Table Of Content

What Is a Stock Market Index?

A stock market index is a tool used to track the performance of a group of stocks that represent a particular segment of the market. It serves as a benchmark for investors to gauge how a market or sector is performing over time.

For example, the S&P 500 measures the performance of 500 large U.S. companies and is often viewed as a barometer for the overall U.S. economy.

If the S&P 500 is up, it typically signals broader market strength. Investors often compare their portfolio’s return against these indices to see if they’re outperforming or underperforming the market.

Some index funds and ETFs even mirror these indices to offer passive exposure to entire markets or sectors.

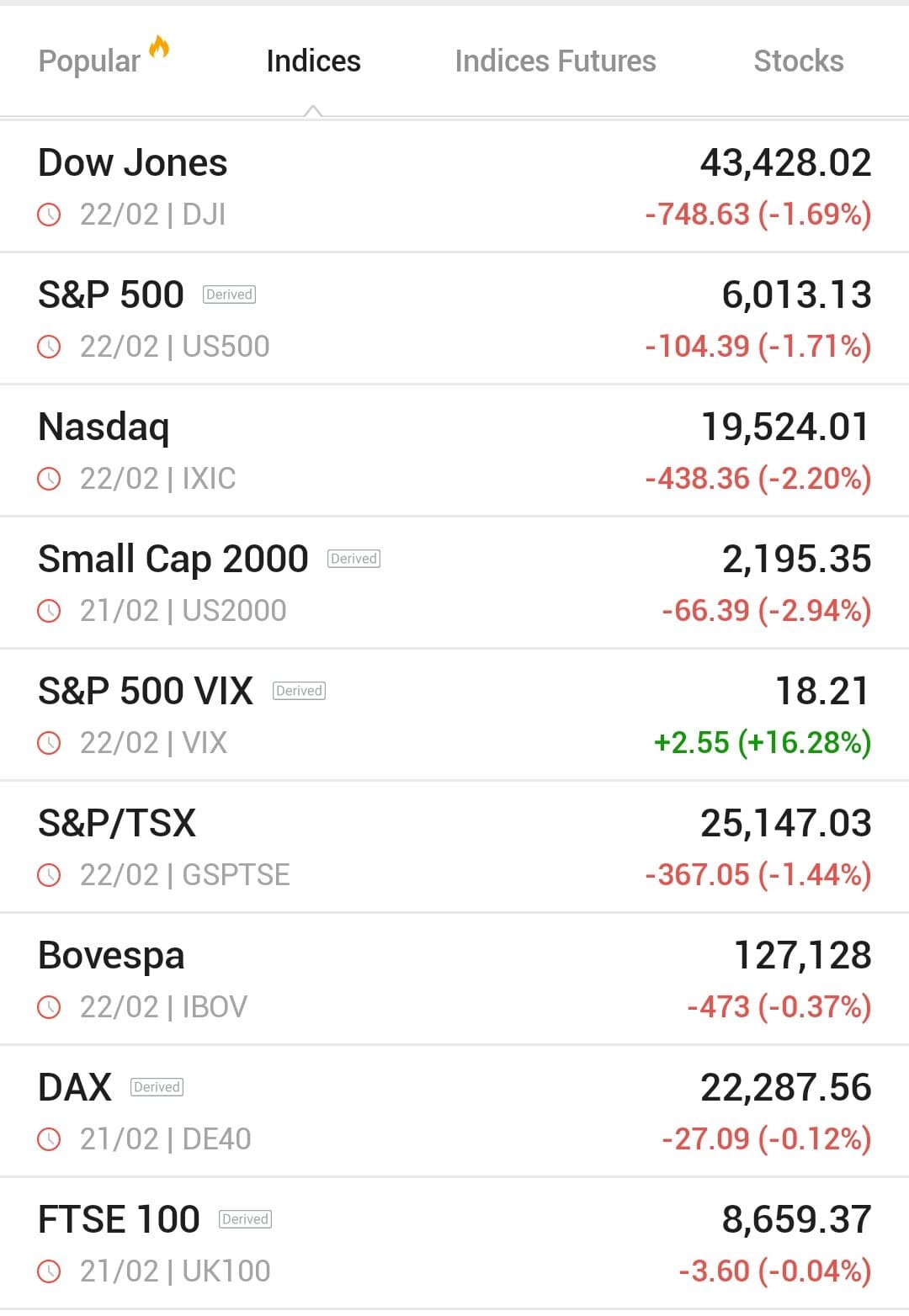

Major U.S. Stock Market Indices

Here are some of the most widely followed U.S. stock indices and how they differ:

Index Name | # of Companies | Weighting Method | Key Focus Area |

|---|---|---|---|

S&P 500 | 500 | Market-cap weighted | Large-cap U.S. stocks |

Dow Jones (DJIA) | 30 | Price-weighted | Blue-chip industrial firms |

Nasdaq Composite | ~3,000 | Market-cap weighted | Tech and growth stocks |

Russell 2000 | 2,000 | Market-cap weighted | Small-cap U.S. stocks |

- S&P 500: Tracks 500 large-cap U.S. companies across various sectors, often used as the main benchmark for U.S. equities.

Dow Jones Industrial Average (DJIA): Includes 30 large, established companies. It's price-weighted, so stocks with higher prices have more impact.

Nasdaq Composite: Focuses heavily on tech and growth companies, tracking over 3,000 stocks listed on the Nasdaq exchange.

Russell 2000: Represents small-cap U.S. companies, often used to assess performance of smaller, more domestically focused businesses.

For example, when tech stocks soar, the Nasdaq tends to outperform the others. In contrast, during economic recoveries, the Russell 2000 may lead due to increased activity in small-cap stocks

International Stock Market Indices: FTSE 100, Nikkei 225, DAX

Global investors track key international indices to assess market trends beyond the U.S. and diversify their portfolios.

Index Name | Country | # of Companies | Weighting Method |

|---|---|---|---|

FTSE 100 | United Kingdom | 100 | Market-cap |

Nikkei 225 | Japan | 225 | Price-weighted |

DAX | Germany | 40 | Market-cap |

CAC 40 | France | 40 | Market-cap |

- FTSE 100 (UK): Includes the 100 largest companies listed on the London Stock Exchange. It’s often used to gauge the health of the UK economy. For example, companies like BP and HSBC significantly influence the index.

Nikkei 225 (Japan): A price-weighted index that tracks Japan’s top 225 blue-chip companies, including Toyota and Sony. Movements often reflect trends in Asia-Pacific markets.

DAX (Germany): Tracks 40 of the largest German companies on the Frankfurt Stock Exchange, such as Siemens and BMW. It serves as a key indicator for the eurozone economy.

CAC 40 (France): Though not in the title, this index is also widely followed, representing major French firms like L’Oréal and TotalEnergies.

These indices are frequently used by international ETFs and mutual funds to provide exposure to foreign equities.

How Stock Market Indices Are Weighted

Indices are structured in different ways based on how each stock contributes to the overall value. The most common method is market capitalization weighting, where larger companies have more influence.

For instance, Apple and Microsoft carry significant weight in the S&P 500 due to their high market values.

Some indices use price weighting, like the Dow Jones Industrial Average, where stocks with higher share prices impact the index more—regardless of company size.

There are also equal-weighted indices, where every stock contributes the same regardless of size, offering a more balanced view across all companies.

-

Why It's Important?

These weighting methods can affect how the index moves.

For example, a major drop in a high-priced stock like Goldman Sachs can pull the Dow down, even if most other stocks are flat or rising.

Understanding weighting helps investors interpret market moves more accurately.

How Companies Are Added or Removed from an Index

Stock market indices regularly update their components to reflect shifts in the market and maintain accuracy.

Companies are added or removed based on specific criteria such as market capitalization, trading volume, sector classification, and financial health.

For instance, the S&P 500 requires companies to have a market cap of at least several billion dollars and consistent profitability.

Removal often happens when a company is acquired, delisted, or no longer meets the index’s standards. Therefore, inclusion in a major index often boosts demand.

How to Invest in Stock Market Indices

Investors can gain exposure to indices without picking individual stocks by using these straightforward investment options:

Index Funds: Mutual funds that track a specific index, such as the S&P 500. They're low-cost and suitable for long-term investors.

ETFs (Exchange-Traded Funds): Trade like stocks but mirror an index. For example, SPY tracks the S&P 500 and can be bought or sold at any time during market hours.

Futures Contracts: Used by more advanced investors to speculate on or hedge against index movements, often with leverage.

Robo-Advisors: Automated platforms that build portfolios using index ETFs, ideal for hands-off investors.

If you're looking to diversify globally, you might invest in ETFs like EWJ (Japan) or VGK (Europe), which track international indices.

FAQ

A stock represents ownership in a single company, while a stock index tracks the performance of multiple companies grouped together. Indices offer a broader view of the market or a sector.

Investors use indices to measure market trends and benchmark portfolio performance. They also guide investment strategies through index funds or ETFs.

Yes, many large companies are included in multiple indices. For example, Microsoft is part of the S&P 500, Nasdaq 100, and Dow Jones.

No, each country has its own indices based on its market structure and leading companies. For instance, Japan has the Nikkei 225, while the UK has the FTSE 100.

Most indices are reviewed quarterly or semiannually. Updates are based on company performance, mergers, or changes in market capitalization.

An index fund aims to mirror the performance of a specific index. It offers diversification and typically comes with lower fees than active funds.

Index funds are diversified, which helps reduce risk, but they are still subject to market volatility. They’re often used for long-term investing.

A sector index tracks companies within a specific industry, such as technology or healthcare. It helps investors focus on particular segments of the economy.

If you hold index funds or ETFs, changes in the index directly impact your returns. Even without direct investments, indices influence market sentiment and asset pricing.