Table Of Content

Can You Buy a Gift Card with a Credit Card?

When you hear the term “gift card” thrown around, the first thought that must certainly come to your head is that a gift card is an item with an assigned monetary value that you can exchange for another good or service.

Gift cards are usually given to people for whom we need to buy a present. Perhaps it could be a teacher, a close friend, and many others.

When you are in the need of a gift card, you may wonder if it is possible to purchase one with a credit card. The answer is: Yes.

Reasons to Buy Gift Cards with a Credit Card

You might think that buying a gift card with a credit card is only useful if you're planning to exchange it for something the recipient wants. But there are actually several benefits to using a credit card for gift card purchases that you might not expect.

Generally speaking, credit cards can be highly valuable elements that, when utilized wisely can help you achieve and maintain sound domestic economic management. From credit-history building to cashback and many other perks. Therefore, it is a no-brainer to opt for these when it comes to shopping.

In addition, gift cards are very useful for different scenarios too. So, this begs the question: Why not combine both of their positive traits?

Buying Gift Cards With Credit Cards: Main Benefits

These are some of the benefits that buying gift cards with credit cards has:

- You can buy a gift for a loved one with little to no effort.

- Gift cards are a great way of giving great presents.

- Gift cards give you broad possibilities when referring to amounts. You can go for as little as $10 to $2,000. This gives you much more room to decide how much money to give to the recipient.

- Earning points on a gift. Most banks give cashback for credit card purchases, so you can get some money back when buying gift cards with credit cards.

- You can earn rewards in different categories for buying gift cards with credit cards. Many businesses offer rewards for buying goods in their stores, so you can accumulate extra benefits by doing this.

- You can garner some advantages from anticipated spending. This form of buying enables you to maximize spending and the rewards that come with that.

- You squeeze the most out of credit card promotions. Many cards offer a welcome bonus after you spend a certain amount.

What to Know Before Buying Gift Cards

As though they are amazing tools for commerce where all parties become benefitted from this type of transaction, there are still some caveats to have in mind before buying gift cards. This is especially important if you ever decide to buy any with credit cards.

There are some aspects you need to know first so that you do not encounter any misunderstandings. Some details often go unnoticed both by the recipient of the gift card and by the giver. You should become acquainted with the additional policies set by either the banks or the merchants that issue gift cards:

- Gift cards are protected by federal law. The Credit Card Accountability Responsibility and Disclosure—AKA Credit CARD—offer several forms of protection for consumers, meaning that they are a safe and convenient way of buying presents.

- Gift cards are often redeemed at their selling points.

- Gift cards provided by banks are subjected to Credit CARD Act regulations. They can only be exchanged where brands under the act are accepted.

- Gift cards from banks always have the logotype of the network of the payment card of choice. i.e., Mastercard, Visa, etc.

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

How to Buy Gift Cards with Credit Card Points?

The notorious aspect about buying gift cards with credit cards is that many times you become the receiver of many benefits bestowed by banks so as to foster consumption.

These benefits usually come in the form of credit card points. These points that you are awarded for your purchases can be traded for other items, such as gift cards.

As a rule of thumb, you should always calculate how much you get for each point. As an example, let's say you have Amex card and you want to give your brother a gift card for a restaurant. If you have 5,000 Amex credit card points, it means that you can give him a gift card for $50.

Steps To Follow When Redeeming Points to Gift Card

The steps you must follow if you want to redeem your credit card points for gift cards are these:

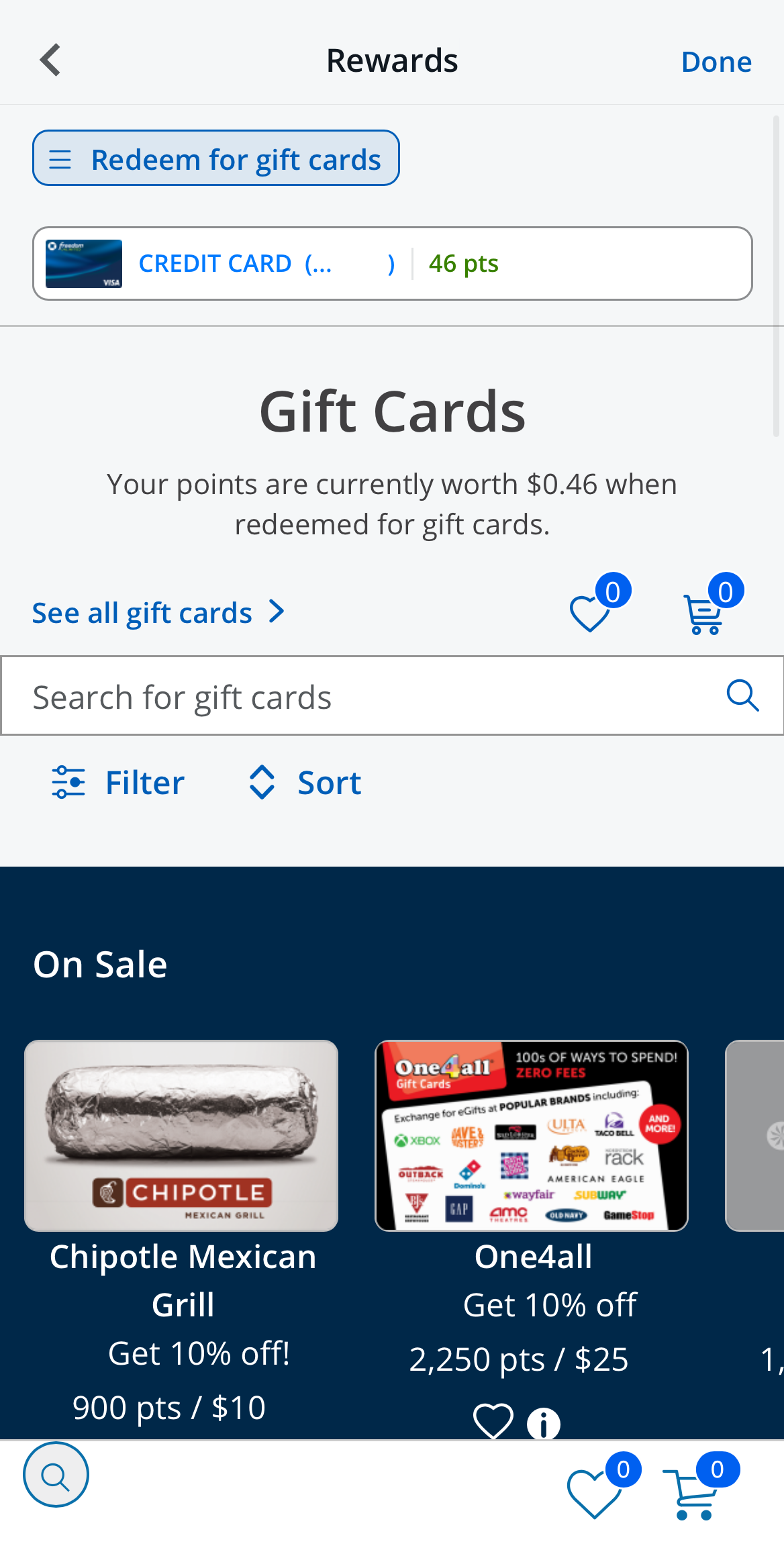

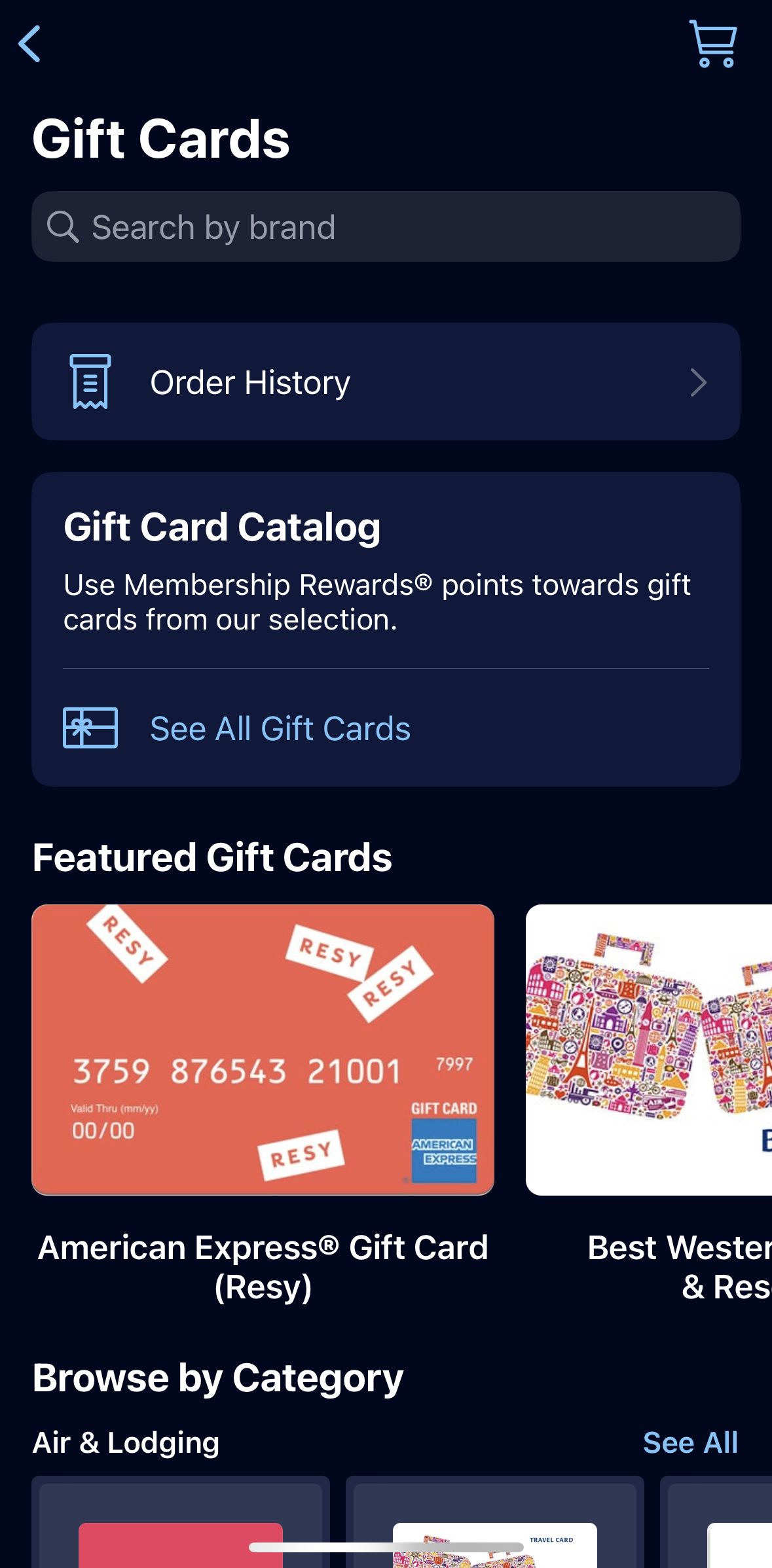

- You have to enter the website of your credit card issuer. They generally have redemption portals where you can exchange your points for gift cards.

- You access the “gift card” section, provided they have one.

- You select the gift card you want and trade it for your points. i.e., you trade your hypothetical 5,000 points for a Burger King gift card that is equivalent to $50.

- Once you receive it, you can give it forward to your brother.

Which Credit Card Portals Let You Buy Gift Cards with Points?

As you can observe, if you want to buy gift cards, you have to access your card issuer’s portal to choose the gift card you want.

Now imagine that you want to give your mother a gift card for her birthday. You have already made some buys, you know that you have some points under your belt—or magnetic band—and you want to trade them. You need a portal for that.

Here are some of the portals that allow you to buy gift cards with points:

- American Express: American Express—also known as Amex—is a well-established brand that lets you buy gift cards with points.

- Capital One: Their portal also permits you to interchange your points for gift cards for restaurants, shops, and so on.

- Chase Ultimate Rewards: You can exchange your points on their portal not only for gift cards, but also for travel points, and many others

- Citi ThankYou – Citi credit card customers can purchase gift cards through the Citi ThankYou portal.

Which Types of Gift Cards Are Available?

Gift cards are not simply nice-looking pieces of plastic that you hand out to your loved ones. There are many types, and each has its own set of advantages. The more you know about the different types, the better your present will be!

These are some of the gift card types that are available in the market:

- Single Store Gift Cards: As you may assume, these are cards that can only be used with one single merchant or brand. However, many single-card brands have many locations where you can buy with those gift cards.

- Family-of-Stores Gift Cards: These types of cards can come quite handy when either you do not know the person all that well, when the recipient has varied tastes, or when you cannot simply make up your mind. These cards are created by families of stores, or by holdings that own diverse stores and simply want to promote them.

- Multi-Store Gift Cards: Sometimes banks give these for promotional purposes, or as incentives for using their products. With multi-store gift cards, you can buy different items at different stores that might not necessarily be affiliated with one another.

Why You Might Not Want to Buy Gift Cards?

While there are plenty of benefits to buying gift cards, it’s also important to consider the potential downsides. As a gift card buyer, being fully informed will help you make a well-rounded decision. These factors are relevant not just for you, but also for the person who will be receiving the gift card.

Here we will show you as well some of the reasons you might NOT want to buy gift cards:

- Many gift cards go unused. You have to be aware that the gift card you are giving is somehow captivating for the user. CBS states that every year, $10 billion worth of gift cards are never exchanged.

- The recipients are still likely to use some of their money. They can wind up spending over 20% over the value of the gift card to buy something they want or like.

- If the gift card gets stolen or goes amiss, that can pose a severe problem for you. Always keep your gift car identification number handy, and ask the giftee whether they have employed it or not.

- Investopedia advises you to use the card as promptly as possible since you can get charged inactivity fees.

Top Offers

Top Offers From Our Partners

Top Offers

Where Else Can I Buy Gift Cards?

The amazing part about gift cards is that they are versatile and easy to find, and you can buy them practically at any store that you desire. You can buy them online, but you also have the possibility of buying them in brick-and-mortar stores.

For instance, you want to acquire a gift card for a friend of yours. However, you have a problem. You are not well-acquainted with technology, and you prefer to change your points for a gift card in person instead of doing it on the computer. Fret no more! Here you can:

- Drugstores: Walgreens, Rite Aid, and Duane Reade are some of the drugstores where you can buy gift cards.

- Grocery stores: Martins, Kroger, and Albertsons are examples of grocery stores that provide this service.

- Retail stores, convenience stores, warehouse stores, and many others too!

FAQs

Yes! As we have previously carefully explained, you can.

You can either use your credit card reward points, or you can also directly buy it online as you would buy any other product that you wished to buy on the Internet.

Yes, it can be done. The other advantage you have with prepaid cards is that you can load them with a specified amount of your choice and buy the gift card—or gift cards—in question. One precaution, though: be careful with any maintenance fees.

You may be inclined to assume that you can only pay gift cards with credit cards. Yet, this is not the case.

You can pay gift cards with debit cards without a problem. In fact, you could also pay with cash or even checks if you wish.

You can buy Google’s own gift card: The Google Play Gift Card. You can buy games, and other products and services, to name a few.

We do advise you though to carefully read the terms and conditions for the service to avoid any future undesired inconveniences.

You can decisively purchase gift cards online with PayPal. As a matter of fact, given the broad options they have, you can make excellent gifts for your loved ones and save a considerable amount of money along the way as well!

You can do it, but it largely depends upon the stores’ conditions of merchandise credit use.

For example, companies like Abercrombie consider that merchandise credits are not reloadable and are not transferable. In short, make sure you find this out before picking any store.