Upstart is best for borrowers who have just started their careers and do not have a long credit history or strong income.

Typical APR

5.20% - 35.99%

Loan Amount

$1,000 - $50,000

Term

36-60 Months

Min score

300

Upstart is best for borrowers who have just started their careers and do not have a long credit history or strong income.

Typical APR

5.20% - 35.99%

Loan Amount

$1,000 - $50,000

Term

36-60 Months

Min score

300

Our Verdict

Upstart provides personal loans ranging from $1,000 – $50,000 with repayment terms of 36-60 Months . What sets Upstart apart is its approach to lending — they consider more than just your credit score. If you have a steady job or other reliable sources of income, you may still qualify for a loan, even if your credit score isn't great.

Getting a loan from Upstart is pretty fast. You can check if you qualify online without it affecting your credit score. If you're approved, you could get the money in your bank account as soon as the next business day.

But there are some things to consider. Upstart charges a fee when you get a loan, and the interest rates can be higher than some other lenders. Also, you can only choose to pay back the loan in either three or five years, so there's not a lot of flexibility there.

Meeting Upstart Personal Loan Requirements

To apply for a personal loan from Upstart, you'll need to meet certain requirements. Here's what you need:

Credit Score Requirements: Upstart accepts applicants with credit scores as low as 300

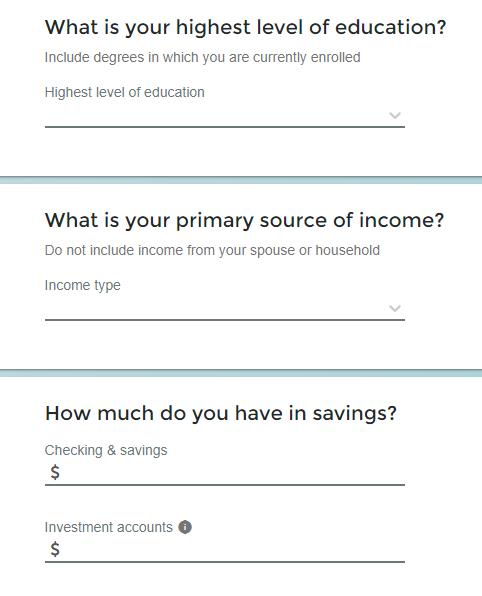

or no credit history at all. However, a higher credit score may improve your chances of approval and could result in better loan terms.Income Requirements: You must have a stable source of income, such as a full-time job, a job offer starting within six months, or another regular source of income. The minimum annual income requirement is $12,000.

Co-signers and Co-applicants: Upstart does not permit joint applicants or co-signers on personal loans. Only individual applications are accepted.

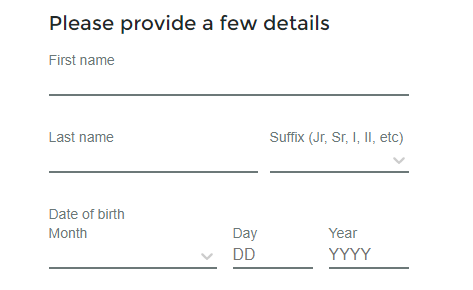

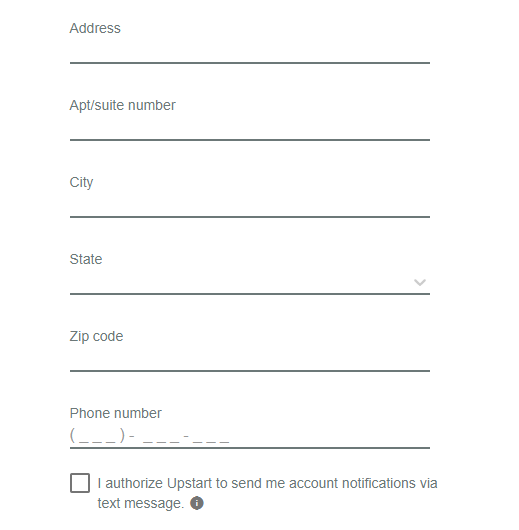

Personal Information: You'll need to provide basic personal information, including your Social Security number, date of birth, and contact information.

Documentation: Be prepared to provide additional documentation, such as pay stubs, tax returns, or other proof of income, during the application process.

Eligibility Verification: Upstart will verify your eligibility by checking for bankruptcies, delinquent accounts, and recent inquiries on your credit report.

Meeting these requirements will help ensure a smooth application process for an Upstart personal loan.

Navigating Upstart Repayment Options

Repaying your Upstart personal loan is flexible, with several payment options to choose from:

- Payment Methods: You can make payments online through Upstart’s website or mobile app, via electronic funds transfer (EFT), or by mailing a check.

- Missed Payments: If you miss a payment, Upstart may charge a late fee — usually $15 or 5% of the overdue amount, whichever is higher. Keep in mind that late payments could also impact your credit score.

- Rescheduling Payments: While Upstart doesn’t offer an official rescheduling option, you can reach out to customer support if you're facing challenges making a payment.

Upstart Personal Loan Pros & Cons

Like all lenders, Upstart has its own set of advantages and drawbacks that potential borrowers should consider:

Pros | Cons |

|---|---|

Soft Pull Inquiry | Limited Repayment Terms |

Flexible Credit Requirements | Origination Fee |

Savings and Discounts | No Joint Applicants |

Quick Funding | High Interest Rates |

No Prepayment Penalty |

- Soft Pull Inquiry

Upstart allows for an initial soft pull inquiry online so the borrower can get an idea of the options for which they may qualify. A soft pull does not affect your credit.

- Flexible Credit Requirements

Upstart accepts applicants with credit scores as low as 300

, providing opportunities for those with thin credit files to qualify.

- Savings and Discounts

Upstart offers competitive starting APRs and waives prepayment penalties, allowing borrowers to save on interest costs.

- Quick Turnaround Times

Upstart has a quick process and an easy application. Many borrowers are approved with money in their account by the end of the next business day. Unlike other enders, Upstart will approve the loan without waiting for investors to invest or fund the loan.

- No Prepayment Penalty

Upstart does not have a prepayment penalty

- Limited Repayment Terms

Borrowers can only choose between three- or five-year repayment terms, lacking the flexibility offered by lenders with more options.

- Origination Fee

Upstart deducts a one-time origination fee of 0% to 12% of your loan amount directly from your loan funds. Upstart has one of the highest origination fees when compared with other lenders. This should be considered in the pricing of your loan when you apply.

- No Joint Applicants

The application is based on the applicant alone. Upstart does not allow for joint applicants.

- High Interest Rates

Upstart has higher interest rates for borrowers with good credit. The best places to get a loan have lower rates for borrowers with excellent credit.

Upstart Customer Experience

Customer reviews for Upstart are generally positive, with many customers praising the fast funding approval process and responsive customer support. On Trustpilot, Upstart has a near-perfect score of 4.9 out of 5.0 based on over 44,000 reviews.

However, common complaints on the BBB cite high origination fees and dissatisfaction with application decisions.

Upstart | |

|---|---|

iOS App Score | No App |

Android App Score | No App |

TrustPilot Rating | 4.9 |

BBB Rating | B+ |

Contact Options | phone/mail |

Availability | 6 am – 5 pm (PT) |

To reach customer service at Upstart, you can call (650) 204-1000 or toll-free at (855) 438-8778. Customer support agents are available every day from 6:00 a.m. to 5:00 p.m. PT.

If you have questions regarding loan payments, customer service operates Monday through Friday from 6:00 a.m. to 6:00 p.m. PT and Saturday from 7:00 a.m. to 4:00 p.m. PT. Additionally, you can email your inquiries to support@upstart.com for assistance.

Additional Insights to Keep in Mind

Before applying for a personal loan with Upstart, it's important to understand additional factors that could impact your borrowing experience:

-

What is the funding time?

The funding time for Upstart personal loans is relatively fast, with borrowers typically receiving their funds as soon as the next business day after loan approval.

This quick funding turnaround can be beneficial for individuals who need immediate access to cash to cover expenses or address financial emergencies.

However, it's essential to note that the funding time may vary depending on factors such as the time of application submission and the borrower's bank processing times.

-

What Happens If I miss a payment?

If you miss a payment with Upstart, you may incur late fees, typically amounting to $15 or 5% of the past due amount, whichever is greater. It's crucial to communicate with Upstart as soon as possible if you anticipate difficulty making payments.

While Upstart doesn't explicitly offer special options for payment difficulties, contacting customer support to discuss your situation may lead to potential solutions or alternative payment arrangements.

Proactive communication can help mitigate negative consequences and demonstrate your willingness to address any financial challenges responsibly.

Which Loan Purposes Upstart Allow?

An Upstart personal loan can be used for a variety of purposes, making it a versatile financing option for borrowers.

Common uses include debt consolidation, home improvements, medical expenses, large purchases, moving or relocation expenses, travel, athletic training, and starting or growing a business.

Is Upstart Loan Right for You?

Upstart personal loans may be suitable for various individuals seeking financing solutions tailored to their unique circumstances. Consider applying if:

Borrowers with Limited Credit History: Upstart considers factors beyond traditional credit scores, making it accessible to individuals with thin credit files or no credit history at all.

Entrepreneurs and Small Business Owners: Upstart's flexible eligibility criteria and quick funding process make it appealing to entrepreneurs needing capital to start or expand a business, providing financial support with minimal hassle.

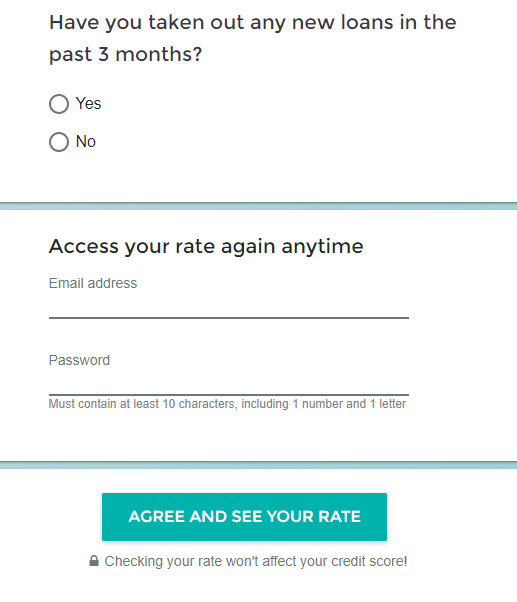

How to Apply For Upstart Personal Loan?

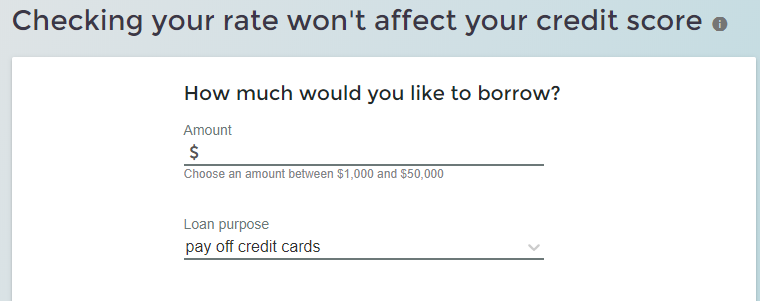

The Upstart application process only takes a few minutes. In the first step, you should set your requested loan amount and choose loan purpose.

You will fill out a short form with some basic questions about yourself, including your full name, contact information, date of birth, employment status, education, how much you have in savings, income, and preferred form of repayment.

This form is for a soft pull, meaning the credit inquiry will not affect your credit. If you're not sure how to apply for the loan, consult with Upstart customer service team.

Top Offers

Top Offers From Our Partners

You will get to see what your rate would be if approved. You will need to review the terms and conditions to make sure there are no mistakes.

Then if you want to move forward, you may need to provide some verification of items stated on the application such as your picture ID, social security card, bank statements, pay stubs, copy of college transcripts or diploma, or tax returns.

Upstart FAQs

Is Upstart a good place to get a loan?

Upstart is included on our top lenders for fair credit, while it allows you to borrow for a variety of purposes. You’ll need to meet a minimum credit score and other requirements to qualify for a loan.

Upstart interest rates range is reasonable, particularly if you have a fair or good credit score, and you can expect to receive your funds approximately one day after the application approval.

Does Upstart check your bank account?

Upstart needs to verify your income to approve any loan application. By providing your financial account details, you do give Upstart authority to retrieve information maintained online by your bank, including your transaction history.

While this may seem intrusive, it does allow for quicker processing, so you can get your loan approved as quickly as possible.

Is Upgrade better than Upstart?

Like Upgrade personal loan, Upstart aims to process loan applications quickly and can release funds in approximately one business day. Upstart also offers similar loan amounts but is a little less flexible in its requirements, as you need to show that you are in full-time employment or have another source of regular income.

Another point in Upgrade’s favor is that Upstart’s rates start at a lower APR, so if you have decent credit, you will pay more with Upstart.

Is Upstart better than Citibank personal loan?

Like Upstart, Citibank personal loan offers similar maximum amount loans and can offer more attractive rates. However, in order to access a Citibank personal loan, you need to be an existing customer and have an established relationship.

It is this relationship that allows Citibank to assess risk and therefore can offer a lower rate. Unfortunately, unless you have the time to open an account and create a positive history with Citibank, Upstart is likely to be a better option.

Is Upstart better than Best Egg?

While Best Egg personal loan does have a solid reputation in the online lending industry, you can only borrow a lower maximum. The typical rates are slightly lower.

Like Upstart, you will need at least fair credit to qualify. You can use your loan for credit card refinancing, consolidating debt or for a large purchase. However, the application process is slightly longer than Upstart. Best Egg typically requires up to three days to process an application and approve a loan.

Is Payoff better than Upstart?

Upstart does allow personal loans for various purposes with a reasonable credit score. However, you must be in full-time employment or have another source of regular income to qualify.

Another advantage Upstart has over Payoff is that you can expect to receive your funds as quickly as one day after approval, although there is a three-business-day hold for educational loans. Payoff's main advantage is its accessibility for debt consolidation borrowers.

So, unless you are looking to consolidate, Upstart is likely to be the better option for you.

Is Discover better than Upstart?

Upstart has a higher borrowing limit compared to Discover personal loan. You can also use the loan for a variety of purposes. Another key difference is the rates, which are far higher compared to Discover.

Upstart requires a credit score of at least 600, so it is easier to qualify for a loan, but you do need to demonstrate that you have a regular income or are in full time employment.

Upstart can also deliver approval and your funds within one day. So, if you are in need of a quick loan and don’t have a great credit rating, Upstart is likely to be the better choice.

Compare Alternative Lenders

APR Range

The annual percentage rate (APR) is the total annual cost of borrowing money. This rate includes the interest rate as well as any additional finance charges. When you take out a personal loan, for example, you may be required to pay loan origination fees.

| 8.99% – 29.99%

| 9.11% – 29.99%

| 10.49% – 19.49% APR

|

Term

The term of your loan is the amount of time you have to repay it. For example, if you get a 24 months personal loan, the loan term is 24 months.

| 24-84 months

| 36-60 months

| 12-60 months

|

Loan Amount | $5,000 – $100,000

| $2,000 -$45,000

| $2,000 – $30,000

|

Minimum Score | 680

| 640

| 680

|

Funding Time | Up to 7 days

| As soon as same day

| Up to 5 days

|

Review Lenders

Personal Loan Reviews

Compare Alternative Lenders

Upstart vs SoFi

SoFi primarily serve people with good credit, whereas Upstart will serve people with poor or no credit. When it comes to providing quick access to funds, Upstart will be faster, while SoFi will offer autopay discounts.

Upstart vs Freedom vs Avant

Avant is best suited for people with bad credit, whereas Upstart offers small loans and quick funding. Finally, Achieve is appropriate if you require a large loan or a joint loan. When compared to one another, each of these lenders has advantages and disadvantages.

Read Full Comparison: Achieve Vs Upstart Vs Avant: Choose The Right Personal Loan

Upstart vs OneMain

Both of these lenders make it possible for people with bad credit to obtain a personal loan. OneMain's offering is a little more limited, with loans that are relatively smaller in size but with more flexible repayment term lengths.

Read Full Comparison: OneMain Vs Upstart: Compare Personal Loan Providers

Upstart vs Rocketloans vs Prosper

Each of these three lenders shares and differs in some ways. In general, Upstart is the best option for people who need a small loan or who may not be able to obtain a FICO score. Rocket Loans is a viable option if you need quick access to borrowed funds, whereas Prosper allows you to get a joint loan and caters to people with fair credit.

Read Full Comparison: Rocketloans Vs Prosper Vs Upstart: Which Personal Loan Is Best?

Upstart vs Best Egg vs Marcus

Upstart is one of the more notable online lenders because it employs artificial intelligence (AI) to guide the process of evaluating applications. As a result of this system, it frequently deals with people who have relatively low credit scores, or even those who do not yet have a credit score.

Best Egg is an online lender that has received numerous awards in recent years for its service, which includes quick approvals and competitive rates. Marcus, a Goldman Sachs offering, is one of the most reputable online lenders you will come across. It promises no-fee personal loans as well as a variety of loan types.

Read Full Comparison: Upstart vs Best Egg vs Marcus: Compare Personal Loan Lenders

Upstart vs Happy Money

Upstart and Happy Money both cater to people with low credit scores and offer flexible repayment terms.

Upstart is better suited for people who want a smaller loan amount or who do not yet have a credit score. If you want to keep your fees as low as possible, Happy Money is the way to go.

Read Full Comparison: Upstart Vs Happy Money: Which Personal Loan Is Better?

Upstart vs SoFi

Upstart is a one-of-a-kind proposition because it employs an artificial intelligence (AI)-based system rather than relying solely on FICO scores. The Consumer Financial Protection Bureau has determined that it is a reputable lender. Upstart is a good option for people who do not have a long credit history and who need funds quickly.

SoFi has been in business since 2011, and in that time it has served over 2.5 million people and funded loans totaling more than $50 million. It is regarded as one of the best in the industry and an excellent choice for those with excellent credit.

Read Full Comparison: Upstart Vs SoFi: Which Personal Loan Is Best?

Upstart vs Upgrade

Upgrade has been in operation for over 15 years and has served the needs of millions of customers during that time. It provides its borrowers with a high level of flexibility as well as a wealth of excellent educational resources.

Upstart takes a different approach than most online lenders because it heavily relies on artificial intelligence (AI) in its operations. Upstart accepts people with low credit scores and will quickly disburse your borrowed funds.

Read Full Comparison: Upstart Vs Upgrade: Which Personal Loan Is Best For Your Needs?

Disclosure

Loan amounts – Your loan amount will be determined based on your credit, income, and certain other

information provided in your loan application. Not all applicants will qualify for the full

amount. Loans are not available in West Virginia or Iowa. The minimum loan amount in

MA is $7,000. The minimum loan amount in Ohio is $6,000. The minimum loan amount

in NM is $5100. The minimum loan amount in GA is $3,100

APRs, Loan term – The full range of available rates varies by state. The average 3-year loan offered

across all lenders using the Upstart platform will have an APR of 25.79% and 36

monthly payments of $37 per $1,000 borrowed. There is no down payment and no

prepayment penalty. Average APR is calculated based on 3-year rates offered in the

last 1 month. Your APR will be determined based on your credit, income, and certain

other information provided in your loan application. Not all applicants will be approved..