Despite the higher rates, Lending Point can be a Competitive option for those with fair credit.

APR

7.99% – 35.99%

Loan Amount

$2,000 – $36,500

Term

24 to 48 months

Min score

580

Despite the higher rates, Lending Point can be a Competitive option for those with fair credit.

APR

7.99% – 35.99%

Loan Amount

$2,000 – $36,500

Term

24 to 48 months

Min score

580

On Credible Website

Our Verdict

LendingPoint is an online personal loan provider, established in 2014 out of Atlanta, GA. LendingPoint focuses on “near prime” borrowers, or borrowers with average to poor credit who struggle to get a loan. The loan amount is $2,000 – $36,500 , and the current APR is 7.99% – 35.99% , depending on your creditworthiness.

Their turnaround time is really quick and most borrowers will see funds in their bank account within 24 hours. Lending Point has a flexible repayment system and doesn’t charge any type of penalty fee for prepayment.

As a popular choice for debt consolidation, Lending Point is a good option but it’s always important to look at the negatives before jumping on board. For example, they have higher interest rates than other companies, they give out a smaller max amount than others, and they charge a hefty late fee if you’re late on your payment too.

Qualifying for a LendingPoint Personal Loan

In order to apply for a personal loan with LendingPoint, certain eligibility criteria must be met. These requirements encompass aspects such as credit score, income, and documentation:

- Credit Score: Minimum credit score of 580 is required to qualify for a personal loan through LendingPoint.

- Income: Applicants must have a minimum annual income of $25,000 to be eligible for a loan.

- Age: Borrowers must be at least 18 years old to apply for a LendingPoint personal loan.

- Identification: Valid photo identification such as a driver's license or government-issued ID is required.

- Social Security Number: Applicants need a valid Social Security number for identity verification.

- Residency: Applicants must reside in a state where LendingPoint operates, excluding Nevada and West Virginia.

- Documentation: Additional documentation such as proof of income, employment verification, and recent bank statements may be required during the application process.

- No Co-signers or Co-applicants: LendingPoint does not permit co-signers or co-applicants on personal loan applications.

Navigating LendingPoint Repayment Options

From fixed monthly payments to flexible payment date arrangements, LendingPoint offers various repayment methods tailored to borrowers' needs:

- Fixed Monthly Payments: Borrowers are required to make fixed monthly payments over the chosen loan term.

- Payment Date Flexibility: While borrowers cannot choose their payment due date before signing the loan agreement, they have the option to change it after closing the loan, and once per year thereafter.

- Automatic Payments: Borrowers can set up automatic payments for convenience, ensuring timely repayment of their loans.

- Early Repayment: LendingPoint does not impose prepayment penalties, allowing borrowers to pay off their loans early to save on interest charges.

LendingPoint Loan Pros & Cons

As we know, each lender has its own pros & cons – here are the relevant things we found for potential borrowers:

Pros | Cons |

|---|---|

Quick Turnaround Times | Origination Fee |

Soft Pull Inquiry | No Secured Loans |

Ability To Refinance | Not Available in All States |

Flexible Repayments | Large Late Payment Fee |

No Prepayment Penalty | High Rates |

Free Credit Score Access | No joint or Co-Signed Loans |

- Quick Turnaround Times

LendingPoint has a quick process and an easy application. Many borrowers are approved with money in their account by the end of the next business day.

- Soft Pull Inquiry

LendingPoint allows for an initial soft pull inquiry online so the borrower can get an idea of the options for which they may qualify. A soft pull does not affect your credit.

- Ability To Refinance

Allows borrowers to potentially secure lower interest rates by refinancing existing loans.

- Flexible Repayments

You can customize your repayments. You can choose a payment due date and schedule your payments every other week, every 28 days, or monthly. You can also request one loan modification during the term of your loan.

- No Prepayment Penalty

Borrowers can pay off their loans early without incurring additional fees.

- No Prepayment Penalty

Provides borrowers with valuable credit monitoring tools at no extra cost.

- Origination Fee

LendingPoint deducts a one-time origination fee of 0% to 10% of your loan amount directly from your loan funds. This should be considered in the pricing of your loan when you apply.

- No Secured Loans

LendingPoint does not offer secured loans, which could be beneficial for borrowers seeking lower rates or easier qualification.

- Not Available in All States

LendingPoint is available in 40 states. See the list here.

- Large Late Payment Fee

LendingPoint has a late fee of $30, which is higher than most other providers.

- High Rates

LendingPoint has high rates. If you have a good credit history there are more competitive rates in the market.

- No joint or Co-Signed Loans

Lack of options for joint loans or co-signers may hinder borrowers who require additional support or have limited credit histor

Customer Experience

One of the drawbacks of using LendingPoint is that it only reports payment to two of the three major credit bureaus. The help center is very well managed, and it provides you with access to a large collection of personal finance resources.

LendingPoint's mobile app allows you to manage all aspects of your loan, which is ideal. The lender is also rated A+ by the Better Business Bureau.

LendingPoint | |

|---|---|

iOS App Score | 4 |

Android App Score | N/A |

TrustPilot | 4.9 |

BBB Rating | A+ |

Contact Options | phone/mail |

Availability | N/A |

The customer service phone number is 888-969-0959. Representatives are available from Monday to Friday, 8 a.m. to 12 a.m. ET, Saturdays from 10 a.m. to 9 p.m. ET, and Sundays from 10 a.m. to 4 p.m. ET.

Additionally, borrowers can email customer service at customerservice@lendingpoint.com for inquiries or assistance regarding their personal loans, including questions about applications, loan terms, payments, and other related concerns.

What Else You Should Know?

Before applying for a personal loan with LendingPoint, it's important to understand additional factors that could impact your borrowing experience:

-

Can I add a cosigner to a LendingPoint personal loan?

Unfortunately, LendingPoint does not allow joint or cosigned loans. If you want to add a cosigner to your loan, LendingPoint is not the right lender for you and you are better to look elsewhere.

However, the lower credit score requirements and flexible lending requirements may mean that you can qualify for a loan without needing a cosigner.

-

Can I get a LendingPoint loan with a 600 credit score?

LendingPoint provides loan options for individuals with less-than-perfect credit, so with a fair credit score of 600, you shouldn’t have trouble qualifying.

However, keep in mind that you may not be eligible for the lowest advertised rates, as those are usually offered to borrowers with good or excellent credit.

-

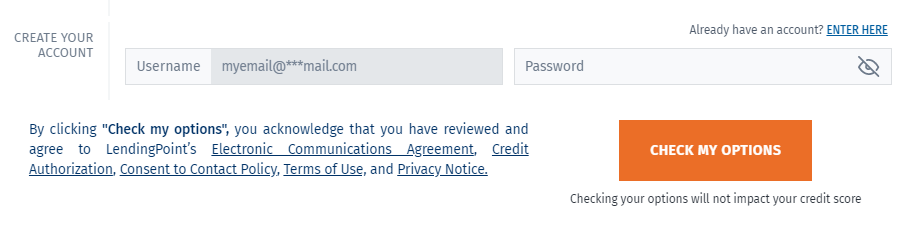

Do LendingPoint personal loans offer prequalification?

Yes, LendingPoint does allow potential customers to prequalify for a loan to streamline the application process and enable comparison shopping.

You can check the available personal loan offers without triggering a hard credit check. The online application is easy and you simply need to submit your name.

-

Is LendingPoint good for debt consolidation?

LendingPoint is a decent option if you’re looking for a debt consolidation loan. You can borrow $2,000 – $36,500

. While direct creditor payments are not offered, LendingPoint does offer quick access to the loan funds.

You may have the money in your account the following business day after approval, so you can quickly initiate payments to your creditors.

However, you do need to bear in mind that there may be an origination fee of 0% to 6% which is billed upfront from your loan funds.

What Can a LendingPoint Personal Loan Be Used For?

LendingPoint loans can be used to pay for debt consolidation or credit card refinancing, moving expenses, vacations, medical expenses, wedding expenses, car purchase or repair, or home improvements.

- Home Improvement – LendingPoint loans can be used for home repairs or renovations. The advantage of using a personal loan for home improvement is the promptness of receiving the funds. Typically, it takes a month or more to get an equity line of credit on your home.

- Debt Consolidation – Since LendingPoint focuses on borrowers with average or poor credit, it is a good provider for those wanting to pay down their debts.

- Vacation – LendingPoint offers a way to get money for your vacation without having to deal with credit cards, or worry about every dime during your travel.

- Wedding Expenses – LendingPoint loans can be used for wedding expenses like engagement rings, and reception and honeymoon costs.

- Moving Expenses – LendingPoint loans can be used to help with moving expenses. For example, a LendingPoint loan could help you take the risk of moving across the country for a new job.

Who Should Consider Applying?

LendingPoint personal loans are best suited for the following types of borrowers:

- Fair to average credit: Borrowers with credit scores ranging from fair (580 and above) to average may find LendingPoint's loan options accessible.

- Those seeking quick funding: Borrowers in need of fast access to funds, with potential same-day approval and next-day funding options.

- Individuals requiring small to medium loan amounts: Borrowers seeking loan amounts ranging from $2,000 to $36,500 for various purposes, such as debt consolidation or home improvement projects.

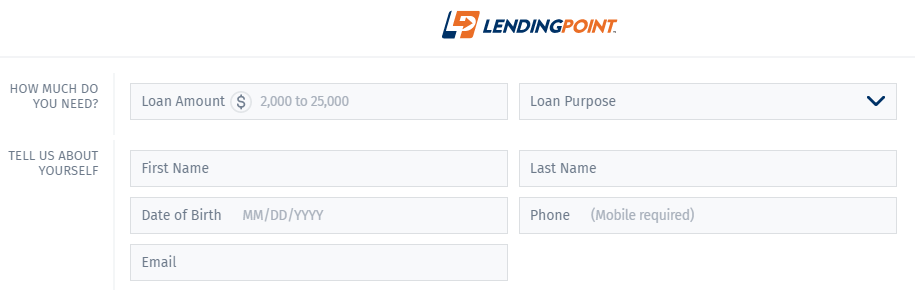

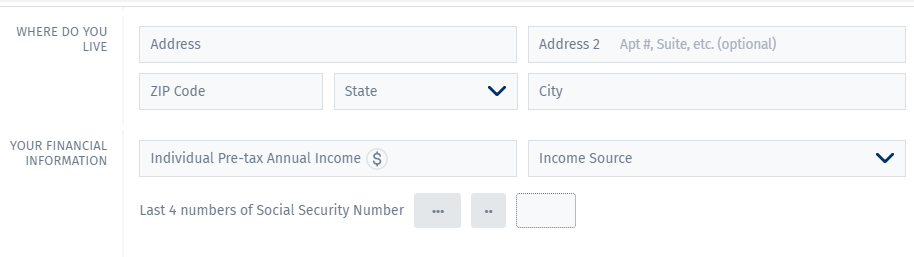

How to Apply With LendingPoint?

The LendingPoint application process only takes a few minutes.

You will fill out a short form with some basic questions about yourself, including your full name, contact information, date of birth, employment status, and income.

The minimum requirements for applying are a minimum credit score of 600 with no bankruptcy, charge-offs, or liens in the past 12 months. The borrower needs one year of consistent employment with a minimum annual income of $20,000.

LendingPoint will usually let you know if you are approved very quickly and have the money in your account in one day. Sometimes the borrower may need to provide verification information such as picture ID, social security card, bank statements, pay stubs, or tax returns.

LendingPoint FAQs

Is LendingPoint a good place to get a loan?

LendingPoint is a great option if you need to borrow a small amount and plan to repay it in under four years. It’s also a solid choice for those who need quick access to funds—approval can take just a day or two, and you’ll receive your money by the next business day.

Does LendingPoint ask for proof of income?

In order to qualify for a LendingPoint loan, you need a minimum income of $25,000 per year. This can be from employment, retirement or another source.

While you can receive a loan offer in seconds, once you select a preferred loan option, LendingPoint does require additional documentation and information, including proof of employment and income.

Compared to similar lenders, the Lending Point minimum score is average. For instance, Lending Club required score is 600 while Upgrade minimum score is 600.

Is LendingPoint better than Avant?

LendingPoint is remarkably similar to Avant. Both offer access to loans with similar rates and similar credit scores to qualify. However, LendingPoint has a far lower maximum loan. So, if you’re looking for a larger loan, Avant has the edge over LendingPoint. Read more on Avant review.

Another key difference is that Avant allows you to pay your credits with the loan proceeds directly, but this is not an option with LendingPoint. You need to receive the funds and distribute them from your designated bank account.

Is LendingPoint better than Onemain?

If you cannot meet the credit score minimums of LendingPoint, Onemain loan may be an option. This provider works with all credit profiles, but this does come at a cost – OMF rates are higher. So, if you do have a credit score of 585 or more, LendingPoint is the better choice.

However, Onemain does allow you to use collateral to back your loan and help you to qualify for a lower rate. But, there is an origination fee of up to 10% that you’ll need to consider.

Alternative Personal Loans For Bad Credit

APR Range

The annual percentage rate (APR) is the total annual cost of borrowing money. This rate includes the interest rate as well as any additional finance charges. When you take out a personal loan, for example, you may be required to pay loan origination fees.

| 9.95% – 35.99%

| 18.00% – 35.99%

| 7.99% – 35.99%

|

Term

The term of your loan is the amount of time you have to repay it. For example, if you get a 24 months personal loan, the loan term is 24 months.

| 24-60 Months

| 24-60 months

| 24 to 48 months

|

Loan Amount | $2,000 – $35,000

| $1,500 -$20,000

| $2,000 – $36,500

|

Minimum Score | 580

| No Minimum

| 580

|

Funding Time | N/A

| As soon as same day

| Typically 1 day

|

Review Personal Loan Top Lenders

Personal Loan Reviews

Compare Alternative Lenders

LendingPoint vs Upstart vs LendingClub

Each of these lenders caters to people with less-than-perfect credit. If you need funds quickly, LendingPoint is probably the best option, while Upstart is a good fit for people looking for small loans.

Finally, if you are looking for a joint loan or want to get some of the most competitive rates, LendingClub stands out.

Read Full Comparison: LendingPoint vs Upstart vs LendingClub: Which Personal Loan Suits You Best?

LendingPoint vs Achieve vs Avant

Achieve is an online lender that only works with relatively large loan amounts and also provides joint loans. Avant caters to people with low credit scores and focuses on providing quick access to funds.

Finally, LendingPoint is a similar option to Avant in many ways, such as its acceptance of lower credit scores and quick application process.

Read Full Comparison: LendingPoint vs Achieve vs Avant: Which Personal Loan Is Better?