Empower

Annual Advisory Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

Empower is a fantastic choice for anyone seeking a cash management account because of its user-friendly interface, competitive interest rates, and comprehensive suite of features.

Empower offers convenient cash management features like check writing, automatic bill pay, ATM access, and a mobile app for easy account management. The dashboard provides a clear overview of your account balance, investments, and recent transactions, allowing you to stay informed about your financial health at a glance.

Empower offers Earn up to 4.00% APY on its cash account. Additionally, Empower offers budgeting tools and personalized spending insights, helping you stay on top of your finances.

Fidelity

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

With Fidelity's Cash Management Account, you get no fees or minimum balance requirements. While basic interest arte on uninvested cash is not so high, investors can earn competitive interest rates through Fidelity government money market fund.

Fidelity provides ATM fee reimbursements, so you can access your cash from any ATM without worrying about fees. It also includes features like mobile check deposits, bill pay, and a debit card, making it easy to manage everyday expenses from your account.

One of the key features is the FDIC Insured Deposit Sweep Program, which moves your cash into partner banks where it is FDIC insured up to $1.25 million.

Acorns

Monthly Fee

Minimum Deposit

Our Rating

Savings Rate APY

-

Overview

- Platform Screenshots

If you're looking for a hassle-free way to manage your cash and grow your wealth, Acorns is a great option.

Acorns offers the Mighty Oak Debit Card, which functions as a central part of its cash management service. The account comes with no overdraft or maintenance fees, and it provides access to over 55,000 fee-free ATMs across the U.S.

What makes Acorns particularly appealing for cash management is its high-interest rates. The Checking account offers a 2.57% APY , which is much higher than traditional savings accounts. Additionally, Acorns offers a dedicated Emergency Fund account with an impressive 1.00% – 3.00% APY, allowing you to grow your savings even faster.

Charles Schwab

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

Charles Schwab is a great choice for anyone looking for a cash management account due to its combination of convenience, features, and competitive interest rates. It offers convenient cash management features like check writing, automatic bill pay, ATM access, a mobile app, and easy integration with other Schwab accounts.

One of the standout features is the unlimited ATM fee rebates, allowing you to withdraw cash from ATMs worldwide without incurring extra charges.

Additionally, Schwab’s mobile app allows you to manage your cash seamlessly, offering real-time updates on your account balance and transactions. You can also pay bills, send money, and use services like Apple Pay or PayPal directly from your Schwab account.

Wealthfront

Annual Advisory Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

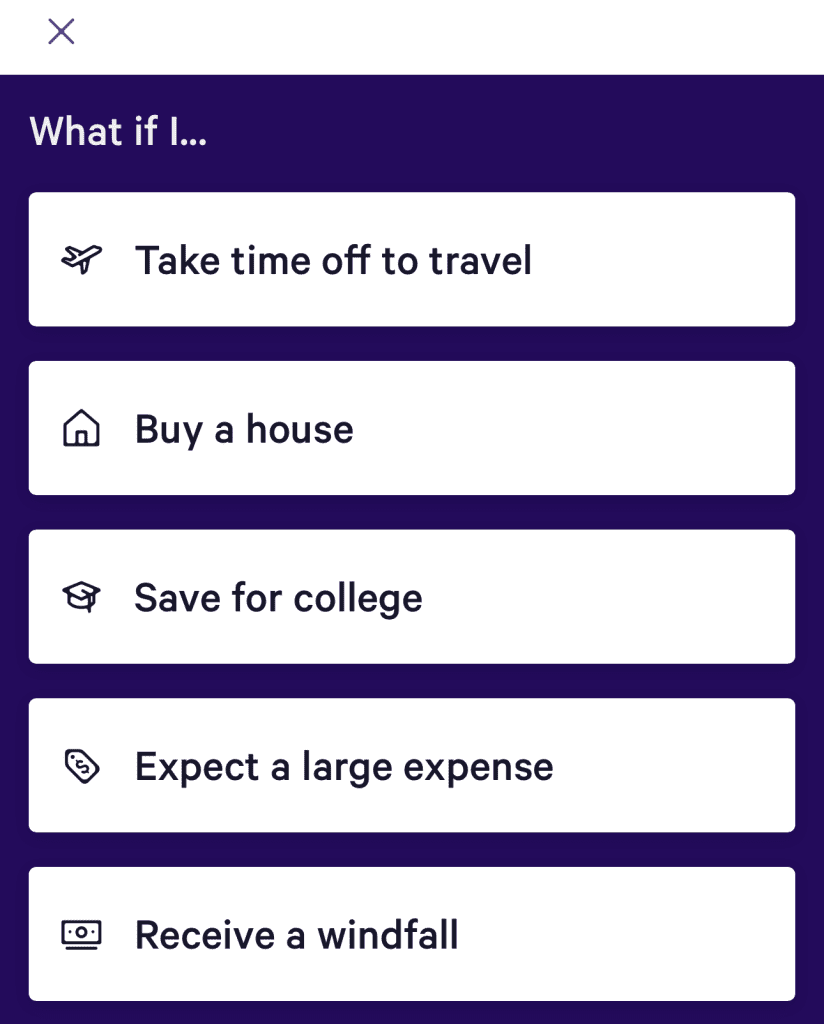

- Platform Screenshots

Wealthfront’s Cash Account is a flexible, all-in-one solution for managing your money. It offers no account fees, including no overdraft or maintenance fees, making it cost-effective. Users can pay bills, deposit checks, and set up direct deposits, all from an easy-to-use mobile app.

The account also provides access to over 19,000 fee-free ATMs, and the funds are FDIC-insured up to $5 million, which is significantly higher than typical bank account coverage. Wealthfront’s Cash Account stands out with its high-interest rate, offering a competitive 4.25% APY.

One of the key benefits of Wealthfront is its automated investment features. You can easily set up automatic deposits from your checking account to your cash management account, and then allocate a portion of those funds to investments based on your risk tolerance and goals.