Table Of Content

What Is an NFT?

An NFT (non-fungible token) is a unique digital asset that represents ownership of a specific item—like art, music, in-game items, or digital collectibles—on a blockchain.

Unlike cryptocurrencies such as Bitcoin or Ethereum, NFTs are non-interchangeable; each one has distinct metadata that makes it different from any other.

In 2025, NFTs are widely used beyond art, expanding into real estate tokenization, digital identity, and loyalty programs.

How Does NFT Work?

NFTs function by leveraging blockchain technology and smart contracts to authenticate ownership and enable secure transfers.

-

Blockchain for Provenance

NFTs are recorded on blockchains like Ethereum or Solana, which store immutable records of ownership and transaction history.

This ensures transparency and security, making it easy to verify if an NFT is authentic.

-

Smart Contracts for Functionality

When someone mints (creates) an NFT, a smart contract is deployed that governs how it behaves.

For example, artists can code royalties into the NFT, so they earn a percentage every time it’s resold.

-

Token Standards

Most NFTs follow token standards like ERC-721 or ERC-1155 (for semi-fungible assets), which define how they interact with wallets and marketplaces.

This standardization enables compatibility across platforms.

Standard | Blockchain | Purpose/Function | Common Use Case |

|---|---|---|---|

ERC-721 | Ethereum | Unique, non-fungible tokens | Art, collectibles |

ERC-1155 | Ethereum | Hybrid of fungible and non-fungible in one contract | Gaming items, batch minting |

SPL Token | Solana | NFT representation on Solana | Solana-based collectibles |

BRC-20 | Bitcoin Ordinals | Experimental NFT-like use on Bitcoin | Bitcoin-native assets |

-

Uses

Beyond digital art, brands use NFTs for event tickets, digital memberships, and gaming assets.

For instance, players can trade NFTs representing exclusive in-game skins or items across different games.

Trading NFTs: What Investors Should Know

Buying NFTs has evolved significantly, and investors in 2025 should understand the unique risks, platforms, and strategies involved in navigating this volatile market.

-

1. Understand NFT Market Volatility

NFTs are highly speculative assets, and prices can swing dramatically based on trends, hype cycles, and influencer endorsements. As with crypto, timing and sentiment play a crucial role in valuations.

Price swings are common: A popular NFT might sell for thousands today and be worth a fraction tomorrow due to waning demand.

Hype drives demand: Influencers, celebrity endorsements, or viral moments can spike prices, but these are often short-lived.

Thin liquidity: Unlike stocks or mainstream crypto, many NFTs don’t have enough buyers, making it hard to sell quickly.

Because of these risks, investors should only trade NFTs with funds they can afford to lose. Diversifying within the broader crypto space can also help manage downside exposure.

-

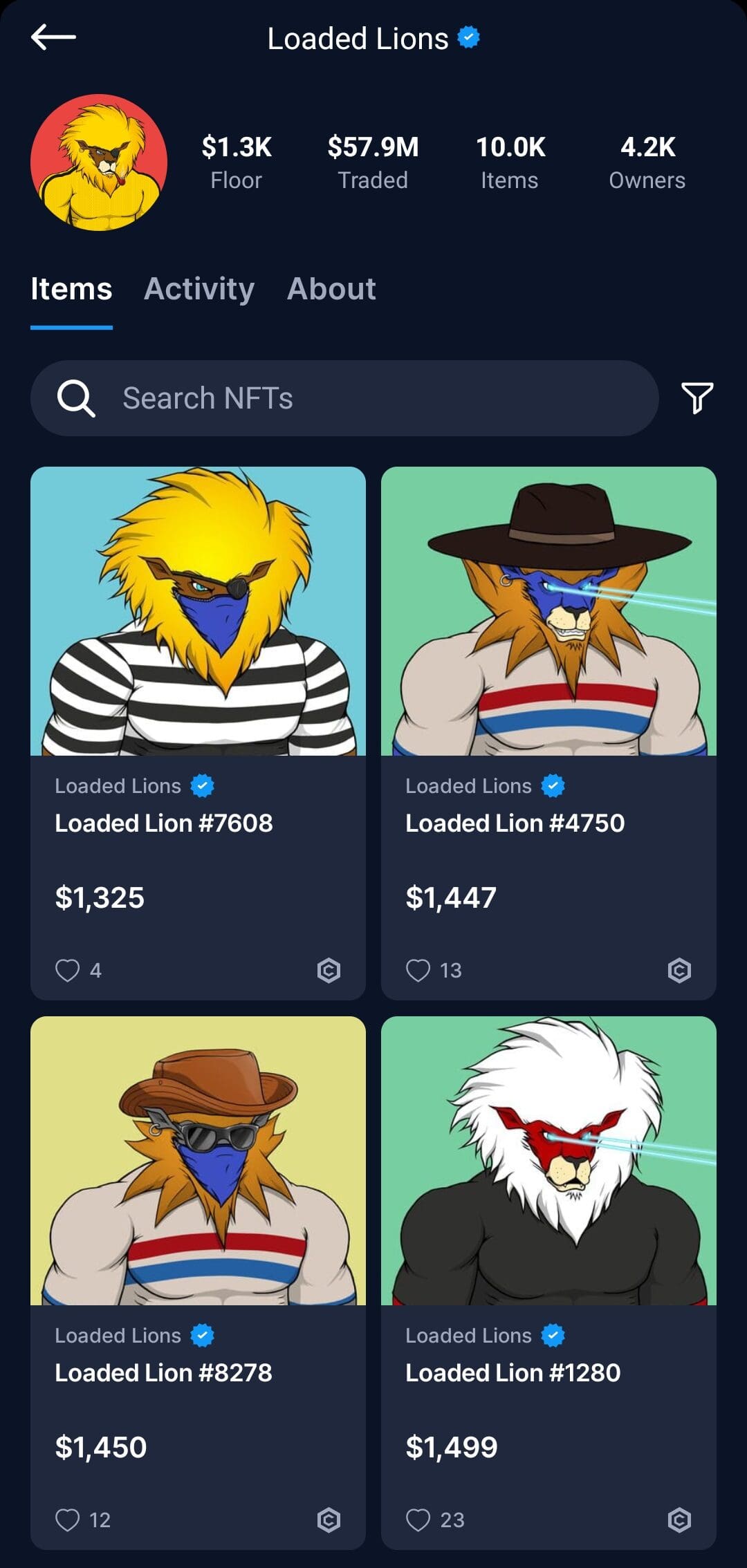

2. Choose the Right NFT Marketplace

NFTs are bought and sold on various decentralized and centralized platforms. The right platform depends on your goals—whether it's flipping collectibles, minting new tokens, or buying established art.

Popular platforms in 2025: OpenSea, Blur, and Magic Eden continue to lead, but niche platforms for music, gaming, and real-world asset tokenization are rising.

Platform fees and royalties: Each marketplace charges transaction fees, and some enforce creator royalties while others don’t.

Wallet compatibility: Ensure your crypto wallet supports the blockchain the NFT is on—Ethereum, Solana, Polygon, etc.

Investors should also assess platform security, community support, and verified collections before making trades to reduce the chance of fraud or buying illiquid assets.

-

3. Analyze NFT Project Fundamentals

Like with startups or crypto tokens, strong NFT projects are backed by utility, communities, and transparent teams. Don’t just buy the art—investigate the ecosystem behind it.

Utility matters: Some NFTs provide holders access to exclusive events, metaverse content, or staking rewards.

Community engagement: Check for active Discord channels, Twitter presence, and ongoing development by the creators.

Team transparency: Anonymous teams raise red flags—reliable projects usually have public, doxxed founders with a track record.

By focusing on fundamentals, investors can better identify NFTs with lasting value rather than chasing the next viral mint. A well-researched NFT project has more long-term upside than short-term flips.

-

Why People Invest in NFTs?

NFT investing goes beyond digital art speculation. Many buyers are drawn by potential price appreciation, community access, and real-world use cases.

In 2025, NFTs are also used for identity verification, in-game asset ownership, and as collateral for crypto loans.

Investors see them as early-stage digital assets that could benefit from growing Web3 adoption, despite the risks of illiquidity and hype-driven cycles.

Risks of Investing in NFTs

NFTs can be profitable, but investors must be cautious as the market comes with unique risks not seen in traditional assets.

Market Hype & Speculation: Many NFTs skyrocket in price due to influencer hype, but values often collapse once the trend fades.

Low Liquidity: Unlike stocks or crypto, selling an NFT quickly isn’t guaranteed—buyers may not exist when you need to exit.

Fraud & Counterfeits: Fake NFT collections still circulate despite improved platform protections. Always verify collections on trusted marketplaces.

Smart Contract Bugs: Flawed code in an NFT’s contract can result in lost ownership or exploits, especially with lesser-known projects.

Because NFTs lack consistent regulation, due diligence is essential. Use secure wallets and avoid investing based on social media trends alone.

Risk Factor | Description | How to Mitigate |

|---|---|---|

Market Volatility | NFT values can crash quickly due to hype and speculation | Invest only what you can afford to lose |

Low Liquidity | Hard to resell certain NFTs at market value | Choose well-known or high-demand NFTs |

Smart Contract Risks | Poor code can lead to loss of assets | Buy from audited or reputable projects |

Scams & Counterfeits | Fake projects can mislead buyers | Verify creators and check blockchain |

Popular NFT Marketplaces in 2025

NFT trading is more fragmented in 2025, with specialized platforms emerging to cater to specific communities, asset types, and blockchain ecosystems.

Blur: Gaining traction with active traders by offering zero fees and airdrop incentives for volume-based users.

Magic Eden: Dominates Solana and cross-chain NFTs, expanding into gaming and Ordinals (Bitcoin NFTs).

OpenSea: Still the largest marketplace for Ethereum-based NFTs, including art, domains, and collectibles.

Zora: Focused on creator-owned NFTs, music collectibles, and onchain minting tools for artists.

Rarible: Offers multi-chain support and tools for DAOs and small communities to create custom marketplaces.

When choosing a platform, consider security, fees, blockchain compatibility, and the audience it attracts.

FAQ

While the image can be copied, the ownership certificate stored on the blockchain cannot. That’s what gives the NFT its unique value.

Most jurisdictions don’t fully regulate NFTs yet, but some countries have introduced rules on fraud, taxes, and financial disclosures for NFT projects.

Some NFTs offer passive income through staking or royalties, but many are purely speculative and don’t provide ongoing returns.

Creators can code royalties into smart contracts, so they receive a percentage every time the NFT is resold—though some platforms bypass this.

Yes, in 2025, platforms like Arcade.xyz allow users to lock NFTs as collateral for crypto loans, but values fluctuate significantly.

Yes, some protocols allow ownership of a single NFT to be split among multiple holders using tokens that represent partial ownership.

Value depends on rarity, creator reputation, community demand, and utility. Some also trade at a premium due to branding or influencer backing.

Gas fees are transaction costs paid to process activity on a blockchain like Ethereum. High activity periods can make them quite expensive.

Yes, platforms like OpenSea and Rarible allow users to mint NFTs through no-code tools using uploaded files and form-based input.