Table Of Content

Citibank CDs

APY Range

Minimum Deposit

Terms

Our Rating

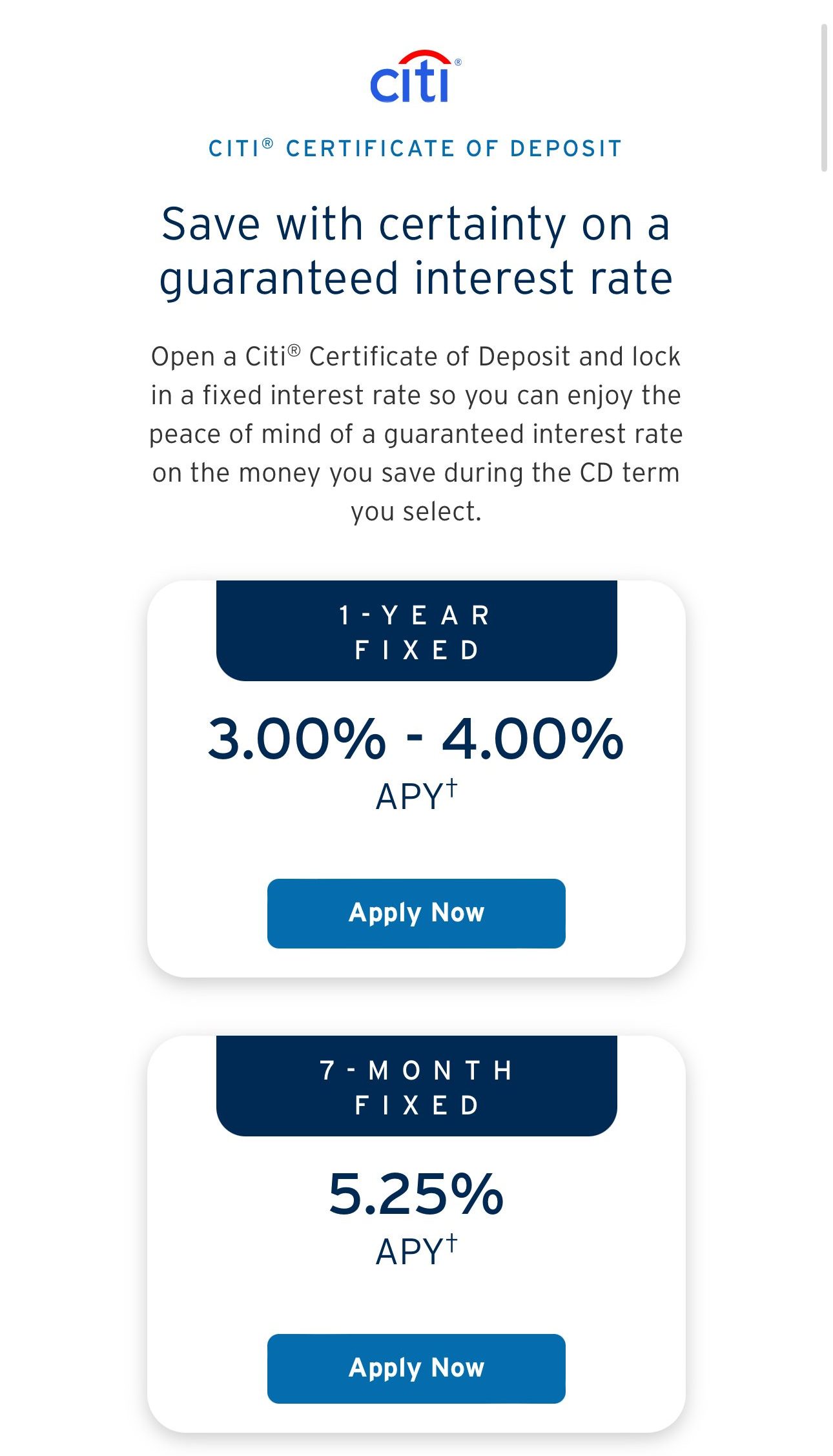

What Are The CitiBank CD Rates?

As of October 2025, the fixed-rate CDs have rates that currently vary from 0.05% – 4.16%. To access the higher rates, you’ll need a nine-month, one-year, or 18-month CD.

The no-penalty CD is only available with a 12-month term, but it allows you to withdraw part of your full balance at any time with no penalty. The only stipulation is that you must wait six days after your initial deposit before you can withdraw. The current rate for the no-penalty CD is 0.05%.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 3.25% | 90 days interest |

6 Months | 2.25% | 90 days interest |

9 Months | 2.00% | 90 days interest |

12 Months | 3.25% | 90 days interest |

12 Months – No Penalty | 0.05% | / |

15 Months | 0.10% | 180 days interest |

18 Months | 4.00%

| 180 days interest |

24 Months | 0.50% – 1.01% | 180 days interest |

30 Months | 0.10% | 180 days interest |

36 Months | 2.00% | 180 days interest |

48 Months | 2.00% | 180 days interest |

60 Months | 2.00% | 180 days interest |

How Do CitiBank CDs Work?

Citibank CDs have a minimum deposit of $500 – $2,500, which is quite reasonable compared to many national banks CD minimum deposit, which often requires $1,000 or even $10,000 to access CD rates. The interest for Citibank CDs are compounded daily and if your CD term is less than one year, it is credited monthly or on maturity. For CD terms of one year or longer, the interest is credited monthly.

You can withdraw your interest at any time during your CD term, once it has been credited to your CD account, but this will reduce the balance and lower the overall amount of interest you can earn.

If you withdraw from your principal balance, there is a early withdrawal penalty. If your CD has a term of one year or less, you will forfeit 90 days of simple interest, but this increases to 180 days of simple interest if your CD has a term of over one year.

One interesting aspect of Citibank CDs is that there is a choice of fixed rate, no penalty or step up CDs. The Step Up Cd has an interest rate that automatically increases every 10 months.

How Much Can You Earn If You Deposit $10,000 Today?

In case you deposit $10,000 to Citibank CD, here you can calculate the expected earnings (before tax) in case the interest is compounded daily:

* Make sure to adjust APY, terms and deposit

Top Offers From Our Partners

Are Citibank CD Rates Competitive Compared to Other Banks?

The national average rate for CDs is approximately 1.85% for one year, which makes most Citibank CDs highly competitive. When compared to other brick-and-mortar banks, Citibank is extremely competitive. Most traditional banks rarely offer lower rate on some terms for the Citibank fixed-rate CD.

Of course, the most competitive CD rates are typically offered with online banks. However, even some of Citibank’s CDs can still stand toe to toe with these products. While some online banks offer higher rates, overall Citibank remains quite competitive.

But, if you are interested in getting the highest rate possible, you may need to look elsewhere or do some serious CD comparison shopping.

Bank | APY | Minimum Deposit | Early Withdrawal Penalty |

|---|---|---|---|

Capital One | 4.00% | $0

| 3 months interest

|

Ally Bank | 3.90% | $0

| 60 days interest |

Synchrony Bank | 4.00% | $0 | 90 days interest |

Discover | 4.00%

| $2,500

| 6 months |

Bank of America | 0.03% | $1,000 | 180 days interest |

Citibank CD Rates vs Citibank Savings Rates

Citibank offers a variety of savings accounts, but Citi Accelerate savings has the highest savings rate – 0.03% – 1.13%. This is equal to the base CD rate, but you can get far higher rates with many of Citibank’s CD products. What you do get with a Citibank savings account is full access to your funds. If you decide that you need some cash, you can simply withdraw the funds and you won’t incur a penalty as you would with a CD.

However, you will need to consider that Citibank accounts typically have a monthly maintenance fee. This varies from $10 to $25 per month, depending on the account package.

While it is possible to have these fees waived, you will need to ensure that you meet at least one of the waiver criteria, or you could end up with fees reducing your savings balance.

Citibank Savings Account

APY Savings

Minimum Deposit

Promotion

Minimum deposit of N/A needed. Expired on N/A

Fees

About Citibank

Citibank is a subsidiary of Citigroup Inc. This is the fourth largest bank when measured by assets. Citibank is best known for its credit cards and retail banking, serving over 110 million customers in the U.S, Mexican and Asian markets.

Citibank has a diverse product line including savings and checking accounts, CDs, investing products, and lending products such as mortgages and personal loans.

FAQs

Does Citibank Offer No Penalty CD Rates?

Yes, Citibank does have a no penalty CD, but it is only available with a 12 month term. However, it offers a highly competitive rate and you can withdraw your funds after six days with no penalty.

Does Citibank offer promotions on CDs?

Unlike Citi savings account promotions, Citibank does not have promotional rates on CDs.

Which Citibank CDs will earn you the most money?

If you want to earn the most money, you’ll need to look at a one year fixed rate CD. Although this rate is available with an 18 month CD, the shorter term means that you can have the opportunity to reinvest your funds with another product sooner.

Do Citibank CDs come with a grace period? How does it work?

Citibank has a seven day grace period that begins the day following your CD maturity date. During this seven day period, you can make deposits, withdrawals or changes to your account without incurring any penalties.

How is CitibankCDs interest calculated?

Citibank offers daily compounded interest on CDs. This is credited to your account monthly, unless you have a CD with a term of less than one year, in which case, it can be credited monthly or on maturity.

How does Citibank’s early withdrawal penalty work?

The early withdrawal penalty depends on the term of your CD. If the term is less than one year, the fee is 90 days of simple interest.

However, for CD terms of over one year, you’ll forfeit 180 days of simple interest. The only exception to this is during the seven day grace period after maturity or if you have opened a 12 month no penalty CD.

Compare Citibank Certificate Of Deposit (CDs)

Capital One CDs and Citibank CDs

Citi has better CD rates than Capital One for specific terms, but Capital One rates are higher on other terms. Here's a full comparison: Capital One CDs and Citibank CDs

Synchrony CDs vs. Citibank CDs

Synchrony Bank offers higher CD rates than Citibank on most terms. Compare CD rates, minimum deposit and early withdrawal fees.

Ally CDs vs. Citibank CDs

Citi Bank and Ally offer competitive CD rates, including no penalty CDs. Which one is the winner? Check out our full comparison: Ally CDs vs. Citibank CDs

Wells Fargo CDs vs Citibank CDs

While Citi Bank offers competitive CD rates on most terms, Wells Fargo offers high rates on specific terms. Compare rates and withdrawal fees.

Citibank CDs vs. Bank Of America CDs

While Citi Bank offers CD competitive rates on most terms, Bank Of America is the winner for specific terms. Citi also offers no penalty CD.

How We Rate Certificates of Deposits: Our Methodology

The Smart Investor team has thoroughly examined certificate of deposit (CD) offerings from various banks, considering multiple factors to provide a comprehensive evaluation. Here's how we rated them across four key categories:

-

CD Rates (50%): We meticulously analyzed the interest rates offered by each bank on their certificate of deposit (CD) products. Higher ratings were awarded to banks offering competitive rates that provide maximum returns for customers' investments. Factors such as the yield curve, current market conditions, and consistency of rates were considered to assess the attractiveness of each bank's CD rates.

-

CD Features (30%): This category evaluated the features associated with each bank's certificate of deposit offerings. Factors considered include the variety of terms available, early withdrawal penalties, minimum deposit requirements, and any additional features or benefits. Higher ratings were given to banks offering a diverse range of CD terms, reasonable early withdrawal fees, and flexible options to meet customers' investment needs.

-

Customer Experience (10%): A positive customer experience is paramount, even when investing in CDs. We assessed each bank's performance in this area, considering factors such as the ease of opening a CD account, the responsiveness of customer service, and overall user satisfaction. Higher ratings were assigned to banks with efficient account opening processes, helpful customer support, and a track record of satisfying customers.

-

Bank Reputation (10%): The reputation of a bank is a critical consideration when investing in CDs. We evaluated each bank's reputation based on factors such as financial stability, regulatory compliance, and public perception. Higher ratings were given to banks with a solid reputation for reliability and trustworthiness, ensuring customers' investments are safe and secure.

By considering these categories and assigning appropriate weights to each, our review aims to provide valuable insights to help individuals make informed decisions when investing in certificate of deposits.

Related Posts

- Citibank Monthly Maintenance Fees: How to Avoid Them?