Table Of Content

What Are Digital Assets?

Digital assets are any content or item stored digitally that holds value or is owned. This includes cryptocurrencies like Bitcoin, NFTs, domain names, digital art, videos, and even tokenized real estate.

They are increasingly used for investment, transactions, or brand representation online. Because digital assets exist in a virtual form, they require specific platforms or wallets for storage and transfer.

As the digital economy grows, understanding these assets is critical for individuals, investors, and businesses alike. Investopedia and Forbes provide further insights.

Types of Digital Assets

Digital assets come in several forms, each offering unique value in both personal and commercial use. Here are four key types:

-

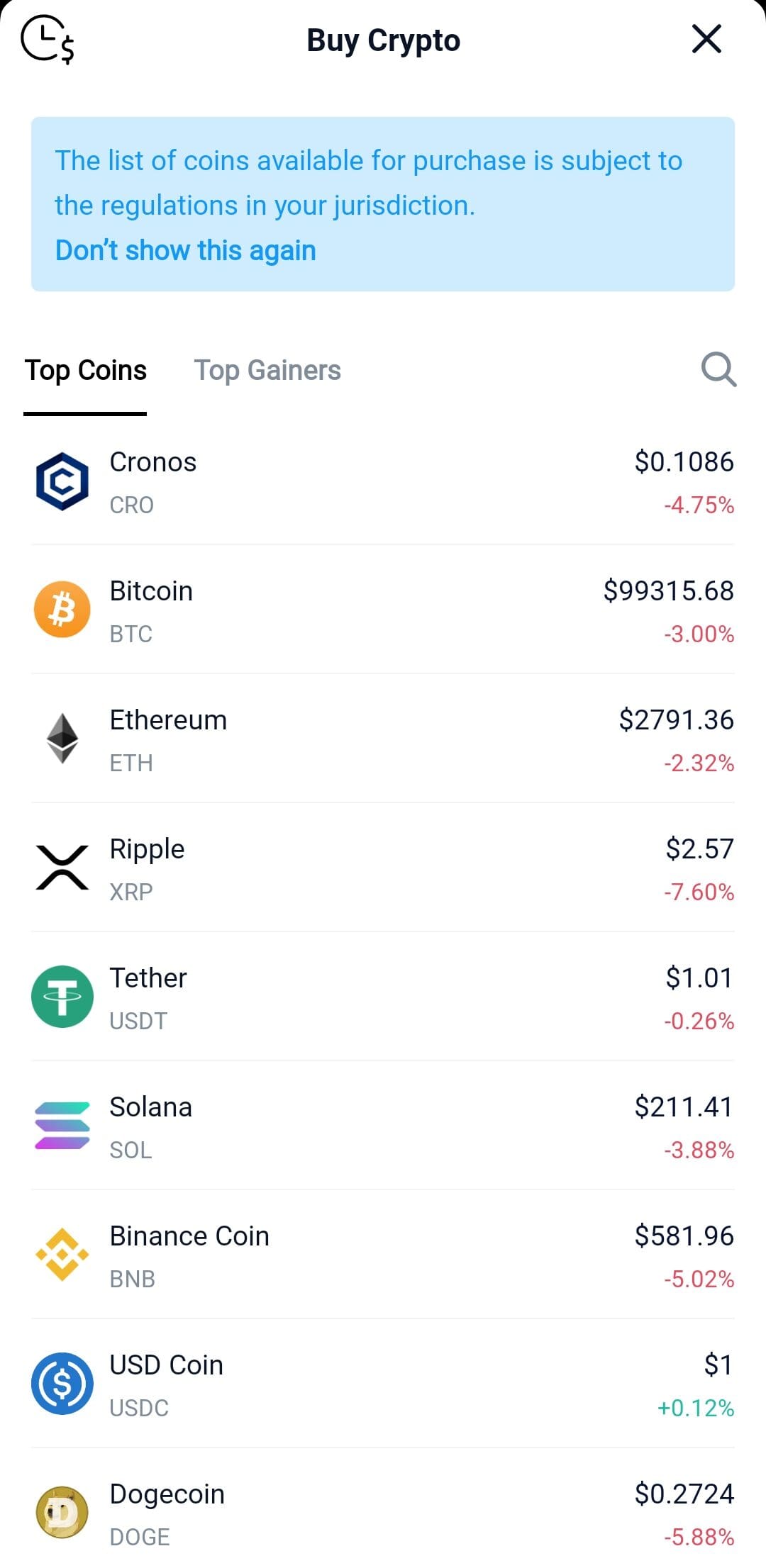

Cryptocurrencies

Cryptocurrencies are decentralized digital currencies that operate on blockchain technology. Bitcoin, Ethereum, and Solana are popular examples.

Borderless Transactions: Users can send or receive funds globally without intermediaries.

Store of Value: Some investors hold crypto as a hedge against inflation, similar to gold.

Utility in Platforms: Many coins enable transactions within decentralized applications (dApps) or smart contracts.

Because they’re decentralized, cryptocurrencies provide financial alternatives where traditional systems are limited. But they’re also highly volatile, so users must weigh risks carefully.

-

Non-Fungible Tokens (NFTs)

NFTs represent unique ownership of digital items like art, music, and in-game assets. Each token is one-of-a-kind and cannot be exchanged equally.

Proof of Ownership: NFTs verify who owns a specific digital item via the blockchain.

Monetization for Creators: Artists and game developers earn royalties from secondary sales.

Digital Collectibles: From Bored Apes to NBA Top Shot, NFTs have become a cultural phenomenon.

NFTs are disrupting how we think about value in the digital world. However, their prices can be speculative, and buyers should assess utility and demand.

-

Tokenized Real-World Assets

Tokenization turns physical items like property, art, or stocks into digital tokens that can be traded or held.

Fractional Ownership: Investors can own a piece of a high-value asset, like real estate or artwork.

Enhanced Liquidity: Trading becomes faster and more accessible via blockchain platforms.

24/7 Market Access: Unlike traditional real estate or art auctions, tokens can be traded at any time.

Tokenized assets bridge traditional finance and blockchain innovation. But investors must still consider regulation and custodial responsibility when participating.

-

Digital Content and Intellectual Property

Digital content includes files like videos, images, eBooks, and intellectual property that exist online or in virtual ecosystems.

Licensable Products: Creators license or sell digital goods on platforms like Envato or Shutterstock.

Revenue Streams: YouTubers, podcasters, and authors monetize views, streams, or subscriptions.

Rights Management: Ownership and usage rights are enforced through digital contracts.

These assets are critical for content creators and businesses building a digital footprint. Proper rights management is essential to protect value and avoid infringement.

Digital Assets vs Traditional Assets

Digital assets, like cryptocurrencies and NFTs, exist entirely in virtual formats and rely on blockchain or online storage systems.

Feature | Digital Assets | Traditional Assets |

|---|---|---|

Format | Virtual (blockchain or digital files) | Physical or paper-based; regulated financial systems |

Accessibility | 24/7 access via internet and apps | Limited by markets and institutional hours |

Liquidity | High for tokens; variable for NFTs | Generally high for public equities, moderate for real estate |

Regulation | Emerging legal frameworks | Heavily regulated by national bodies |

Volatility | Higher, especially in crypto markets | More stable over time (e.g., blue-chip stocks) |

Traditional assets, on the other hand, include physical or institutional financial instruments such as real estate, stocks, or bonds.

While traditional assets are regulated and widely adopted, digital assets offer greater flexibility, faster transactions, and broader access. However, they also carry unique security and volatility concerns.

Digital Assets: Benefits and Risks

Digital assets offer flexibility and new opportunities, but they also bring serious challenges investors must carefully consider.

Pros | Cons |

|---|---|

Greater Accessibility | Regulatory Uncertainty |

Fast Settlement | Cybersecurity Risks |

Fractional Ownership | Market Volatility |

Creator Empowerment | Limited Consumer Protections |

- Greater Accessibility

Anyone with internet access can participate in digital markets, unlike traditional investing which often requires brokers or banks.

- Fast Settlement

Transactions on the blockchain settle quickly, often within seconds or minutes.

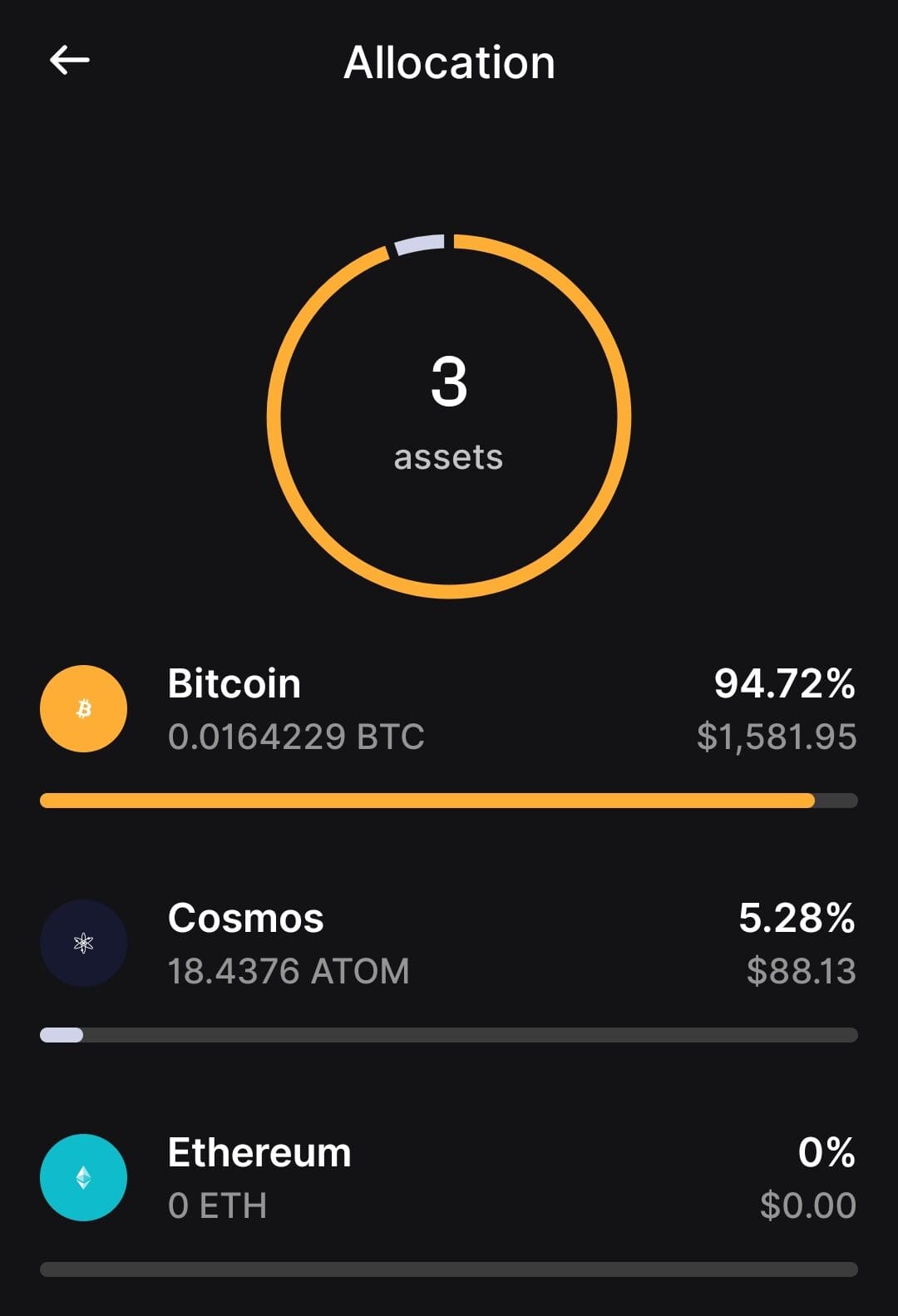

- Fractional Ownership

Users can invest small amounts in high-value assets, such as real estate or rare collectibles via tokenization.

- Creator Empowerment

Artists, musicians, and content creators can monetize their work directly through NFTs or streaming platforms.

- Regulatory Uncertainty

Many countries are still defining how digital assets should be classified and taxed, causing confusion for users.

- Cybersecurity Risks

Digital assets are vulnerable to hacking, phishing, and loss due to improper wallet management.

- Market Volatility

Crypto and NFT prices can swing dramatically, resulting in significant losses.

- Limited Consumer Protections

Unlike banks or brokerages, crypto platforms often lack deposit insurance or recovery options.

Store & Protect Digital Assets

To securely store digital assets, users often rely on cryptocurrency wallets, which come in two main forms: hot wallets (connected to the internet) and cold wallets (offline storage).

Cold wallets, like hardware devices, are recommended for long-term storage due to their resistance to hacking.

Platforms like Ledger and Trezor are commonly used for this purpose. Additionally, using multi-factor authentication (MFA), strong password management, and non-custodial wallets can increase protection.

But it’s not just about storage—regular backups and awareness of phishing scams are equally important. If digital assets are lost without a recovery phrase or key, they often become permanently inaccessible.

FAQ

No, digital assets have many non-investment uses. NFTs can provide access to online events, represent identity in Web3, or grant licensing rights for digital content.

Yes, companies increasingly use digital assets for payment processing, fundraising via token sales, and customer loyalty through blockchain-based rewards programs.

Legal recognition of ownership depends on jurisdiction and asset type. Some tokens represent enforceable rights, while others are still in regulatory gray areas.

Digital real estate refers to land in virtual worlds like Decentraland. It’s not physical but can be monetized, traded, and developed just like a real asset.

Value depends on demand, scarcity, utility, and ownership rights. For example, Bitcoin is valued for scarcity and decentralization, while NFTs are valued for uniqueness and creator affiliation.

Yes, some digital assets like staking tokens or virtual property can generate passive income. This depends on the asset’s platform, utility, and terms of use.

Without a recovery plan or access to wallet keys, digital assets can be lost. Some platforms offer inheritance tools, but users should also plan through wills or smart contracts.

Yes, all cryptocurrencies are digital assets, but not all digital assets are currencies. Many represent art, property rights, or utility tokens instead.

Yes, most countries tax digital assets. Selling, staking, or converting them may trigger capital gains or income taxes, depending on the specific action and jurisdiction.