Table Of Content

What Is a Stock Buyback and How Does It Work?

A stock buyback, also known as a share repurchase, is when a company uses its cash to purchase shares of its stock from the open market or directly from shareholders. This reduces the number of outstanding shares and can benefit existing investors. Here's how it works:

The company announces a buyback plan, specifying the amount or percentage of shares it intends to repurchase.

Shares are bought over time through the open market, tender offers, or private negotiations.

Fewer outstanding shares mean each remaining share represents a larger ownership stake in the company.

As a result, metrics like earnings per share (EPS) often improve, potentially boosting the stock price.

For example, in 2023, Apple spent over $77 billion on buybacks to return value to shareholders and signal confidence in its future performance.

Why Companies Choose to Buy Back Shares?

Companies repurchase shares for strategic financial reasons. Each motivation serves a different purpose depending on the company’s goals, market conditions, or internal structure:

Company | Year | Buyback Size | Reason | Impact |

|---|---|---|---|---|

Apple | 2023 | $77 billion | Return capital | Increased EPS |

Meta Platforms | 2023 | $25 billion | Undervalued shares | Boosted investor confidence |

McDonald’s | 2024 | $3.5 billion plan | Support stock price | Stronger market performance |

Alphabet (Google) | 2023 | $70 billion | Offset compensation dilution | Maintained share stability |

ExxonMobil | 2023 | $17.5 billion | Cash surplus post-boom | Returned excess cash |

-

Return Excess Cash to Shareholders Efficiently

Companies like Microsoft and Apple generate significant cash flow beyond what’s needed for operations or expansion.

Instead of increasing dividends—which commit them to recurring payouts—they use buybacks as a flexible way to return value to shareholders.

-

Improve Earnings Per Share and Stock Metrics

Reducing the share count increases earnings per share (EPS), making the company appear more profitable on paper.

McDonald’s, for instance, has used multi-billion-dollar buybacks to enhance its financial ratios and support its stock price, especially during periods of slower revenue growth

-

Signal Confidence in Undervalued Stock

When leadership believes the stock is undervalued, buybacks serve as a signal of confidence.

Meta Platforms repurchased over $25 billion in 2023 after a stock dip, reassuring investors of its long-term strength and growth potential.

-

Offset Dilution from Stock-Based Compensation

Tech companies like Amazon and Google issue stock to employees as part of compensation.

Buybacks help neutralize the effect of this dilution, maintaining shareholder value and limiting the expansion of the total share count

Stock Buybacks vs. Dividends: Which Benefits Investors More?

Both stock buybacks and dividends offer ways to return value to shareholders, but they serve different investor needs.

- Buybacks are more flexible and can boost stock metrics like earnings per share, which may lead to long-term price appreciation.

- Dividends, on the other hand, provide immediate income and are favored by investors seeking steady cash flow—such as retirees who rely on quarterly payouts from companies like Coca-Cola.

The better option depends on the investor’s goals and the company’s financial strategy

Feature | Stock Buybacks | Dividends |

|---|---|---|

Payout Type | Indirect (via share price) | Direct cash to shareholders |

Flexibility | High, timing varies | Regular schedule (quarterly) |

Tax Efficiency | Often more favorable | May trigger income tax |

Ideal For | Growth-focused investors | Income-focused investors |

Stock Buybacks: Pros and Cons

Stock buybacks offer strategic advantages but also carry potential downsides depending on timing, intent, and how they're executed by management:

Pros | Cons |

|---|---|

Boosts earnings per share | Can misallocate capital |

Signals confidence in stock | Risk of bad timing |

Provides financial flexibility | Lack of transparency |

Offsets stock-based dilution | May benefit executives, not owners |

- Boosts Earnings Per Share (EPS):

Fewer outstanding shares can raise EPS, making the company appear more profitable—even if total profits stay flat.

- Signals Management Confidence

Buybacks often indicate executives believe the stock is undervalued, like Meta’s $25B repurchase after a price dip.

- Flexible Use of Capital

Unlike dividends, buybacks are optional and can be adjusted based on market or financial conditions.

- Offsets Share Dilution

Firms like Google use buybacks to balance out new shares issued through employee stock programs

- May Prioritize Optics Over Growth

Companies might use buybacks to artificially improve EPS instead of investing in innovation or expansion.

- Risk of Poor Timing

If shares are repurchased when overpriced, it wastes capital—as seen in some oil firms during boom years.

- Less Transparent Than Dividends

Investors may not clearly see the benefit unless share prices rise significantly post-buyback.

- Potential for Misuse

Executives with stock-based pay may favor buybacks to inflate stock prices short-term, not long-term value.

Spotting Buyback-Ready Companies: What to Watch For

Investors can spot potential buyback candidates by analyzing financial strength, stock performance, and management behavior. Here are a few ways:

Look for High Free Cash Flow: Companies generating consistent free cash flow, like Apple or Microsoft, often have the funds to buy back shares. This surplus makes them strong candidates for future repurchases.

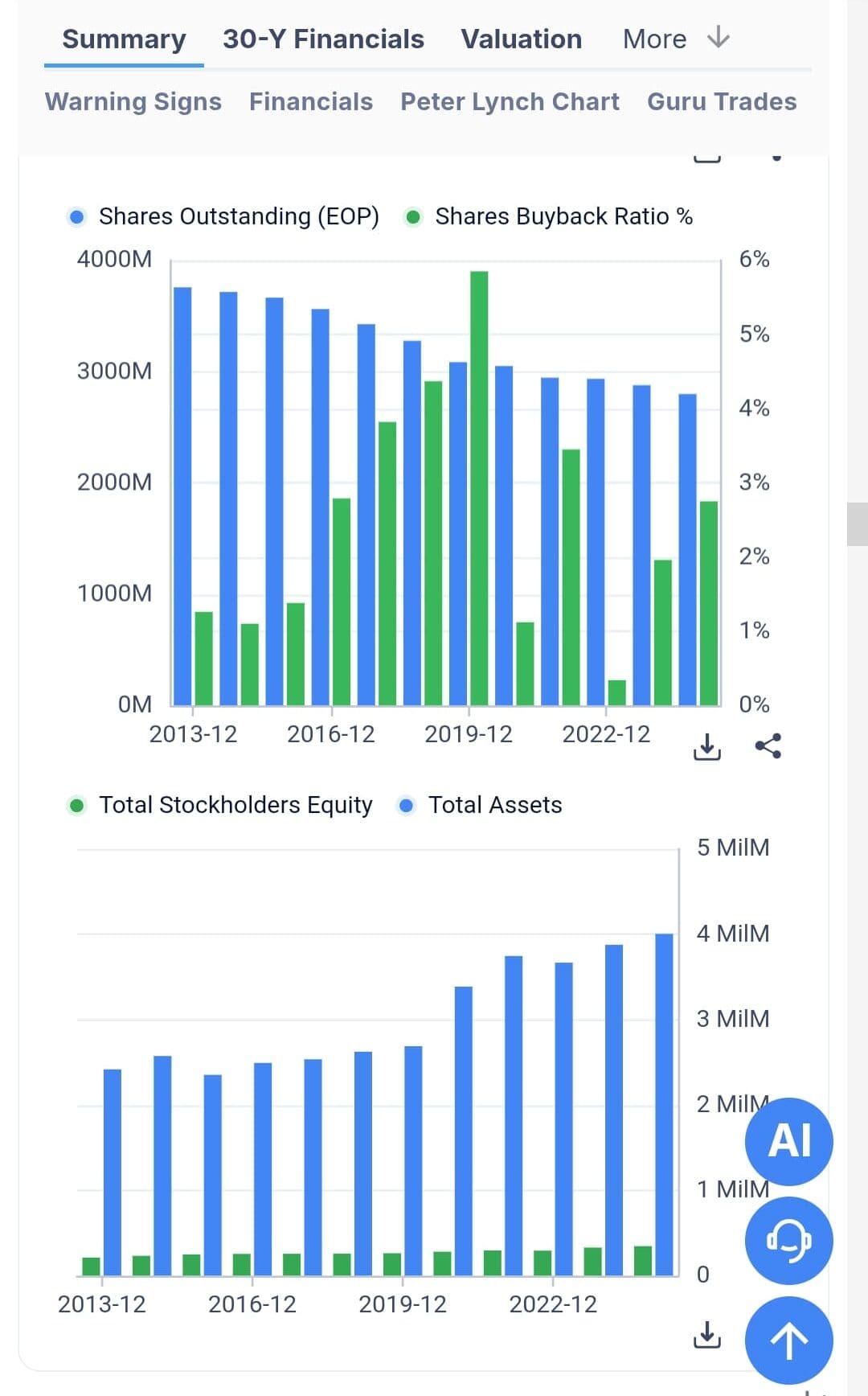

Monitor Share Count Trends: A declining number of shares outstanding over several quarters suggests active repurchase programs. You can track this using earnings reports or platforms like Morningstar and Yahoo Finance.

Watch for Undervalued Stocks with Strong Balance Sheets: Firms with low debt and undervalued stock (based on P/E or P/B ratios) are likely to initiate buybacks. For example, Meta ramped up buybacks when its share price dropped in 2022–2023.

FAQ

Not necessarily. While they can show confidence, some companies use buybacks to mask weak fundamentals or temporarily boost metrics.

They can reduce volatility in the short term by creating buying pressure, but the effect varies depending on the market and execution.

Yes. A buyback announcement isn’t a commitment. Companies can scale back or cancel based on market conditions or internal priorities.

Not always. Long-term holders may benefit from increased value, but short-term traders might not see immediate gains.

Buybacks don’t trigger a tax event unless the investor sells shares. Gains are taxed as capital gains, not income.

Yes. Companies might prioritize buybacks over dividends when they want flexibility or prefer capital returns without long-term payout obligations.

Open market buybacks happen gradually through stock exchanges. Tender offers involve buying shares at a set price directly from shareholders.

Yes, especially in the U.S., where the SEC requires companies to disclose repurchase activity to avoid market manipulation concerns.

Yes. Companies often repurchase shares when markets fall, believing their stock is undervalued and aiming to restore investor confidence.

Yes. Tech and financial companies often lead in buybacks due to strong cash flow and fewer reinvestment needs compared to capital-intensive sectors.