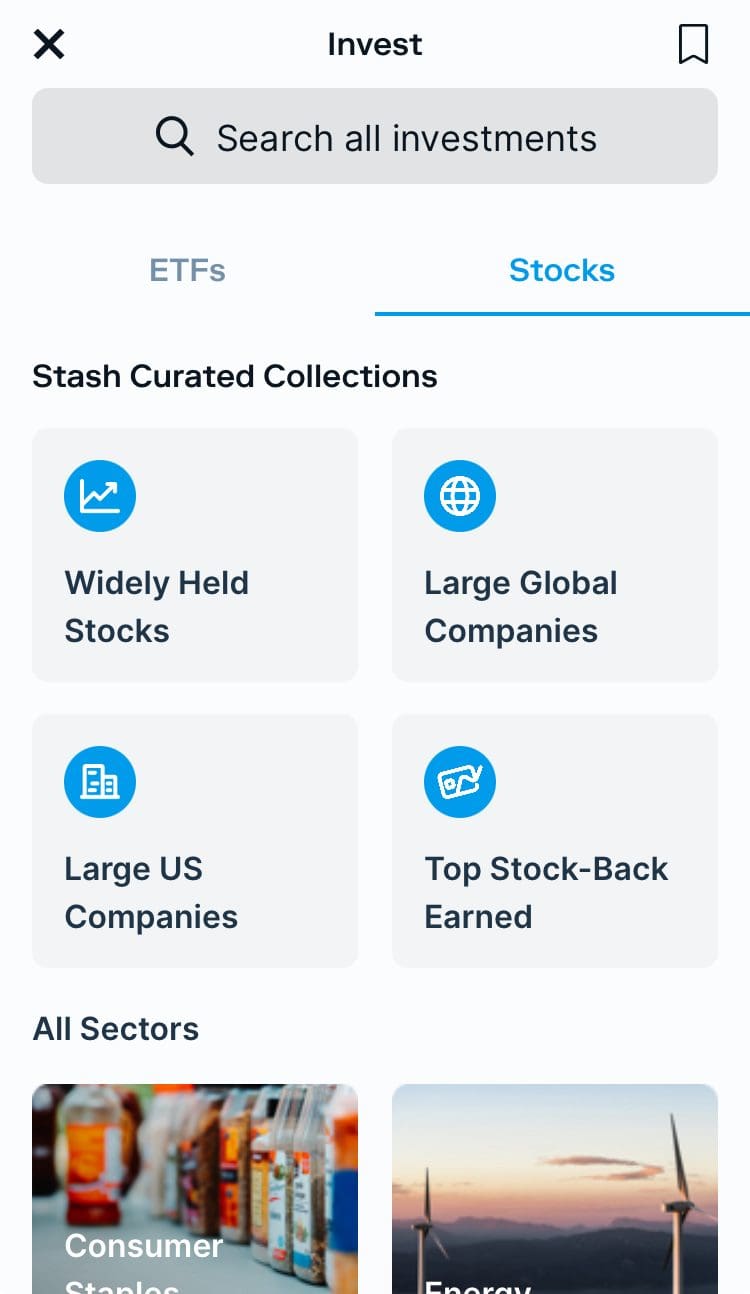

Stash is designed for younger and less experienced investors . It offers a two-tier subscription-based model, providing digital advice and investment management through its Smart Portfolio.

Stash | Webull | |

|---|---|---|

Investing Options | 4,000 stocks, ETFs and REITs | 10,000 US stocks and ETFs. |

Investing Types | Stocks, ETFs, REITS and Fractional Shares | Stocks, Options, Futures, ETFs, OTC, Margin, Fractional Shares |

Automated Investing | Yes | Yes |

Paper Trading | No | Yes |

Tax Loss Harvesting | No | No |

IPO Access | No | Yes |

Unique to Stash is the Stock-Back card, which rewards spending with stock instead of cash, integrating everyday transactions with investment growth. It also offers decent cash management accounts and IRA accounts.

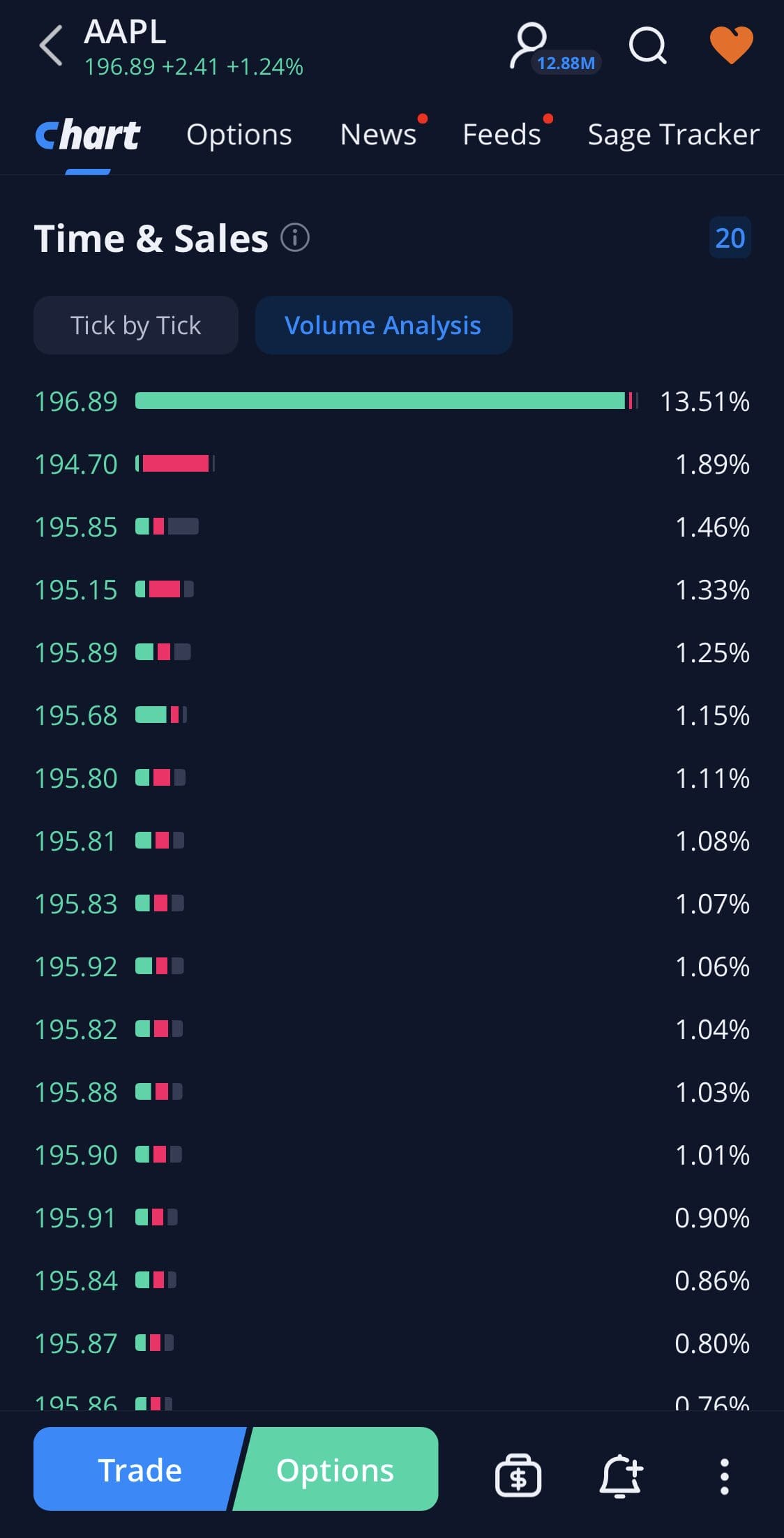

On the other hand, Webull targets more active and self-directed traders, offering commission-free trading of stocks, ETFs, options, and futures.

Webull’s platform is robust, featuring customizable trading screens, extended hours trading, IPO Access, and a user-friendly mobile app.

Webull’s Smart Advisor robo-advisor service offers automated portfolio management.

-

Self Investing And Trading Options

Webull is our winner when it comes to self-investing and trading options.

Webull's self-investing and trading options cater primarily to active traders and self-directed investors, offering a range of features that make it a versatile and powerful platform.

One of its standout features is commission-free trading on stocks, ETFs, options, and futures, which significantly lowers the cost of trading and is a major draw for frequent traders.

Webull fixed income investments, including US Treasury bonds:

The platform includes a customizable trading workstation with advanced charting tools, technical indicators, and the ability to trade directly from charts.

Webull offers extended hours and pre-market trading, which is not available with Stash. This flexibility allows traders to take advantage of market movements outside of regular trading hours.

On the other hand, Stash excels in areas that make investing accessible and straightforward, particularly for beginners and younger investors.

It supports a wide range of ETFs and nearly 4,000 stocks and fractional shares. Additionally, Stash provides access to REITs, which are not available on Webull.

Stash's self-investing and trading options are geared towards beginner investors who appreciate guidance and simplicity in managing their investments.

-

Automated Investing

Webull's robo-advisor, known as Webull Smart Advisor, provides automated investment management tailored to the needs of self-directed investors seeking a hands-off approach.

The Webull Smart Advisor creates portfolios based on users' risk tolerance, financial goals, and investment timelines. It utilizes a diversified mix of low-cost ETFs, focusing on efficient market exposure across various asset classes.

The automated system periodically rebalances the portfolio to maintain the desired asset allocation, ensuring alignment with the user's investment objectives.

Webull Smart Advisor | Stash | |

|---|---|---|

Robo Advisor Minimum Deposit | $100 | $5 |

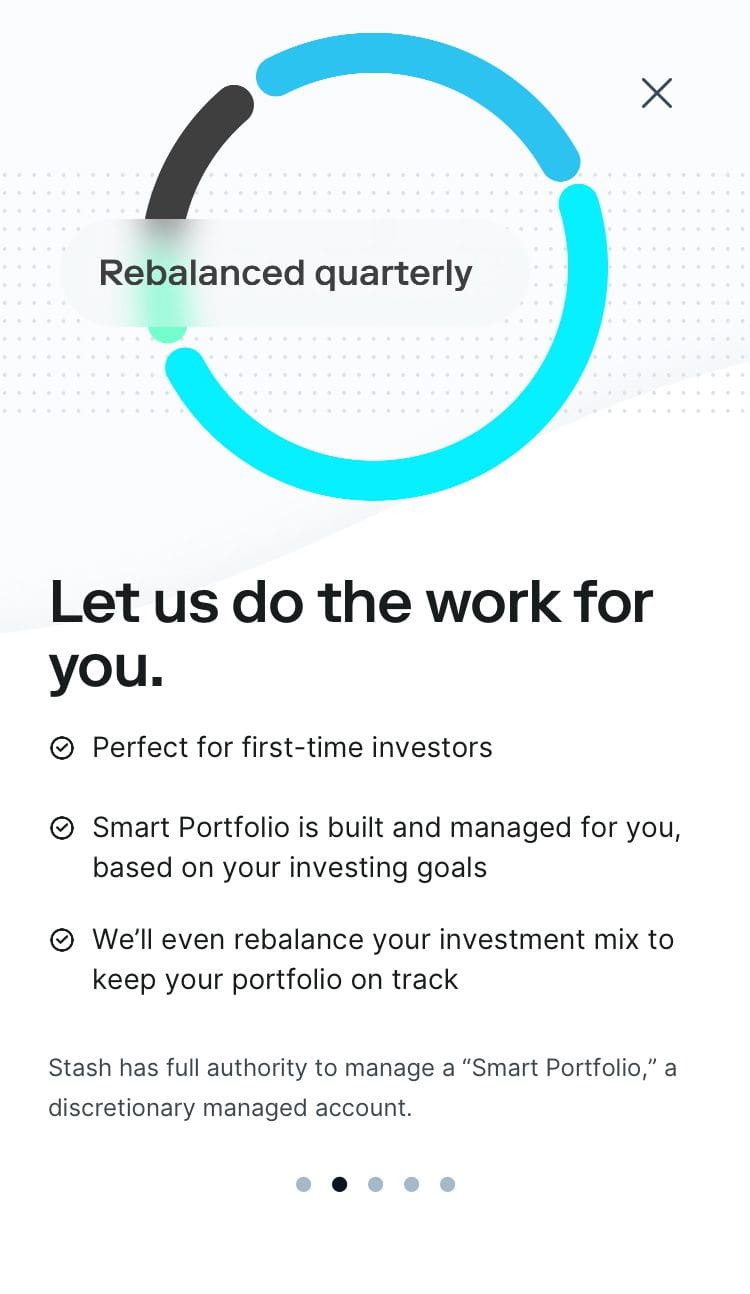

Similarly, Stash’s automated investing service is offered through its Smart Portfolio, which is designed to provide a simple, fully managed investment solution.

Investors can choose their risk level, and Stash automatically allocates funds across domestic, international, and bond holdings to match the user's risk tolerance and financial goals.

The Smart Portfolio is rebalanced quarterly, ensuring the portfolio remains aligned with the investor's chosen risk profile.

-

Fees

There is no clear winner whem it comes to fee as both Webull and Stash offer no trading commissions.

However, if you tend to use a Robo Advisor, the fees depends on your portfolio value as well as your subscription plan if you use Stash:

Webull Smart Advisor | Stash | |

|---|---|---|

Robo Advisor Fee | 0.20% | Monthly $3 – $9

$3 for Stash Growth plan, $9 for Stash+ plan |

-

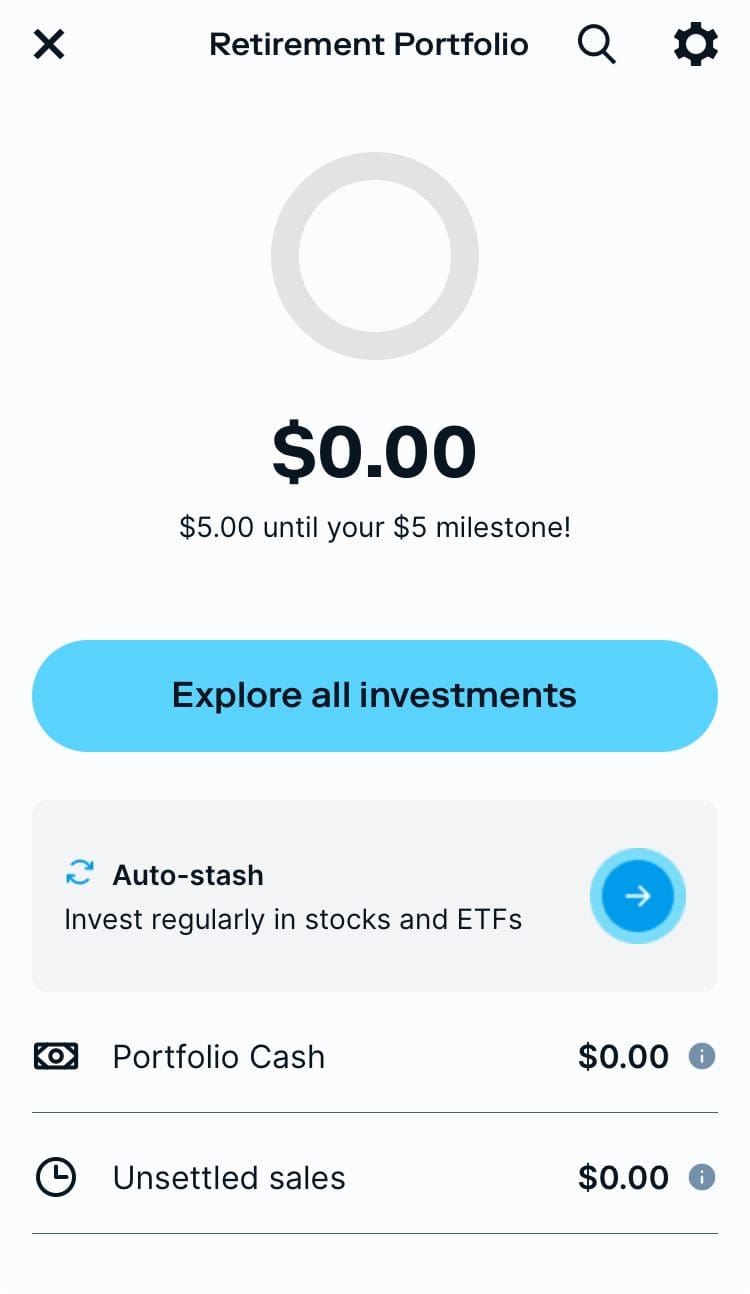

Retirement Accounts

When it comes to retirement options, there is no real difference as both platforms offer similar options.

With a Webull IRA, you can choose between Traditional, Roth, and Rollover IRAs, all with no account minimums or fees.

Stash offers basic retirement options, including traditional IRAs and Roth IRAs. It allows users to invest in a range of ETFs and REITs through these accounts.

Both platforms lacks advanced features like automated IRA portfolio management and tax-loss harvesting.

-

Cash Management And Savings Rates

When it comes to banking options, there is no clear winner as Webull offers a very competitive APY in its cash account, while Stash offers better cash management features.

Webull | Stash | |

|---|---|---|

Savings APY | 5.00% | N/A |

Webull High-Yield Cash Management offers an impressive 5.00% APY on uninvested cash within your Webull account, with no need for a new account, no fees, and no minimum balance.

The Stash banking service includes a checking account with no hidden fees, no minimum balance requirements, and early payday access.

This account is paired with a Stock-Back® Card, a unique debit card that rewards users with fractional shares of stock based on their spending.

Additionally, Stash banking provides budgeting tools and automatic round-up investments.

Bottom Line

In summary, Webull suits more experienced traders seeking feature-rich and advanced trading and research features.

Stash is ideal for those starting their investment journey and want to get other financial tools than investing.

Compare Webull Side By Side

Fidelity excels in investment options, wealth management, and retirement planning. Webull trading platform is one of the most fascinating we've seen.

Webull offers user-friendly tools and perfect app design, while IBKR is best suited for more experienced investors and global market access.

Interactive Brokers vs. Webull: Compare Brokerage Account Options

ETRADE is best for a comprehensive array of investment options, while Webull app design and charting is one of the most appealing we've seen

Webull is better suited for experienced traders needing advanced tools, whereas Robinhood caters to beginners and those who prefer simplicity