If you live in Illinois and need a bank that suits you best, you probably know there are many options out there. You can choose from small local banks to bigger ones that cover larger regions or national ones. And don't forget the ease of online banks, which are also available.

We considered several factors while making our selection. These include the number of physical branches they have, the variety of products they offer, the interest rates they provide for deposits, the quality of their online banking services, and how well they take care of their customers.

Best Illinois Regional And Community Banks

In Illinois, you've got a lot of different community and regional banks to pick from. We took a close look at some of them, and here are the ones that really stood out to us:

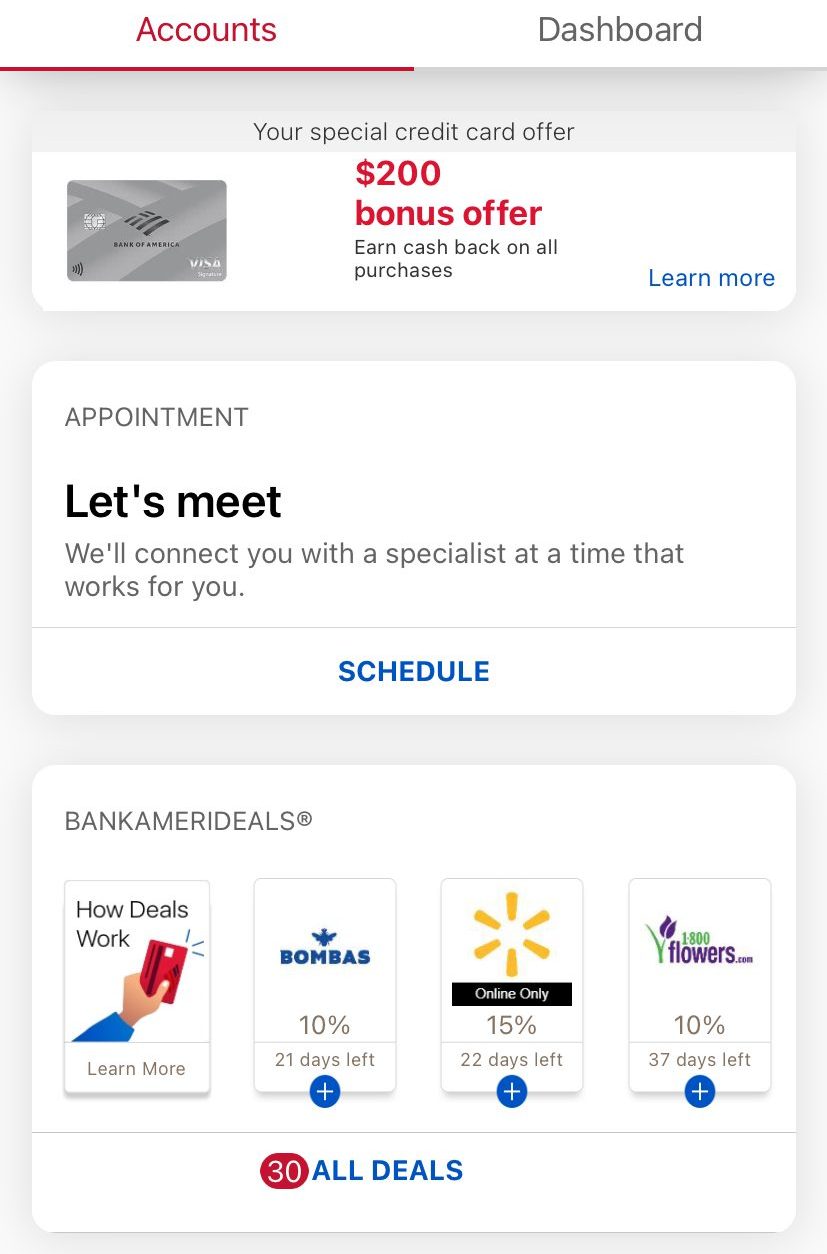

Huntington Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Huntington Bank is a prominent regional financial institution in Illinois, boasting an extensive network of 120 branches spread across 70 cities.

One of its key strengths lies in offering a basic checking account devoid of fees. Notably, the bank's 24-hour grace period on overdrafts offers a safety net for customers who accidentally overdraw their accounts, earning praise for its customer-centric approach. Huntington also offers decent rates on money market accounts and specific CDs.

However, it is essential to be mindful of certain limitations. Huntington's interest rates on accounts are comparatively low, potentially impacting earnings on deposited funds. Additionally, some of their interest-bearing checking accounts mandate high minimum balances, which may pose challenges for individuals with limited funds seeking such options.

Fifth Third Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

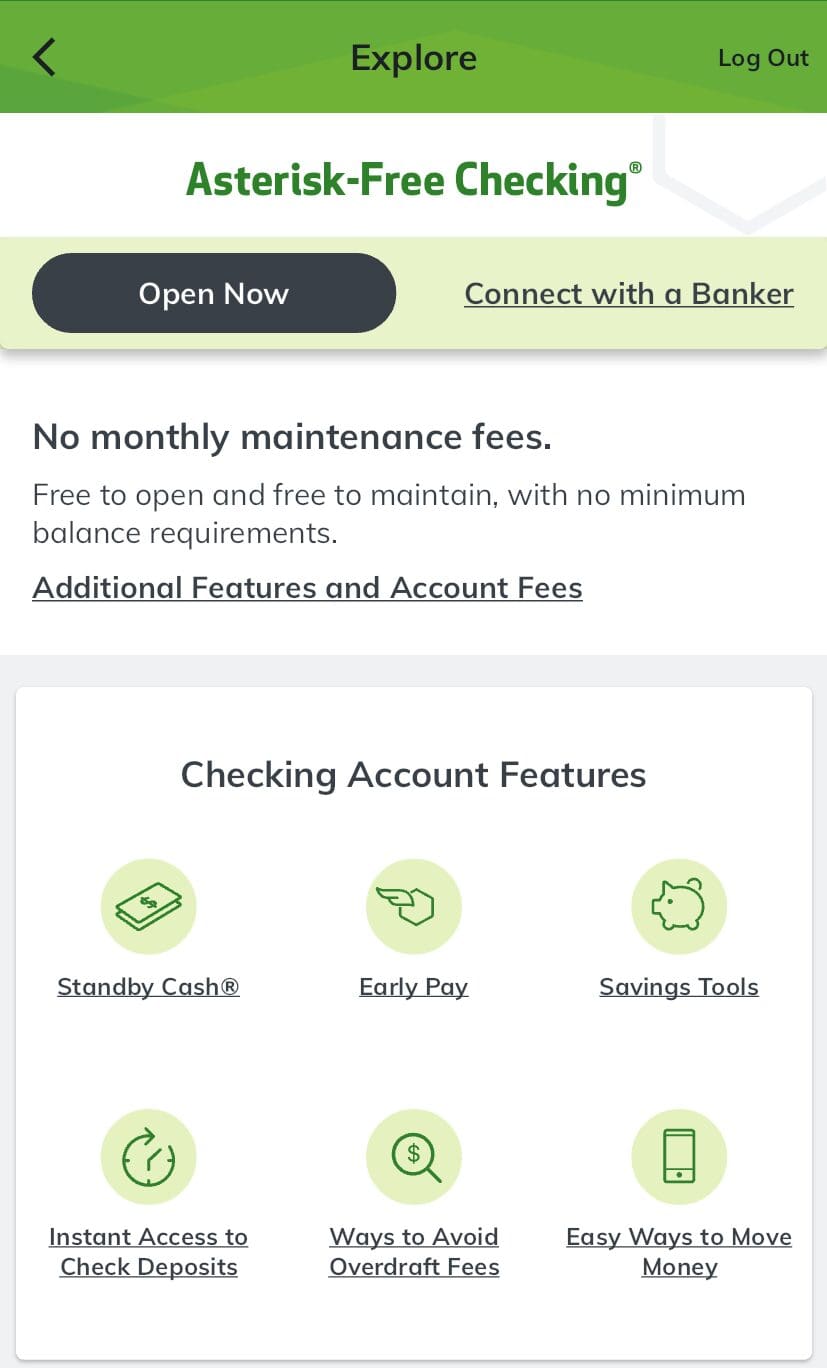

Fifth Third Bank is a regional financial institution that serves customers in Illinois. They have a strong presence in 80 cities, with nearly 150 branches in the state. The bank offers various checking and savings accounts, as well as lending products, credit cards, mortgages, lines of credit, and investing options.

They also provide a money market account and offer a range of CD terms for those who want to save and grow their money. Another advantage of banking with Fifth Third is that they have low minimum deposit requirements for their accounts, and they offer access to a wide network of fee-free ATMs. Customers can also create savings goals:

However, if you're looking for banks with the highest interest rates, you might want to check out other options. Also, it's worth noting that their customer service representatives may not be available 24/7, but they're still reachable even on weekends.

BMO Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

BMO Bank, previously known as BMO Harris, is a conventional retail bank catering to clients seeking a comprehensive range of personal banking solutions. Operating with a network of over 160 branches spread across 90 cities in Illinois, their services are incredibly accessible and convenient.

The bank distinguishes itself with its low fees, which are easily avoidable, and a variety of debit card options for customers to choose from. Notably, BMO maintains a low minimum opening balance requirement for both checking and savings accounts. Additionally, the bank offers a global presence and provides FDIC insurance for added security.

While BMO excels in providing a full suite of services, some of its deposit products may not be particularly noteworthy. Opening an account is hassle-free, with the option to complete the process online in just three simple steps or by visiting the nearest BMO bank branch

Best Illinois National Banks

We took a close look at some of the best banks in Illinois. We carefully studied and compared several important things about them.

We checked how many branches they have and where they are located. We also looked at the different products they offer. One thing we paid extra attention to was how well their deposit rates are, especially for CDs when compared to regular savings accounts.

U.S. Bank

Checking Fees

Checking Promotion

Earn $250 for $2,000–$4,999.99 in direct deposits.

Earn $350 for $5,000–$7,999.99 in direct deposits.

Earn $450 for $8,000+ in direct deposits. needed. Expired on 12/30/2024

Savings APY

CDs APY

U.S. Bank has many products and services for you to choose from, like checking and savings accounts, a money market account, and CDs. They have more than 150 branches in Illinois spread across 100 cities. The bank has a wide network of ATMs, making it convenient for customers to access cash. They offer various checking account options to suit different needs.

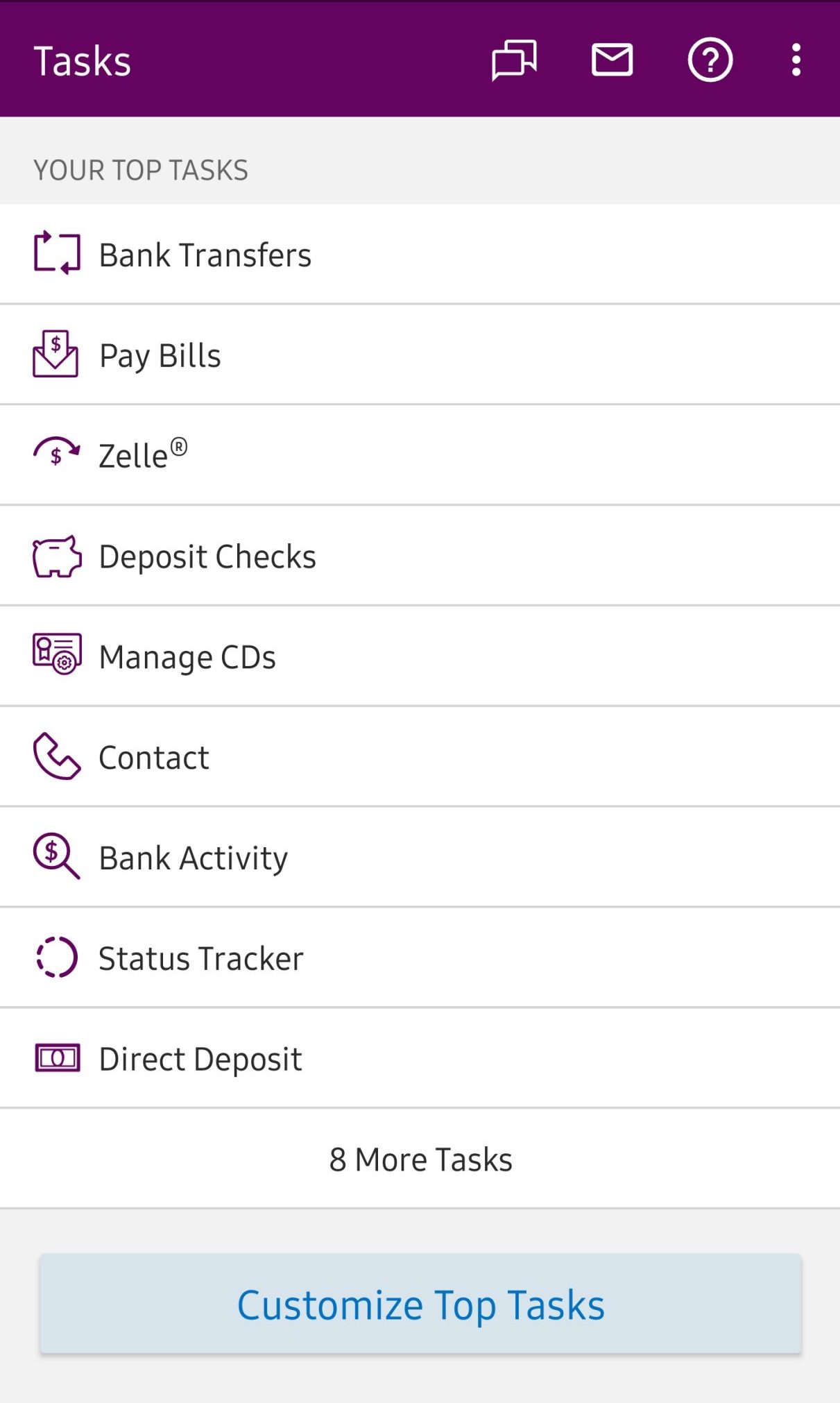

If you want to grow your savings, they have a promotional CD with attractive high-rate choices. Their mobile app is highly rated by both iPhone and Android users, showing that it is easy to use and efficient.

However, there are some downsides. The interest rates on savings, CDs, and money market accounts are relatively low, which means customers may earn less from their savings. Also, not all checking accounts provide fee-free ATM withdrawals and overdraft protection, so there may be additional charges for account holders.

Bank Of America

Checking Fees

Checking Promotion

Savings APY

CDs APY

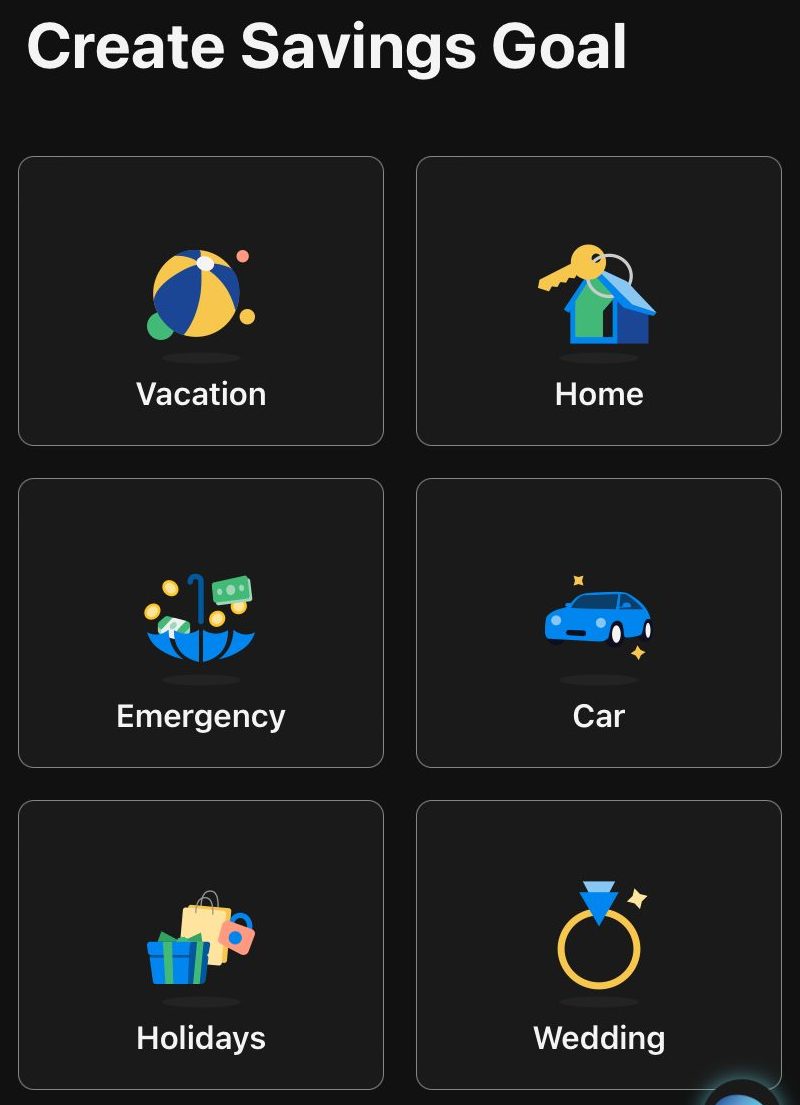

Bank of America is a big US bank that offers lots of financial services like checking and savings accounts, credit cards, mortgages, loans, investments, and wealth management. They have over 110 branches in Illinois spread across 60 cities, so finding a branch is easy.

The bank has many branches, making it convenient for customers, and they also have user-friendly online and mobile banking for easy transactions. Bank of America credit card rewards programs are attractive to cardholders.

However, there are some downsides. Bank of America charges fees, which might not suit those looking for fee-free options. They have improved customer service, but some people still face occasional issues with responsiveness and support. Also, their interest rates on savings accounts and certain loans might not be the best.

Overall, Bank of America is a good choice if you can meet the requirements to avoid fees, need various financial products, and are interested in mortgage services.

Chase Bank

Checking Fees

Checking Promotion

Savings APY

CDs APY

Chase Bank has lots of banking services for different needs, like checking accounts, savings accounts, credit cards, loans, investments, and business banking. They have over 250 branches in 120 cities in Illinois, which makes it easy to use their services.

The bank is great because it has many branches and ATMs, so you can get your money easily. They also have many credit cards to choose from.

But, there are some things to think about. Some of their accounts have high monthly fees, so you need to be careful. Also, their savings account and CD rates might not be the best compared to other banks.

Best Illinois Online Banks

When we searched for online banks in Illinois, we mainly checked their savings and CD rates. We also wanted to see if they have other services like checking accounts, loans, credit cards, and mortgages

Upgrade

Checking Fees

Checking Promotion

Savings APY

CDs APY

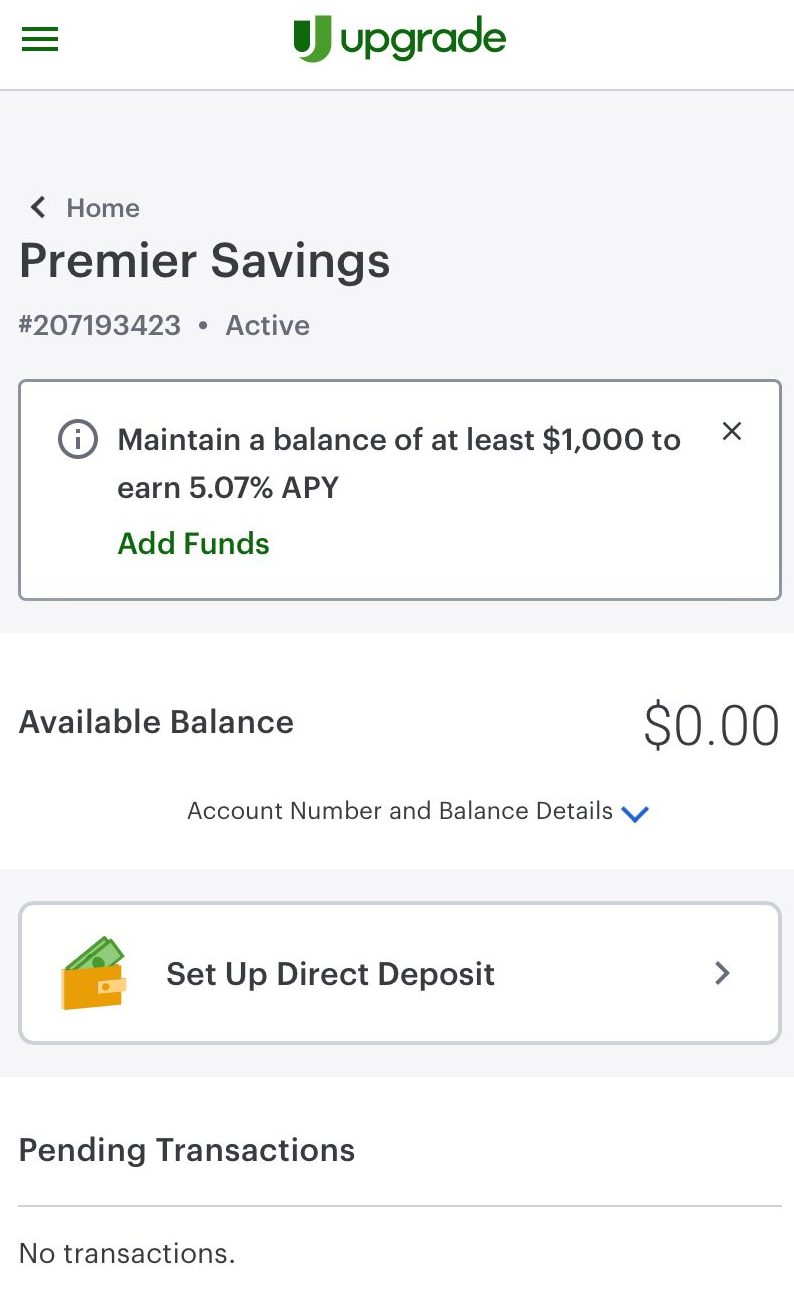

Upgrade is a fintech company in the banking industry, offering a range of financial products such as checking, savings, and credit cards. Although not a bank itself, it partners with Cross River Bank to provide accounts and FDIC insurance, ensuring customers' funds are protected.

For those seeking free checking and cash back on debit card purchases, Upgrade presents a viable choice. They also offer competitive interest rates on high-yield savings accounts, making it an attractive option for savers. Furthermore, customers benefit from no monthly fees, ATM fee rebates, and extended phone customer service hours, enhancing the overall banking experience.

However, there are some limitations to consider. Upgrade lacks an overdraft protection program, and cash deposits and branch access are not available, which may be inconvenient for certain customers.

Ally Bank

Checking Fees

Checking Promotion

Savings APY

CDs APY

Ally Bank is a well-known online banking institution that offers a wide range of financial products to its customers. They have checking accounts, savings accounts, CDs, IRAs, mortgages, and auto loans. One great thing about Ally is that most of their accounts don't have any monthly fees, which is a money-saving benefit for their clients.

Ally Bank savings rates are very competitive as well a their CD rates. They also have convenient features like 24/7 customer service, mobile banking, and online bill payment, making managing finances easier for their customers.

However, it's important to mention that Ally Bank doesn't have physical branches because it operates online, which might not be suitable for people who prefer in-person banking. Moreover, when compared to traditional banks with physical locations, Ally might not offer the same variety of services.

FAQs

Which banks have the largest presence in Illinois?

As of 2025, Chase Bank, BMO Bank, and U.S. Bank maintain the highest number of branches in Illinois, boasting over 150 branches each.

What's Illinois's finest bank?

The perfect Illinois bank for you depends on what you prioritize – in-person service, savings options, or no-fee checking accounts. Discover our recommended banks above, each with its unique advantages.

What bank offers the highest CD rates in Illinois?

In Illinois, the best CD rates change with different terms. Some banks offer the best rates for 2 year, while others have the best rates for 9 months. Take a look at our recommended Illinois banks for high CD rates and compare them with credit unions.

Where can I find the best savings rates in Illinois?

It's not easy to find the best savings rates, but in Illinois, a few banks and credit unions stand out. Discover some of the top options for high savings rates in Illinois for 2025.

How We Picked The Best Bank In Illinois: Methodology

The Smart Investor team conducted an extensive review to identify the best banks in Illinois. We assessed them based on four main categories, each with specific features:

- Financial Products and Services (40%): We evaluated the range and quality of financial products and services offered by each bank, including checking accounts, savings accounts, CDs, loans, credit cards, and investment options. Banks offering a diverse array of financial products with competitive rates and terms received higher ratings in this category.

- Banking Features and Tools (30%): This category assessed the availability and functionality of banking features and tools, such as transfer options, the ability to set savings goals, account linking capabilities, mobile app usability, check deposit options, and other features important for banks. Banks offering a comprehensive suite of features and user-friendly tools earned higher scores.

- Customer Experience (20%): We closely examined the overall customer experience, including the ease of account opening, communication with customer service representatives, the usability of online banking platforms and mobile apps, and the responsiveness of customer support. Banks with user-friendly interfaces, efficient digital banking tools, and responsive customer service received higher ratings.

- Bank Reputation (10%): Our team analyzed each bank's reputation based on factors such as customer satisfaction ratings, JD Power scores, TrustPilot reviews, and any notable awards or recognitions received. Banks with positive reputations and a history of providing excellent service to customers in Illinois received higher ratings.

Within each category, we assigned weights to various features and qualities to ensure a comprehensive evaluation of each bank.