Table Of Content

What Is ATH in Crypto?

ATH stands for “All-Time High,” referring to the highest price a cryptocurrency has ever reached in its trading history.

It signals peak market valuation and is often used as a benchmark for future price movements. Traders and investors closely track ATHs because they represent moments of intense demand and market enthusiasm.

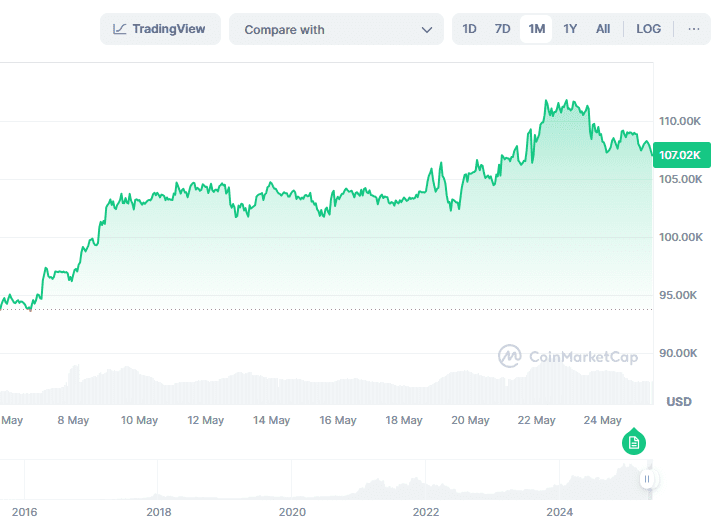

For example, Bitcoin reached its all-time high (ATH) of around $110,000 in 2025, before falling sharply. ATHs are key momentum indicators in both short-term trading and long-term investing strategies.

Why ATH Is a Big Deal For Investors

ATHs create excitement and shape investor decisions because they reflect maximum historical price optimism and potential market turning points.

Signals Strong Momentum: Reaching an ATH often indicates that a coin is experiencing significant buying pressure and upward trend continuation.

Triggers FOMO Behavior: As prices climb to new records, investors may rush in out of fear of missing out, further boosting demand.

Sets New Psychological Benchmarks: An ATH becomes a price memory, influencing future resistance or support levels in market psychology.

Encourages Profit-Taking: Many investors choose to cash out after an ATH, expecting a pullback or market correction to follow.

As a result, ATHs can spark both bullish surges and selloffs depending on sentiment. Understanding this duality helps investors make more informed entry and exit decisions.

How to Identify And Track Coins ATH?

Knowing how to spot an ATH can help you time trades and better analyze crypto price trends across different platforms and timelines.

-

Use Historical Price Charts

Start with a trusted platform like CoinMarketCap or TradingView to pull up the full price history of a coin.

Look for the peak closing price: Focus on the highest daily close, not just intraday spikes.

Zoom out on long-term charts: Use weekly or monthly views to ensure you're seeing the full picture.

Compare across exchanges: Different exchanges may report slight pricing variations due to liquidity differences.

By viewing long-term performance, you can visually confirm whether the asset is currently testing or surpassing past highs

-

Follow Major News or Community Announcements

ATHs are often triggered or confirmed by news events, community hype, or large-scale announcements.

Track major exchange listings: Coins tend to surge when listed on platforms like Binance or Coinbase.

Watch for protocol upgrades or partnerships: Major updates can boost investor confidence and drive price upward.

Monitor social sentiment and trending hashtags: Twitter, Reddit, and Discord often react to ATHs in real-time.

Because crypto markets are highly reactive, news-driven events can be an early indicator of potential ATH breakouts.

-

Use Technical Indicators

Technical tools can provide early hints when a coin is approaching or surpassing its ATH.

Monitor RSI and MACD levels: Overbought conditions often precede ATH tests.

Use Fibonacci extensions: These help identify potential future highs based on past price movements.

Set alerts for breakout patterns: Platforms like TradingView let you set alerts for ATH breakouts or volume spikes.

Therefore, using technical indicators with chart analysis can confirm whether a coin is breaking into uncharted price levels.

How Investors Can Leverage ATH?

Reaching an all-time high isn’t just a milestone — it can also offer strategic opportunities for informed and disciplined investors.

Set Stop-Loss or Trailing Orders: As prices peak, use trailing stop-losses to protect gains while allowing room for further upside if momentum continues.

Analyze Volume Strength: Higher volume near ATHs signals strong demand. If a breakout is supported by volume, it may suggest a sustainable move.

Rebalance or Diversify: Use the ATH as a chance to rebalance your crypto portfolio, taking profits and reallocating to undervalued assets or stablecoins.

Monitor Market Sentiment: Tools like Fear & Greed Index or social trends can help gauge if the ATH is part of irrational exuberance.

Plan Entry on Pullbacks: If you missed the rally, wait for a healthy retracement after the ATH rather than buying at the peak.

Because ATHs often mark emotionally charged market conditions, leveraging them requires a calm, calculated approach.

By combining technical signals, sentiment tools, and portfolio discipline, investors can use ATHs not just to celebrate gains — but to set up smarter next moves.

FAQ

An ATH is the highest price ever recorded, while a spike might be a temporary high that doesn’t break the all-time record.

Yes. During strong uptrends, coins can break their own ATH several times over days or weeks as new buyers enter the market.

Not necessarily. It could reflect strong fundamentals or hype. But investors should evaluate context, volume, and sentiment before buying.

Check if the breakout has high volume, positive news backing it, and healthy consolidation. Weak breakouts often reverse quickly.

ATHs may vary slightly by exchange due to different liquidity levels and trade volumes at the time of the high.

Yes, small-cap cryptos are more volatile and can hit new highs quickly during hype cycles — but they can also crash just as fast.

Buying at ATH carries higher risk of short-term pullbacks. It's smarter to wait for confirmation or dip-buying opportunities.

ATH acts as a resistance level. Once broken, it may become new support, giving traders signals for further upside potential.

Some coins, like Bitcoin, have revisited and broken past ATHs in later cycles. Others never return, especially if fundamentals decline.

Frequently, yes. Investors take profits near ATHs, leading to short-term sell pressure. But not all ATHs lead to major crashes.