Fidelity offers a robust platform suitable for day traders. It features a combination of reliable research tools, an intuitive interface, and various advanced features.

While it may not offer the same deep customization as some institutional platforms, Fidelity provides a solid experience for those who trade stocks, invest in ETFs, and trade options.

Fidelity Tools for Day Traders

Fidelity’s platform comes with an impressive set of tools that day traders can use to track markets, analyze potential trades, and execute orders quickly.

Here are the features we found most useful when using Fidelity for day trading:

-

Advanced Charting and Fidelity Active Trader Pro

Active Trader Pro (ATP) is Fidelity’s advanced trading platform, designed to cater to active traders who need real-time data and a customizable interface.

Custom Layouts: Save personalized layouts with multiple charts, watchlists, and live data, enabling quick access to key assets.

Technical Indicators: Utilize over 40 technical indicators, such as Moving Averages or RSI, to make informed decisions based on price action.

Real-Time Data: View price charts with live quotes, news, and volume statistics, offering immediate insight into market movements.

We used ATP to monitor a variety of stocks, creating customized views with charts like Bollinger Bands and RSI to spot short-term reversal opportunities.

-

Smart Order Routing and Rapid Order Entry

Fidelity’s Smart Order Routing ensures that orders are sent to the best available market for the fastest and most efficient execution.

Custom Hotkeys: Program specific order types and sizes for rapid trade placement during high-volume periods.

Smart Routing: Fidelity’s system ensures that orders are sent to the best available market for the fastest and most efficient execution.

Efficient Execution: Reduce slippage during volatile moments with Fidelity’s order routing, which automatically adjusts based on market conditions.

When trading stocks with high volatility, we mapped hotkeys to quickly enter and exit trades, ensuring minimal slippage and timely execution.

-

Extended Trading Hours & Market Access

Fidelity offers access to pre-market and after-hours trading, giving traders the flexibility to act on important news before or after the regular market session.

Trade Outside U.S. Hours: You can place trades in global markets while U.S. markets are closed, taking advantage of overnight developments in Europe or Asia.

News Alerts: Set alerts for news or events that might influence your trades, so you can react swiftly.

Global Exposure: Track and trade assets from international markets, watching how global trends might impact your U.S. investments.

For example, we used Fidelity’s early trading hours to enter positions based on overseas market moves, allowing us to get ahead of U.S. market reactions.

-

Options Trading and Real-Time Options Chain

For day traders focused on options, Fidelity provides detailed options chains with access to real-time data on Greeks, implied volatility, and more.

Live Greeks & Implied Volatility: Monitor real-time data for delta, theta, and Vega to assess risk and volatility.

Options Strategy Builder: Construct advanced strategies like vertical spreads and covered calls directly from the options chain.

Volume Spikes: Use Fidelity’s options scanner to spot unusual activity in specific contracts, helping identify trade opportunities.

During earnings season, we utilized Fidelity’s real-time options data to spot rising volatility in specific tech stocks, building a strategy around them.

-

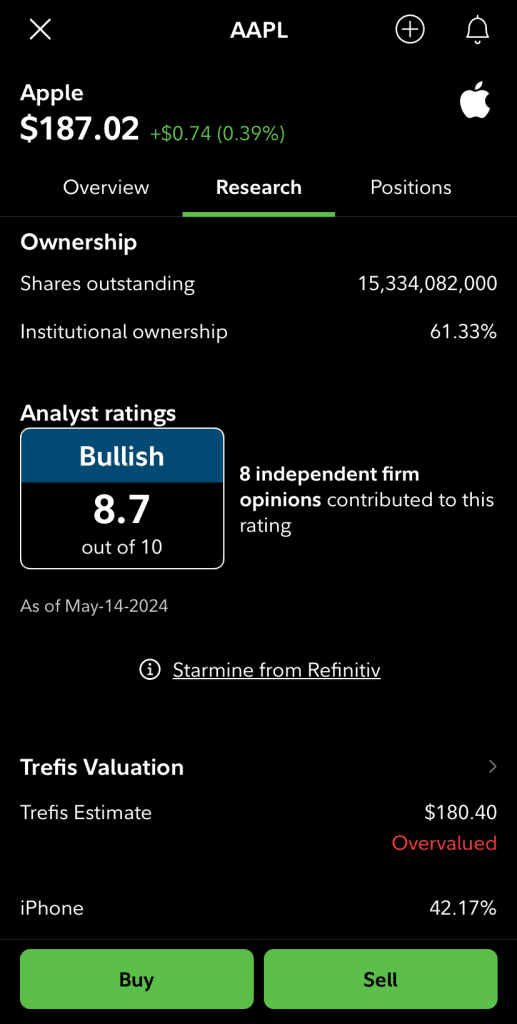

Real-Time Market News and Research

Fidelity provides integrated market news and research directly on its platform, which can be invaluable for day traders who need to stay updated with real-time information.

Live News Feed: Stay on top of breaking news with a customizable live news feed that delivers the latest market developments, earnings reports, and analyst recommendations.

Research Reports: Access in-depth research reports from leading firms, helping you understand the broader market sentiment or trends influencing specific stocks or sectors.

Sector Performance: Track the performance of different sectors with real-time data to spot momentum shifts.

We used the news feed to track updates on macroeconomic events and earnings reports, making quick trades based on the latest information.

-

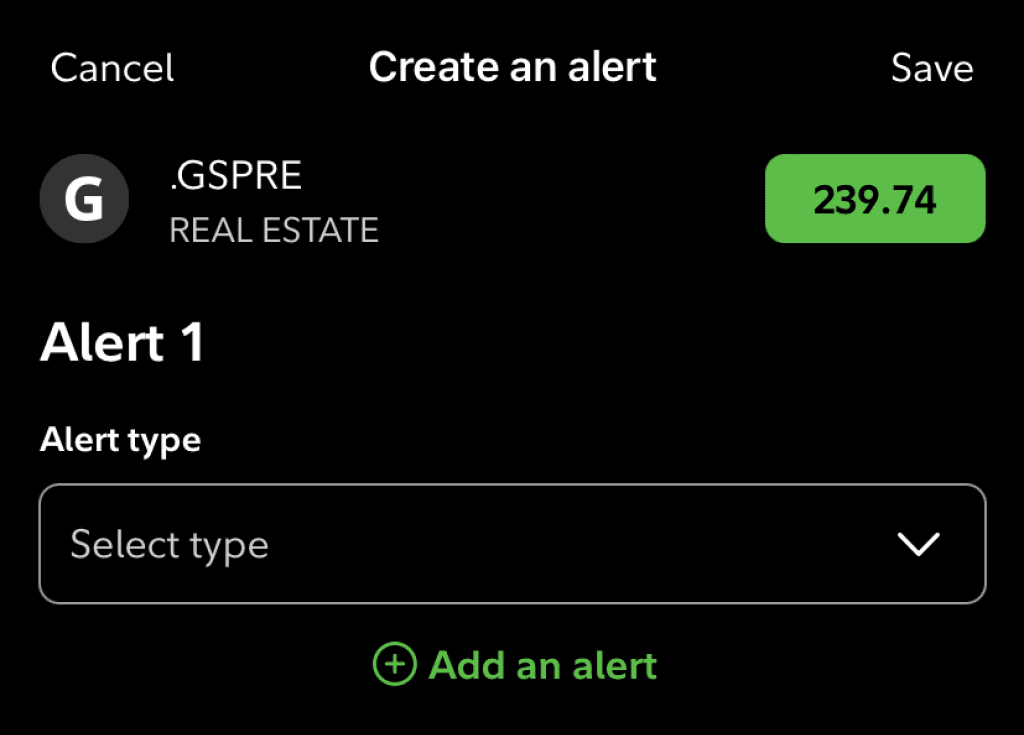

Customizable Alerts and Notifications

Fidelity allows day traders to set custom alerts and notifications, ensuring that no important movement goes unnoticed.

Price Alerts: Set up alerts for specific price points, whether for stocks, ETFs, or options, to notify you when an asset hits a certain level.

Volume and Technical Alerts: Receive alerts based on volume spikes or specific technical indicators, such as RSI or MACD crossovers.

News Alerts: Set news alerts related to your watchlist, so you can respond immediately to any breaking information that could impact your trades.

We created price alerts for tech stocks, which helped us act quickly when prices moved in our favor during volatile market conditions.

-

Fractional Shares for Flexibility

Fidelity offers fractional shares, allowing day traders to purchase less than a full share of expensive stocks, making it easier to diversify and test strategies with smaller capital.

Affordable Diversification: Buy into high-priced stocks like Amazon or Tesla without needing large amounts of capital.

Risk Management: Fractional shares help manage risk by enabling traders to spread investments across a range of assets.

Liquidity: Trade fractional shares with the same flexibility as full shares, allowing for quick entry and exit from positions.

We used fractional shares to trade small positions in high-growth stocks, testing short-term strategies without committing too much capital.

What’s Missing for Some Day Traders?

While Fidelity provides a comprehensive suite of tools, there are still a few areas where it may not meet the needs of all day traders, especially those looking for more complex features or faster execution.

No Futures Trading: Fidelity’s platform lacks futures trading, which may be limiting for traders looking to hedge their stock positions with futures contracts.

Limited Customization for Advanced Users: While ATP offers a variety of tools, it may lack the deep customization options that other platforms like Interactive Brokers or Thinkorswim offer.

No Social or Copy Trading: Unlike platforms such as eToro or Webull, Fidelity doesn’t provide social or copy trading features, which could be useful for beginners looking to learn from others.

Despite these shortcomings, Fidelity remains a strong choice for traders seeking a solid mix of research, tools, and ease of use.

Alternative Platforms for Day Traders

If Fidelity doesn’t meet all of your day trading needs, several other platforms offer features tailored to specific trading styles or preferences.

Thinkorswim (by Charles Schwab): Offers powerful charting, paper trading, and scripting with thinkScript, making it ideal for technical traders.

TradeStation: Best for advanced traders seeking speed and automation, with the ability to trade stocks, options, and even cryptocurrencies.

Webull: A beginner-friendly platform offering extended hours, real-time data, and a clean interface with fewer advanced features than Fidelity.

eToro: Ideal for those who want to participate in social trading and copy strategies from other successful traders.

Depending on your trading style, these alternatives may provide specific features, such as simplified order execution, easier navigation, or more community-driven strategies.

[elementor-template id=”211350″]