If you’re stuck between Yahoo Finance Silver and Gold, think of it like research mode vs. beast mode. Silver is packed with pro research tools—Morningstar, Argus, and top-tier news. But Gold?

That’s for investors who want action. Trade ideas, smart money tracking, and 40 years of data let you go full analyst.

Whether you’re building a dividend portfolio or hunting momentum plays, this breakdown will help you decide which one fits your investing vibe (and budget).

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

What You'll Get On Both Plans?

Here are 10 key features that both Yahoo Finance Silver and Gold plans include, focusing on what investors can expect at both levels.

While Gold expands on some of these features, this list strictly reflects what is shared between the two tiers.

-

Stock & ETF Screener

Both Silver and Gold plans include access to Yahoo Finance’s powerful screener tool, which filters stocks and ETFs based on metrics like market cap, sector, dividend yield, and analyst ratings.

For example, a dividend investor can search for high-yield stocks in the utilities sector. This is one of the best stock screeners apps out there.

-

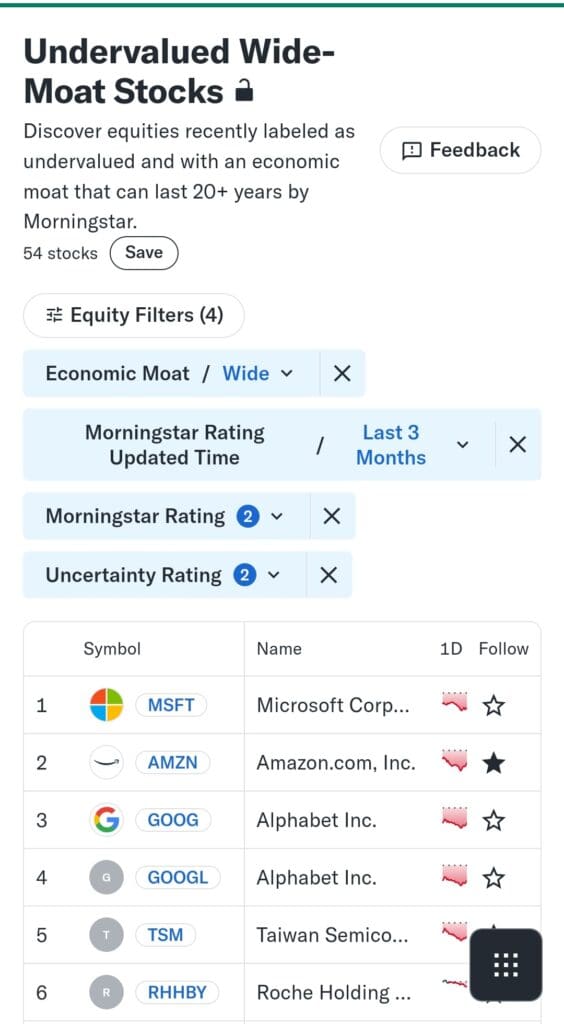

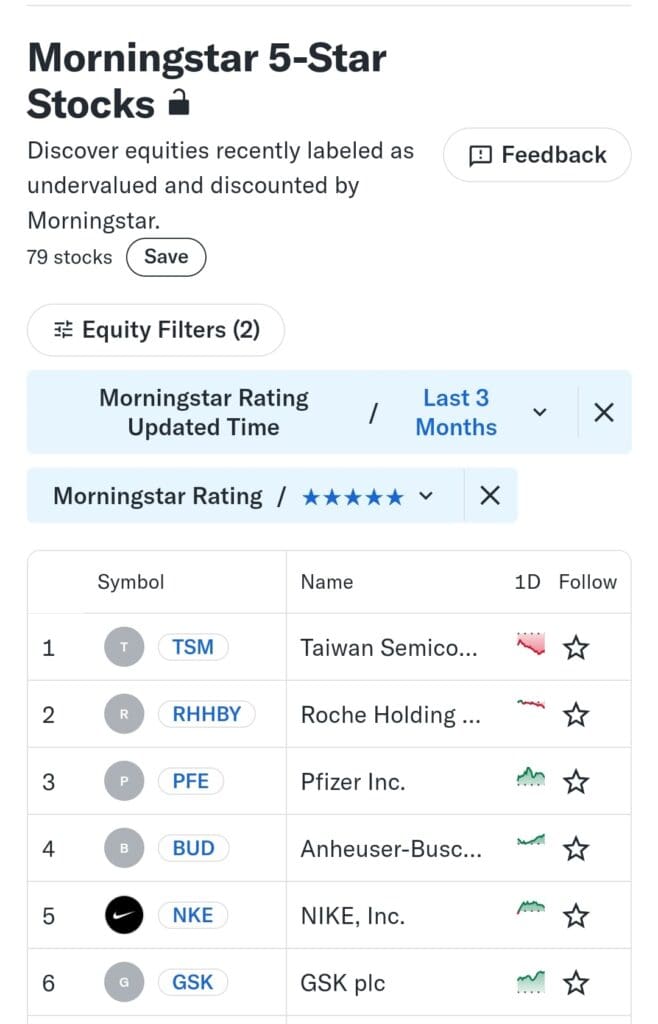

Morningstar Stock Ratings

Subscribers to both Silver and Gold plans gain access to Morningstar’s professional stock research. These ratings include fair value estimates, competitive analysis, and a 1–5 star system.

For instance, an investor can quickly assess whether a stock like Procter & Gamble is undervalued or overvalued before buying.

-

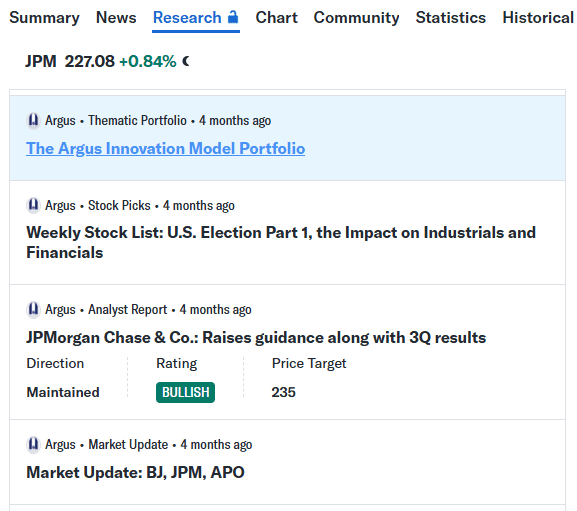

Argus Research Reports

Each plan includes Argus Research‘s analyst-backed stock picks and commentary. These reports help investors identify buy, hold, or sell opportunities based on deep company analysis.

An investor researching Tesla can use Argus insights to understand earnings trends and macroeconomic impacts.

-

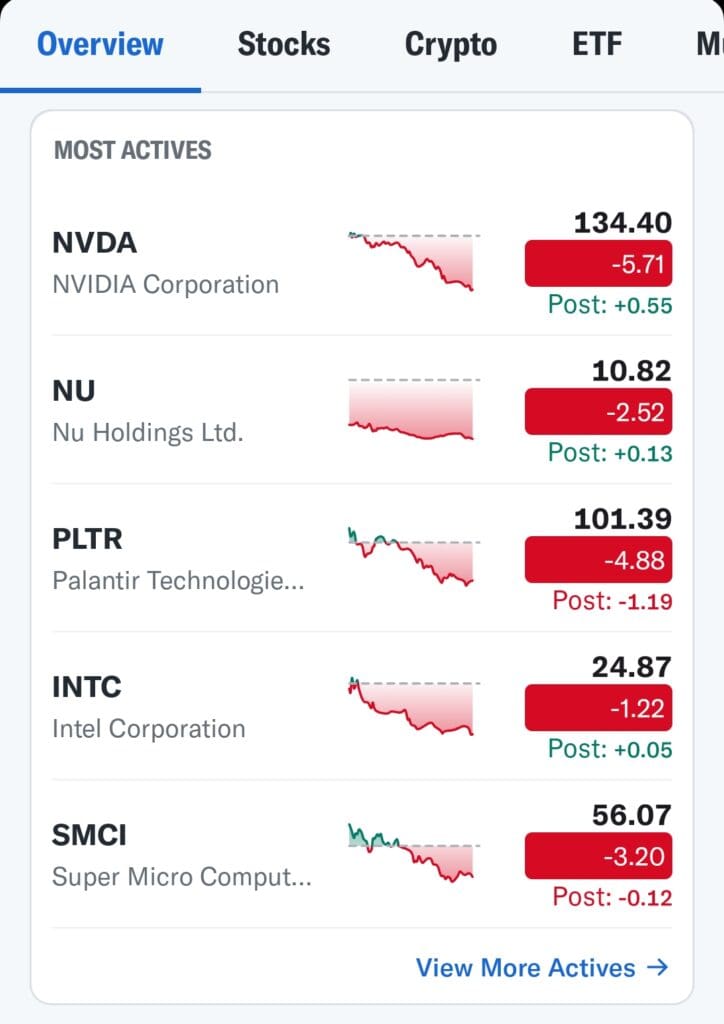

Real-Time Stock Quotes

Silver and Gold users receive live stock price updates without any delay. This is vital for active investors tracking volatility or planning swing trades.

For example, someone watching Nvidia after earnings will see price movements in real time, allowing faster reaction.

-

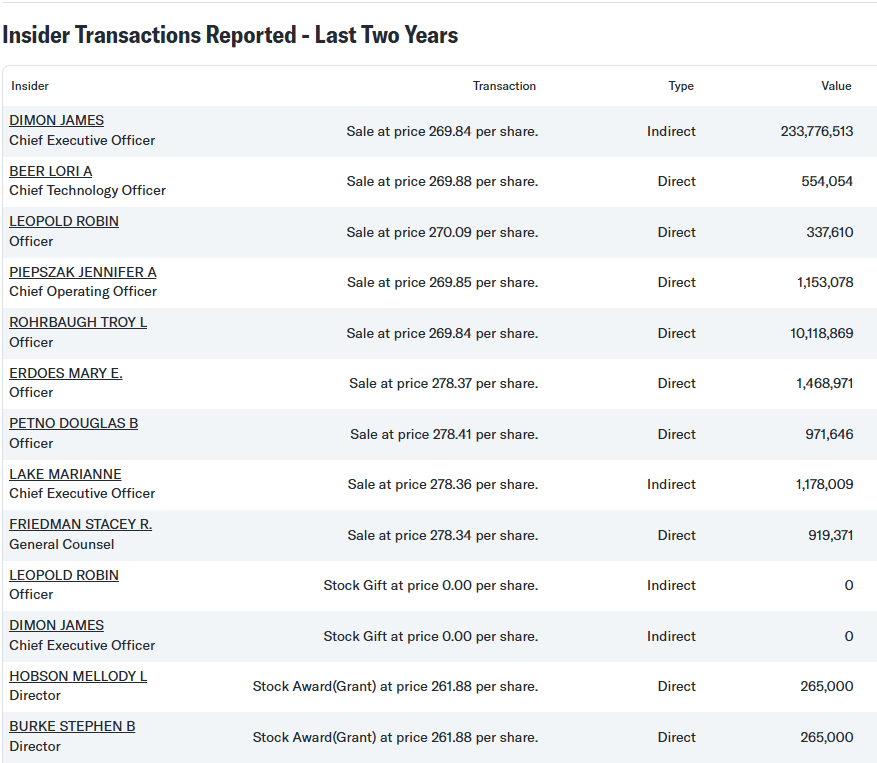

Insider Trading Insights

Both plans offer detailed insider trading data, such as recent CEO stock purchases or CFO sales.

Investors can use this to spot confidence or caution from management. If a company like Apple sees heavy insider buying, it may signal long-term bullish sentiment.

-

Portfolio Risk & Performance Tracking

Silver and Gold users can track their full investment portfolios, assess performance over time, and analyze sector exposure.

For example, a user linking a Fidelity and Robinhood account can visualize total returns, see volatility trends, and check diversification across tech and healthcare sectors.

-

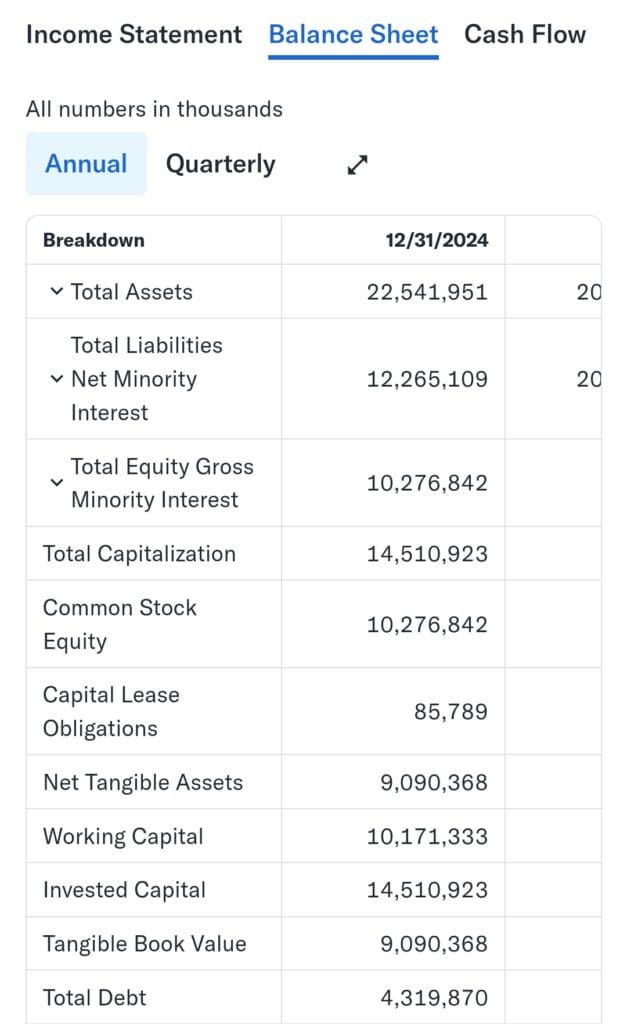

Company Financials Overview

Each plan provides in-depth access to financial statements including income, balance sheet, and cash flow reports.

This helps value investors compare revenue growth, profit margins, and debt levels before choosing between companies like Johnson & Johnson or Pfizer.

-

Stock Charts with Technical Indicators

Silver and Gold both support basic technical charting features like moving averages, RSI, and MACD.

For example, a trader looking at Meta can use a 50-day moving average to identify a bullish crossover.

-

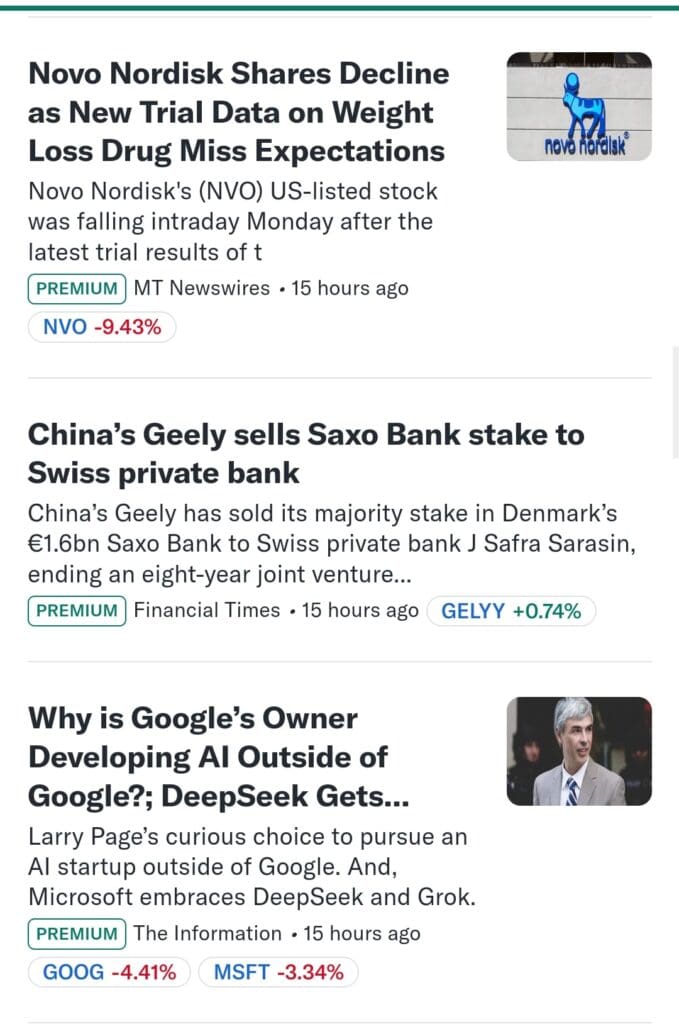

Premium News Access

Users at both levels can read premium articles from sources like Financial Times and The Information. This is especially useful for staying ahead of market shifts.

For instance, if the Financial Times covers a pending merger, investors can evaluate how it may impact related stocks.

-

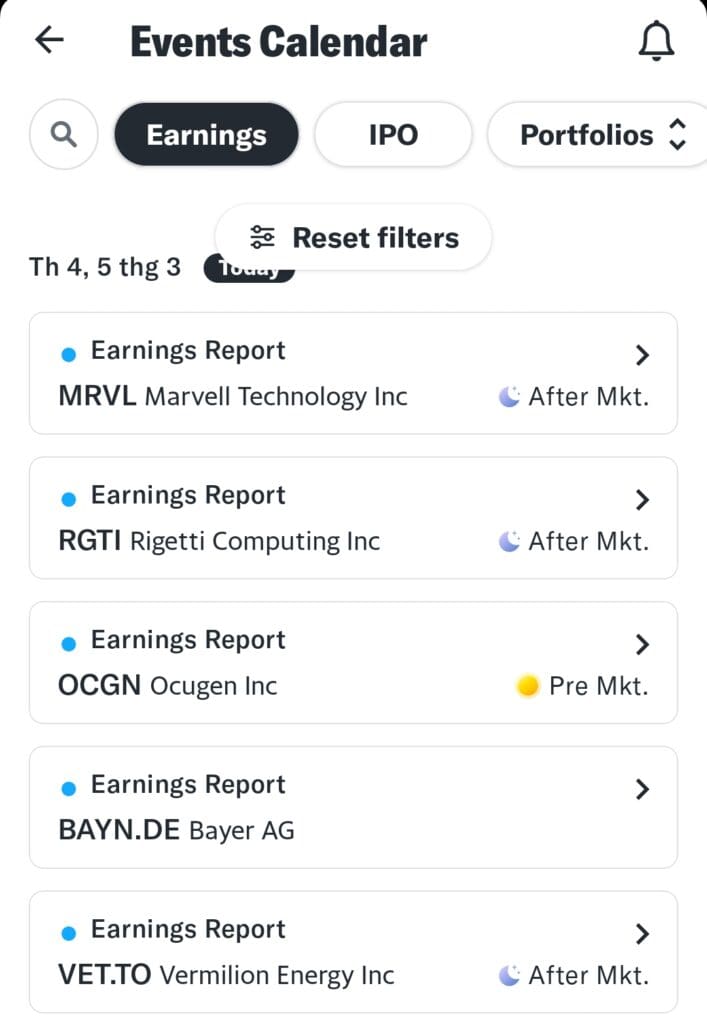

Earnings Calendar & Alerts

Silver and Gold subscribers get a real-time earnings calendar with alerts. This helps traders prepare for key events like Amazon’s quarterly results.

They can set notifications to track pre-market or after-hours movement, making it easier to plan trades around earnings volatility.

What You'll Get If You Upgrade To The X Plan?

Here are 7 standout features that are unique to the Yahoo Finance Gold plan, offering advanced tools for investors who want deeper analysis and trading insights.

-

40 Years of Historical Financial Data

Yahoo Finance Gold unlocks up to four decades of income statements, balance sheets, and cash flow reports.

This extended history supports deep fundamental analysis and long-term trend evaluation.

-

Advanced Technical Chart Patterns

With over 50 chart patterns and event annotations, Gold is one of the top professional-level technical analysis tools.

Traders can identify breakouts, reversals, and trend setups using visual tools like double tops or head-and-shoulders.

-

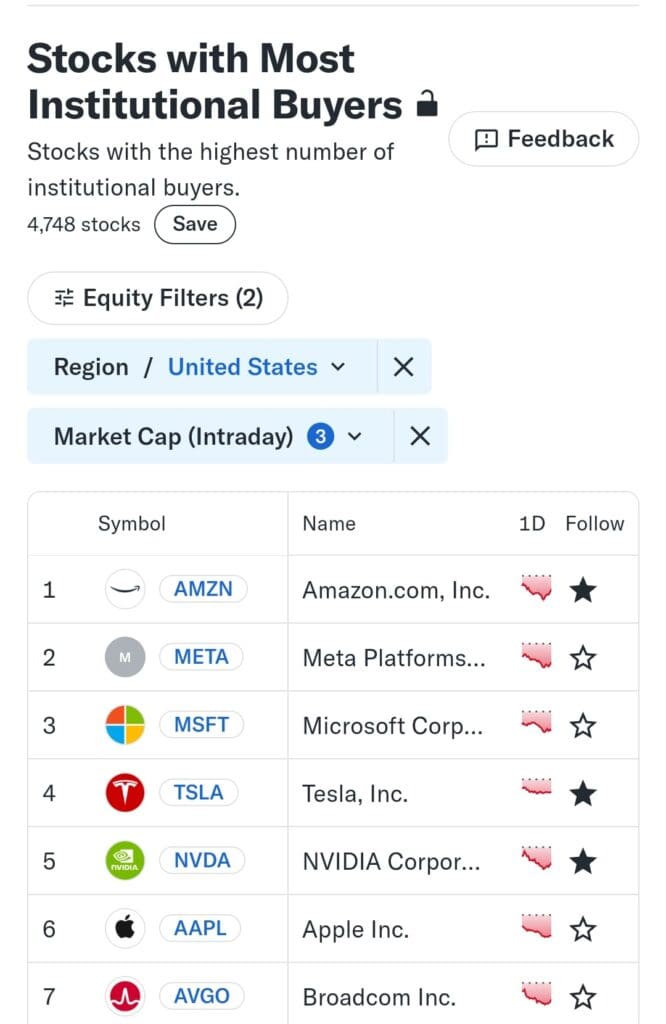

Smart Money Screener

Gold introduces a screener that tracks institutional activity, such as hedge fund purchases and large fund holdings.

This helps investors follow “smart money” and align their trades with institutional sentiment. Silver users don’t include this level of institutional insight.

-

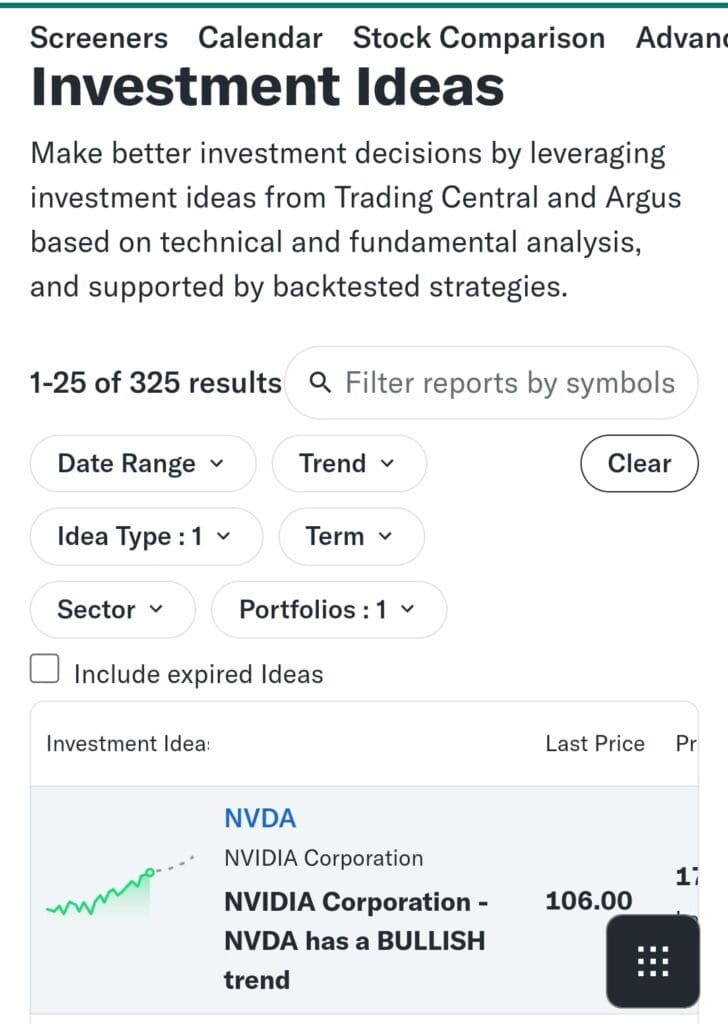

Personalized Trade Ideas

Gold users receive curated trade suggestions based on technical indicators, stock momentum, and analyst data.

This helps investors discover high-probability opportunities aligned with their portfolio and market interests.

-

Export Historical Data to CSV

Gold subscribers can download stock data, earnings reports, and financials directly into CSV files for Excel or Google Sheets analysis.

This is ideal for backtesting strategies or creating custom models. Neither the Bronze nor the Silver plan supports data exports.

-

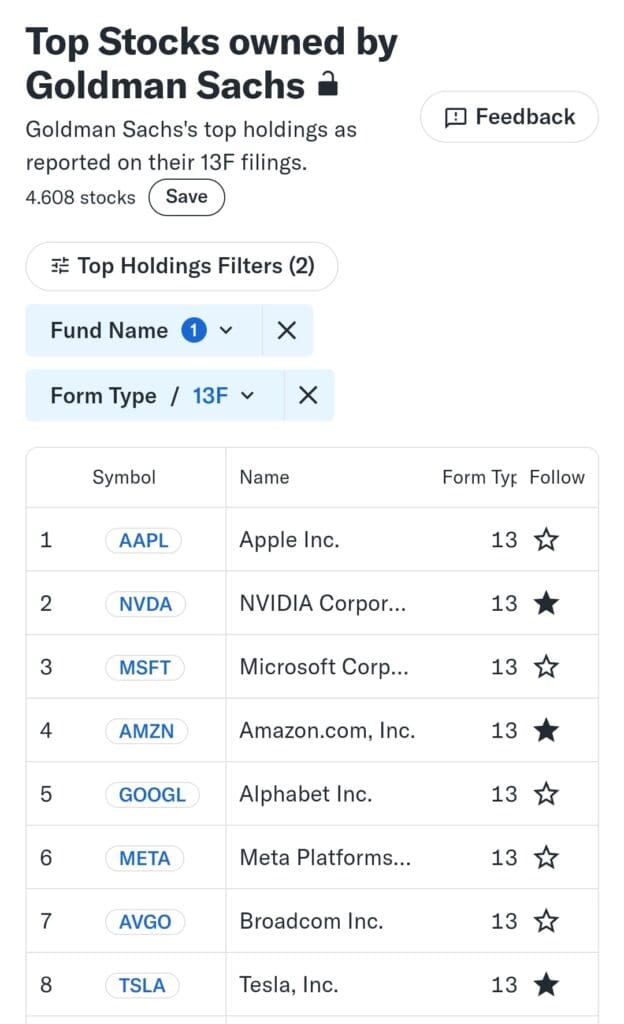

Top Holdings Screener

This tool lets Gold users see which stocks are most commonly held by institutions like mutual funds and hedge funds.

Investors can spot widely supported stocks or hidden gems gaining traction. It’s a unique feature not available in the lower-tier plans.

-

Technical Pattern Alerts

Gold users can set real-time alerts for technical chart setups like moving average crossovers or breakout zones.

These alerts allow active traders to act immediately without constantly monitoring charts. Lower tier users only get basic price alerts without pattern-specific notifications.

Which Investor Types May Prefer the Yahoo Finance Silver Plan?

The Silver plan is ideal for investors seeking professional stock research, fair value analysis, and market-moving news without advanced technical tools.

Fundamental Analysts: Silver provides Morningstar and Argus ratings, making it perfect for those who base decisions on company financials and expert insights.

Long-Term Stock Investors: Buy-and-hold investors can validate picks using research reports and access fair value estimates for better entry points.

Dividend & Income Seekers: Track dividend sustainability and payout ratios to build a stable income-focused portfolio.

News-Driven Investors: Premium access to Financial Times and The Information keeps users ahead of macroeconomic shifts and company-specific developments.

Overall, Silver is a smart fit for research-focused investors who want more than free data but don’t need trading-level tools.

Which Investor Types May Prefer the Yahoo Finance Gold Plan?

Gold suits investors who want personalized trading ideas, institutional-level data, and advanced charting for deeper strategy and research execution.

Active Swing Traders: Benefit from real-time technical alerts, pattern recognition, and custom trade ideas to identify timely entry and exit points.

Institutional Trend Followers: Use the Smart Money and Top Holdings screeners to track hedge fund activity and align with big-money moves.

Data-Heavy Analysts: Access to 40 years of historical financials and CSV exports enables custom models, backtesting, and long-term forecasting.

DIY Portfolio Managers: Advanced portfolio tools, deep financial data, and technical chart overlays help manage and adjust investments with precision.

Gold is ideal for hands-on investors ready to act on data-driven insights with pro-level features.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

Yahoo Finance Silver vs Gold: Which Is Best For You?

Silver is perfect if you want strong research reports, premium news, and better stock validation tools. It’s affordable and ideal for long-term, research-driven investing.

But, if you’re an active trader or a data nerd, Gold offers way more—trade ideas, technical alerts, smart money tracking, and deep financial data.