Table Of Content

Webull Tools for Day Traders

Webull offers a surprisingly powerful suite of tools for day traders, even though it markets itself to a broader investing audience.

It offers many advantages for short-term strategies, from real-time data and advanced charts to customizable orders and paper trading.

Based on our firsthand platform use, several key features stand out for day trading on Webull.

-

Pre-Market and After-Hours Access for Early Moves

Webull provides extended trading hours — 4 AM to 8 PM ET — which is ideal if you're reacting to earnings releases or macro news outside the standard session.

Let’s say you’re watching Meta stock after an evening earnings call. If it gaps down at 6 AM to $315, but you expect a rebound, you could set a limit buy and sell into strength by 9:30 AM.

Also, Webull’s pre-market price data helps you spot unusual volume early on — a useful signal for volatility plays.

-

Advanced Charting and Technical Tools

Webull’s built-in charting suite is robust, especially compared to most mobile-first brokers. You can stack multiple indicators, run custom timeframes, and build multi-chart layouts.

Key features for technical traders:

Over 60 indicators and drawing tools

Multi-timeframe comparison windows

Level 2 data with NBBO (for Pro subscribers)

For example, we used RSI combined with Bollinger Bands and volume indicators to time trades in NVDA during high-volatility sessions.

Once RSI dipped under 30 and touched the lower band with a volume spike, we entered — and used the MACD crossover for exit confirmation. These setups work well on both mobile and desktop thanks to Webull’s seamless sync.

-

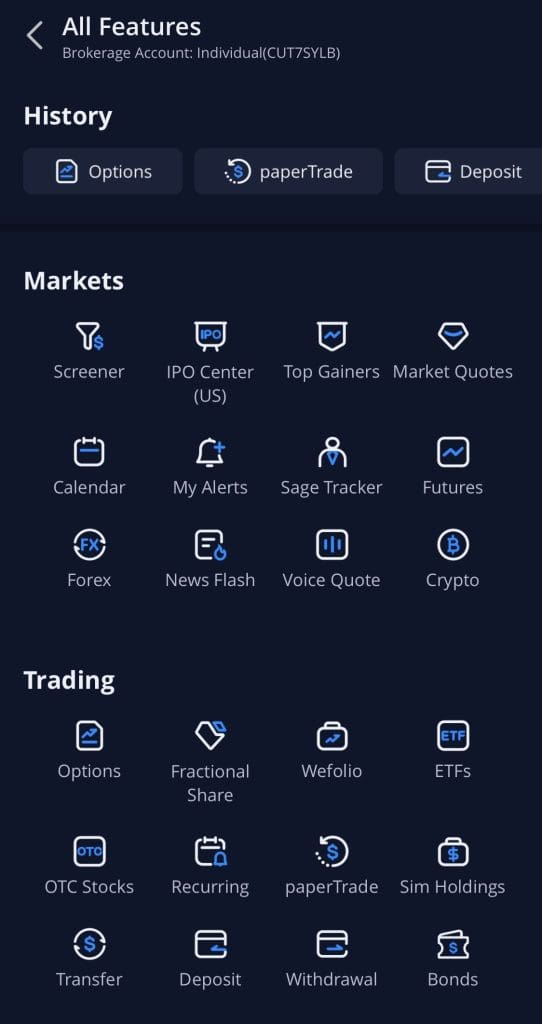

Paper Trading to Test New Day Trade Setups

One standout Webull feature that we constantly use: paper trading. You can simulate trades with full access to charts, live market data, and even options and futures.

Before trading volatile stocks, I used the paper trading tool to backtest support bounces and resistance rejections. This gave us the confidence to go live with a similar setup once we saw consistent paper profits.

Advantages of using Webull’s paper trading for day trades:

Practice without risking capital

Try complex setups (like option spreads or gap fills)

Train for earnings seasons or trend breakouts

-

Hotkeys and Desktop Customization for Fast Execution

Webull’s desktop platform offers hotkeys — a major plus for day trading. Once you get familiar with the setup, it’s easy to create one-click orders tied to specific keys, which is crucial during fast-moving setups.

We used Ctrl + B to open a buy order on trending momentum names and Ctrl + C to cancel positions in a flash. You can also configure the order presets — such as defining order sizes or setting a limit/stop-loss combo — for faster exits.

Other customization benefits:

Create watchlists by sector or strategy

Multi-chart grids to track correlated names

Real-time news and calendar widgets in one place

-

Trailing Stops and Bracket Orders to Control Risk

Webull lets you place bracket orders, stop-losses, and trailing stops — all essential tools for protecting gains or minimizing downside.

Let’s say you’re trading Apple around $170. You can set a bracket order: a take-profit at $174 and a stop-loss at $168. Or, if you're aiming for momentum, a trailing stop of $1 below the peak ensures your trade locks in profit automatically if the stock reverses.

Key bracket options in Webull:

Entry with predefined take-profit and stop-loss

Trailing stops that follow the price dynamically

Real-time modification from the mobile or desktop app

-

Real-Time Options Chain for Quick Strategy Adjustments

Day traders who use options will benefit from Webull’s live, scrollable options chain. You can view Greeks, volume, open interest, and IV changes in real time — helpful when scalping earnings plays or fast movers.

We used this feature during Nvidia’s earnings week: IV dropped post-release, so we quickly pivoted from buying calls to selling spreads using the options ladder and execution shortcuts.

Key benefits:

See near-expiration chains and update orders on-the-fly

Monitor unusual options activity that might hint at directional bets

Adjust strategies as implied volatility shifts mid-day

-

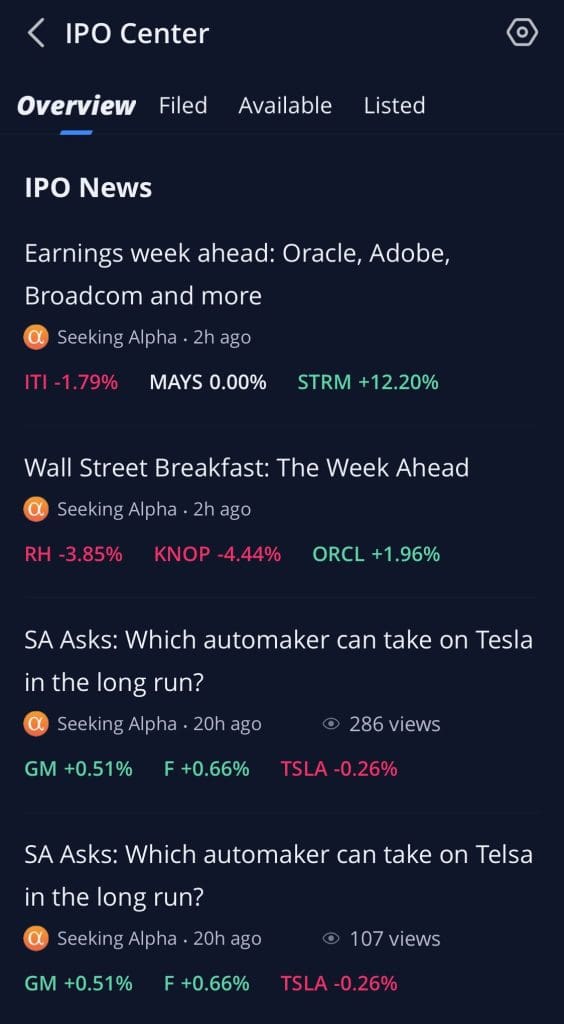

Integrated News and Earnings Calendar for Timely Catalysts

Webull's newsfeed and earnings calendar are seamlessly integrated into both the mobile and desktop apps. We’ve used this combo to identify stocks with upcoming earnings, FDA announcements, or analyst upgrades — all of which can fuel intraday volatility.

For instance, if you're scanning pre-market and notice that Rivian (RIVN) has earnings that evening, you might choose to day trade the volatility leading into the close — then exit before the actual event.

Useful components:

Filter by earnings date, type of news, or sector

Use news sentiment as an edge for short-term momentum trades

Tag headlines directly to your watchlists for follow-up later

What Day Trading Tools Are Still Lacking on Webull?

Despite all the strong features, there are still a few areas where Webull could step up its game for high-volume or algorithmic traders:

No Advanced Algo Trading Tools: Unlike Interactive Brokers, Webull doesn’t yet offer algorithmic order routing or programmable strategies.

No Direct Access Routing: You can’t control order routing to specific exchanges or ECNs — an edge for very active traders.

Limited Asset Classes: While futures and crypto are available, mutual funds and forex are missing.

Alternative Platforms for Serious Day Traders

If you're looking for a day trading setup that goes beyond Webull, here are some alternatives we’ve tested or used:

Thinkorswim (Charles Schwab): Superior charting, backtesting, and paper trading with hotkeys and Level 2 data.

Interactive Brokers (IBKR): Global access, low margin rates, and custom order scripting through Trader Workstation (TWS).

TradeStation: Excellent for custom strategies, bracket orders, and lightning-fast execution for pros.

Broker | Annual Fees | Best For |

|---|---|---|

E-Trade | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| Options & Futures Trading |

Interactive Brokers | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% | Professional Trading Tools |

Fidelity | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| Retirement Account Investing |

Vanguard | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | Low-Cost ETF Investors |

J.P. Morgan Self Investing | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | Chase Bank Customers |

Charles Schwab | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | Advanced Trading Tools |

Merrill Edge | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | Bank of America Clients |