Regions requires good to excellent credit, but it is possible to qualify if you have a fair credit score and a pre existing relationship with Regions.

APR

5.74% - 20.99%

Loan Amount

$2,000 -$35,000

Term

24 - 60 months

Min score

Good

Regions requires good to excellent credit, but it is possible to qualify if you have a fair credit score and a pre existing relationship with Regions.

APR

5.74% - 20.99%

Loan Amount

$2,000 -$35,000

Term

24 - 60 months

Min score

Good

Our Verdict

Regions Bank provides personal loans to help customers with a variety of financial needs. They offer three types of loans: unsecured, secured, and deposit-secured. Unsecured loans range from $2,000 to $50,000 and can be used for things like home improvements or consolidating debt. Secured loans require collateral, such as a vehicle or property, while deposit-secured loans use existing accounts, like CDs or savings, as collateral.

One of the benefits of Regions Bank's personal loans is the potential for same-day funding, allowing customers to access funds quickly. Additionally, there are no origination fees, and borrowers may qualify for interest rate discounts by enrolling in automatic payments.

However, there are some requirements to consider. To apply for an unsecured loan, you must be an existing Regions Bank customer with at least six months of account history. The loan terms, rates, and fees may vary based on factors like creditworthiness and the type of loan chosen.

Meeting Regions Personal Loan Requirements

To apply for a Regions Personal Loan, you need to meet certain criteria:

- Credit Score Requirements: While Regions Bank does not specify a minimum credit score requirement, borrowers with higher credit scores typically qualify for better loan terms and rates.

- Income Requirements: Regions Bank does not disclose specific income requirements, but applicants are generally expected to have a stable source of income to repay the loan.

- Co-signers and Co-applicants: Regions Bank allows co-signers or co-applicants on unsecured personal loans, which can help applicants with lower credit scores or income levels qualify for the loan.

- Existing Regions Bank Account: To apply for an unsecured loan online, applicants must be existing Regions Bank customers with a bank deposit account open for at least six months.

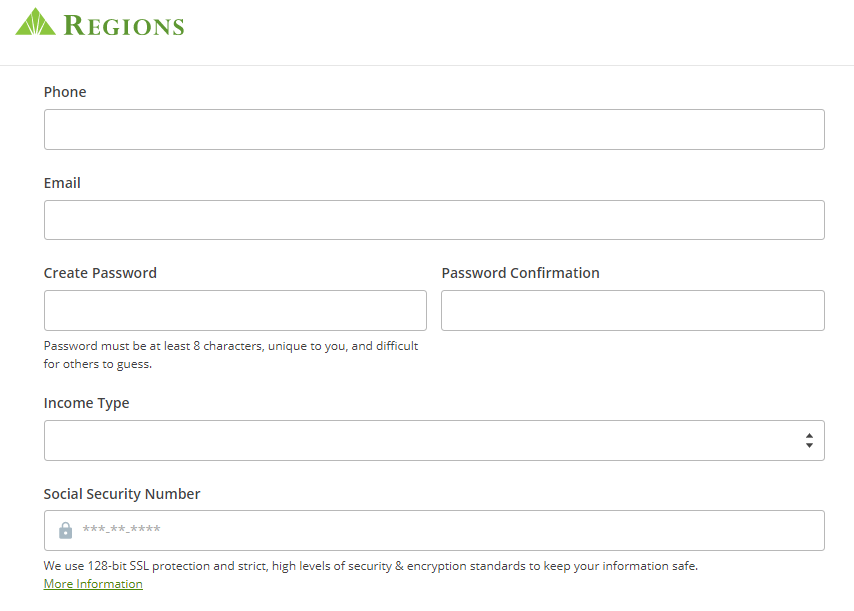

- Personal Information: Applicants will need to provide personal information such as their name, address, Social Security number, and contact details.

- Financial Information: Applicants will be required to provide financial information, including income, employment details, and information about existing debts.

- Collateral Documentation (for secured loans): If applying for a secured loan, applicants will need to provide documentation related to the collateral being used, such as vehicle or property information.

Regions Personal Loan Pros & Cons

Like all lenders, Regions has its own set of advantages and drawbacks that potential borrowers should consider:

Pros | Cons |

|---|---|

Quick Turnaround Times | Possible Late Fees |

No Prepayment Penalty | Existing Customer Requirement |

Relationship Points | Limited Transparency |

Co-signers Allowed | |

No Origination Fees | |

Interest Rate Discounts | |

Rate Quotes Available |

- Quick Turnaround Times

With Regions using Avian, you should expect a quicker turnaround process than with other large banks.

- No Prepayment Penalty

The borrower can pay off their loan early without any fees.

- Relationship Points

Regions has reward points for their customers. You can earn points with personal loans but you need to already be a Regions banking customer.

- No Origination Fees

Borrowers can benefit from Regions Bank's policy of not charging origination fees, saving money on loan processing costs.

- Co-signers Allowed

Regions Bank permits co-signers or co-applicants on unsecured personal loans, increasing the likelihood of approval for applicants with lower credit scores.

- Rate Quotes Available

Applicants can check their loan rates without affecting their credit score, allowing for informed decision-making.

- Interest Rate Discounts

Enrolling in automatic payments from a Regions Bank account can lead to interest rate discounts, potentially reducing the overall cost of borrowing.

- Possible Late Fees

Missing loan payments may result in late fees and negatively impact the borrower's credit score, potentially leading to additional financial consequences.

- Existing Customer Requirement

Unsecured loans are only available to existing Regions Bank customers with at least six months of account history, limiting access for new customers.

- Limited Transparency

Regions Bank does not disclose specific income or credit score requirements, making it challenging for applicants to gauge their eligibility.

Regions Customer Experience

Customer reviews for Regions Bank personal loans are mixed. Some customers appreciate the convenience of same-day funding and the option for interest rate discounts. However, others have raised concerns about the lack of clarity around income and credit score requirements, as well as the bank's existing customer eligibility criteria. There are also some complaints about high maximum APRs and the potential for late fees.

Citi | |

|---|---|

iOS App Score | 4.9 |

Android App Score | 4.7 |

BBB Rating | F |

Contact Options | phone/chat |

Availability | 24/7

|

Customers can reach Regions Bank customer service through various channels. They can visit a local branch in person during operating hours or contact the bank via telephone.

Regions Bank provides a toll-free customer service phone number (888-462-7627) for inquiries and assistance. Additionally, customers can reach out to Regions Bank through social media platforms such as Twitter (@RegionsBank) for support during specified hours.

Additional Insights to Keep in Mind

Before applying for a personal loan with Regions, it's important to understand additional factors that could impact your borrowing experience:

-

What is the funding time?

The funding time for Regions Bank personal loans can be relatively quick, with the possibility of receiving funds into your account on the same business day, depending on the time of approval.

-

What Can a Regions Personal Loan Be Used For??

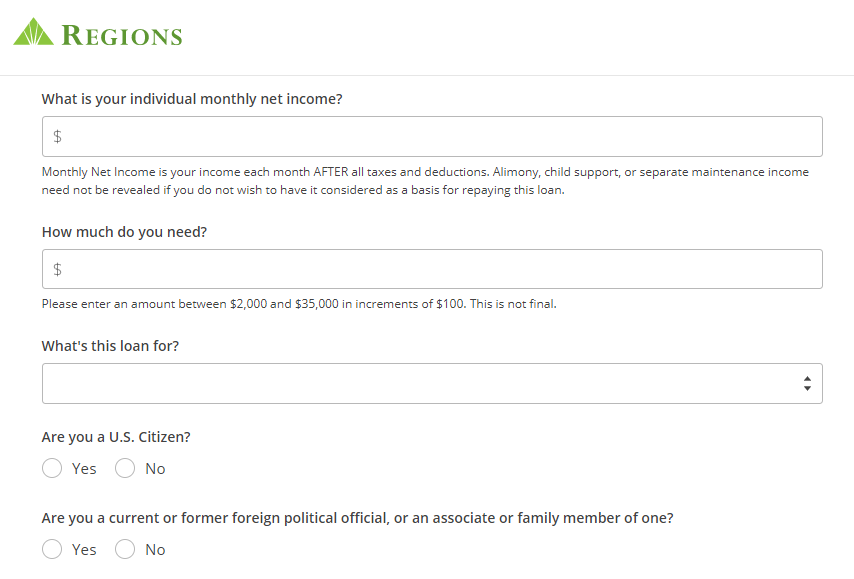

A personal loan from Regions Bank can be used for a variety of purposes, offering borrowers flexibility in managing their finances. Common uses include home improvements, debt consolidation, emergency expenses, education costs, medical bills, and even vacations.

These loans provide borrowers with the freedom to address various financial needs without specific restrictions on how the funds are utilized.

Is Regions Loan Right for You?

A Regions Bank personal loan can be a suitable financial solution for various individuals facing different financial circumstances. Here are some options for who should consider applying:

- Individuals in need of quick funding: Regions Bank offers same-day funding options, making it ideal for those requiring immediate access to funds for emergency expenses or time-sensitive projects.

- Those with good credit history: Borrowers with strong credit scores may qualify for competitive interest rates and favorable loan terms, making a Regions Bank personal loan an attractive option for consolidating debt or funding major expenses.

How to Apply For Regions Personal Loan?

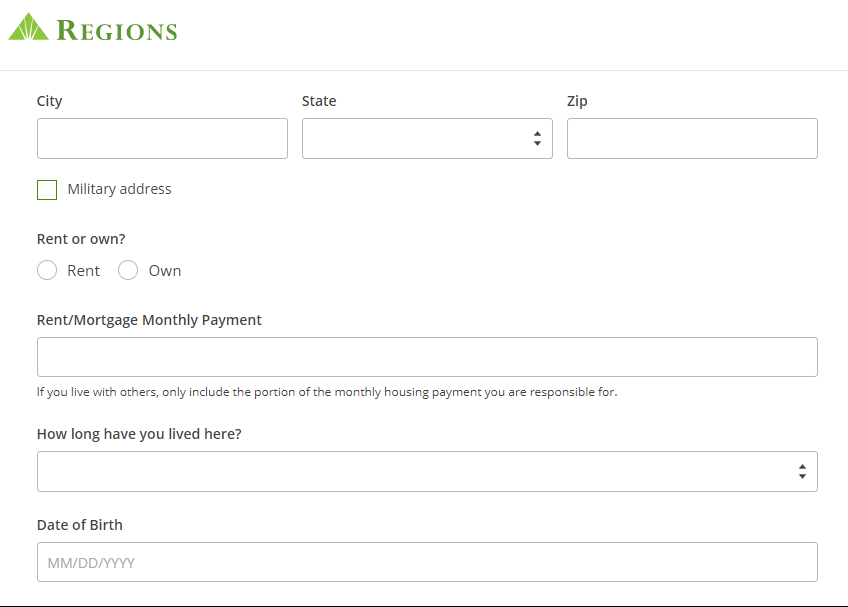

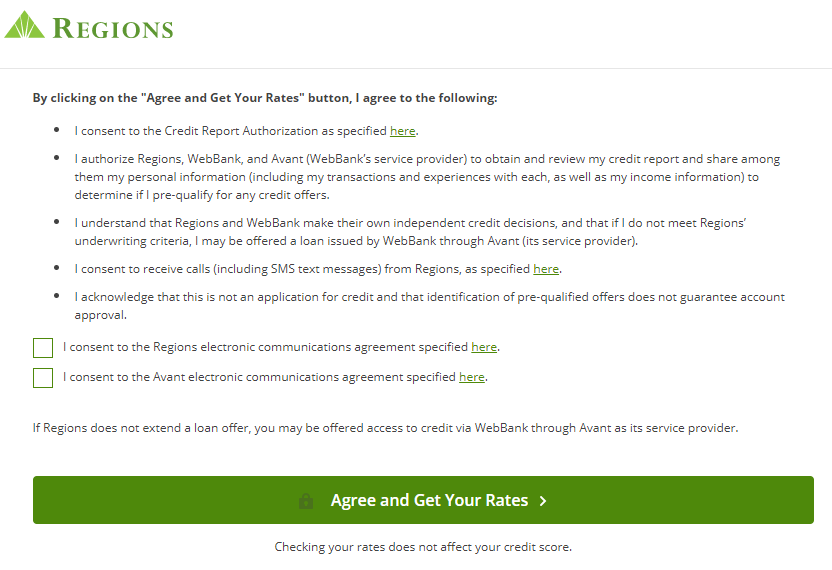

Regions uses Avant for their application process. Once you are directed to Avant, you will still see Regions’ logo along with Avant’s. You fill out a basic form to start, which includes creating an account.

You will then fill out the information about yourself including your address, date of birth, social security number, housing information, and income information. Regions will then do a hard pull and check your credit.

Both Avant and Regions will get a copy of your credit report. If you do not meet Regions’ underwriting standards the application may be passed on to Avant, which has less strict lending standards.

If you decide to move forward you will need to answer more verification questions and upload verification information, like identification or pay stubs.

You can sign loan documents online. It is often possible for the loan to be closed and money sent to your account before the end of the next day.

Review Personal Loan Online Marketplaces

| |||

|---|---|---|---|

APR Range

The annual percentage rate (APR) is the total annual cost of borrowing money. This rate includes the interest rate as well as any additional finance charges. When you take out a personal loan, for example, you may be required to pay loan origination fees.

| 6.99% – 35.99%

| 4.99% – %35.99

| 5.99% – 35.99%

|

Term

The term of your loan is the amount of time you have to repay it. For example, if you get a 24 months personal loan, the loan term is 24 months.

| 12-84 months | 6-84 months | 3-72 months |

Loan Amount | $600 – $200,000 | $1,000 – $100,000 | $1,000 – $35,000 |