Table Of Content

Buying Bitcoin is easier than ever, thanks to a growing number of platforms offering user-friendly features, strong security, and flexible payment options.

However, the right platform for you depends on your goals—whether you're investing long term, trading actively, or just getting started.

Where to Buy Bitcoin: Best Exchanges and Platforms

Below are six of the best places to buy Bitcoin, each offering unique benefits. We’ve broken down what makes each platform effective, with key points and examples to help guide your decision.

1. Coinbase: Best for Beginners

Coinbase is one of the most popular platforms for buying Bitcoin, especially among new users. The interface is clean and intuitive, and the onboarding process is quick.

Easy buying process: Users can purchase Bitcoin in just a few taps using a debit card, bank transfer, or PayPal.

Educational resources: Coinbase Learn rewards users with small amounts of crypto for completing short lessons, making it ideal for beginners.

Secure storage: Coins are stored in a combination of hot and cold wallets, and Coinbase also offers an optional vault feature with time-delayed withdrawals.

Because of its simplicity and strong reputation, Coinbase is a go-to for anyone just starting with Bitcoin.

However, it charges relatively high fees compared to other exchanges, so active traders may prefer other platforms.

2. Cash App: Best for Simplicity

Cash App is a mobile-based peer-to-peer payment platform that also allows Bitcoin purchases directly from your phone. It’s perfect for users who want to keep things simple.

Instant Bitcoin buys: You can buy Bitcoin with your Cash App balance or linked debit card instantly.

Bitcoin withdrawals: Unlike some mobile platforms, Cash App lets you send Bitcoin to external wallets.

Auto-invest feature: Users can set up recurring daily, weekly, or biweekly Bitcoin purchases.

Cash App is best for casual investors or those already using the app for money transfers. However, it lacks the robust trading features found in dedicated crypto exchanges.

3. Gemini: Best for Regulated Environment

Buying Bitcoin on Gemini is easy. It is known for being heavily regulated and trusted by institutions. It strikes a balance between ease of use and compliance.

Regulatory oversight: Gemini is licensed and regulated in the U.S., making it one of the most compliant exchanges.

Bitcoin rewards credit card: Users can earn Bitcoin by spending with the Gemini Credit Card.

Secure storage: Digital assets are insured and stored in offline, air-gapped cold storage systems.

Therefore, Gemini suits users who value trust, regulation, and additional features like earning Bitcoin while spending. It may not have the lowest fees, but its compliance-first approach adds confidence.

4. eToro: Best for Social Trading

eToro combines crypto trading with a social platform that allows users to copy strategies from top Bitcoin investors. It’s ideal for people who want to learn by following others.

CopyTrader feature: You can automatically mirror the Bitcoin trades of experienced investors.

Beginner-friendly interface: eToro’s platform is sleek and accessible on both desktop and mobile.

Multi-asset exposure: Users can invest in stocks and crypto in one place, making it easier to manage diversified portfolios.

Buying Bitcoin on eToro is simple. While it’s not the deepest platform for technical analysis, it excels at making crypto feel approachable.

5. Binance.US: Best for Low Fees

Binance.US offers a robust trading experience with some of the lowest fees in the U.S. market. While it caters more to experienced users, beginners can still navigate it with a bit of practice.

Low trading fees: Binance.US charges just 0.1% per trade, and users can further reduce fees by paying with BNB tokens.

Recurring buys: You can schedule recurring Bitcoin purchases to dollar-cost average over time.

Advanced tools: For users who want more control, Binance offers charting, order types, and trading pairs for Bitcoin.

Although Binance.US doesn't have Coinbase's educational focus, it's a smart choice if you plan to buy Bitcoin regularly or in larger amounts.

6. Kraken: Best for Security

Kraken is widely recognized for its strong security practices and transparent operations. It has never been hacked since its founding in 2011, which gives investors peace of mind.

Strong security: It uses cold storage, two-factor authentication, and global settings lock for extra safety.

OTC services: Kraken offers Over-the-Counter (OTC) trades for large Bitcoin purchases, ideal for high-net-worth individuals.

Educational content: Kraken Learn provides in-depth guides on Bitcoin investing, helping users make informed decisions.

As a result, buying Bitcoin on Kraken appeals to security-focused investors who are serious about crypto. While it has fewer flashy features than newer platforms, its stability and history are a major plus.

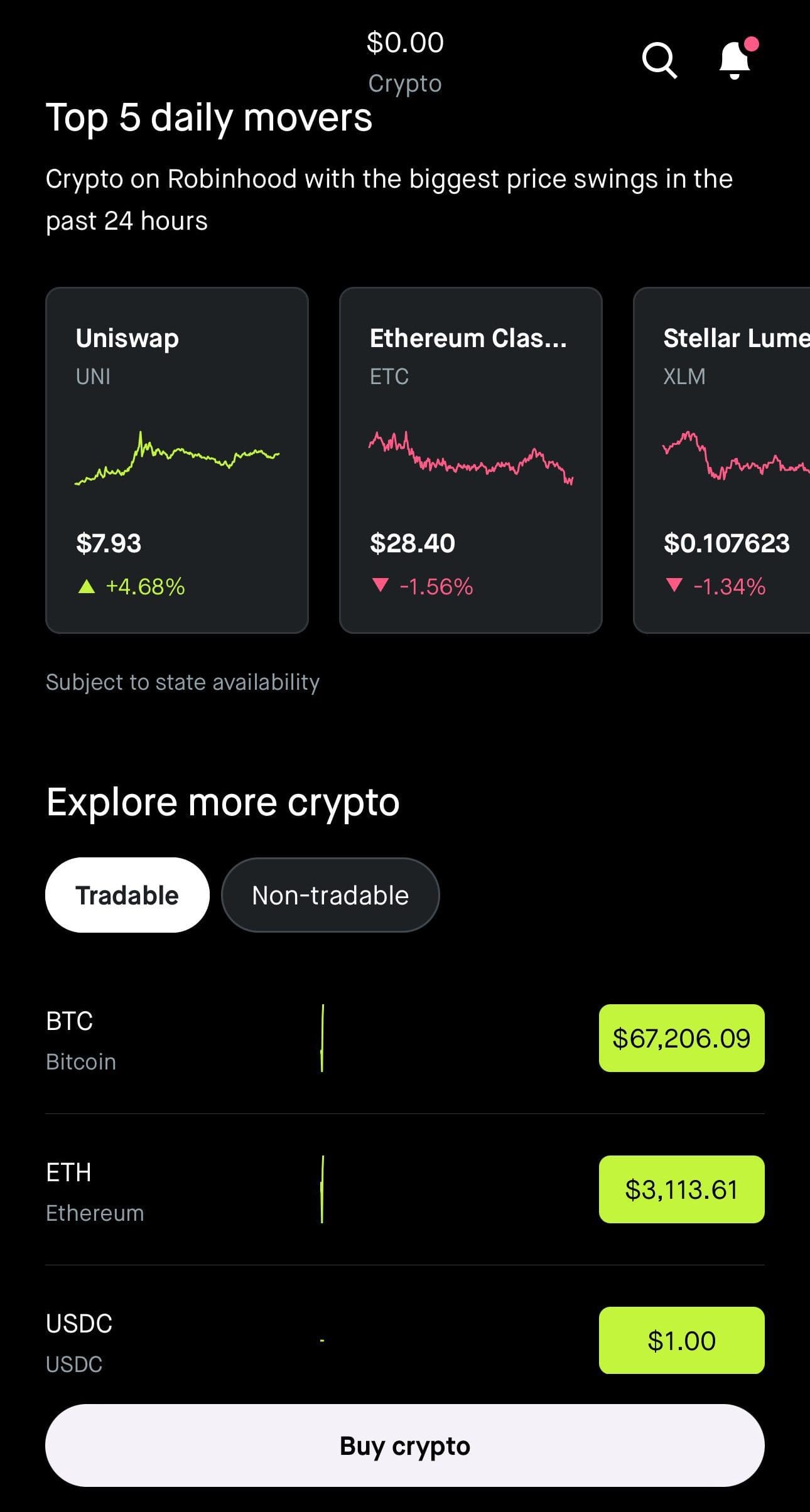

7. Robinhood: Best for Bitcoin with Stock Investing

Robinhood allows users to buy Bitcoin alongside stocks and ETFs in one streamlined app. It’s especially appealing to investors who prefer managing everything in one place.

Zero commission fees: Bitcoin purchases come with no direct trading fees, though spreads apply.

Unified portfolio: You can view your crypto and stock investments side by side in a single dashboard.

Instant funding: Users can access up to $1,000 instantly for crypto purchases through Robinhood Instant.

Because it’s beginner-friendly and offers commission-free trading, Robinhood is ideal for newer investors. However, it doesn't allow users to withdraw Bitcoin to external wallets.

8. Swan Bitcoin: Best for Automatic Recurring Buys

Swan Bitcoin focuses exclusively on Bitcoin, offering a simple interface and tools designed for long-term investors who want to dollar-cost average.

Auto-invest tools: Users can schedule recurring daily, weekly, or monthly Bitcoin buys.

Low fees: The platform charges modest fees, with better rates for larger volume or annual payment plans.

Direct wallet withdrawals: Bitcoin can be auto-withdrawn to your self-custody wallet for enhanced control.

Swan Bitcoin is great for Bitcoin-only investors who want a hands-off, secure, and savings-style approach. It’s not for those looking to trade altcoins or other assets.

Things to Consider Before Buying Bitcoin

Before investing in Bitcoin, it’s important to understand the risks, mechanics, and tools involved so you can make informed decisions.

Volatility is high: Bitcoin's price can swing dramatically in short periods, so be prepared for sudden gains or losses.

Security is your responsibility: Storing Bitcoin on exchanges is convenient but risky. Consider transferring it to a private wallet for long-term safety.

Regulations vary: Bitcoin is legal in most countries, but local tax and reporting rules differ—research your region’s laws before buying.

Fees can add up: Trading platforms often charge spreads or transaction fees that eat into your profits. Compare costs across exchanges first.

Use cases differ: Decide if you’re buying Bitcoin for investment, payments, or speculation, as each goal may require a different approach.

Understanding these factors can help you avoid common mistakes and better align your Bitcoin purchases with your financial goals.

FAQ

Yes, platforms like Cash App and PayPal are safe for basic Bitcoin purchases, especially with strong authentication. However, these platforms may restrict withdrawals to external wallets, limiting control.

Most regulated exchanges require identity verification due to anti-money laundering laws. If you want privacy, look for peer-to-peer platforms or Bitcoin ATMs—but be cautious about scams and fees.

You can leave Bitcoin on the exchange, but it's safer to transfer it to a private wallet you control, especially for long-term storage or large amounts.

Swan Bitcoin and Coinbase both offer solid recurring buy options. Swan focuses on long-term investing with automatic wallet withdrawals, while Coinbase provides a more general user experience.

Yes, most platforms allow you to buy fractions of a Bitcoin, sometimes as little as $1 or less, making it accessible to all types of investors.

No, credit card purchases usually come with higher fees than bank transfers. Platforms like Coinbase and Bitstamp clearly show fee differences during checkout.

Gemini and BlockFi (when available) offer Bitcoin rewards through credit card spending. These features let you earn Bitcoin passively as you make everyday purchases.

Using a regulated U.S. exchange offers added legal protection and clearer tax reporting. Exchanges like Gemini, Kraken, and Coinbase comply with U.S. financial laws.

Some platforms, like Coinbase and BitPay, accept PayPal and Apple Pay. However, availability depends on your region and may have higher processing fees.

If you leave Bitcoin on the exchange and it gets hacked, recovery isn't guaranteed unless the platform has insurance. That's why transferring to a private wallet is recommended.

Not all platforms offer crypto-to-crypto trading. Exchanges like Binance and Kraken support it, but simpler apps like Cash App only let you buy and sell Bitcoin in USD.