Table Of Content

What Makes a Good ETF Screener?

A good ETF screener helps investors identify funds that match their goals, risk profile, and market view with precision and speed.

Customizable Filters – Investors should be able to filter by asset class, sector, region, expense ratio, and performance to find suitable ETFs.

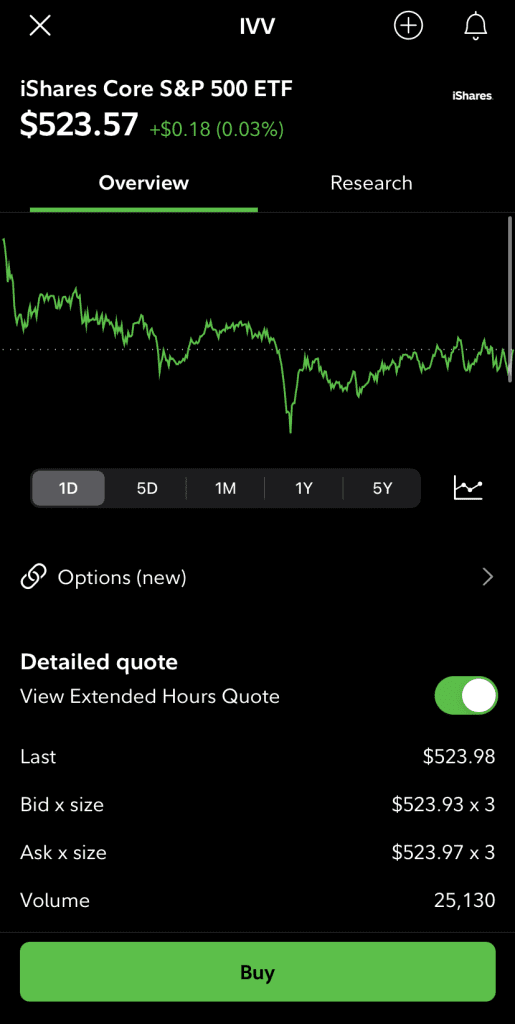

Real-Time Data – Reliable screeners show up-to-date prices, volume, and trends, which is critical for active traders.

In-Depth ETF Profiles – Quality tools provide fund flows, holdings breakdown, sector exposure, and historical performance for research-based investing.

Comparison Tools – Some screeners allow side-by-side ETF comparisons to help users choose between similar funds.

These features allow beginners and professionals alike to make smarter, data-driven ETF investment decisions.

Top Free and Paid ETF Screeners

Choosing the right ETF screener can dramatically improve how you analyze and select funds.

Whether you’re focused on cost, sector exposure, or performance trends, the best ETF screeners combine powerful filters, real-time data, and investor-friendly tools to support smarter decisions.

1. Fidelity ETF Screener

Fidelity offers a powerful, user-friendly ETF screener that's ideal for both casual and experienced investors. Its platform is free and fully accessible with a Fidelity account.

Advanced Filter Criteria – You can narrow down ETFs by performance, sector, index type, dividend yield, and even ESG ratings.

Strategy-Oriented Screens—Users can save time by exploring preset screens like “Low Expense Ratio” or “High Growth Potential.”

ETF Research Pages – Each ETF includes detailed performance charts, top holdings, and risk metrics to support thorough analysis.

It’s particularly helpful for retirement-focused investors looking to optimize ETF picks inside IRAs or Fidelity brokerage accounts.

No upgrade is required, making it an excellent free resource for all ETF investors.

2. Morningstar ETF Screener

Morningstar’s ETF screener is built for in-depth analysis, making it ideal for investors who want to assess both fundamentals and ratings.

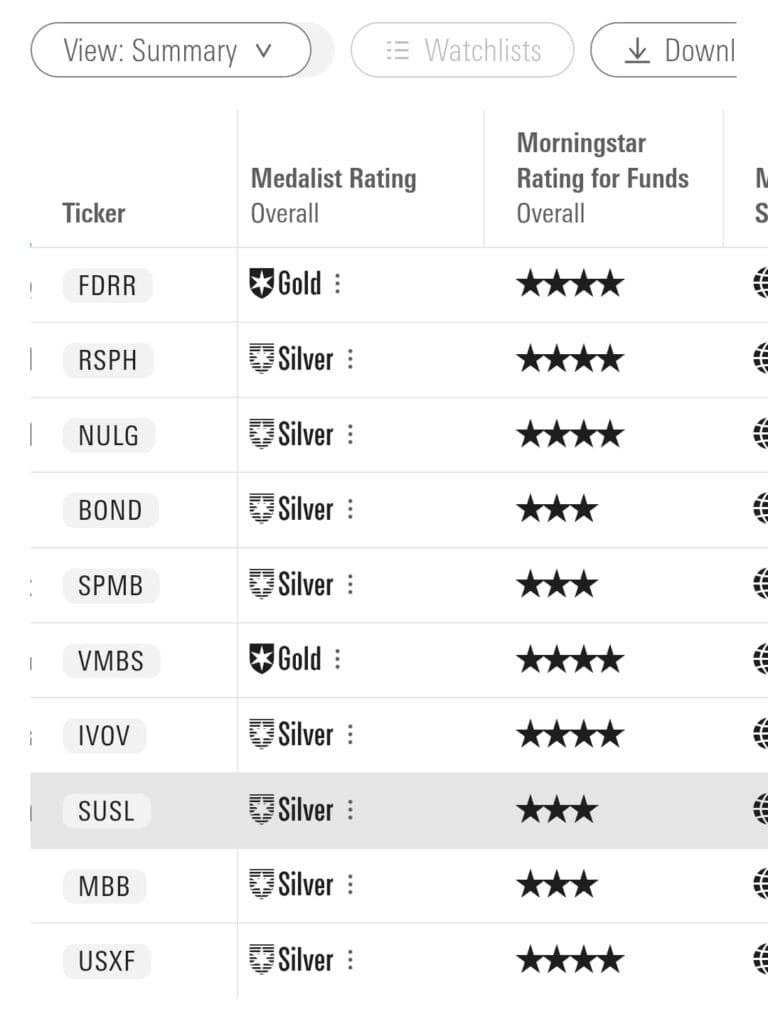

Morningstar Ratings and Scores – ETFs are rated based on past performance and forward-looking analyst research, offering extra insight beyond raw data.

Portfolio X-Ray Tool – Investors can analyze their ETF portfolio exposure across sectors and asset classes, useful for rebalancing.

Risk and Return Metrics – Sharpe ratio, standard deviation, and downside capture are displayed, aiding in risk-adjusted decision-making.

The free version is limited to basic filters, but Morningstar Investor unlocks premium analytics and screen customization.

It’s best suited for research-driven investors managing diversified portfolios.

3. TradingView ETF Screener

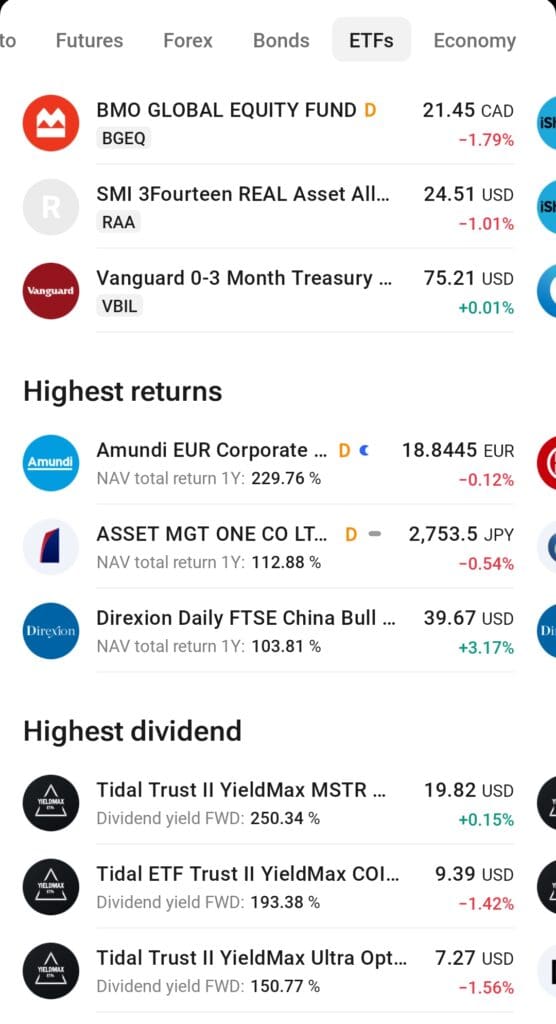

TradingView isn’t a traditional ETF screener, but its charting and screening tools are valuable for technical traders who trade ETFs.

Custom Technical Filters – Screen ETFs based on RSI, MACD, moving averages, and breakout signals for short-term strategies.

Interactive Charts with Indicators – Once filtered, ETFs can be analyzed with overlays like Bollinger Bands or Fibonacci levels.

Watchlists and Alerts – Users can save ETF ideas and get notified when technical conditions are met.

While the free version includes limited filters and alerts, the Premium plans unlock more indicators and faster data.

ETF.com Screener

ETF.com offers a straightforward screener that focuses on transparency. This tool is useful for investors comparing funds by cost, liquidity, and structure.

Fund Focus Filters – Users can screen by fund issuer, leverage, structure (e.g., physical vs. synthetic), and active vs. passive strategy.

Expense Ratio Comparison – Helps investors spot lower-cost options in similar categories to boost net returns.

Liquidity and Spread Data – Data on average volume and bid/ask spread help ensure investors can trade ETFs efficiently.

This tool is especially helpful for cost-conscious investors and institutional users needing transparency. It's entirely free and doesn’t require login.

VettaFi (ETF Database)

VettaFi’s ETF Database has filtering tools, comparison features, and educational support for ETF investors and advisors.

Theme and Sector Search – Easily find ETFs that align with current trends like AI, clean energy, or dividend growth.

ETF Comparison Tool: This tool allows users to compare up to five ETFs side by side based on returns, fees, and liquidity.

Flows and Sentiment Tracker – Reveals investor behavior through fund inflows/outflows, great for timing decisions.

Free users get core filters, but advisors and professionals can subscribe to VettaFi for advanced data. It’s best for trend-following ETF investors or those building model portfolios.

What Features to Look for in an ETF Screener?

A strong ETF screener offers more than just filters—it should simplify your search and guide you toward the right investment choices.

Flexible Filter Options – Choose by asset class, geography, sector, market cap, dividend yield, and other specific metrics.

Expense Ratio and Fee Insights – Screeners should clearly display costs to help compare similar ETFs on a net-return basis.

Performance History – Look for tools that show multi-year returns and compare funds to benchmarks or peers.

Risk Metrics – Useful screeners include volatility, Sharpe ratio, and beta to match ETFs with your risk appetite.

Holdings Transparency – Top screeners reveal top holdings, sector weightings, and rebalancing schedules.

Liquidity and Volume Filters – Help day traders or active investors avoid illiquid ETFs with wide bid/ask spreads.

Comparison Tools – Ability to analyze multiple ETFs side-by-side makes it easier to identify the best fit.

These features help investors narrow thousands of ETFs into a shortlist tailored to their strategy, goals, and timeline.

Plan | Subscription | Best For |

|---|---|---|

Morningstar Investor | $34.95

$249 ($20.75 / month) if paid annually | Retirement Planners |

Zacks Premium | $249 ($20.75/month)

No monthly plan | Research-Driven Investors |

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| Stock Picks |

Yahoo Finance Gold | $49.95

$479.40 ($39.95 / month) if paid annually | Casual Investors |

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually | Global Market Investors |

TipRanks Premium | $359 ($30 / month)

No monthly plan | Analysts Followers |

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | Research-Oriented Investors |

FAQ

ETF screeners filter entire funds based on attributes like holdings, fees, and strategy, while stock screeners focus on individual company metrics.

Yes, most screeners allow you to filter ETFs based on dividend yield, payout frequency, or dividend growth history to meet income goals.

Many screeners include international and global ETFs. You can often filter by region or currency exposure to tailor your search.

This depends on the platform. Some update daily, while others with technical tools like TradingView may offer real-time data for active trading.

Most platforms include 1-year, 3-year, and 5-year returns along with comparisons to indexes or benchmarks.

Yes, many screeners have preset filters or educational tools to help beginners find ETFs by theme, cost, or investment strategy.

Several screeners, like Morningstar and Fidelity, allow filtering by ESG scores or sustainability ratings.

Yes, platforms often let you filter by management style—passive vs. active—so you can find actively managed ETF options.

If you need deeper analysis, portfolio tools, or sentiment tracking, premium screeners like TipRanks or Morningstar Investor can add value.