| ||

|---|---|---|

Benzinga Pro Basic | TipRanks Premium | |

Price | $367 ($30.58 / month) | $359 ($30 / month)

No monthly plan |

Best Features | ||

Our Rating |

(4.4/5) |

(4.6/5) |

Read Review | Read Review |

TipRanks or Benzinga Pro: Compare Top Features

In this article, we’ll compare TipRanks Premium and Benzinga Pro Basic, highlighting their core strengths and key features.

We’ll walk you through their stock screening capabilities, real-time alerts, expert insights, and portfolio tools to help you decide which platform aligns better with your trading or investing approach.

-

Stock Screening Tools

TipRanks Premium provides a comprehensive stock and ETF screener that filters by smart score, analyst ratings, hedge fund activity, insider trades, dividend yield, and more.

It allows investors to combine sentiment and fundamentals into one screening process, offering deep insights like top analyst picks and smart score rankings.

Benzinga Pro Basic lacks an advanced stock screener altogether. Users must manually search for stocks or use external tools, making it less efficient for filtering based on investor criteria.

-

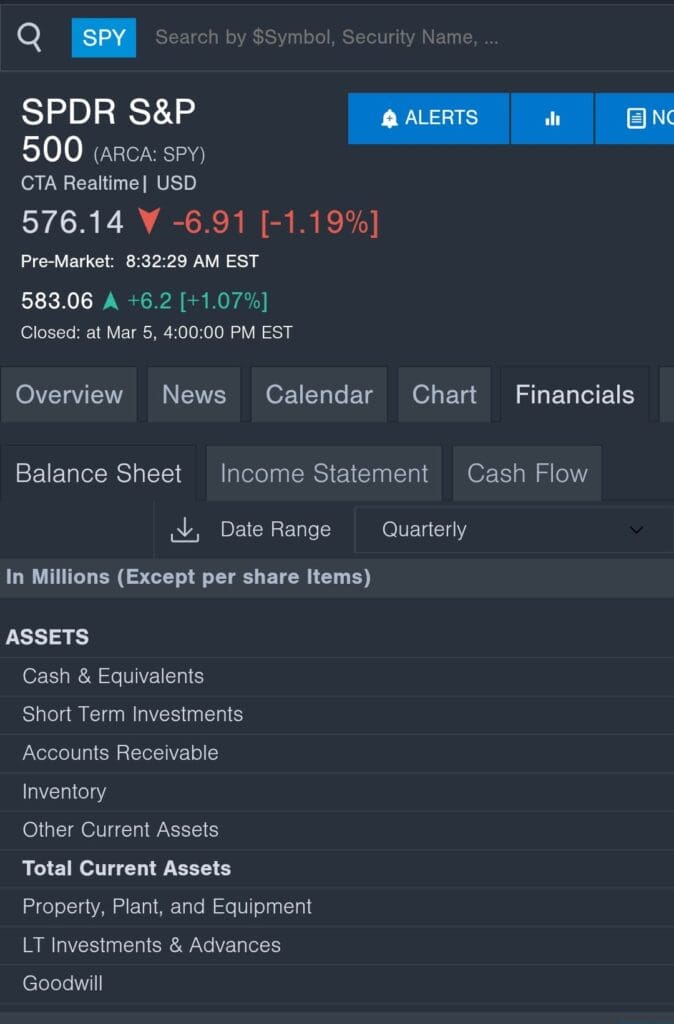

Fundamental Analysis Tools

TipRanks Premium wins for deeper stock research tools, particularly its expert tracking, analyst scorecards, and smart score integration.

It tracks expert recommendations, ranks analysts by performance, and integrates this with insider activity and hedge fund sentiment. However, it lacks in-depth financial statements and institutional-grade analysis.

Benzinga Pro Basic offers basic fundamentals like earnings, dividend yields, and analyst ratings, but doesn’t provide deep financial research or access to detailed stock reports.

It also lacks integration with premium third-party research providers like Morningstar or S&P.

-

Stock Picks & Recommendations

TipRanks Premium focuses heavily on curated stock ideas from top analysts, insiders, and hedge funds.

It showcases top smart score stocks, high-rated analysts' picks, and insider buys — all ranked by performance. These recommendations are personalized and updated regularly.

Benzinga Pro Basic, by contrast, does not provide stock picks or curated recommendations.

-

Market Sentiment Analysis

Benzinga Pro Basic excels in real-time news delivery. Its full newsfeed includes earnings, analyst moves, economic reports, and SEC filings.

It offers live alerts and headlines that traders can act on immediately. However, it lacks sentiment scoring or social data features.

TipRanks Premium, while not real-time, analyzes sentiment from analysts, bloggers, news articles, and insiders to assign smart scores and predict market momentum.

-

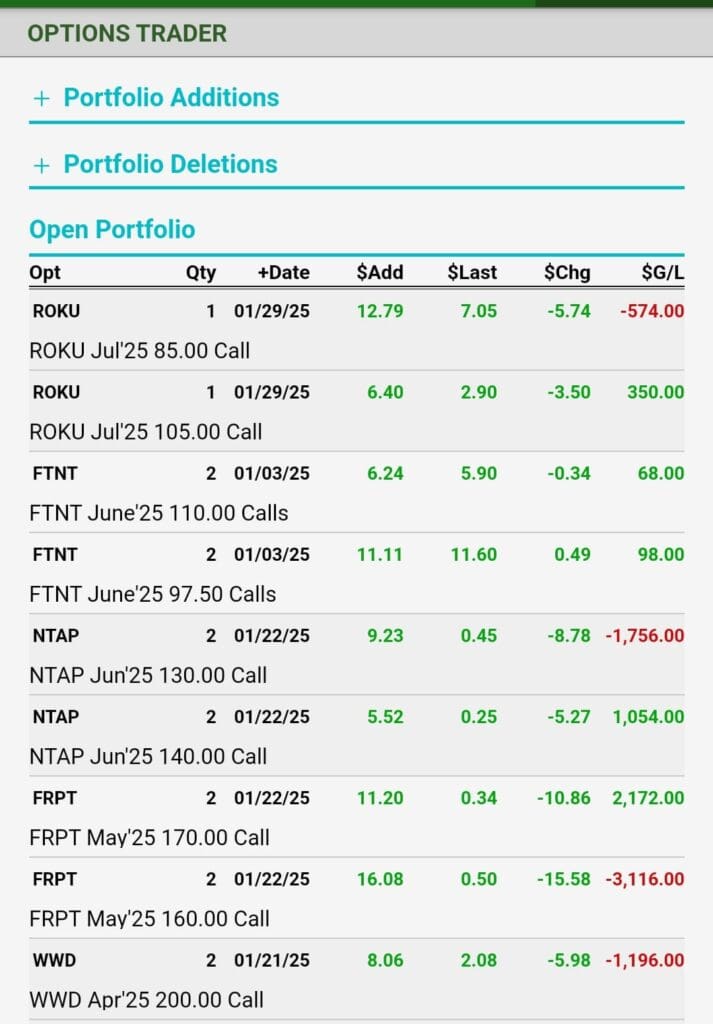

Portfolio Analysis & Alerts

TipRanks Premium offers solid portfolio tracking with smart score integration, asset allocation insights, holdings breakdowns, and volatility analysis. Users can set alerts for analyst rating changes, insider trades, and hedge fund activity.

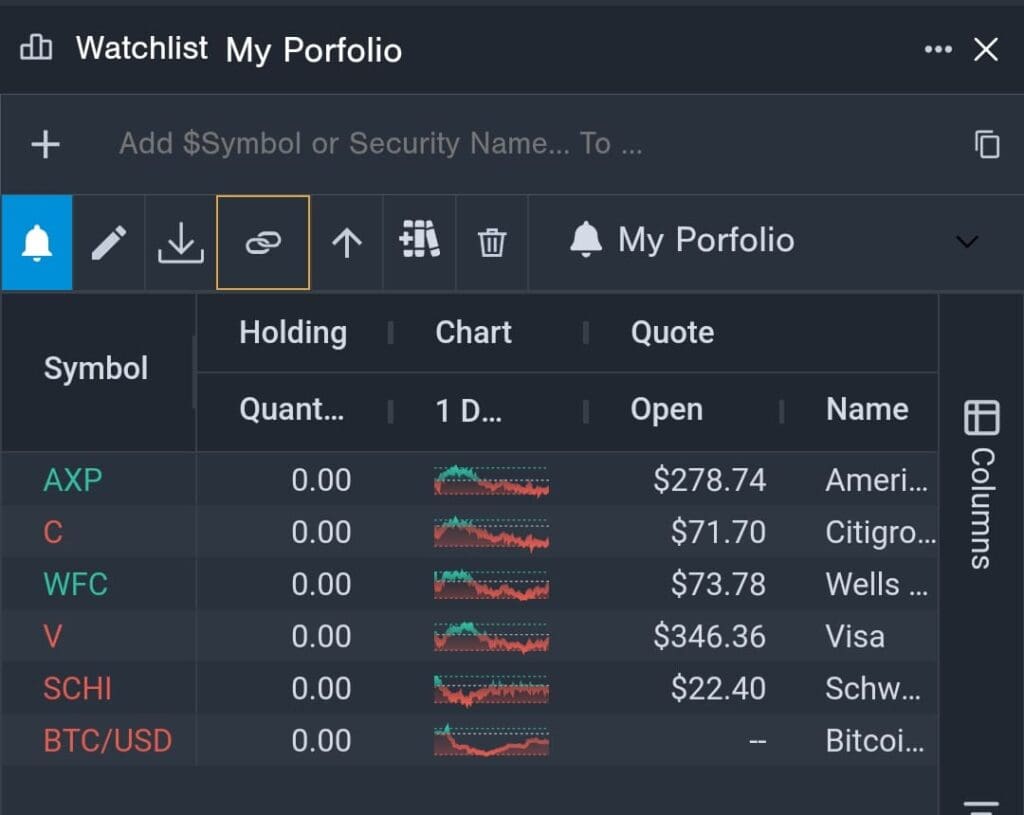

Benzinga Pro Basic lacks portfolio analysis entirely and only supports basic watchlist alerts for price or news updates. There’s no way to track portfolio performance, diversification, or valuation.

-

Technical Analysis Options

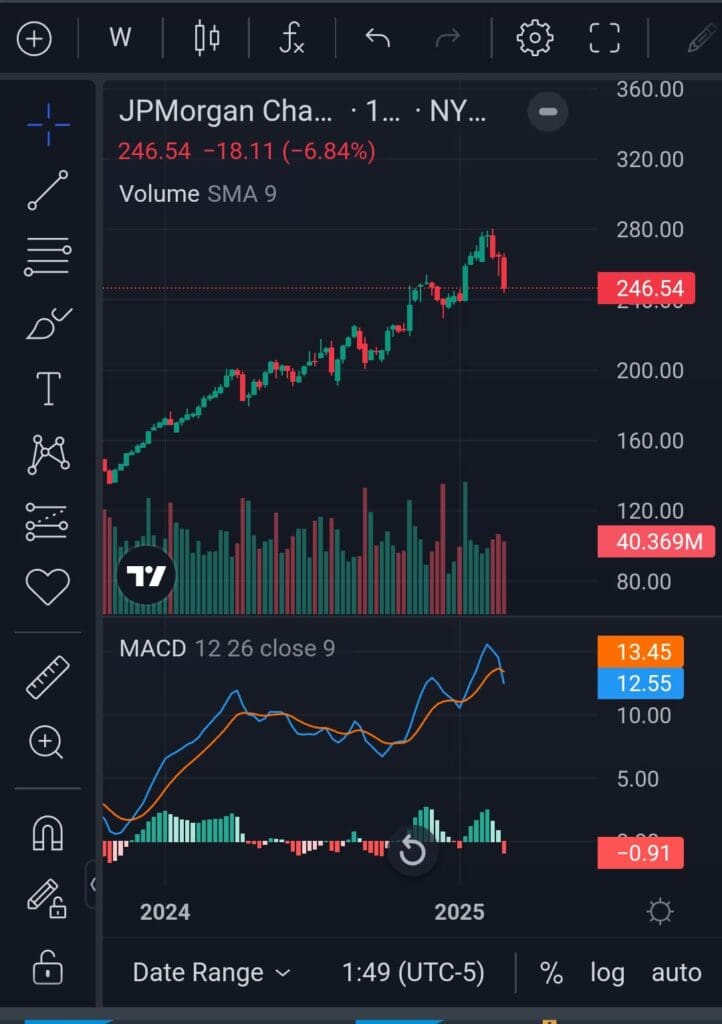

Benzinga Pro Basic is stronger for real-time charting, while TipRanks adds context but lacks true technical depth.

TipRanks Premium offers chart overlays with smart score, insider activity, and analyst ratings, but lacks advanced tools like drawing, pattern recognition, or custom scripts.

-

ETF, Bonds & Fund Analysis Tools

TipRanks Premium includes an ETF screener with smart scores, insider activity, and analyst sentiment — making it useful for evaluating ETFs.

However, there’s no detailed bond or fund research. Benzinga Pro Basic includes ETF data and sector performance trends but lacks customization or deep filtering.

Neither platform provides advanced bond screening or mutual fund research.

Who Should Consider TipRanks Premium?

Investors seeking expert-driven stock research, smart scoring, and insider activity insights may find the TipRanks Premium subscription a valuable resource.

Long-Term Investors: Ideal for those who want to track analyst forecasts, insider buying, and hedge fund sentiment for strategic stock picks.

Dividend-Focused Investors: Great for screening high-yield stocks using dividend data, analyst ratings, and smart scores.

Retail Investors: Offers easy access to top analyst picks and financial blogger insights to support better stock selection.

Portfolio-Focused Users: Helpful for analyzing portfolio allocation, volatility, and valuation metrics with personalized news and performance tracking.

TipRanks Premium is well-suited for investors who prefer data-backed recommendations, long-term stock analysis, and detailed portfolio evaluation.

Plan | Annual Subscription | Promotion |

|---|---|---|

TipRanks Premium | $359 ($30 / month)

No monthly plan | 30 day money-back guarantee |

TipRanks Ultimate | $599 ($50 / month)

No monthly plan | 30 day money-back guarantee |

Who Should Consider Benzinga Pro?

Traders who rely on fast market updates, earnings news, and real-time stock quotes may find the Benzinga Pro Basic subscription more useful.

News-Driven Traders: Offers immediate access to earnings, analyst moves, and market headlines to act quickly on new developments.

Momentum and Day Traders: Real-time price quotes and alerts help capitalize on short-term market shifts and breakout opportunities.

Event-Focused Investors: Includes economic calendars, earnings dates, and SEC filings to plan around key market events.

Active Watchlist Users: Custom alerts for news and price changes make it easier to monitor multiple stocks at once.

Benzinga Pro Basic is best for short-term traders who need quick, real-time information to drive intraday decisions.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Benzinga Pro – Basic | $37

$367 ($30.58 / month) if paid annually | 14-day free trial |

Benzinga Pro – Streamlined | $147

$1,497 ($124.75 / month) if paid annually | 14-day free trial |

Benzinga Pro – Essential | $197

$1,997 ($166.42 / month) if paid annually | 14-day free trial |

Benzinga Edge | $19

$228 if paid annually

| $129

$129 for new member’s annual price ($11/month), including 7-day money-back guarantee

|

Bottom Line

TipRanks Premium shines for long-term, research-driven investors who want smart scores, analyst rankings, and insider sentiment to guide decisions. It excels in portfolio analysis, stock recommendations, and data-backed insights.

Meanwhile, Benzinga Pro Basic is built for speed, delivering real-time quotes, breaking news, and customizable alerts—perfect for active and momentum traders.

Both platforms serve different goals, with TipRanks leaning analytical and Benzinga delivering immediate market awarene