Fifth Third Bank

Checking Fees

Savings APY

Minimum Deposit

CDs APY Range

Fifth Third Bank functions as a regional financial institution, serving customers in 12 states through a network of almost 1,100 branches.

It presents a variety of checking and savings accounts, all of which require no minimum opening deposits. Additionally, the bank provides a money market account and a diverse selection of CD terms. Its primary branch presence can be found in Ohio, Michigan, Illinois, Florida, and Indiana.

Customers of Fifth Third Bank benefit from accounts with low minimum deposit requirements, and they can access a vast network of fee-free ATMs.

However, those in search of highly competitive interest rates may need to explore alternative options. Although the bank's customer service representatives are not available 24/7, they remain accessible even on weekends. Fifth Third Bank has been selected as one of our top banks in Illinois, Ohio, and Florida.

Variety Of Checking Options

Fifth Third Bank offers four different checking account options with varying features and fees:

Momentum Checking | Preferred Checking | Express Checking | |

|---|---|---|---|

Monthly maintenance fee | $0 | $25 | $0 |

Balance to waive fee | / | $100,000 across your deposit and investment accounts | / |

Check writing | Yes | Yes | / |

fee-free partner ATMs Access | Yes | Yes | Yes |

Dedicated banker | No | Yes | No |

-

Fifth Third Momentum® Checking account

The Fifth Third Momentum® Checking account is the bank's featured and most popular checking option. It offers all the benefits of a checking account with no monthly service charge, making it a free checking account.

There is no minimum balance or deposit required to open the account. With Fifth Third Extra Time®, customers have additional time to make a deposit and avoid overdraft fees until midnight ET the next business day.

The account also provides unlimited check writing, 24/7 mobile and online banking, the option to receive paychecks up to two days early with Early Pay, and the ability to get a cash advance on qualified deposits with MyAdvance®.

-

Fifth Third Preferred Checking

Fifth Third Preferred Checking® offers exclusive benefits, including higher interest rates on checking accounts, preferred discounts, and services. Avoid $25 monthly service charges by maintaining a combined total balance of $100,000 across deposit and investment accounts once a month.

Enjoy unlimited check writing, a secondary checking account, improved loan rates, complimentary Fifth Third Identity Alert®, and online bill pay.

-

Fifth Third Student Banking

Fifth Third Student Banking is a checking account designed for students aged 13 and above, with no minimum deposit or balance requirements. It offers a Fifth Third Debit Card, unlimited check writing, and online bill pay convenience.

-

Fifth Third Express Banking

Fifth Third Express Banking® offers a secure and accessible bank account with no monthly service fee or balance requirement.

It provides check cashing and deposits, immediate access to funds, 24/7 mobile and online banking, a Fifth Third Debit Card, and tools for credit building. Note that check writing and check deposits are not available at ATMs.

-

Fifth Third Military Checking

For military families, including active duty, retired, reserve/guard and veterans. Also includes commissioned officers of the Public Health Service and the National Oceanic and Atmospheric Administration.

Savings Accounts: Rates Are Not Competitive

The Fifth Third Momentum Savings account has no minimum deposit but APY is low – only 0.01%, far from the what you can get with other savings accounts.

You can avoid the $5 monthly service charge by meeting specific criteria: having a Fifth Third Checking Account, maintaining an average monthly balance of $500 or more, having someone under 18 as an account owner, or being enrolled in Fifth Third Military Banking.

Fifth Third Bank Savings | |

|---|---|

Savings APY | 0.01% |

Savings Fees | $5

The monthly service charge for Fifth Third savings accounts is waived if you meet any of the following criteria: having a Fifth Third checking account, having all savings account owners listed on the Fifth Third checking account, maintaining an average monthly balance of $500 or more, having an account owner under 18 years old, or being enrolled in Fifth Third Military Banking.

|

Minimum Deposit | $0 |

This account offers the convenience of automatic checking-to-savings transfers to reach your savings goals faster and combines savings and checking statements for added ease.

CDs: Competitive Rates But High Minimum

Fifth Third Bank offers a variety of CD terms from 7 days to 7 years, but the standard rates are relatively low, ranging from 0.05% to 0.10% APY, which might not be highly competitive.

To remedy this, they provide promotional rate CDs with terms of 5, 9, and 12 months, featuring significantly higher APYs that are competitive compared to other banks and credit unions. A minimum deposit of $5,000 is required to open a CD account. Here you can compare CD rates with other banks.

Fifth Third Bank CDs | |

|---|---|

3 Month | 4.26% |

7 Month | 4.20% |

13 Month | 3.75% |

24 Month | 3.20% |

60 Month | 2.25% |

Minimum Deposit | $5,000 |

Early withdrawal from the CD account results in penalties based on the term:

- For CD terms of 7 days up to 364 days, a 1% penalty of the withdrawn principal applies.

- For CD terms of 365 days up to 36 months, a 2% penalty of the withdrawn principal applies.

- For CD terms of 36 months or greater, a 3% penalty of the withdrawn principal applies.

The penalty amount cannot exceed the interest earned, except during the first 6 days where a minimum 7-day interest penalty may be deducted from the principal.

Money Market: Nice Features, Low Rates

The Fifth Third Relationship Money Market Savings Account provides additional benefits such as the ability to write checks and the convenience of combined savings and checking statements. Monthly service fee is $5 per month.

You can meet certain criteria to avoid a monthly service charge on Fifth Third savings accounts. This includes having a Fifth Third checking account, maintaining an average monthly balance of $500 or more, having an account owner who is under 18, or being enrolled in Fifth Third Military Banking will also waive the service charge.

Fifth Third Bank Savings | |

|---|---|

Money Market APY | 0.01% |

Fifth Bank Credit Cards

Fifth Third Bank offers three credit cards for different purposes:

The Preferred Cash/Back Card: it offers Fifth Third Preferred Banking Clients unlimited 2% cash back on every purchase. It comes with no annual fees, no international transaction fees, and allows cash back redemption with no minimum requirement.

The 1.67% Cash/Back Card: this card offers 1.67% cashback and key perks: no annual fee, no international transaction fees, touch-free payments, cell phone protection, digital wallet support, and the ability to temporarily lock and unlock the card for added security.

The 1% Cash Back Card: this card offers a low intro rate with a long 0% APR. Earn unlimited 1% cash back on all purchases with no annual or international transaction fees. Cashback can be redeemed anytime with no minimum requirement

- Secured Card: Fifth Third also offer a secured card that can help customers build credit and report activity to 3 credit bureaus. However, this card has an annual fee.

Our Real Experiences with the Fifth Third

We've taken a user-centric approach to assess the functionality of the Fifth Third banking features.

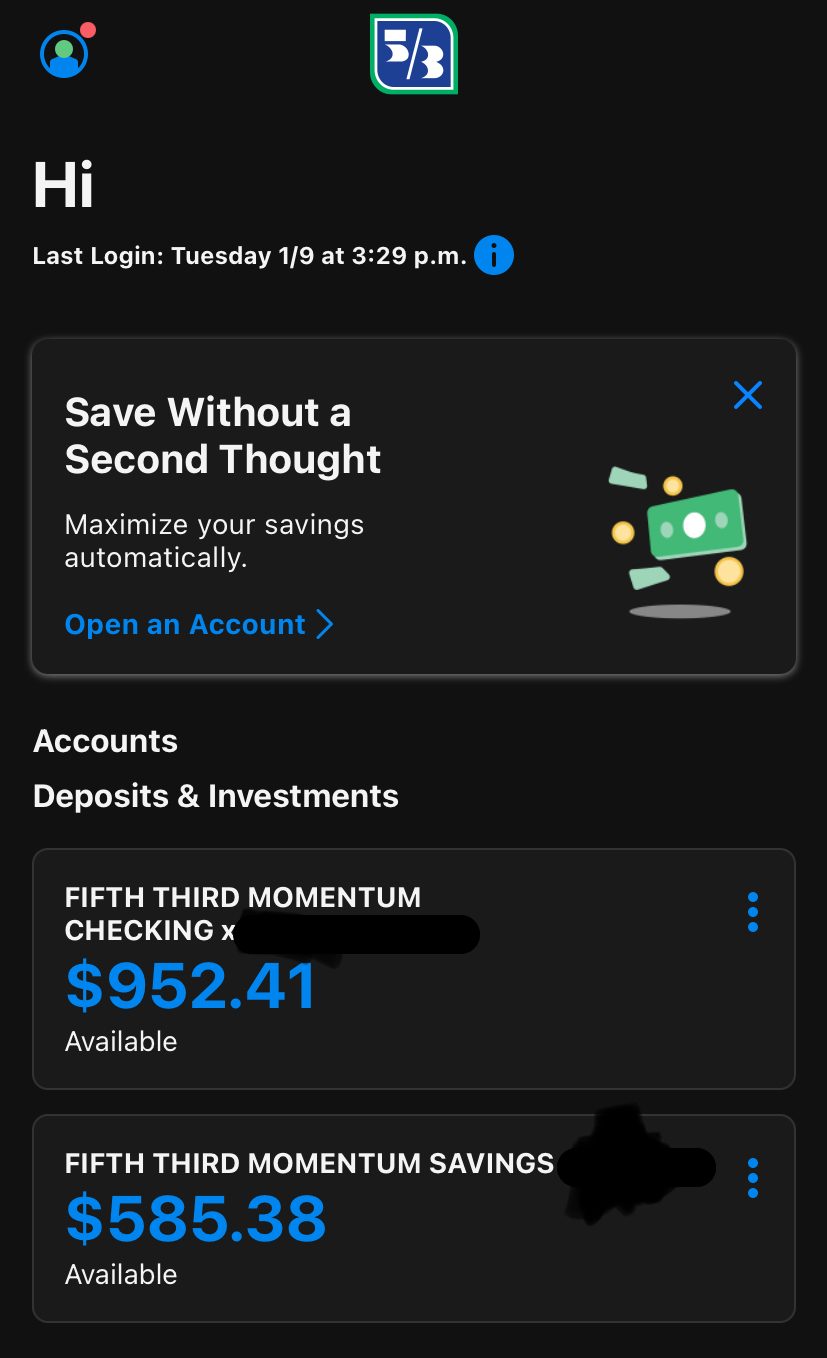

The main screen of the Fifth Third app serves as a central hub for a user's financial snapshot. Account balances, recent transactions, and upcoming payments are prominently displayed.

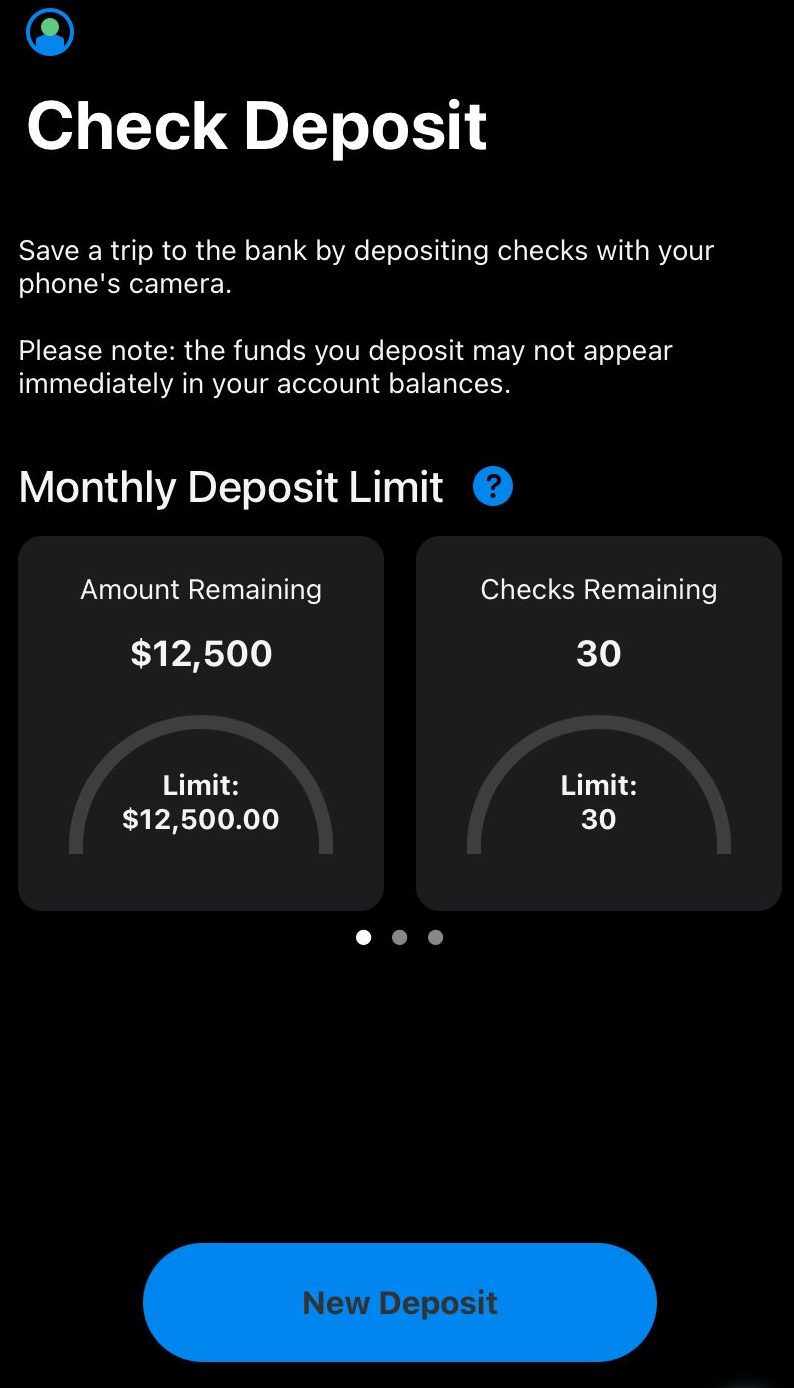

One of the standout features of the Fifth Third Bank app is the Check Deposit function. This allows users to deposit checks remotely by capturing an image of the check using their mobile device's camera. Our experience with this feature has been smooth and hassle-free.

It's easy to manage Fifth Third's credit or debit card as it allows for quick actions such as card activation, temporary card freezes, and PIN changes. The ability to report lost or stolen cards directly through the app adds a layer of security, giving users peace of mind in case of emergencies.

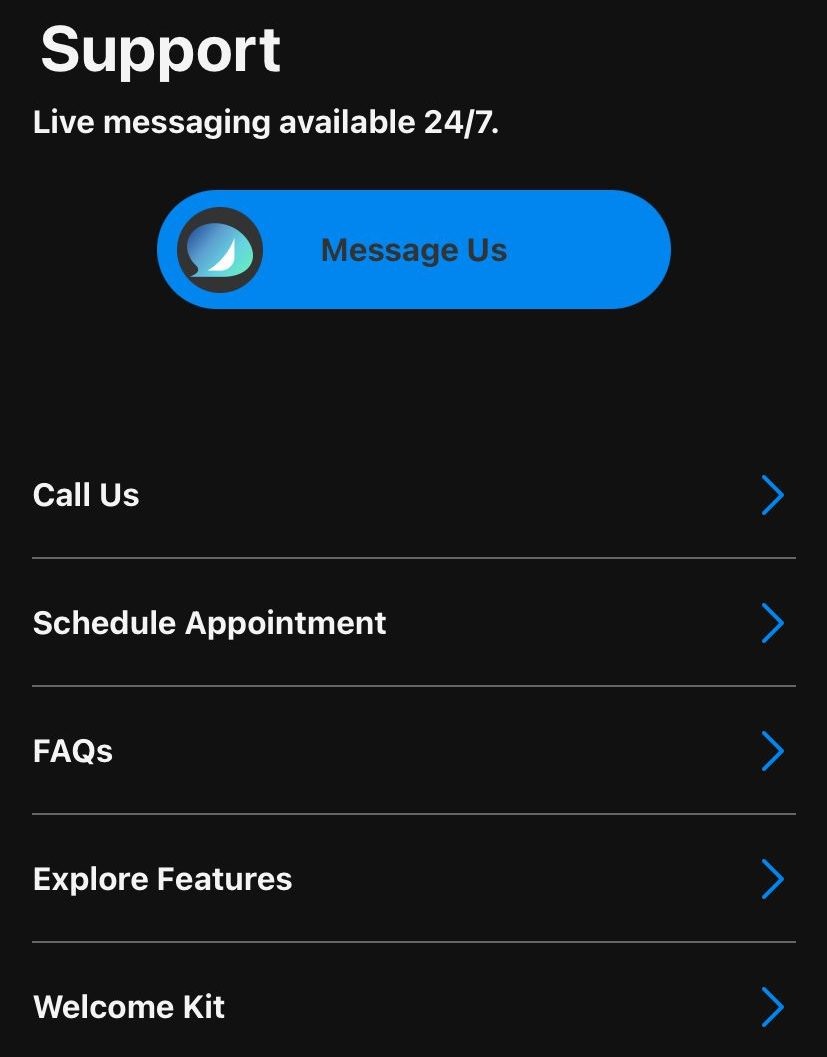

Lastly, there are many options for those who need support. Our interaction with customer support through the app has been positive, with responsive and knowledgeable representatives addressing queries promptly.

FAQs

How does Fifth Third Momentum® Savings help with saving money?

Fifth Third Momentum® Savings simplifies saving by offering visual goal tracking and automatic savings. By linking your Fifth Third Momentum® Checking account, you can put your savings on autopilot.

What do I need to open a savings account online?

To open an online savings account, you'll require your social security number, driver's license or state ID, a mobile phone with camera access for ID scanning, and your existing bank account number if you plan to make a transfer.

How can I renew my CD?

For CDs with the automatic renewal feature, there is a one-day grace period (for terms under 32 days) or a ten-day grace period (for terms of 32 days or more) after the maturity date to redeem it without penalty.

Does Fifth Third a good bank?

Consider M&T if you're seeking checking accounts, planning to deposit money in CDs, or require access to branches. However, be aware that the savings account rates are relatively low. Fifth Third Bank has been selected as one of our top banks in Florida, Ohio, and Illinois.

Compare Fifth Third Versus Other Banks

We believe Chase is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Chase vs. Fifth Third Bank

While Bank of America and Fifth Third Bank offer a range of banking services, Fifth Third is our winner in this competition. Here's why: Bank of America vs. Fifth Third Bank

Fifth Bank may be better than Wells Fargo when it comes to checking accounts, but is it enough? See our complete comparison, and our winner: Wells Fargo Bank vs. Fifth Third Bank

Huntington and Fifth Third Bank provide various banking services, and figuring out which is best can be tricky. Here's our comparison: Fifth Third Bank vs. Huntington Bank

Overall, we like Fifth Third a bit more than Truist bank, mainly due to the various checking options. Truist is better in credit cards.

PNC Bank and Fifth Third Bank are two big players when it comes to brick-and-mortar banking. Let's compare them and see which is our winner: PNC Bank vs. Fifth Third Bank

Our winner is U.S. Bank as it offers better package banking than Fifth Bank, but there are cases when Fifth Bank wins. Here's our comparison: U.S. Bank vs. Fifth Third Bank

How We Rate And Review Banks: Our Methodology

The Smart Investor team extensively reviewed hundreds of banks and credit unions. We assessed them based on four main categories, each with specific features:

-

Diversity of Products and Their Attractiveness (40%): We extensively analyzed the breadth and appeal of each bank's product offerings, including savings accounts, checking accounts, loans, investment options, and more. Higher ratings were assigned to banks with a diverse range of products that are attractive in terms of interest rates, fees, terms, and additional features. This category provides insights into the variety and value of the bank's offerings, crucial for meeting customers' diverse financial needs.

-

Account Features (30%): This category delves into the features and benefits accompanying each bank's accounts. We scrutinized factors such as promotions, deposit and withdrawal options, ATM accessibility, online and mobile banking functionalities, as well as additional perks like overdraft protection and rewards programs. Banks offering comprehensive and convenient features received higher ratings, reflecting the overall value of their accounts to customers.

-

Customer Experience (20%): A positive customer experience is paramount in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Bank Reputation (10%): The reputation of a bank is a critical consideration for customers. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were awarded to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories, individuals can make informed decisions that align with their financial needs and preferences, ensuring they choose a bank that offers competitive products, excellent features, a positive customer experience, and a solid reputation.