Merrill Edge | Vanguard | |

Monthly Fee | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% |

Account Types | Brokerage, Retirement, Wealth Management | Brokerage, Retirement, Wealth Management |

Savings APY | 0.01% – 4.11% | 3.65% |

Minimum Deposit | $0 – $50,000

Merrill Edge Self-Directed Trading: $0 Merrill Guided Investing – Robo Advisor: $1,000 for growth-focused strategies OR $50,000 for income-focused strategies Merrill Guided Investing – Online Advisor : $20,000 for growth-focused strategies OR $50,000 for income-focused strategies | $0 – $5M

Vanguard Brokerage: $0,

Vanguard Digital Advisor: $100,

Vanguard Personal Advisor: $50,000,

Vanguard Personal Advisor Select: $500,000,

Vanguard Wealth Management: $5M |

Best For | Bank of America Customers, Advanced Traders | Long Term Investors, Retirement, Robo Advisor, Wealth Management |

Read Review | Read Review |

Merrill Edge vs. Vanguard: Compare Features

Vanguard excels for long-term, cost-conscious investors with its low fees, broad range of low-cost funds, and strong retirement planning tools.

Its simple platform suits hands-off investors focused on gradual wealth building, though it lacks advanced trading features and detailed market analysis tools

Vanguard | Merrill Edge | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | Full Access To Almost Any Asset |

Investing Types | Stocks, Options, ETFs, Bonds & CDs, Mutual Funds, Money Market Funds | Stocks, Options, Margin, ETFs, Bonds & CDs, Mutual Funds, Margin

|

Automated Investing | Yes | Yes |

Paper Trading | No | No |

IPO Access | No | No |

Dedicated Advisor | Yes | Yes |

Tax Loss Harvesting | Yes | No |

Merrill Edge shines for those seeking a more versatile investing experience with access to advanced trading tools, in-depth market analysis, and a broader range of account types.

At the same time, its integration with Bank of America provides a great experience if you're a BofA customer.

-

Self Investing And Fundamental Analysis Options

Vanguard is our winner in self-investing, but the difference is insignificant.

Merrill Edge excels in user-friendly tools and seamless integration with Bank of America, making it ideal for investors who value convenience and accessibility.

Its brokerage platform is particularly strong in providing comprehensive research and insights, including Morningstar ratings and extensive market analysis.

The platform includes essential research and screening tools, allowing users to perform basic fundamental analysis and portfolio monitoring, but it lacks more advanced tools and third-party research, limiting its appeal to more experienced investors.

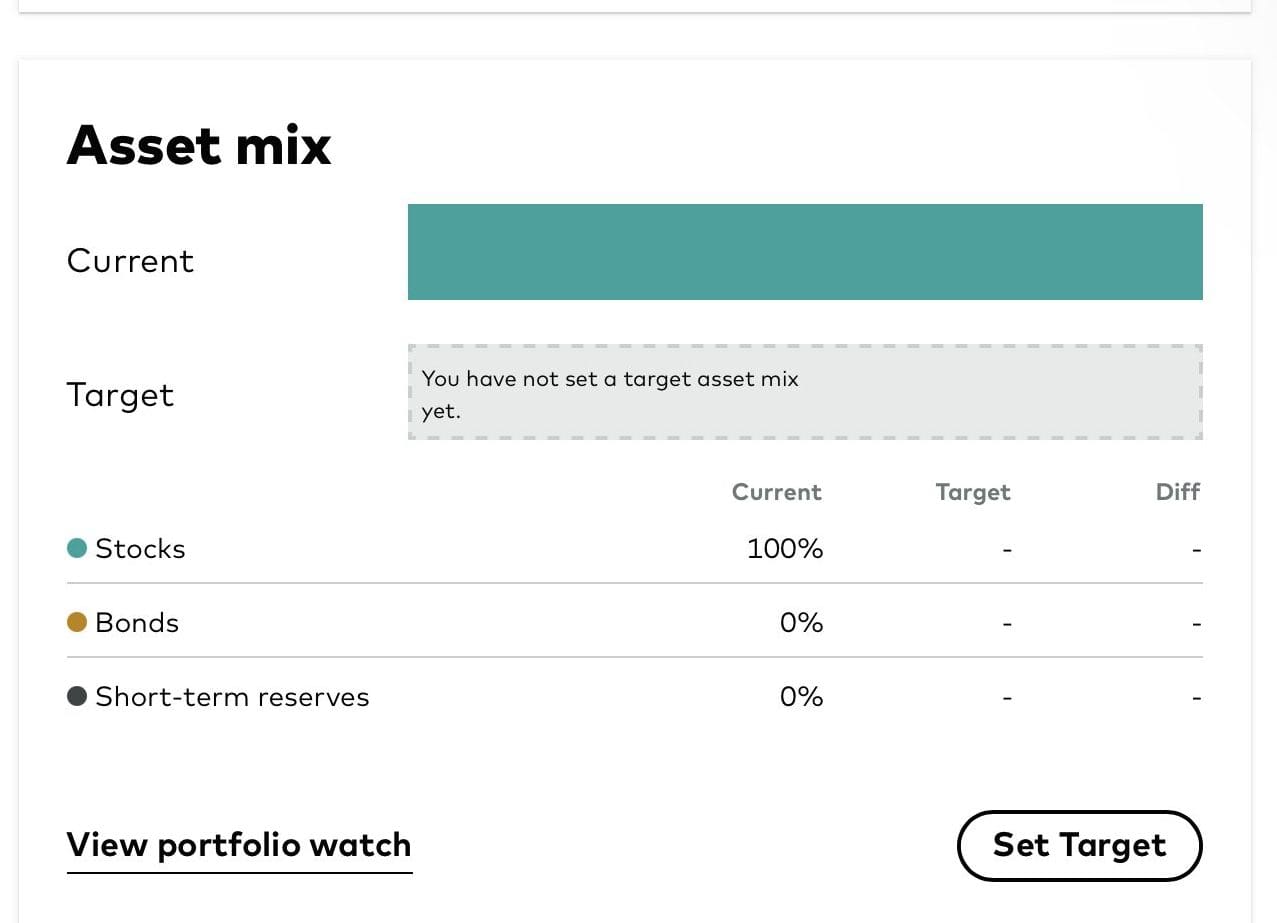

On the other hand, Vanguard is ideal for long-term investors who want access to a wide variety of assets, like ETFs, mutual funds, and retirement accounts.

They offer tools like Portfolio Watch and Portfolio Tester, which help investors monitor their investments, test different strategies, and ensure their portfolios are diversified.

-

Trading Options And Technical Analysis Tools

Merrill Edge is our winner when it comes to technical analysis. Although Merrill doesn't have the richest tools in terms of features and options, it's good enough for the average trader.

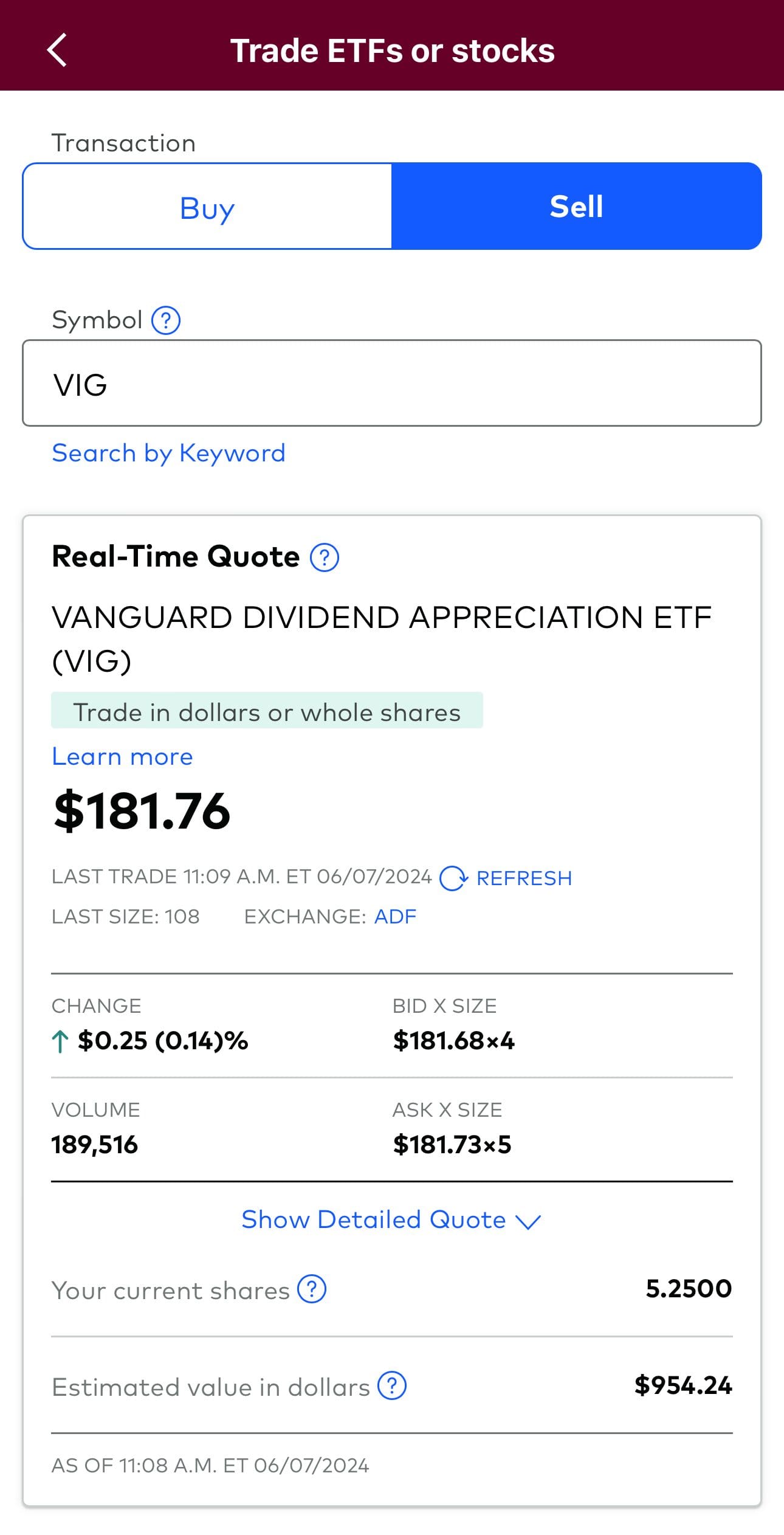

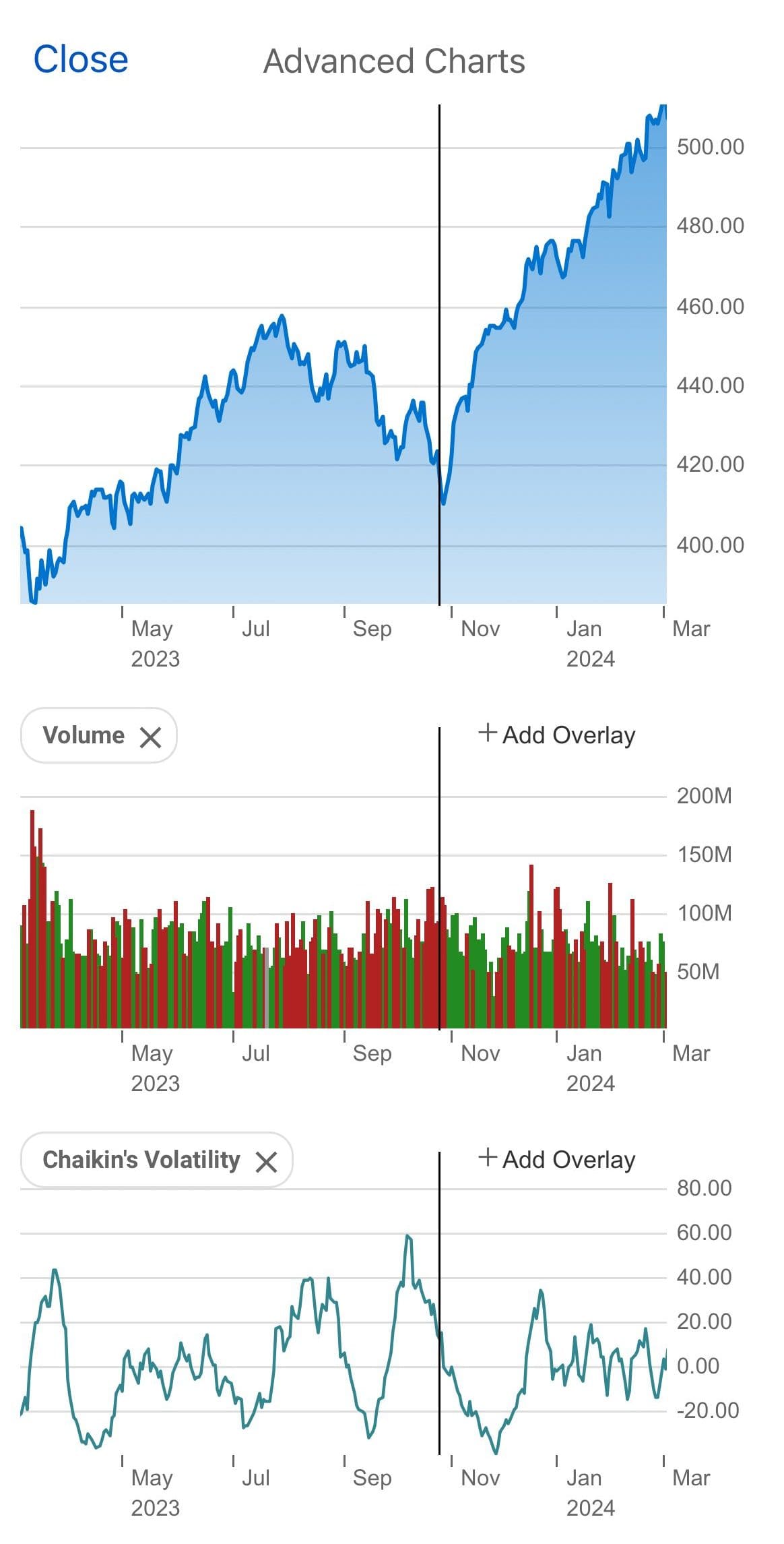

Merrill Edge excels in providing a user-friendly platform with strong technical analysis tools that are accessible even to novice traders. Its Market Pro platform is particularly well-regarded for advanced charting capabilities, offering over 100 technical indicators and 20+ drawing tools.

Merrill Edge also integrates insights directly into its charts, making it easier for traders to understand market trends and technical events.

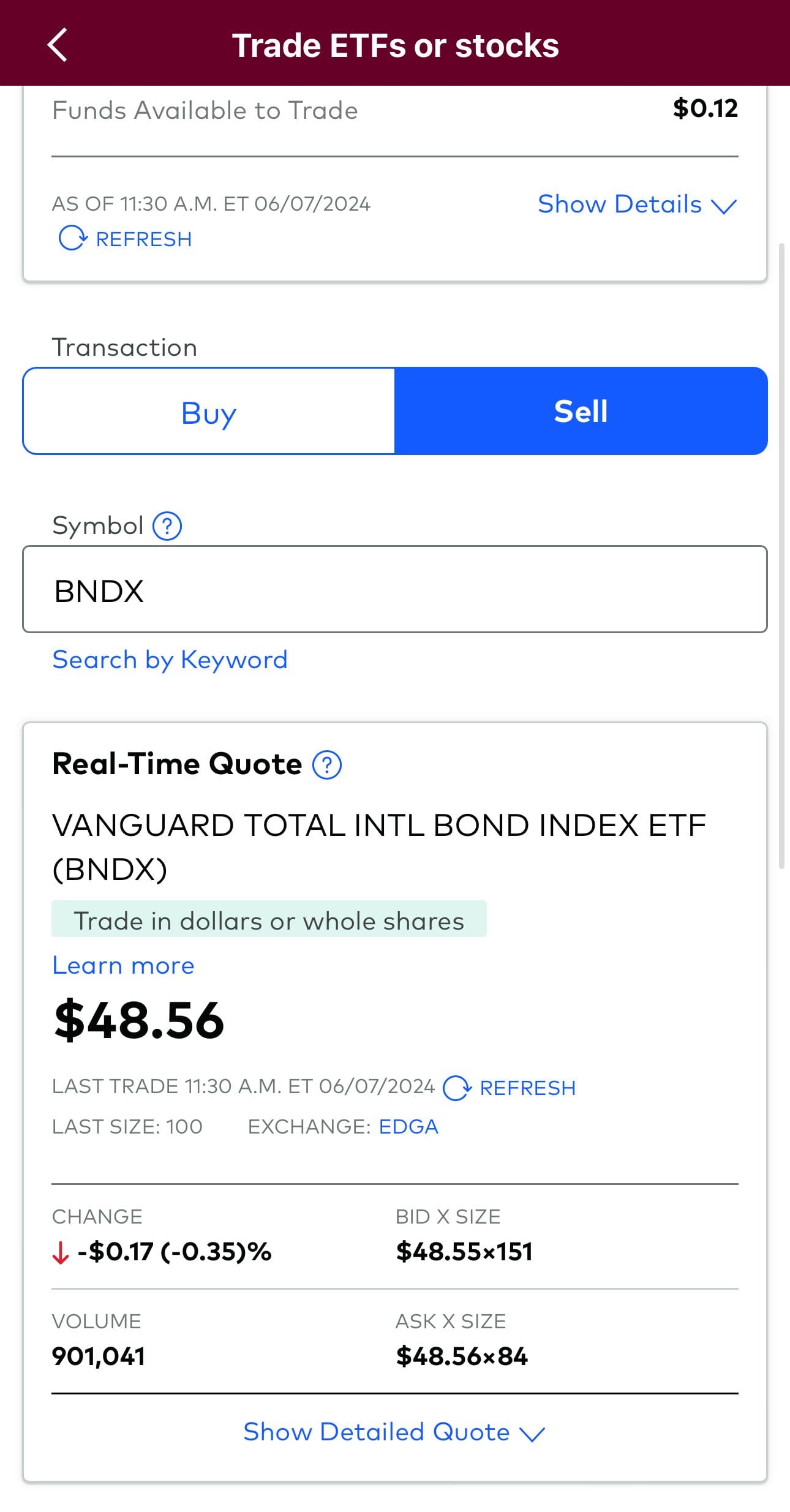

While Vanguard focuses on low-cost funds and simple trading options, its platform is pretty basic. You can buy, sell, and see advanced data for fundamental investors, but not for traders.

It doesn’t offer advanced charting or market indicators, which may not meet the needs of more active traders looking for detailed analysis.

-

Robo Advisor And Automated Investing

There is no clear winner here, as Merrill and Vanguard offer great robo-advisor options.

Merrill Edge’s robo-advisor, Merrill Guided Investing, is a standout for those who value personalized, hands-off investing with professional oversight.

It offers tailored portfolios managed and rebalanced by Merrill’s team, providing a blend of automated investing with human insight.

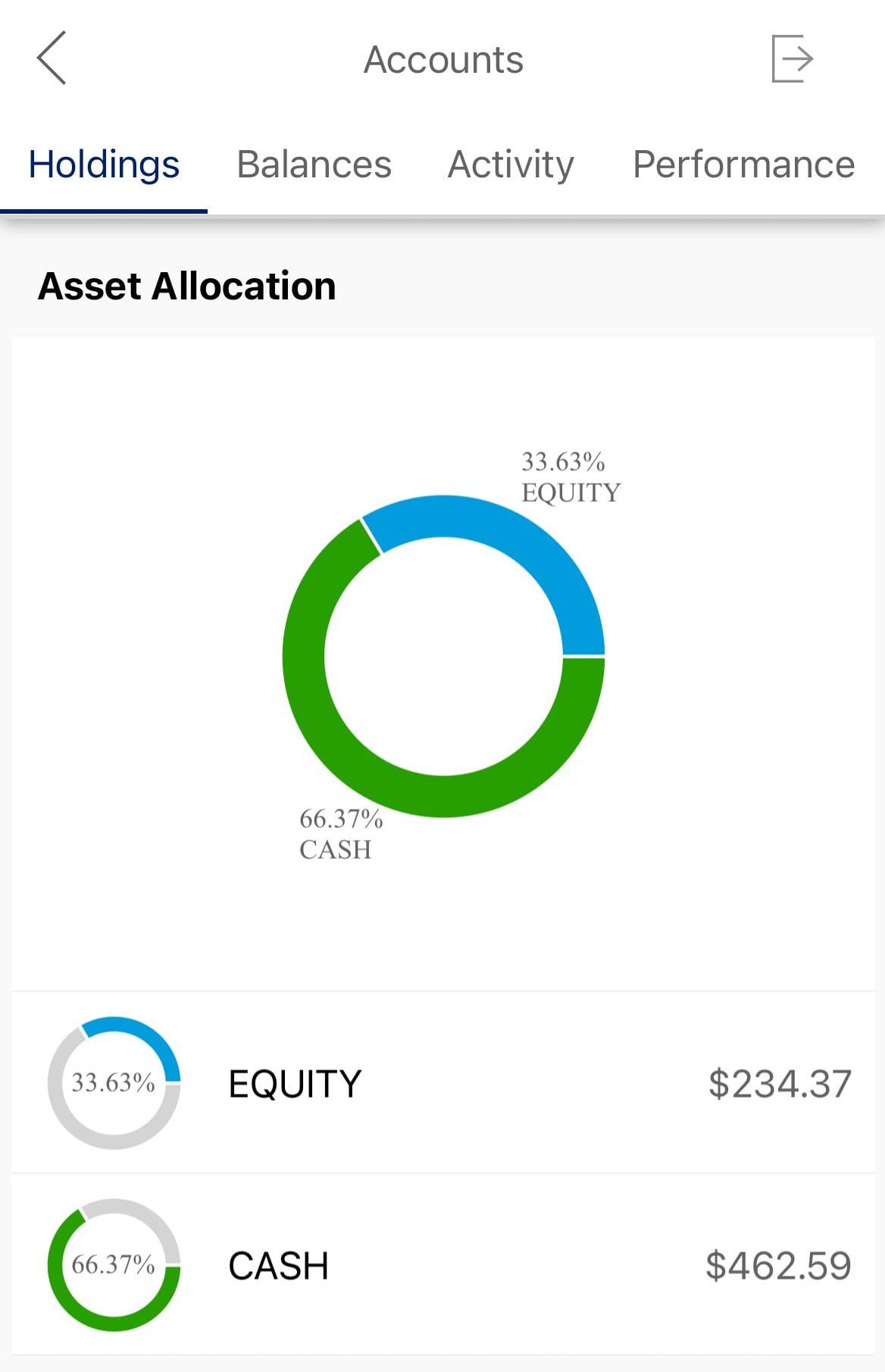

For hands-off investors, Vanguard’s robo-advisor, Vanguard Digital Advisor, starts with a personalized assessment of your risk tolerance and financial goals.

If you prefer a mix of automated technology and human advice, Vanguard’s Personal Advisor adds professional financial guidance to the robo-advising service.

-

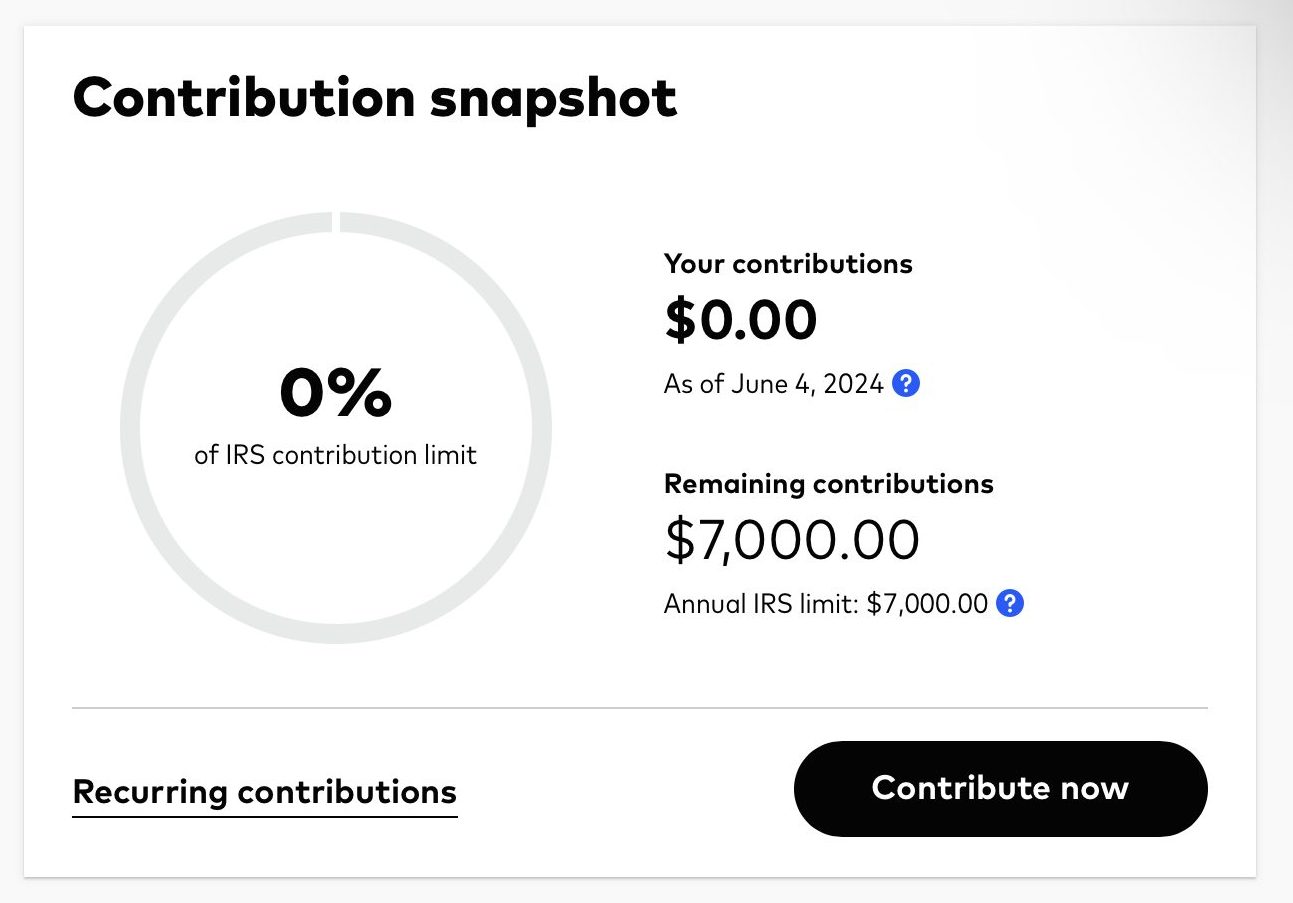

Retirement Accounts

Vanguard offers a more sophisticated array of investment options within its retirement accounts.

Vanguard is well-known for its retirement options, such as traditional and Roth IRAs, SEP IRAs, and SIMPLE IRAs.

Their focus on low-cost index and target-date funds makes them a solid choice for long-term retirement planning, with tools to help set goals, estimate expenses, and track IRA contributions.

Merrill Edge offers traditional and Roth IRAs, as well as rollover and inherited IRAs. The platform’s intuitive design, along with access to professional advice through Merrill’s advisory services, makes it ideal for those who prefer a guided approach to retirement planning.

-

Fees

When it comes to fees, Vanguard is generally cheaper.

Vanguard’s fees are up to 0.30% for account management, with $0 commissions on U.S. stocks, mutual funds, and ETFs.

Advisory services range from 0.015% to 0.03%, depending on the service level.

Vanguard | Merrill Edge | |

|---|---|---|

Fees | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor |

When it comes to Robo Advisory, Merrill fees are fixed and increase if you need personal assistance from a dedicated advisor.

-

Cash Management And Savings Rates

Unless you're a BofA customer, Vanguard offers better cash management options, especially if you have a high amount of uninvested cash.

For cash management, Vanguard offers the Cash Plus Account, which earns interest on balances, and money market funds, though the latter require a $3,000 minimum.

Vanguard | Merrill Edge | |

|---|---|---|

Savings APY | 3.65% | 0.01% – 4.11% |

Similarly, Merrill Edge doesn't offer a stand-alone checking account. Instead, existing BofA customers benefit significantly from its integration with Bank of America.

Also, the cash account is disappointing as you are eligible for the high interest only if you maintain at least $100K in your account.

-

Wealth Management Options

Both Vanguard and Merrill offer good plans for wealth management.

Merrill Wealth Management provides personalized services designed for clients with specific financial goals, offering the opportunity to collaborate closely with a dedicated advisor. Typically, clients need a minimum of $250,000 in investable assets to access these services.

Additionally, clients benefit from Bank of America’s premier research and insights, ensuring their investment strategies are informed by expert analysis and up-to-date market trends.

Vanguard’s Wealth Management services are geared toward investors with at least $5 million in assets, focusing on long-term financial planning, managing investments, and estate planning.

They combine automated tools (robo-advisors) with advice from certified financial planners to create personalized strategies that help minimize taxes and plan for the future, including estate planning.

Bottom Line

Overall, Vanguard may be a better option for investors and those who manage a large amount of cash, whether in retirement or in their investment accounts.

However, the differences are not significant, while Merrill offers better trading options and similar features to Vanguard in most categories.

Vanguard vs. Competitors: How Does It Stack Up?

While Vanguard appeals to buy-and-hold investors, Schwab’s platform is designed for those who want to engage actively with the market

Vanguard is our pick for long-term investors, wealth management, or retirement, while E-Trade may be better for traders active investors

Vanguard provides more options for investors, while Interactive Brokers offers superior technical tools for active traders

Vanguard vs. Interactive Brokers: Which Brokerage is Right for You?

Vanguard offers more options for investors, including retirement, robo advisors, and wealth management, while Robinhood is best for traders.

Vanguard offers a better approach for serious investors, while JP Morgan's self-directed is better for beginners and advanced traders

Vanguard vs. J.P. Morgan Self-Directed: Which Broker is Best For You?

Fidelity is our choice due to its better retirement options and more extensive trading app. But, the differences are insignificant.

How Merrill Edge Compares to Other Online Brokers

Both offer similar tools for the average investor or trader, but Merrill is better at automated investing. Here's our full comparison:

J.P. Morgan Self-Directed Investing vs. Merrill Edge: Compare Brokerage Accounts

Merrill Edge and E-trade offer great options for long and short-term investors, including robo-advisor, but there are differences.

Merrill Edge is best for long-term investments, including retirement, while Robinhood is perfect for active traders who value simplicity.

Merrill Edge vs. Robinhood: Compare Brokerage Account Options

Merrill Edge stands out for its interface and integration with BofA, but IBKR is the ultimate winner for trading and investing. Here's why:

Interactive Brokers vs. Merrill Edge: Compare Brokerage Account Options

Fidelity has more investing options, cheaper robo-advisor, and more banking options. Merrill is better for Bank of America customers.

Schwab is our winner for investors and traders. However, the differences between brokerages are not significant. Here's our comparison: