Capital One 360 Performance Savings Account

APY

Minimum Deposit

Our Rating

Fees

Features And Benefits

Here are the main features and benefits you can get with the 360 Performance savings account:

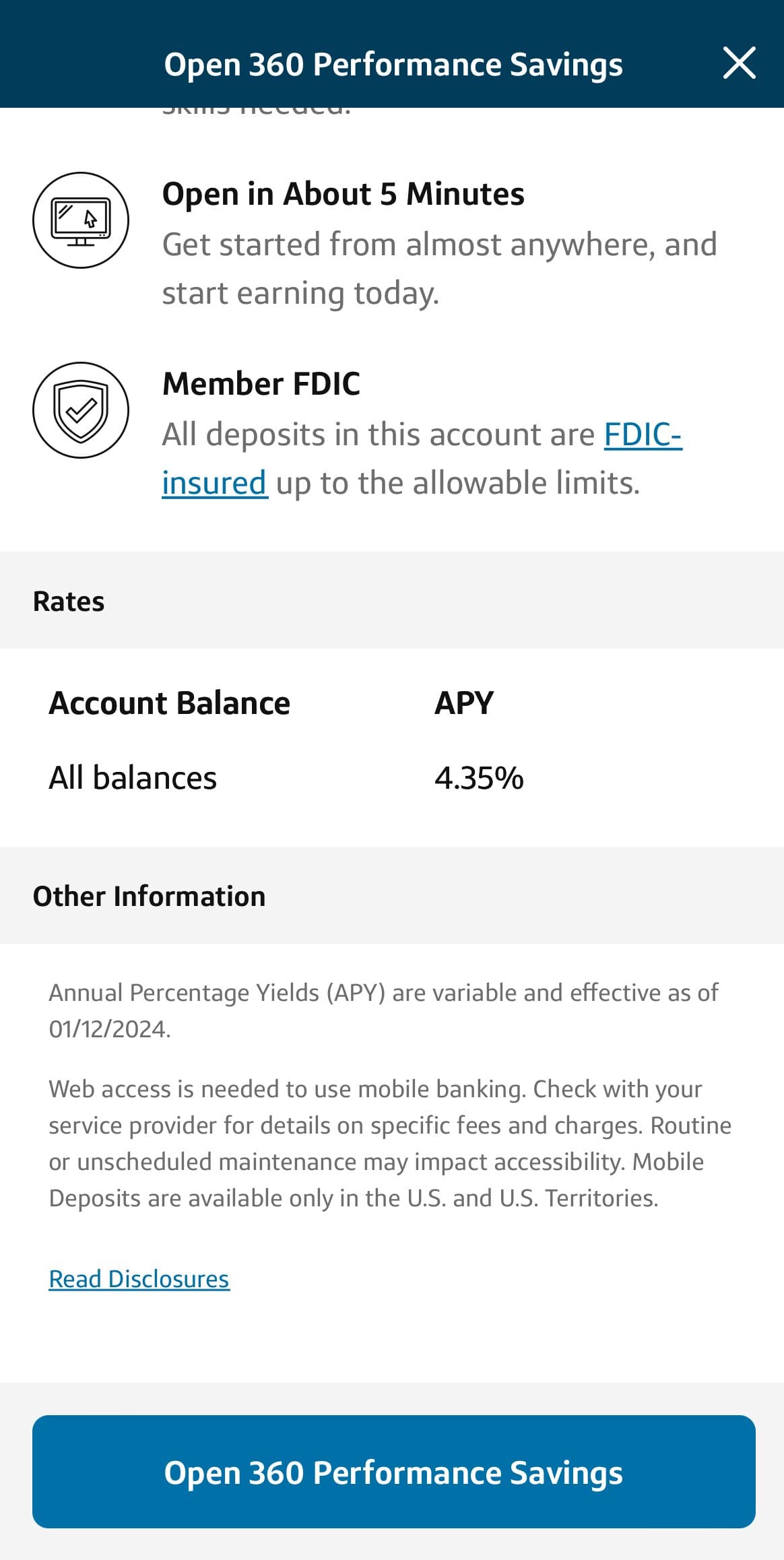

- Highly Competitive APY: If you’re looking for high yield returns, the 360 Performance Savings account certainly fits the bill. This account offers one of the best savings rates with a far higher than average APY on your balance. As of November 2025, you can get 3.50% APY.

- No Minimum Balance Requirements: Although there are online savings accounts that offer similar or slightly higher rates, many accounts have a minimum balance requirement to qualify for these rates. However, the Capital One 360 Performance Savings account does not have any minimum balance requirements to either open or maintain it.

- No Monthly Maintenance Fees: Maintenance fees can quickly erode the returns on your savings. Even if the fees can be waived, you need to keep an eye on your account to ensure that you don’t pay the fee every month. This is not a problem with the 360 Performance Savings account, as there are no monthly maintenance fees.

- Some Branch Access Available: While Capital One is classified as an online bank, it does have a small number of branches if you prefer in person banking. There are full service branches in several states, particularly on the East Coast. However, Capital One also has Cafes that combine coffee, WiFi and snacks with banking services and money coaching.

- Free Credit Monitoring Services: As a Capital One customer, you can access Capital One credit monitoring services without any additional fees. This is a great tool for those looking to improve their financial and credit health.

- FDIC Coverage: You don’t need to worry about your funds being safe, as Capital One has FDIC insurance. This means that should Capital One fail, you have up to $250,000 of protection to cover your account funds.

Limitations

While there are many benefits, Capital One 360 Performance Savings Account has a couple drawbacks to consider:

- No ATM Cards: This account does make accessing your funds a little tricky. Unless you live near a branch location, you will need to transfer your funds into another account. The account does not provide an ATM card, which is a little unusual for an online savings account.

- Limited Withdrawals: The account has a cap of six withdrawals or transfers out of the account per statement cycle. If you do exceed this limit, you may incur a fee, or in a worst-case scenario, Capital One may close your account.

- Transfer Delays: If you’re transferring to or from an external account, your transfers may take a couple of days. Considering you can’t simply use an ATM to withdraw funds, this is quite a frustrating account limitation.

Savings Calculator: How Much You'll Earn With Capital One?

Initial deposit

Monthly contribution

Period (years)

APY

-

Interest earned

-

Contributions

-

Initial deposit

Total savings

* Make sure to adjust APY and deposit

Capital One 360 Performance Savings vs Ally Savings

While on the surface Capital One 360 Performance Savings and Ally Savings may appear the same, there are some small differences:

Capital One Savings | Ally Savings | |

|---|---|---|

APY | 3.50% | 3.40%

|

Fees | $0 | $0 |

Minimum Opening | $0 | $0 |

- Similarities

- Differences

- No monthly fees: Both accounts have no monthly maintenance fees and are considered some of the top no-fee savings accounts.

- No minimum deposit: You can open either account with $0

- APY rate paid on full balance: Regardless of your balance, you can earn the advertised APY rate.

- Savings goals tools: Both accounts have tools to help you work towards your savings goals.

- Debit card savings: Both accounts have a feature that automatically transfers small amounts from your checking account when you use your debit card. For example, if you swipe for $4.85, you’ll be billed $5 on your checking account and the remaining $0.15 will be directed into your savings.

- APY: While both accounts are high yield savings, Capital One’s rates are usually slightly higher than Ally’s.

- Branches: Although Capital One does have a limited branch network, Ally is completely online with no physical branches.

Capital One 360 Performance Savings vs Discover Savings

Again, the Capital One 360 Performance and Discover savings accounts are quite similar. There are some great similarities, but a couple of differences that separate them.

Capital One Savings | Discover Savings | |

|---|---|---|

APY | 3.50% | 3.50% |

Fees | $0 | $0 |

Minimum Opening | $0 | $0 |

- Similarities

- Differences

- Rate: Both accounts have the same highly competitive rate

- Maintenance fees: There are no monthly maintenance fees on either account

- Mobile banking: Both Capital One and Discover have mobile tools that help you to manage your finances and work towards savings goals.

- No minimum deposit: Neither the 360 Performance or Discover savings accounts have a minimum deposit requirement.

- Account Definition: The Capital One account is defined as a high yield savings account, which does impose some restrictions, including a limit of six withdrawals out of the account per calendar month.

- Savings Tools: Capital One has a suite of digital savings tools, including auto savings plans, savings goals and mobile check deposit.

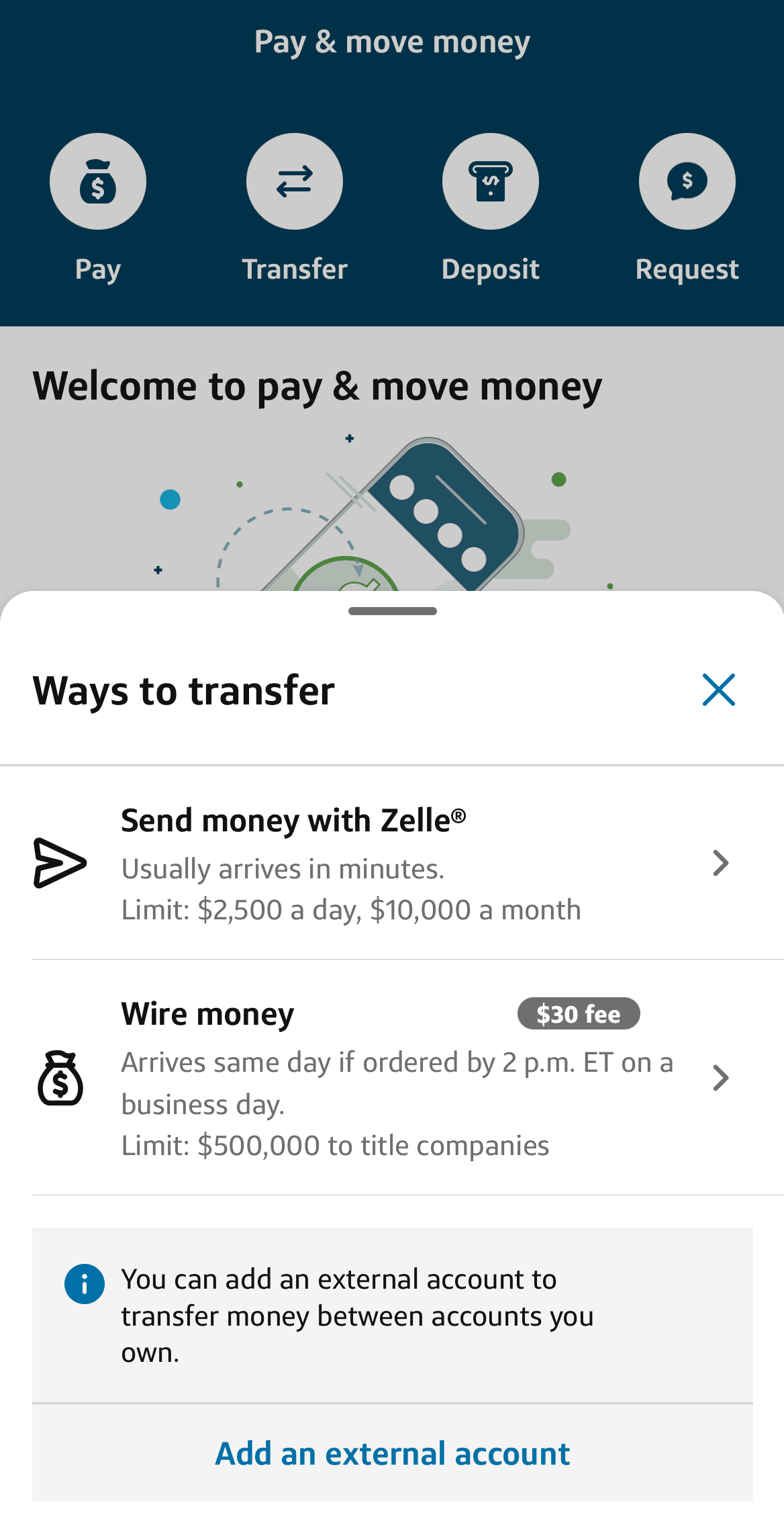

How to Deposit and Withdraw Money?

Several methods exist to deposit and withdraw funds into your 360 Performance Savings account. As we touched on above, withdrawing your funds is a little trickier, but there are still several ways to access your money, including:

Deposit | Withdraw |

|---|---|

Mailed Check | Electronic Transfer |

Wire Transfe | Wire Transfer |

Mobile Deposit Check | Via A Branch |

Branch | |

Electronic Transfer Via Linked Account | |

Auto Recurring Deposit |

- Mailed Check

You can mail a check to Capital One locations, but this is quite slow.

- Wire Transfer

Wire transfers are quite efficient, but you may incur a fee from the sending bank.

- Mobile Deposit Check

The Capital One app allows you to deposit checks by entering the details and photographing the check.

- Via A Branch

You can visit a Capital One branch or a Cafe to deposit funds.

- Electronic Transfer Via Linked Account

You can link your external bank account to your new 360 Performance savings account and then transfer funds as and when you like.

- Auto Recurring Deposit

Capital One aims to make building a savings fund easier by accepting auto-recurring deposits to savings. It can be from your linked checking account or directly from your employer.

If your account is a 360 checking account, it will be instantly processed, but other accounts can take several business days.

- Electronic Transfer

You can transfer funds out of your savings account into a Capital One checking or external bank account.

- Wire Transfer

This is quicker than a regular electronic transfer, but fees will apply.

- Via A Branch

You can call into your branch and the Capital One teller will be able to assist you with a withdrawal.

Just bear in mind that whichever method you use, you can only have a maximum of six withdrawals from your 360 Performance account in any month or you may incur fees or account closure.

Should I Open a 360 Performance Savings Account?

The Capital One 360 Performance Savings account is a solid choice offering competitive rates, but it may not be the right choice for everyone. You'll need to ask yourself several questions to determine if it is a good fit for you.

- Do you need to make frequent withdrawals? The 360 Performance Savings is a high-yield account, so there are restrictions on how often you can withdraw. If you anticipate making more than six withdrawals in a typical month, this is not the right account for you.

- Is in-person support important? Some of us feel perfectly comfortable managing all aspects of our banking online, but others prefer the reassurance of having access to in-person support. Although Capital One has a branch and cafe network, it is small. So, if in-person support is essential to you, you'll need to check if there is a location in your area.

- Do you need an ATM card? This is another area where it can have no importance to some people but be a crucial point for others. If needing an ATM card is important to you, you'll need to look for a different account.

- Do you have a Capital One checking account? Having a savings account could be beneficial if you already have a Capital One checking account. You'll be able to transfer funds between the accounts after they are linked quickly, and you can enjoy other Capital One bank account perks.

How to Open a Capital One Performance Savings Account?

Capital One makes it super simple to open a new Capital One savings account online. You should be able to complete the entire process in approximately five minutes with the following steps.

- Find the Product Page: The first thing you’ll need to do is browse the Capital One website to find the Performance 360 Savings product page. This highlights the account features, so you can confirm it is the right account for you.

- Click the “Apply” Button: Once you’re happy that you’d like to go ahead with opening the account, you simply need to click the “apply” button to start the application process.

- Fill in the Application Form: This is a fairly standard form that you’re likely to encounter when applying for a savings account with any bank. You’ll need to provide some basic details including your full name, phone number, address and social security number.

- Verify Your ID: Federal regulations require that all financial institutions verify the identity of applicants before opening an account. This means that you’ll need to provide proof of your ID in the form of a copy of your driver’s license, passport or state issued photo ID.

Can I Open a Capital One 360 Joint Savings Account?

Yes, you can either open the account as a joint account or add a co-owner later. To create a joint account, you’ll just need to indicate this on the application form and you’ll see prompts to complete the details for the second account holder.

These details are the same as we discussed above and you’ll also need to verify the ID of the second account holder.

FAQs

Does Capital One offer an IRA savings account?

Yes, you can open an IRA account via Capital One 360 or Capital One Investing. However, you already need to be a Capital One 360 customer with a savings, checking or CD account.

Does Capital One offer a health savings account?

Capital One does not currently offer a HSA.

Can you direct deposit into a Capital One savings account?

Yes, you can direct deposit funds into your Capital One savings account.

How do you close a Capital One 360 Performance Savings Account?

The easiest way to close your account is to call the Capital One customer support line. An advisor can walk you through the closure process.

How much can I withdraw from Capital One 360 Performance Savings?

Capital One does not publish a withdrawal maximum for this account, just bear in mind that you can only make a maximum of six withdrawals in any month.

Can I transfer my IRA to a Capital One savings account?

Typically yes, but you will need to assess the tax implications of transferring your IRA into a savings account.

Top Offers From Our Partners

![]()

How We Rate And Review Savings Account: Methodology

The Smart Investor team has conducted an in-depth analysis of savings accounts offered by banks and credit unions tailored to the needs of savers. Our review focused on four key categories, with specific considerations for savers, and here's how we rated them:

- Savings Rates and Terms (40%): We thoroughly examined the interest rates provided by financial institutions, along with any unique terms and conditions attached to their savings accounts. Higher scores were awarded to banks and credit unions, offering competitive rates, reasonable minimum deposit requirements, and minimal fees, ensuring savers get the best value for their money.

- Savings Account Features (30%): This category assessed the array of features designed to cater to savers' needs, including fees, minimum deposit requirements, mobile app functionality, ATM access, and withdrawal options. Financial institutions providing a diverse range of features and convenient banking solutions received higher ratings in this category, reflecting their commitment to meeting the specific needs savers.

- Customer Experience (20%): The ease of account opening, the responsiveness of customer service, the usability of mobile apps (thoroughly tested by our team), and the bank's policies for assisting customers were evaluated in this category. Banks and credit unions offering seamless account opening processes, efficient customer service, and user-friendly digital platforms were rated higher, ensuring a positive banking experience for savers.

- Bank Reputation (10%): We considered the reputation of each financial institution, incorporating ratings from trusted sources such as JD Power, TrustPilot, and local Better Business Bureau reviews. Higher scores were awarded to banks and credit unions with positive reputations and satisfied customers, reflecting their reliability and trustworthiness.

By weighing these categories appropriately and focusing on factors relevant to savers, our review provides valuable insights to help residents of the state make informed decisions when selecting a savings account.

Compare Capital One Savings

Citi Accelerate Savings vs Capital One 360 Performance Savings

While Citi Accelerate Savings account offers a slightly higher APY than Capital One 360 Performance Savings, it has drawbacks to consider.

Citi Accelerate Savings vs Capital One 360 Performance Savings: Which Is Better

Discover Online Savings Account vs Capital One 360 Performance Savings

The Discover Online Savings and the Capital One 360 Performance Savings rates are similar. Compare account features, benefits and drawbacks.

Discover Online Savings Account vs Capital One 360 Performance Savings: Compare Side By Side

Ally Bank Savings Account vs. Capital One 360 Performance Savings

Compare Ally and Capital One Savings account rates, features, benefits, and limitations to determine which one is the best option for you

Ally Bank Savings Account vs. Capital One 360 Performance Savings: Which Is Best?

Capital One 360 Performance Savings vs. American Express HYSA

Capital One and Amex savings rates are quite similar. However, each of them has its own benefits, features and tools. Here's our comparison: Capital One 360 Performance Savings vs. American Express High Yield Savings Account

Chase Savings vs Capital One 360 Performance Savings

Capital One Savings provides a significantly higher savings rate when compared to Chase. Let's explore the features and additional benefits.

Chase Savings vs Capital One 360 Performance Savings: Compare Side By Side