|

| |

|---|---|---|

Seeking Alpha Premium | Stock Analysis Pro | |

Price | $299 ($24.90 / month)

No monthly subscription | $79 ($6.58 / month) |

Best Features | ||

Our Rating |

(4.6/5) |

(4.4/5) |

Read Review | Read Review |

Compare Stock Research & Analysis Features

In this article, we’ll compare Seeking Alpha Premium and Stock Analysis Pro, focusing on their strengths and core features.

We’ll break down their stock screening tools, research capabilities, portfolio insights, and recommendation systems to help you decide which platform better fits your investing style.

-

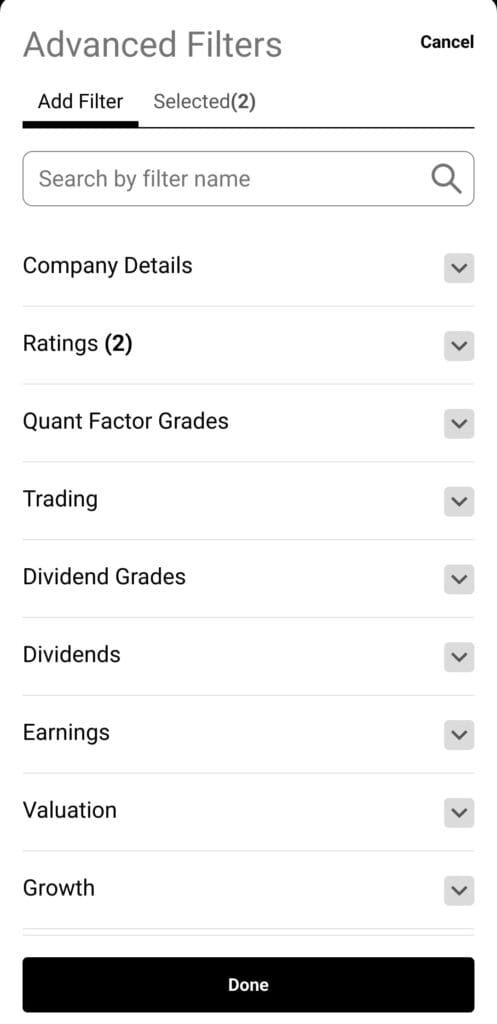

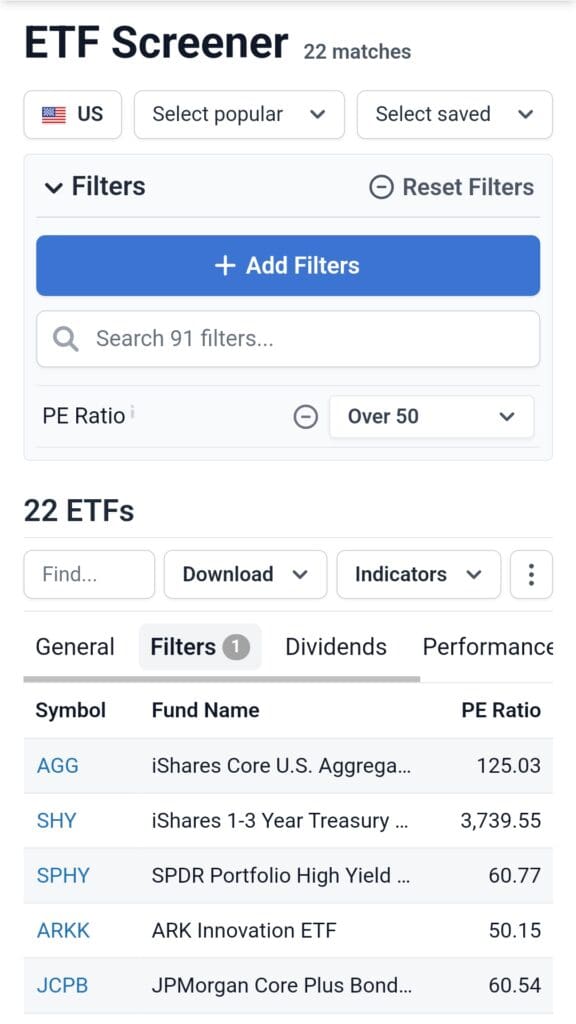

Stock Screening Tools

Our Verdict: Stock Analysis Pro clearly leads here due to deeper filtering options, long-term historical data, and customization.

Stock Analysis Pro provides a far more customizable screener with over 200+ indicators, including technical metrics, performance ratios, and financial history spanning up to 40 years.

Users can save and download screeners, apply analyst-specific filters, and export thousands of rows to Excel or CSV.

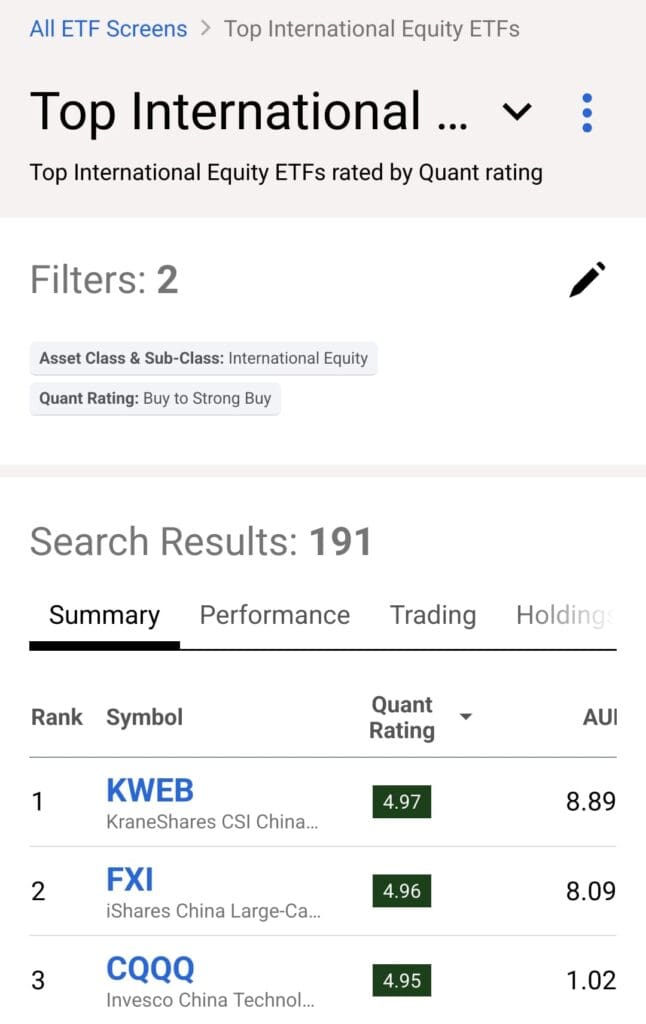

Seeking Alpha Premium offers a robust stock and ETF screener that integrates Quant Ratings, Factor Grades, and valuation filters.

Investors can sort stocks by dividend strength, growth, profitability, and momentum. However, it lacks advanced charting or the ability to export data.

-

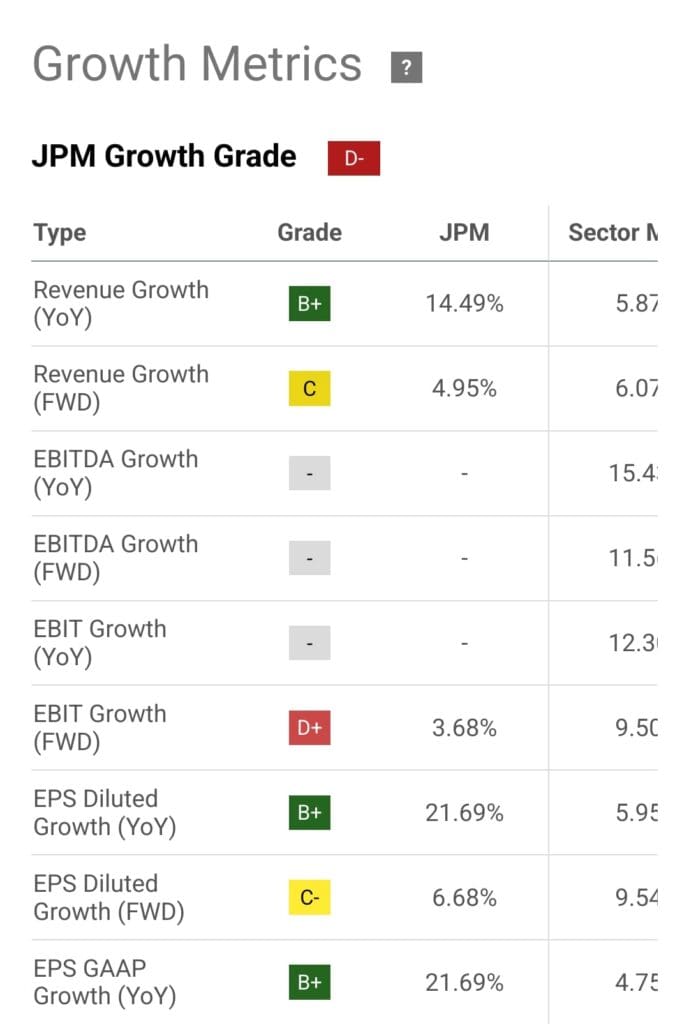

Fundamental Analysis Tools

Seeking Alpha Premium wins in this category thanks to its unique blend of data, proprietary ratings, and expert-written content.

Seeking Alpha Premium shines with its Quant Ratings, Factor Grades, and access to full financial statements, earnings trends, valuation models, and dividend safety ratings.

It also includes unlimited expert articles, author performance tracking, and earnings call transcripts.

Stock Analysis Pro offers in-depth access to 10–40 years of financial data, analyst ratings, and customizable comparison tools.

However, it lacks original investment articles and does not provide curated expert insights or SEC filings.

-

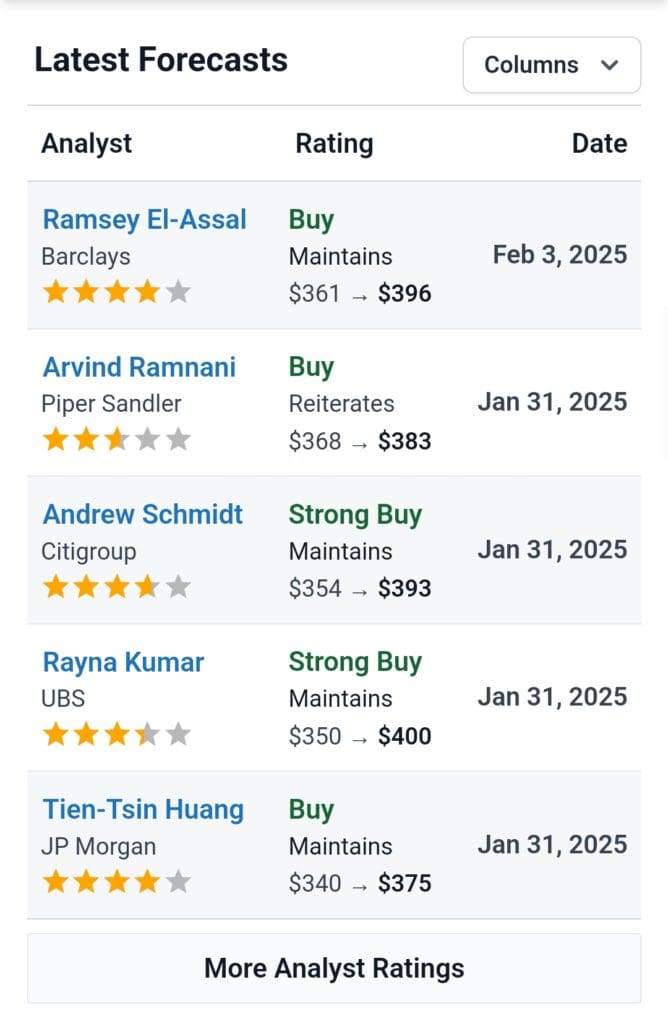

Stock Picks & Recommendations

Seeking Alpha Premium provides curated stock lists such as Top Growth Stocks, Dividend Stocks, and Yield Monsters.

However, for true stock picks, users would need to subscribe to Alpha Picks, which is a separate product.

Stock Analysis Pro offers stronger built-in recommendation tools through the Top 50 list and analyst rankings, making it better for users seeking expert-driven picks without extra cost.

-

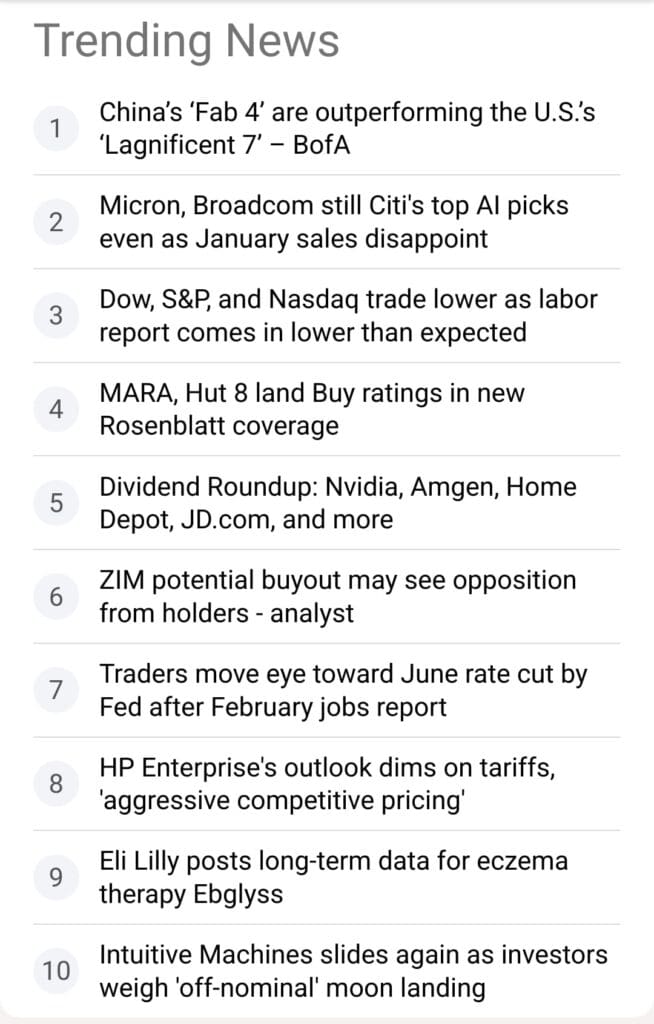

Market Sentiment Analysis

Seeking Alpha Premium includes a real-time news dashboard, earnings calendars, market alerts, and article-based sentiment from a wide range of contributors.

It also tracks news related to your portfolio and lets you follow author performance.

Stock Analysis Pro includes a news aggregation section and trending tickers but lacks deeper social sentiment tools or real-time breaking news.

There are no community-driven insights or contributor-driven sentiment features.

-

Portfolio Analysis & Alerts

Seeking Alpha Premium is one of the best tools for portfolio monitoring and real-time alerts, while Stock Analysis Pro lacks this functionality entirely.

It also provides real-time alerts on earnings revisions and stock news. However, it lacks performance tracking or allocation analytics.

Stock Analysis Pro supports unlimited watchlists with deep metric tracking, but it does not provide performance analysis, diversification warnings, or alert-based insights.

-

Technical Analysis Options

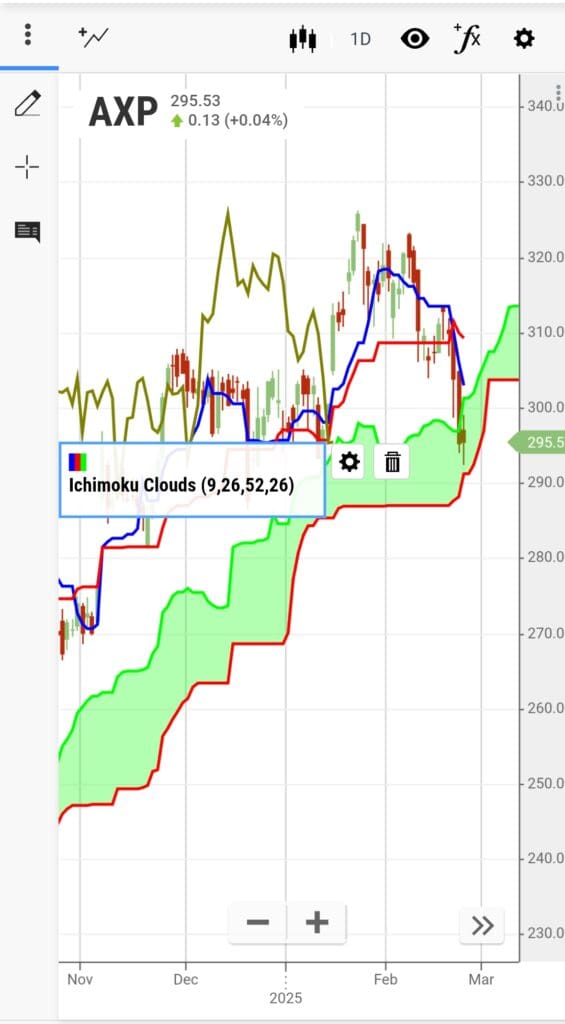

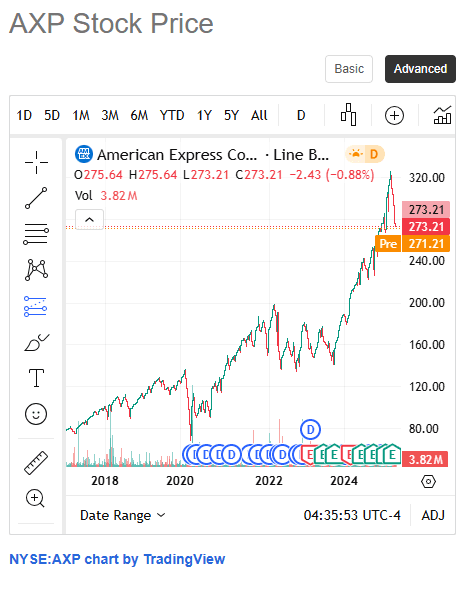

Stock Analysis Pro clearly dominates in technical analysis with advanced charting tools and indicators that Seeking Alpha doesn’t offer.

Seeking Alpha Premium focuses on fundamentals and has minimal charting or technical indicators. It lacks tools like RSI, moving averages, or trend analysis.

Stock Analysis Pro includes customizable charts with over 200 technical indicators, overlays, drawing tools, and saved chart views, making it one of the best apps for technical analysis.

-

ETF, Bonds & Fund Analysis Tools

Stock Analysis Pro offers a powerful ETF screener with over 200 indicators, full ETF holdings, dividend metrics, and downloadable data. It still doesn’t cover bonds or mutual funds.

Seeking Alpha Premium covers ETF rankings based on Quant Ratings and sector exposure but lacks deep mutual fund or bond research.

Which Investors May Prefer Seeking Alpha Premium?

Seeking Alpha subscription suits investors who prioritize deep stock research, expert opinions, and dividend-focused portfolio management over technical trading tools.

Fundamental-Focused Investors: Those who value earnings reports, SEC filings, valuation models, and in-depth financial data will benefit from the detailed stock pages.

Dividend Seekers: Dividend safety scores, payout history, and curated high-yield lists help income investors find reliable dividend-paying stocks.

Research-Driven DIY Investors: With unlimited expert articles and contributor insights, self-directed investors can explore diverse stock opinions and market outlooks.

ETF-Oriented Investors: While not as detailed as some ETF tools, the rankings and sector views offer a helpful overview for passive fund investors.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

Which Investors May Prefer Stock Analysis Pro

Stock Analysis Pro subscription is ideal for investors who want data-rich screeners, detailed financial history, and advanced technical and ETF analysis features.

Quantitative Analysts: The ability to filter stocks using 200+ metrics and 40 years of data is perfect for in-depth financial modeling.

ETF-Heavy Investors: Full ETF holdings, category filters, and dividend metrics help users compare funds with clarity and precision.

Technical Traders: Those who rely on technical indicators, customizable charts, and saved chart views will find the platform highly capable.

Independent Researchers: Investors who don’t need articles or picks but want raw data, Excel downloads, and corporate actions data will thrive here.

Plan | Annual Subscription | Promotion |

|---|---|---|

Stock Analysis Pro | $79 ($6.58 / month) | 60-day money back guarantee |

Bottom Line

Seeking Alpha Premium shines for investors who want a data-backed, fundamentals-first approach with dividend insights, expert articles, and smart portfolio monitoring.

It’s best for self-directed investors who value curated content and financial health tools. Meanwhile, Stock Analysis Pro excels in raw data depth, screeners, and long-term trend analysis.

With powerful charting, 40-year history, and top ETF tools, it’s ideal for advanced DIY analysts and technical traders who prefer to build insights independently.