Table Of Content

What Is a Stock Screener?

A stock screener is a research tool that lets investors filter and sort stocks based on predefined criteria such as market cap, sector, dividend yield, or valuation metrics like P/E ratio.

It is commonly used by long-term investors or analysts who want to narrow down a list of stocks that match specific investment strategies.

For example, someone looking for undervalued dividend-paying stocks might filter for companies with low P/E ratios and a dividend yield above 4%.

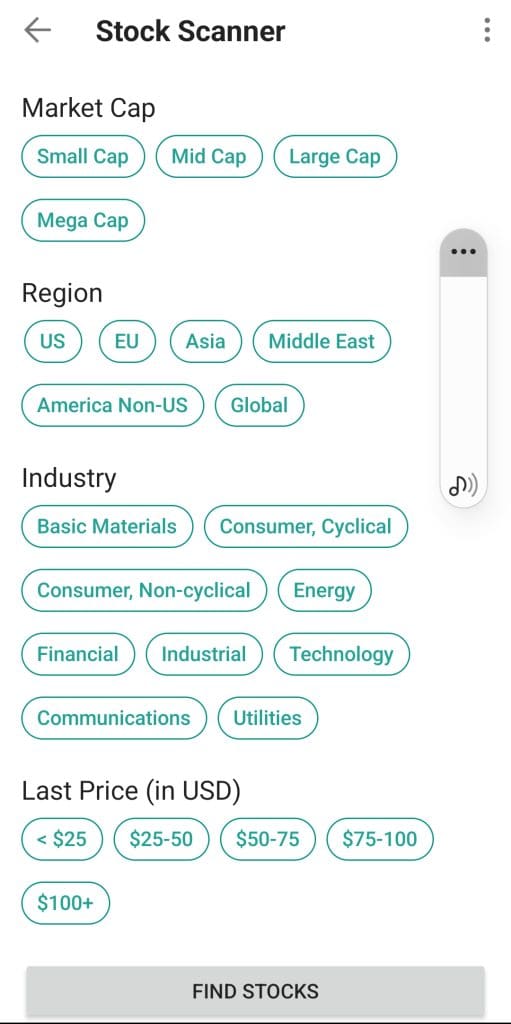

What Is a Stock Scanner?

A stock scanner is a real-time trading tool that continuously monitors the market to alert users to stocks that meet certain technical or volume-based criteria as they happen.

Traders often use scanners to spot momentum plays, breakout patterns, or sudden volume spikes throughout the trading day.

For instance, a day trader might set a scanner to highlight stocks making new intraday highs on rising volume.

Stock Scanner vs. Screener: Key Differences

While both tools help investors filter stocks, their use cases, speed, and goals differ significantly.

-

Real-Time vs. Static Analysis

A stock scanner operates in real time, constantly updating and alerting traders to immediate market activity. A screener, however, provides a static snapshot based on current or historical data.

-

Trading vs. Investing Focus

Screeners are geared toward longer-term investing strategies, while scanners are favored by intraday or swing traders looking to capitalize on short-term price moves.

-

Customization and Alerts

Scanners often support live alerts, technical triggers, and momentum filters. In contrast, screeners focus on filters like fundamentals, industry classification, or earnings history.

-

Platform Integration

Scanners tend to integrate directly with trading platforms, enabling faster execution. Screeners are often used separately for research before placing trades.

Which One Is Best For You?

The right choice depends on your investing style and time horizon.

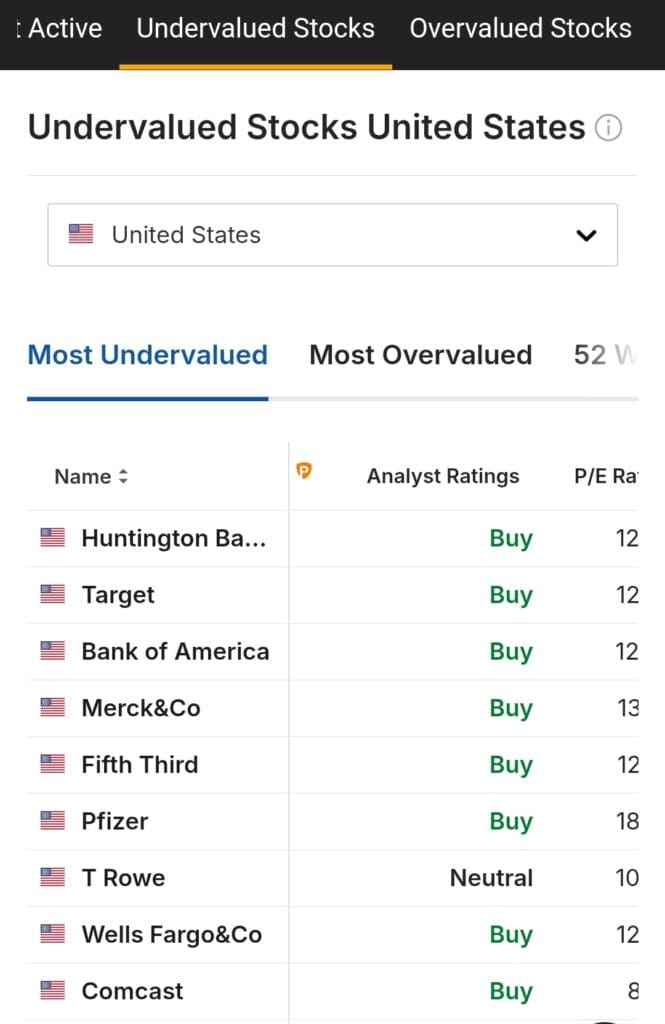

If you're a long-term investor focused on company fundamentals, a stock screener is ideal for researching undervalued or high-growth opportunities.

But if you’re an active trader looking to act on intraday movements or short-term technical setups, a stock scanner offers the real-time data and alerts you need.

Therefore, understanding your goals—whether it's building a long-term portfolio or reacting to fast market changes—is key to selecting the right tool.

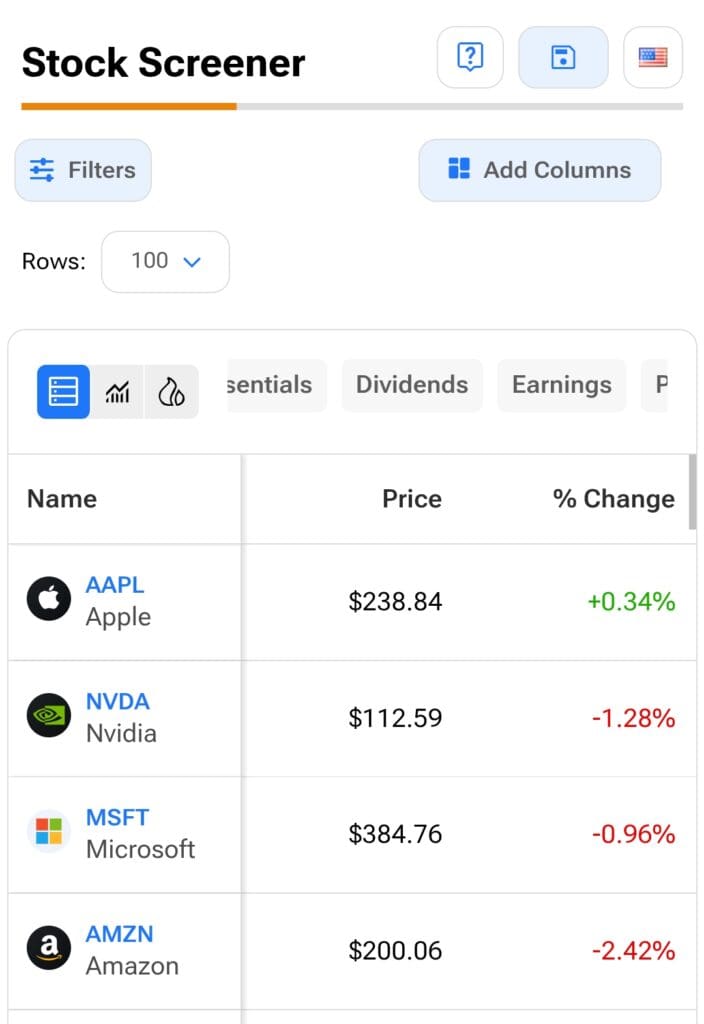

Leading Stock Screeners for Fundamental Investors

For investors who focus on long-term fundamentals, several platforms stand out.

TipRanks: Offers a unique blend of analyst ratings, hedge fund activity, and insider trading data to help users assess stock quality.

Seeking Alpha: Known for its crowd-sourced analysis and quantitative ratings, it's great for identifying stocks with strong earnings potential or dividend safety.

Yahoo Finance: A user-friendly and free tool that allows investors to screen based on metrics like EPS growth, valuation ratios, and market cap.

Overall, these tools allow investors to filter stocks using deep financial data and research insights:

Plan | Subscription | Best For |

|---|---|---|

Morningstar Investor | $34.95

$249 ($20.75 / month) if paid annually | Retirement Planners |

Zacks Premium | $249 ($20.75/month)

No monthly plan | Research-Driven Investors |

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| Stock Picks |

Yahoo Finance Gold | $49.95

$479.40 ($39.95 / month) if paid annually | Casual Investors |

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually | Global Market Investors |

TipRanks Premium | $359 ($30 / month)

No monthly plan | Analysts Followers |

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | Research-Oriented Investors |

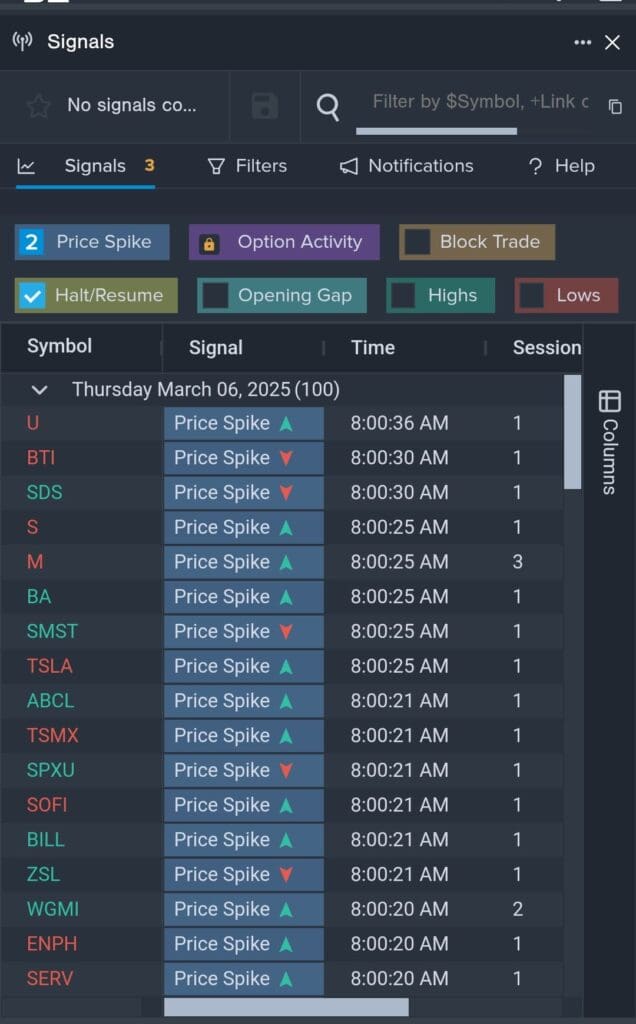

Leading Stock Scanners for Active Traders

Active traders benefit most from platforms that scan the market in real time and offer customizable alerts.

Benzinga Pro: Features real-time news, price spikes, and unusual options activity scanners, which are essential for day traders.

TradingView: Offers both chart-based scanning and scriptable indicators, making it perfect for technical traders monitoring trend shifts or breakouts.

Finviz Elite: An upgraded version of the popular Finviz screener, it includes intraday charts and technical signal filters for spotting high-momentum stocks.

These platforms are designed to respond to market volatility quickly, helping traders execute short-term strategies effectively.

Plan | Subscription | Best For |

|---|---|---|

TradingView Premium | $59.95

$432 ($23.98 / month) if paid annually | Technical Analysts |

Benzinga Pro | $37

$367 ($30.58 / month) if paid annually | News-Driven Traders |

MarketBeat All Access | $39.99

$399 ($33.25 / month) if paid annually | Portfolio Trackers |

GuruFocus Premium | $499 ($41.58/ month)

No monthly plan, price for US citizens, price change by region | Guru Investors Portfolios |

StockTwits Edge | $22.95

$229.50 ($19.10 / month) if paid annually

| Social Sentiment Traders |

Finviz Elite | $39.50

$299.5 ($24.96 / month) if paid annually | Chart Pattern & Backtesting |