Table Of Content

What Is Zacks Investment Research?

Zacks Investment Research is a comprehensive platform widely used for fundamental analysis and stock research.

It provides key market insights, stock rankings, and expert-backed research, making it an essential tool for investors aiming to make informed decisions.

Zacks offers a mix of free and premium features, including access to stock ratings through its Zacks Rank, analyst reports, earnings estimates, and sector performance insights.

Premium plans provide more detailed equity research reports, stock screeners, and deeper insights into stocks, mutual funds, and ETFs for those considering a Zacks subscription.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Zacks Premium | Annual: $249 ($20.75/month)

No monthly plan | 30-day free trial |

Zacks Investor Collection | $59

$495 ($41.25 / month) if paid annually | 30-day free trial |

Zacks Ultimate | $299

$2,995 ($249.5 / month) if paid annually | 30-day free trial |

How to Use Zacks Fundamental Analysis Tools

Zacks offers a wide range of fundamental analysis tools that can help investors identify strong stocks, ETFs, and mutual funds based on key financial metrics.

Here are four effective ways to leverage Zacks' tools for stock research:

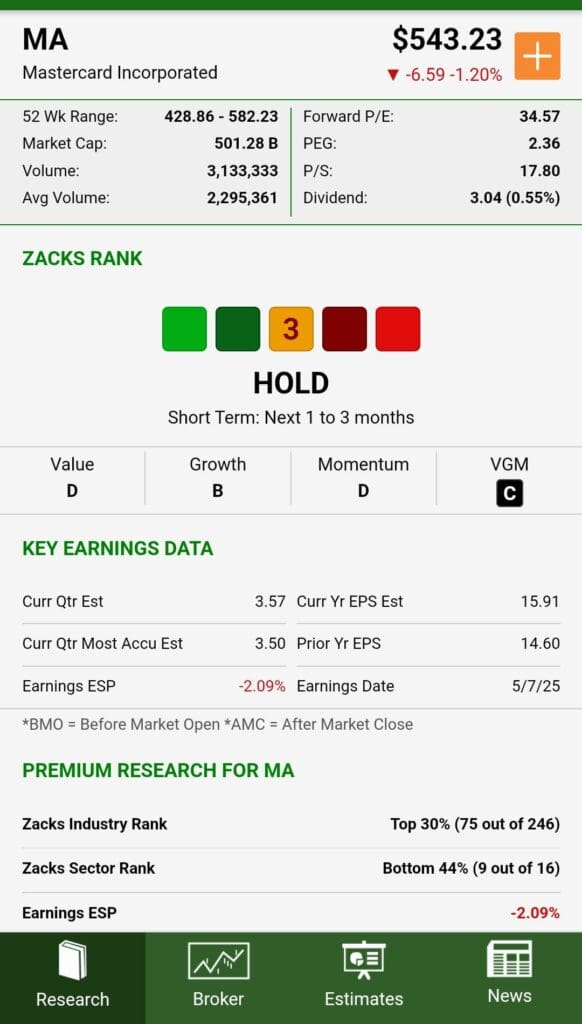

1. Leverage Zacks Rank for Stock Evaluation

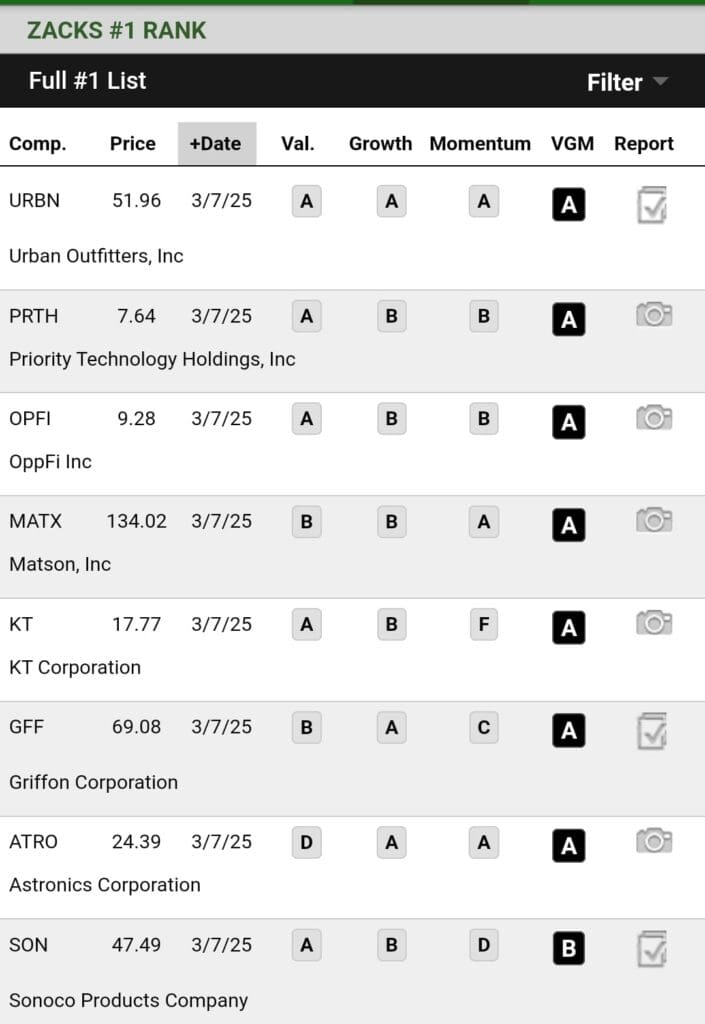

The Zacks Rank is one of the platform's key features, providing a proprietary rating system for stocks, ETFs, and mutual funds. It evaluates securities based on earnings estimate revisions from analysts. The rank categorizes stocks from Strong Buy (Rank #1) to Strong Sell (Rank #5), giving investors a quick way to assess stock potential.

Earnings Estimate Revisions: The Zacks Rank updates daily based on analysts’ earnings revisions, which reflect changing market sentiment.

Performance History: Stocks ranked #1 have a historical track record of outperforming the market, making them a solid choice for growth-focused investors.

2. Use Zacks Style Scores for Additional Insights

The Zacks Style Scores offer a deeper layer of analysis by grading stocks based on three critical factors: Value, Growth, and Momentum. These scores help investors assess whether a stock aligns with their investment strategy.

Value: Identifies undervalued stocks based on valuation metrics like P/E and P/B ratios.

Growth: Highlights stocks with strong earnings and revenue growth potential.

Momentum: Pinpoints stocks showing strong price performance, making them attractive for technical traders.

-

Examples

An investor seeking growth stocks might filter for stocks with an A in Growth Score and a B in Momentum Score, ensuring they’re targeting companies poised for earnings growth and market price appreciation.

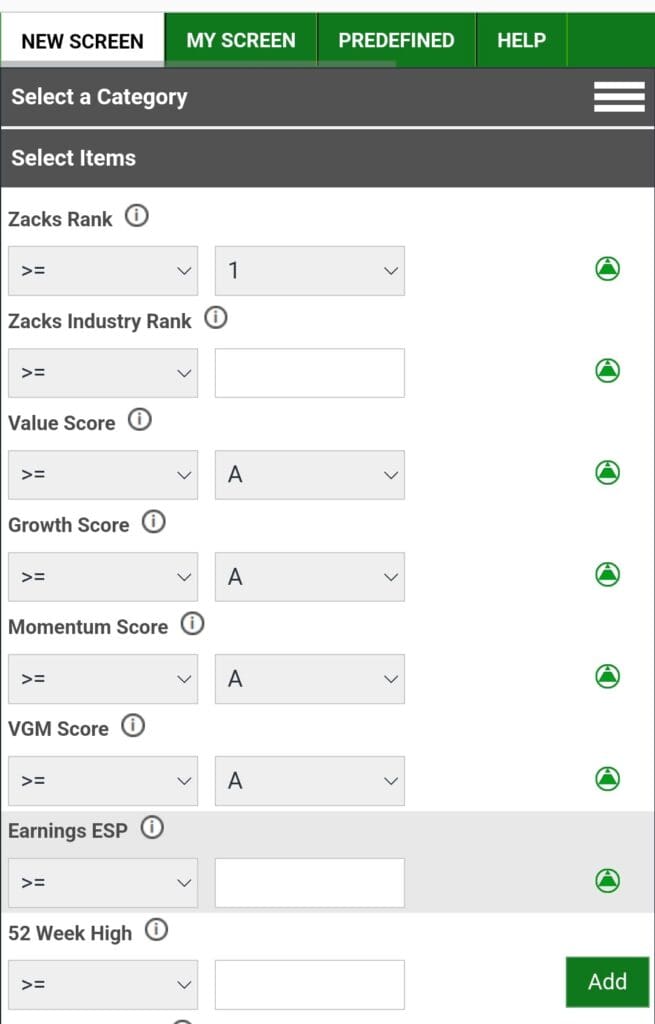

3. Utilize the Zacks Stock Screener for Customized Research

The Zacks Stock Screener allows investors to filter stocks based on a wide range of customizable criteria. It is a useful tool for narrowing down a large universe of stocks to match specific investment goals.

Sector & Industry: Filter stocks based on industry sectors, such as technology or healthcare.

Market Cap: Choose stocks from small-cap to large-cap to suit different risk appetites.

Valuation & Earnings Metrics: Set filters based on earnings growth, P/E ratios, and dividend yields.

-

Examples

An investor interested in growth stocks in the technology sector can filter stocks by Market Cap > $10B, Sector: Technology, and a P/E Ratio < 20, identifying mature companies with significant growth potential.

4. Explore Zacks Research Reports for In-Depth Stock Analysis

Zacks provides equity research reports on over 1,000 companies. These reports offer detailed analysis of a company’s fundamentals, including its growth prospects, valuation metrics, competitive positioning, and earnings forecasts.

The reports also include Zacks Rank and Style Scores to give a well-rounded view of each stock.

Equity Research: Zacks reports break down the strengths and weaknesses of companies, helping investors understand whether a stock is a good buy, hold, or sell.

In-Depth Metrics: Key metrics include return on equity (ROE), net profit margin, and growth projections.

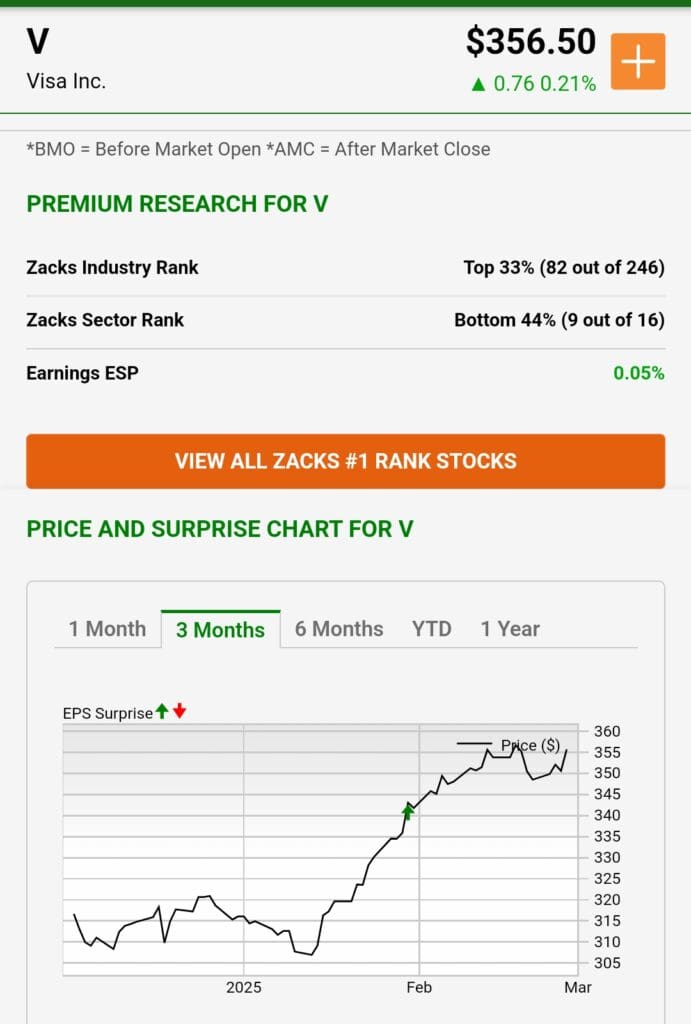

5. Monitor Industry Trends with Zacks Industry Rank

Zacks' Industry Rank groups stocks into over 250 sectors and ranks them based on earnings estimate trends. This ranking system helps investors identify which industries are performing well and likely to continue outperforming.

Sector Analysis: Zacks uses earnings estimate trends to rank industries and sectors, providing insight into which ones are gaining momentum.

Industry Outperformance: Research shows that stocks from top-ranked industries tend to outperform those in lower-ranked sectors.

6. Track Earnings Trends with Zacks Earnings ESP

The Zacks Earnings ESP (Expected Surprise Prediction) filter identifies stocks with the highest likelihood of beating earnings estimates. This tool is valuable for short-term investors and those interested in earnings-driven strategies.

Earnings Surprises: The Earnings ESP filter shows stocks with analysts' expectations likely to be exceeded, making them potential opportunities for short-term gains.

EPS Revisions: The filter also incorporates analysts' earnings revisions, giving an up-to-date picture of stock momentum.

7. Use the Zacks Focus List for Handpicked Recommendations

Zacks Ultimate includes exclusive access to the Focus List, a curated portfolio of 50 stocks chosen by Zacks analysts based on strong earnings momentum and growth potential.

This curated list is ideal for long-term investors looking for high-quality, well-researched stock picks.

Expert-Curated: Each stock on the Focus List comes with a detailed research report explaining why it was selected, backed by Zacks' proprietary ranking and research tools.

Long-Term Focus: These stocks are selected for their strong future growth prospects, making them ideal for investors who want a long-term buy-and-hold strategy.

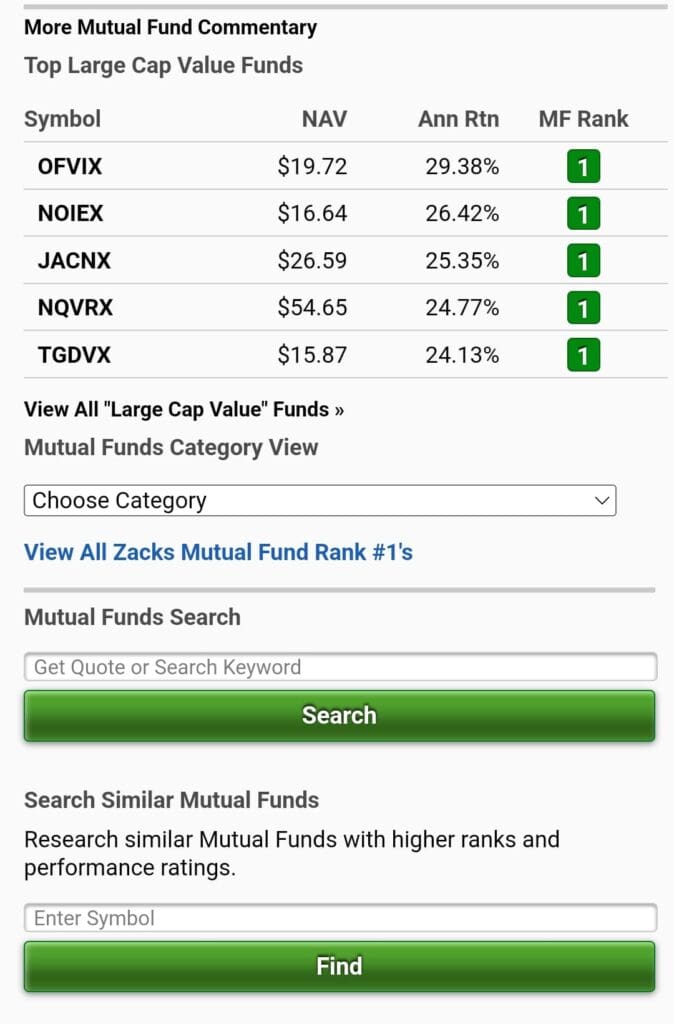

8. Evaluate Mutual Funds with Zacks Mutual Fund Rankings

Zacks offers Mutual Fund Rankings, which provide insight into fund performance, risk, and expenses. These rankings are based on factors like historical returns, management quality, and portfolio composition.

Fund Performance: Zacks ranks mutual funds based on their past performance over various time frames.

Risk Metrics: Investors can assess the risk of each fund using metrics like standard deviation, beta, and Sharpe ratio.

9. Access Zacks Rank #1 List with Zacks Premium

Zacks Premium gives you access to the Zacks Rank #1 List, a handpicked selection of stocks with the highest earnings estimate revisions.

This list includes top-rated stocks expected to outperform the market based on earnings growth potential.

Proven Performance: Stocks in the Zacks Rank #1 list have historically outperformed the market, giving investors an edge in selecting high-potential stocks.

Daily Updates: The list is updated daily, providing fresh insights on top-performing stocks in various sectors.

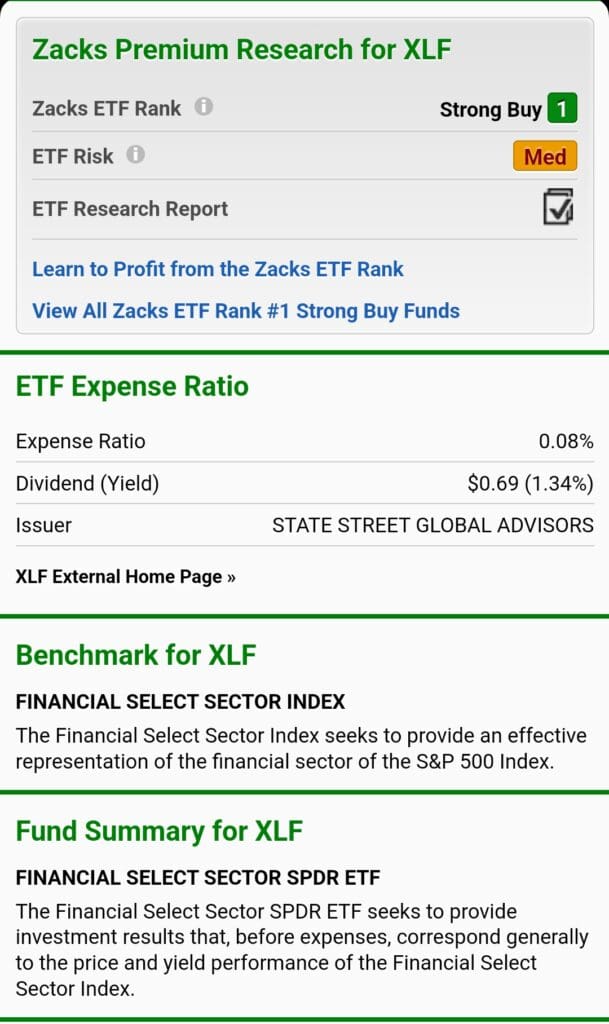

10. Analyze ETFs with Zacks ETF Research Reports

Zacks offers ETF Research Reports that provide in-depth analysis of exchange-traded funds, including fund composition, performance outlook, and sector breakdowns.

This tool helps investors assess which ETFs fit best into their portfolios.

Fund Composition: Zacks evaluates the underlying assets of each ETF, allowing investors to understand what stocks or sectors the fund is targeting.

Performance Outlook: The research report provides an outlook on the fund’s expected performance, helping investors make informed decisions about adding it to their portfolios.

FAQ

Zacks Rank is a proprietary system that evaluates stocks based on earnings estimate revisions from analysts. It ranks stocks from Strong Buy (Rank #1) to Strong Sell (Rank #5). This helps investors identify stocks with strong earnings potential and growth.

Zacks Rank is updated daily, reflecting the latest earnings estimate revisions. This ensures that the rank stays current and provides a real-time snapshot of a stock’s potential based on analysts’ updated expectations.

Zacks Style Scores grade stocks on three factors: Value, Growth, and Momentum. This tool helps investors focus on stocks that fit their preferred investment style, whether they prioritize undervalued stocks, growth potential, or strong price performance.

Zacks' Stock Screener allows you to filter stocks based on customizable criteria, such as Zacks Rank, market cap, sector, and Style Scores. This tool helps you narrow down stocks that meet specific investment goals, whether you're looking for growth or value stocks.

The Focus List is a curated list of 50 stocks chosen by Zacks analysts for their strong earnings momentum and growth potential. It’s an excellent resource for long-term investors looking for high-quality stock picks backed by expert analysis.

The Earnings ESP filter identifies stocks likely to exceed earnings expectations based on analysts’ revisions and historical accuracy. It helps investors target stocks with high potential for short-term price movement due to earnings surprises.

Yes, Zacks provides detailed research on mutual funds and ETFs, allowing you to filter and compare funds based on performance, expenses, and risk metrics. You can use this tool to find the best funds that align with your investment goals.

Absolutely. Zacks provides tools like the Focus List and Zacks Rank, which help identify stocks with strong long-term growth potential. These features are especially valuable for buy-and-hold investors who seek to build a diversified, growth-focused portfolio.