Table Of Content

When buying physical gold, even a tiny difference in the price you pay over the spot can add up, especially when purchasing multiple ounces of gold.

For example, a 3% premium vs. a 5% premium might not seem huge until you spend thousands. This guide breaks down smart strategies and real examples to help you avoid common traps.

Product Type | Average Premium Over Spot | Best Use Case |

|---|---|---|

1 oz Gold Bar | 3%–5% | Long-term investment, low-cost storage |

1 oz Gold Coin (Eagle) | 6%–10% | Liquidity, IRA-eligible |

10 oz Gold Bar | 2%–3% | Bulk buyers seeking lowest premiums |

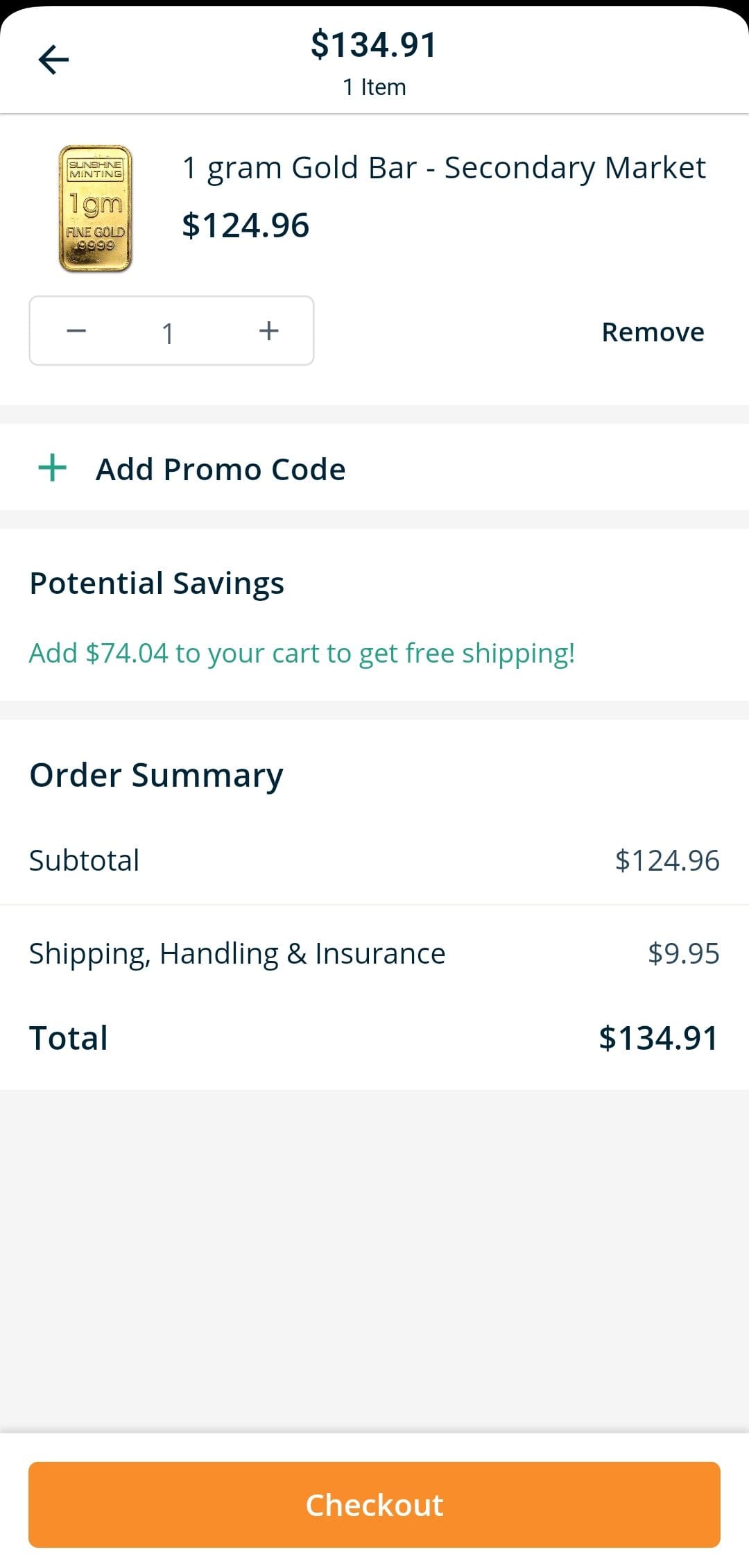

1 gram Gold Bar | 15%–25% | Small gifts or beginners with low budget |

Proof/Collectible Coins | 20%–50%+ | Rare coin collectors, not ideal for value |

How to Buy Gold at the Lowest Price: Smart Strategies

Not all gold purchases are created equal. The key to paying less lies in knowing where, what, and how to buy.

Below are practical, proven strategies that can help you reduce premiums and get more gold for your money—whether you're investing $500 or $50,000.

-

Buy Gold Bars in Larger Weightsr

Buying gold in larger denominations—like 1 oz or 10 oz bars—is often cheaper per gram than smaller pieces. Dealers charge premiums over spot price, and those premiums drop as the size increases.

For instance, a 1-gram bar may carry a 20% markup, while a 1 oz bar might only be 3–5%. APMEX and SD Bullion offer side-by-side comparisons showing this clearly.

If you’re planning to invest over $2,000 in gold, larger bars can help stretch your dollar further.

-

Use Reputable Online Dealers Instead of Local Shops

Online gold dealers usually offer lower prices due to lower overhead.

Sites like JM Bullion and BGASC often list prices closer to the spot rate than many brick-and-mortar stores. For example, a local dealer may charge $80 above spot for a 1 oz coin, while an online platform may only charge $50.

Online platforms also let you compare multiple options in real-time, making it easier to find the best deal.

-

Watch for Dealer Promotions and Discounts

Some dealers run limited-time offers on specific products or for first-time buyers. For example, SD Bullion frequently promotes discounted 1 oz rounds with lower premiums during holiday sales.

Signing up for email alerts or joining loyalty programs can also unlock exclusive pricing.

-

Buy From Peer-to-Peer Marketplaces (With Caution)

Platforms like Craigslist or Facebook Marketplace sometimes list gold at below-retail prices, especially from individuals looking to liquidate quickly. While this can lead to excellent deals, it comes with risks.

Always test for authenticity (e.g., using a gold testing kit), meet in safe public places, and avoid deals that seem too good to be true. This approach is best for experienced buyers who can verify weight and purity on the spot.

-

Purchase Through IRA-Eligible Dealers (For Long-Term Investors)

If you're buying gold as part of your retirement strategy, using a gold IRA provider can help you minimize taxes and consolidate costs. Some IRA custodians work with partner dealers to offer reduced pricing on gold coins and bars.

This works best for those rolling over existing retirement accounts or making a long-term commitment.

Setting up a Gold IRA with established dealers like APMEX can provide long-term cost savings on premium purchases:

-

Avoid Collectible or Numismatic Coins

While rare or historical coins can be exciting, they often carry high premiums unrelated to gold content.

A 1 oz American Gold Eagle in proof condition could sell for hundreds more than its melt value. If your goal is wealth preservation or investment, focus on bullion coins or bars instead.

These track the gold spot price more closely and are easier to liquidate without losing value. The U.S. Mint itself cautions investors against confusing numismatics with bullion.

Best Places to Buy Gold at the Lowest Cost

Below are some of the most cost-effective places to buy gold, along with real examples of what makes each one stand out.

Dealer | Known For | Typical Premium | Key Features |

|---|---|---|---|

SD Bullion | Lowest online prices | 2%–4% | Bulk discounts, weekend deals |

JM Bullion | Competitive pricing + promos | 3%–6% | No hidden fees, free shipping |

APMEX | Large selection, AutoInvest | 4%–7% | Loyalty rewards, scheduled buys |

BullionVault | Cheapest digital gold option | 0.5%–1.5% | Stored in vaults, fractional buying |

Local Dealer | Personalized service | 5%–10%+ | Immediate delivery, no shipping delay |

1. SD Bullion

SD Bullion is known for offering some of the lowest gold prices online, especially on larger bars and bulk orders.

Their “Deals” section frequently includes discounted 1 oz gold rounds and 10 oz bars with premiums as low as 2–3% over spot.

They also offer a “Low Price Guarantee,” making it a top pick for cost-conscious investors.

For a thorough breakdown of their services, check out our SD Bullion review.

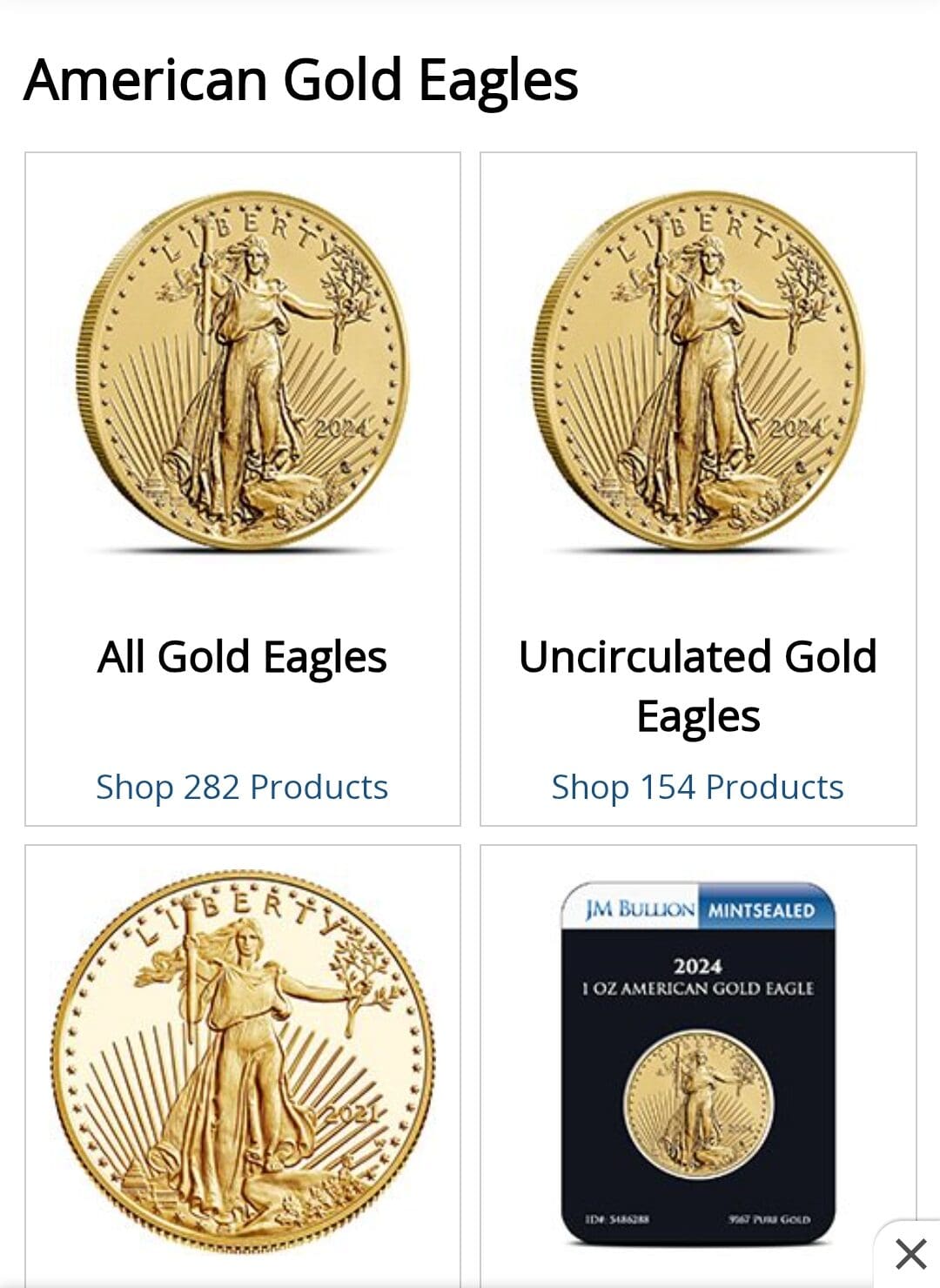

2. JM Bullion

JM Bullion consistently ranks among the most affordable online gold dealers. They offer transparent pricing, no hidden fees, and regular promotions on popular bullion products.

Their “Starter Packs” for new investors provide a great low-cost entry point with reduced premiums.

JM Bullion's American Gold Eagles are available with competitive premiums compared to other online dealers:

3. APMEX

APMEX is one of the largest and most trusted online dealers, offering competitive prices and a wide selection.

While their prices aren't always the absolute lowest, they frequently offer volume discounts and exclusive promotions.

For example, their AutoInvest program allows buyers to lock in recurring purchases of gold bars at lower pricing tiers.

For example, their AutoInvest program allows buyers to lock in recurring purchases of gold bars at lower pricing tiers.

4. Local Coin Shops (Only During Spot Deals)

While local coin shops often have higher overhead costs, some offer “spot price” promotions to attract new customers.

These are typically limited to one or two items per person but can be a great way to buy gold at minimal premium.

However, without such specials, local shops tend to charge higher premiums.

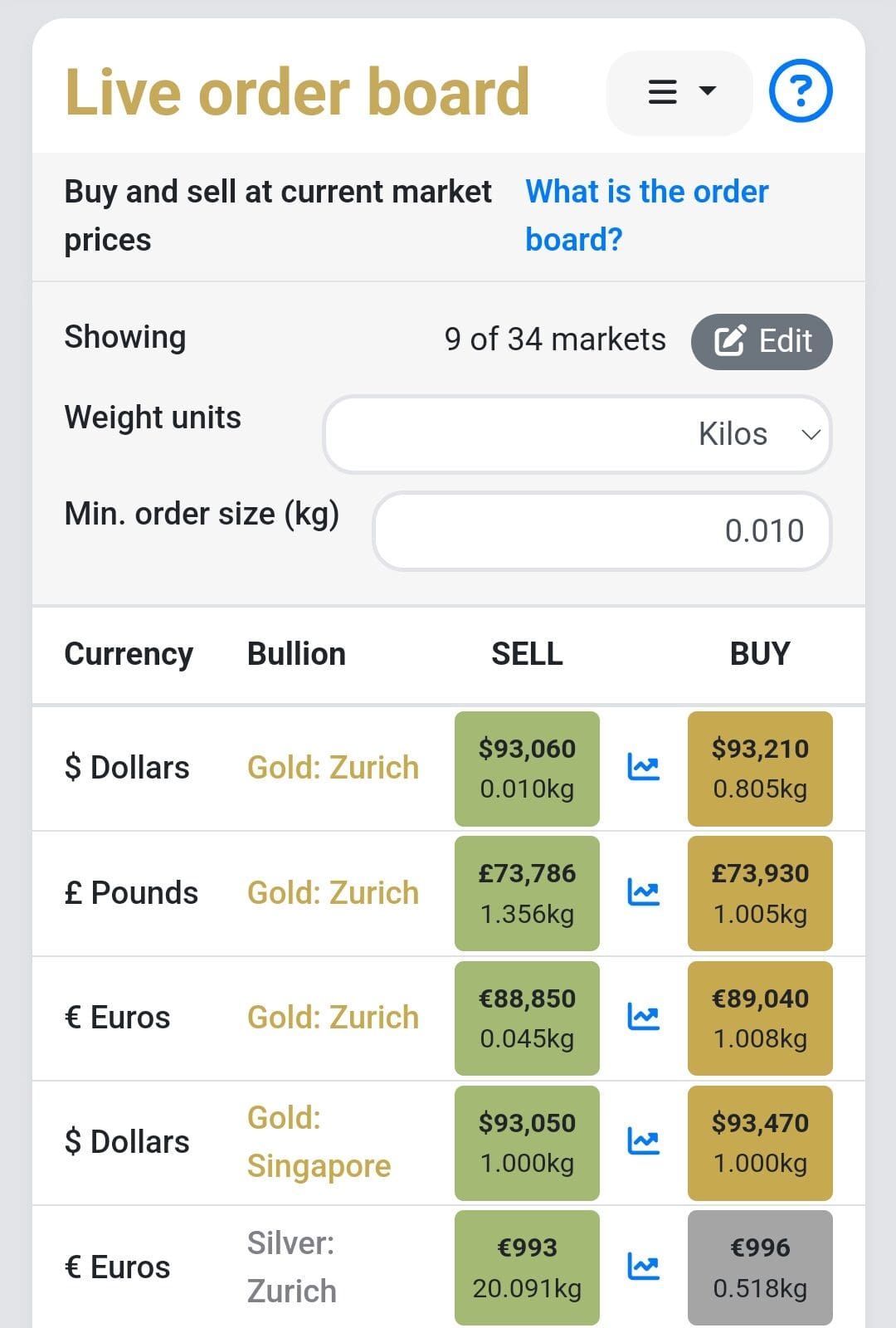

5. BullionVault (for digital gold buyers)

BullionVault is ideal for investors looking to buy allocated gold at extremely low premiums without physical delivery.

You can buy fractions of gold stored in secure vaults worldwide, often for just 0.5–1% over spot. This platform is great for those who want gold exposure without paying shipping or insurance fees.

For example, buying $5,000 worth of gold via BullionVault could cost hundreds less in total fees compared to physical coins.

Online vs. Local Gold Dealers: Where Are Prices Lower?

Online gold dealers almost always offer lower prices than local shops. This is primarily due to reduced overhead, higher sales volume, and more competition online.

Dealers like JM Bullion and SD Bullion list real-time prices with transparent premiums—often just 3–5% over spot. In contrast, many local coin shops charge 7–10% over spot, plus sales tax (depending on your state).

However, local shops may be better for small one-time purchases or those who value face-to-face transactions.

They also occasionally run in-store spot price specials. But for consistently lower pricing, online platforms are the better bet.

FAQ

Yes, as long as you use reputable dealers like APMEX, JM Bullion, or SD Bullion with verified reviews and secure checkout.

Premiums typically range from 3% to 10% depending on the product type, weight, and dealer.

Yes, ETFs have lower fees and track gold prices, but they don’t give you ownership of physical gold.

Yes, larger purchases often qualify for lower premiums, especially with bars over 1 oz or 10 oz.

Bars are usually cheaper per ounce since they don’t carry design or collector premiums like coins.

Sometimes—especially with local shops or cash purchases, dealers may offer better pricing.

It depends on your state; some states exempt gold bullion from sales tax, others do not.

Generic gold bars or rounds typically carry the lowest premiums over spot price.

Yes, many dealers offer a discount for cash, check, or wire payments versus credit cards.

Usually not—pawn shops often have higher markups and inconsistent quality or authentication.

No, the U.S. Mint only sells to authorized distributors, not to the general public.