Table Of Content

What Is Market Cap in Crypto?

Market cap in crypto, short for market capitalization, refers to the total value of a cryptocurrency's circulating supply. It’s calculated by multiplying the current price of one coin by the total number of coins in circulation.

For example, if a token is worth $50 and has 10 million coins in circulation, its market cap is $500 million.

This metric helps investors assess a coin's relative size, popularity, and market dominance compared to others in the crypto space.

Coin | Price per Coin | Circulating Supply | Market Cap |

|---|---|---|---|

Coin A | $0.50 | 10 Billion | $5 Billion |

Coin B | $20.00 | 10 Million | $200 Million |

Why Does Market Cap Matter?

Crypto market cap matters because it provides quick insight into a project’s scale and investor sentiment, but should not be the only metric used.

Shows Overall Size and Risk: A higher market cap often suggests a more established and less volatile project. For example, Bitcoin and Ethereum have large caps, making them generally more stable than newer tokens.

Influences Investment Strategy: Investors often group cryptocurrencies into large-cap, mid-cap, or small-cap. Each comes with different risk/reward trade-offs.

Helps in Portfolio Diversification: By comparing market caps, investors can balance their crypto portfolios across different tiers for better risk management.

Not a Standalone Indicator: A high market cap doesn’t guarantee security or success. Some tokens inflate their market cap through low liquidity or large token supplies.

As a result, while market cap offers a useful snapshot, it’s best used with other metrics like trading volume, developer activity, and tokenomics.

Market Cap Category | Typical Range (USD) | Risk Level | Typical Use Case |

|---|---|---|---|

Large-Cap | > $10B | Low | Stable investments |

Mid-Cap | $1B – $10B | Medium | Growth opportunities |

Small-Cap | $100M – $1B | High | Speculative investments |

Micro-Cap | < $100M | Very High | High-risk, early-stage projects |

How Market Cap Determines a Cryptocurrency’s Ranking

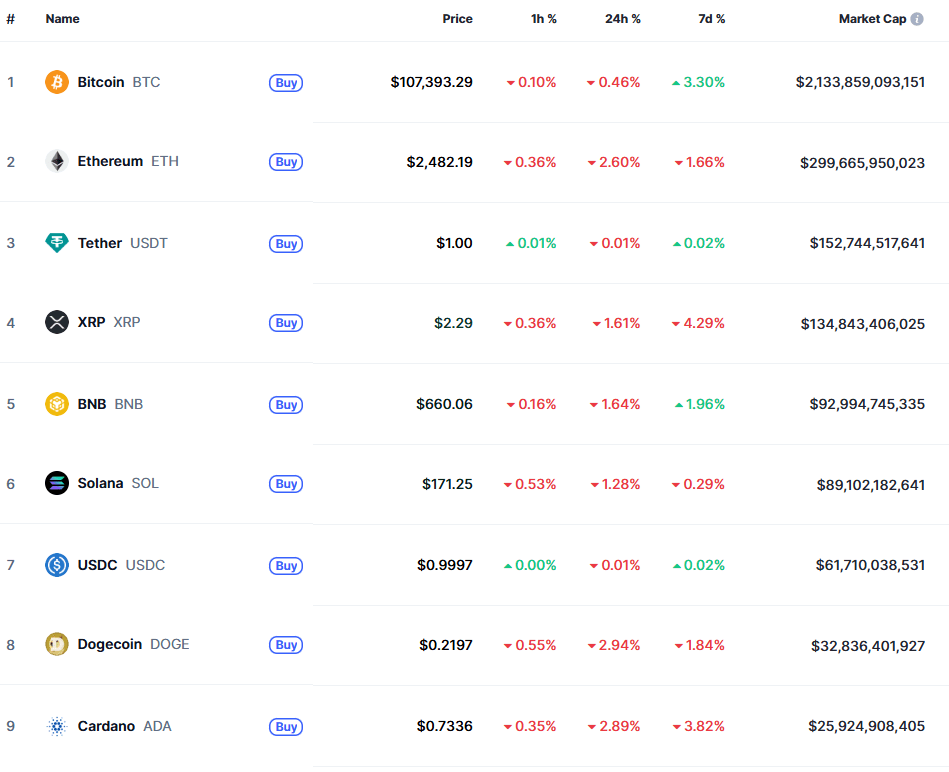

Market cap is the primary metric used to rank cryptocurrencies on sites like CoinGecko and CoinMarketCap. Rankings can impact visibility, trading volume, and investor attention.

Direct Correlation: Coins with higher market caps are ranked higher. For example, Bitcoin and Ethereum consistently top the rankings due to their massive market caps.

Investor Perception: A top-10 ranking can boost a coin’s reputation, leading to increased buying interest and potential exchange listings.

Media and Analyst Focus: Analysts and media outlets often focus on top-ranked coins, which can drive more user traffic and interest.

Project Maturity Signals: Being in the top tier often implies stronger community support, development activity, and broader acceptance.

Therefore, a cryptocurrency’s rank isn’t just about status—it also affects how easily it’s discovered and trusted by both retail and institutional investors.

How Market Cap Affects Crypto Prices & Investment Decisions

Market cap influences how investors perceive value, risk, and potential returns—ultimately guiding pricing, rankings, and portfolio strategies.

-

Sets Expectations for Price Movement

A lower market cap typically suggests more room for price growth, but also higher volatility.

For example, a $10 million project doubling in value is more plausible than Bitcoin doubling overnight.

Investors often speculate on small-cap coins for explosive returns, although the risk of loss is also higher.

-

Affects Liquidity and Trading Volume

Large-cap cryptocurrencies generally have more liquidity, making it easier to enter or exit positions.

Bitcoin and Ethereum, for instance, are heavily traded, allowing for tighter spreads and less slippage.

Small-cap coins may experience sharp price swings due to lower volume, which can amplify both gains and losses.

-

Drives Institutional Interest

Institutions often favor high market cap coins because they are perceived as safer and have better infrastructure support.

Bitcoin’s dominance, for instance, has led to the creation of Bitcoin ETFs and widespread institutional custody solutions, which small-cap coins lack.

-

Impacts Media and Analyst Coverage

High market cap coins receive more coverage, which can fuel price momentum.

When a coin enters the top 10, for example, it often sees a surge in interest from retail investors, trading platforms, and influencers—adding to price pressure and investor demand.

Don't Trust Only on Market Cap. Here's Why.

Relying solely on market cap to judge a cryptocurrency can be misleading because it oversimplifies complex factors that determine a coin’s true value and risk:

Doesn’t Reflect Liquidity: A token might show a high market cap, but if trading volume is low, it's difficult to buy or sell without major price swings.

Can Be Manipulated: Market cap is price × circulating supply. If a small amount of the coin is traded at an inflated price, it can distort the entire market cap. This is especially common with coins that have large token supplies but little real-world activity.

Ignores Locked or Unreleased Tokens: Some projects hold large portions of tokens in reserves or vesting contracts. These tokens aren’t circulating yet, but market cap calculations may ignore how future unlocks can dilute value and pressure prices.

Doesn’t Measure Fundamentals or Use Case: A coin may have a high market cap but no real utility, weak development, or poor security. Meanwhile, a smaller-cap project might be innovative and undervalued. Market cap doesn’t account for innovation or adoption.

Therefore, while market cap is a useful snapshot, it must be paired with metrics like trading volume, token distribution, roadmap progress, and community engagement for smarter investing.

FAQ

Market cap is useful, but not comprehensive. It doesn’t account for liquidity, supply lock-ups, or real-world use. Combine it with metrics like volume and developer activity for deeper insight.

Fully diluted market cap assumes all possible tokens are in circulation, which can overstate value. It's useful for comparing future potential but not always current value.

Generally yes, because it reflects scale and liquidity. But it doesn’t eliminate risks like regulation, technical flaws, or market crashes.

Yes. A coin priced at $0.01 could still have a massive market cap if it has billions of coins in circulation, like Dogecoin.

Rankings change as coin prices and circulating supplies fluctuate. Even small price movements can shift rankings, especially for mid- and small-cap coins.

Coins with higher market caps often get listed on more exchanges due to perceived stability and user demand, increasing access for investors.

Yes. Burning tokens reduces supply and can decrease market cap if price stays constant. New issuances increase supply and can inflate market cap.

In low-volume tokens, yes. A few large trades can spike price and artificially raise market cap, misleading casual investors.