Bank of America is one of the largest brick-and-mortar banks in the US, while American Express Bank is among the best online banks.

In this article, we will compare their savings accounts, checking accounts, CDs, credit cards, and lending products.

Checking Accounts

When it comes to checking accounts, there isn't a straightforward winner, but if we had to pick one, Bank of America comes out on top.

Bank of America has more choices for different customers, with access to physical branches and extra features. On the flip side, American Express Bank offers a free checking account with interest on the balance, but it's an online-only account.

-

Account Types

Bank of America has three personal checking account options. Although each has a monthly fee, customers can avoid it through different methods.

BofA Checking Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Safe Balance | $4.95 | $500 |

Advantage Plus | $12 | $1,500 |

Advantage Relationship

| $25 | $20,000 |

The Amex Rewards Checking is an interest-bearing checking with no monthly fees that easily managed through the user-friendly Amex App or online platform, allowing you to review transactions, transfer funds, and track rewards seamlessly.

Bank Account | Monthly Fee | APY On Balance |

|---|---|---|

Amex Rewards Checking | $0 | 1.00% |

-

Features

Bank of America's basic accounts, such as the Safe Balance, offer digital banking convenience, with features like no overdraft fees and a $0 liability guarantee for enhanced security.

The Advantage Relationship account is a premium account that provides additional benefits, including interest earnings and fee exemptions for select banking services. Overdraft protection is also included, ensuring a more comprehensive and secure banking experience for customers.

BofA Checking Account | Main Features |

|---|---|

Safe Balance | Digital banking, no overdraft fees, $0 liability guarantee |

Advantage Plus | Paper checks, overdraft protection, $0 liability guarantee |

Advantage Relationship

| Earns interest, no fees on select banking service ,overdraft protection |

With Amex Rewards Checking, customers can earn Membership Rewards points on eligible Debit Card purchases with no monthly fees, and it's backed by Amex with 24/7 customer service and fraud monitoring.

Mobile check deposits are simple with the Amex App, and digital transfers enable easy money transfers between connected accounts, including the Amex High Yield Savings account. Additionally, you can add your debit card to your digital wallet for quick and convenient payments in-store and online.

Bank Account | Main Features |

|---|---|

Amex Rewards Checking | Interest on balance, mobile check deposits, digital transfers, debit card with purchase protection, rewards your everyday spending

|

Savings Accounts

When it comes to savings accounts, American Express Bank is a clear winner.

Unlike Bank of America, Amex Savings Account rate is very competitive. At American Express, customers can manage their savings with simple transfers and auto-deposits and get 24/7 customer service.

Like many other brick-and-mortar banks, Bank of America Savings offers relatively low-interest rates on savings accounts, far below what you can find on other savings accounts.

Both banks don't have money market accounts for personal customers.

American Express Savings Account | Bank Of America Savings | |

|---|---|---|

Savings Rate | 3.50% | 0.01% – 0.04% |

Minimum Deposit | $0 | $100 |

Fees | $0 | $8 per month

Can be waived by maintaining a balance of $500+, becoming a Preferred Rewards member or linking to your B of A Advantage Banking account. Fees are also waived for enrolled students aged under 24

|

Certificate Of Deposits (CDs)

When comparing CD options, both Amex and Bank Of America offer similar options.

Both banks offer high rates only on specific, featured CD terms. While it may be good enough for some customers, there are other banks (mainly online banks) that offer higher rates across the board.

-

Bank of America CD Rates

CD Term | APY |

|---|---|

3 Months | 3.75% |

6 Months | 0.03% |

7 Months (Featured) | 4.00% |

12 Months | 0.03% |

13 Months (Featured) | 2.75% |

24 Months | 0.03% |

25 Months (Featured) | 2.00% |

36 Months | 0.03% |

-

American Express CD Rates

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

12 Months | 3.25% | 270 days interest |

18 Months | 3.85%

| 270 days interest |

24 Months | 4.00% | 270 days interest |

36 Months | 3.60% | 270 days interest |

48 Months | 3.60% | 365 days interest |

60 Months | 3.75% | 540 days interest |

Credit Cards

American Express is our winner when it comes to credit cards, with more credit card options and redemption options than Bank of America.

For everyday use, there are simple cards like the Blue Cash Everyday® Card and the Blue Cash Preferred® Card from American Express.

If you're a more advanced user, Amex has fancier cards. The American Express ® Gold Card gives you extra rewards for dining, groceries, and flights, especially if you love to travel. For serious travelers, The Platinum Card® from American Express is one of the best. It comes with tons of travel perks, like airport lounge access and bonus points for lots of different purchases.

American membership Rewards program provide cardmembers with various benefits and rewards for using their American Express cards. Points can be redeemed for a variety of rewards, including travel, merchandise, gift cards, statement credits, and more.

Card | Rewards | Bonus | Annual Fee |

| Blue Cash Preferred® Card from American Express | 1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

| $250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

| $95 ($0 intro for the first year) |

|---|---|---|---|---|

| American Express® Gold Card | 1X – 4X

4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases

| 100,000 points

100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership

| $325 |

| The Platinum Card® from American Express | 1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

| 175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

| $695 |

| Delta SkyMiles® Gold American Express Card | 1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

| 50,000 Miles

Earn 50,000 bonus miles after you spend $2,000 in purchases on your new card in your first 6 months of card membership.

| $150, $0 intro first year |

| Hilton Honors American Express Card | 3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

| 100,000 points

100,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

| $0 |

Bank of America also offers a variety of cards to suit different needs, but it has fewer options and redemption options compared to Amex.

If you're into cash back on your regular purchases, the Bank of America Customized Cash Rewards card lets you pick bonus categories. Travel enthusiasts can benefit from the Bank of America Travel Rewards card, earning points for travel without foreign transaction fees.

For those seeking premium perks, the Bank of America Premium Rewards Elite Credit Card is worth considering. It packs substantial rewards for travel and dining, along with statement credits for travel expenses.

Card | Rewards | Bonus | Annual Fee | Bank of America Unlimited Cash Rewards

| 1.5%

unlimited 1.5% cash back on all purchases

| $200

$200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

| $0 |

|---|---|---|---|---|

Bank of America® Customized Cash Rewards credit card | 1-3%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

| $200

$200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

| $0 | |

Bank of America® Travel Rewards credit card | 1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

| 25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

| $0 | |

BankAmericard | N/A | 21 billing cycles on purchases and balance transfers made within the first 60 days | $0 | |

Bank of America® Premium Rewards® Elite | 1.5x – 2x

2 points for every dollar you spend on travel or dining purchases, with 1.5 points per dollar on all your other purchases | 75,000 points

75,000 bonus points if you spend $5,000 or more within 90 days of opening your account

| $550 | |

Bank of America Premium Rewards | 1.5X – 2X

Unlimited 2X points on travel and dining purchases. Unlimited 1.5X points on all other purchases | 60,000 points

60,000 online bonus points after spending $4,000 on purchases in the first 90 days.

| $95 |

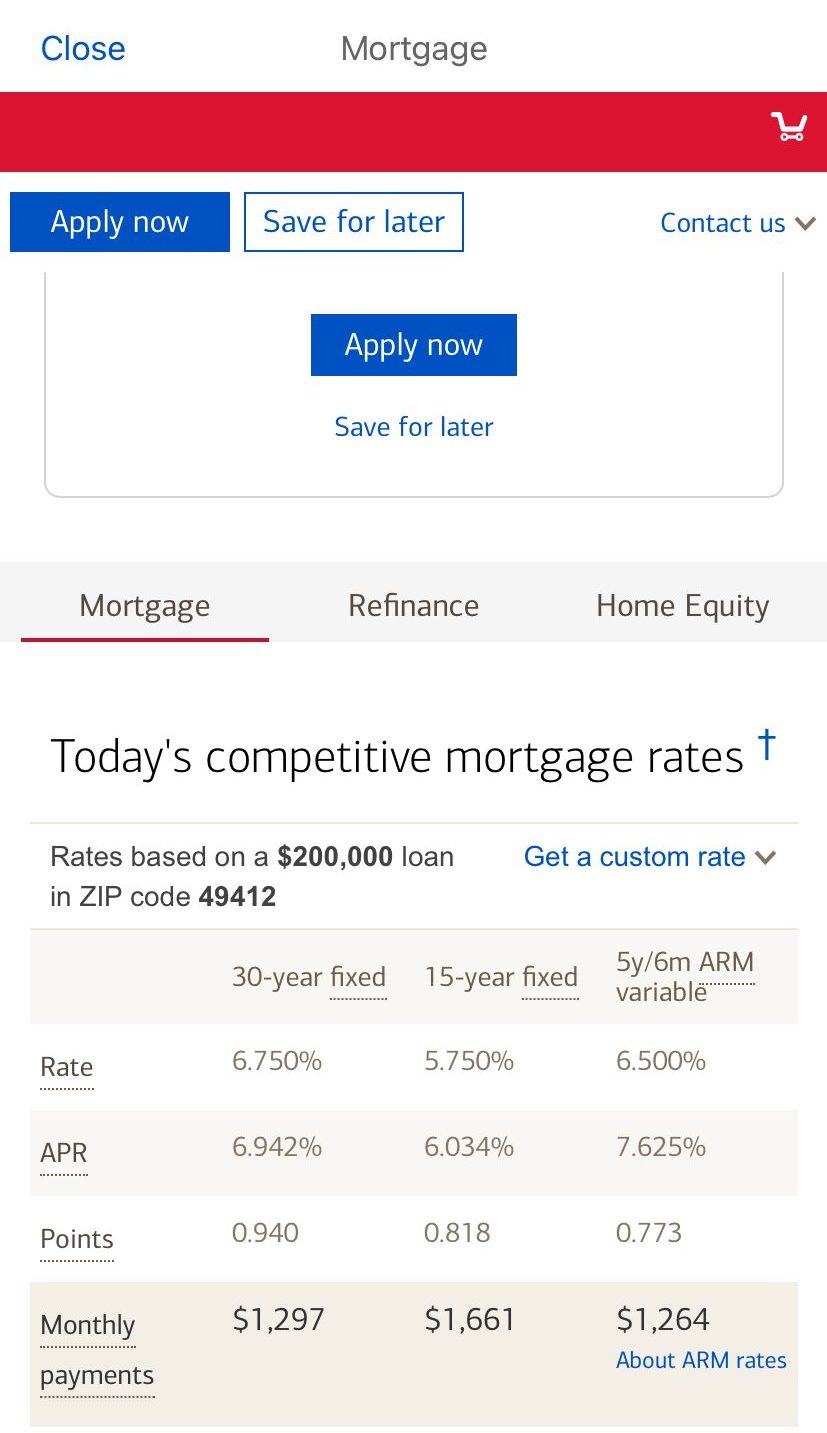

Mortgage And Loans

Bank of America is our winner when it comes to lending options, as it offers more options for borrowers than Amex.

Bank of America offers mortgages, mortgage refinancing, home equity loans, and auto loans. It doesn't offer personal or student loans.

With Amex, there are no lending options for customers.

Which Bank Is Our Winner?

There is no clear winner, as each bank excels in different areas. However, for most consumers, Bank of America may be a better option. American Express is a solid option for customers with higher wealth.

Bank Of America provides personal experience and many branches, as well as decent checking account and lending options. On the other hand, American Express is best for those who want online banking, high savings rates, and great credit card selection.

However, it is crucial to assess various factors, primarily focusing on those that are significant for your specific needs. This could include banking services, overdraft assistance, frequent ATM usage, proximity to bank locations, and other elements that vary from person to person.

Our Methodology: Breaking Down Bank Comparisons

In our thorough banking comparison, The Smart Investor team carefully reviewed and compared banks across five key categories:

Checking Accounts (30%): We examined features like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers available to customers.

Savings Accounts and CDs (20%): Our focus was on important factors such as the Annual Percentage Yield (APY), minimum deposit requirements, account flexibility, FDIC insurance coverage, special savings offers, variety of CDs, automatic renewal options, and early withdrawal penalties.

Credit Cards (15%): We analyzed rewards programs, annual fees, introductory bonuses, travel benefits, APR, and balance transfer options offered by each bank's credit cards to provide a comprehensive comparison of available features.

Lending Options (15%): We assessed the variety of loan options provided, including personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, offering insights into the banks' lending capabilities.

Customer Experience and Bank Reputation (20%): Our evaluation included an analysis of online banking and mobile app usability and ratings, accessibility of customer support, online reviews, JD Power research, Trustpilot ratings, and overall financial stability, providing a holistic view of customer experience and reputation.

Compare American Express Bank

Discover Bank is a full-service online bank as well as a provider of payment services. Discover can be used for banking and retirement planning by individuals. Discover is best known for its credit cards with rewards, but it also provides personal, student, and home equity loans.

American Express is one of the world's most well-known credit card brand names. Customers can get a personal banking solution from American Express National Bank, which offers online savings and CD options. Personal savings accounts have a high potential yield. They do not, however, provide as many products as Discover Bank does.

Read Full Comparison: Discover vs American Express: Which Bank Account Is Better?

Capital One is a premium online banking service that offers convenient, dependable service and physical locations to anyone looking for them. Capitol One 360, in addition to providing a trustworthy and dependable service, has no hidden fees or minimums, allowing you to continue earning interest on your daily money. There are over 38,000 fee-free ATMs and over 2,000 Capital One ATMs to meet your money access needs.

American Express is one of the world's most well-known credit card brand names. Customers can get a personal banking solution from American Express National Bank, which offers online savings and CD options. Personal savings accounts have a high potential yield. American Express National Bank is a respectable, secure banking option that does not offer any extra features but does offer the most important one.

Read Full Comparison: American Express vs Capital One: Which Bank Is Better For You?

Although Chase Bank has a modern, trendy image, it is one of the oldest banks in the United States. JP Morgan Chase's consumer division, Chase Bank, is one of the largest banks in the United States. Even though its interest rates aren't particularly competitive when compared to online banks and credit unions, loyal Chase customers who keep a significant amount of money with the bank can earn slightly better rates.

American Express is best known for its credit card business. The financial services firm, on the other hand, has a banking subsidiary that offers high-yield savings and CD accounts. For those looking to save money with a well-known financial institution, the American Express High Yield Savings Account is a popular option.

Read Full Comparison: American Express vs Chase Bank

The Citi checking account is a fairly standard product. The account does have a $12 monthly fee, but it is waived if you make a qualifying deposit or make a qualifying bill payment. Overdraft protection is also available, which automatically transfers funds from your savings account to avoid overdraft fees.

Because the American Express savings account has a high yield, the number of withdrawals or transfers you can make each month is limited to nine. It's also a nice touch that American Express allows you to choose paper statements if you prefer the old-fashioned way.

Read Full Comparison: American Express vs Citi: Where to Save Your Money?

While CIT Bank lacks a credit card option, it does have a decent eChecking account, mortgages, and home loans. However, American Express has personal loans and an impressive choice of credit card options.

CIT Bank vs American Express: Which Bank Account Is Better For You?

While Amex has a decent checking account and better credit card options, Ally's CD and lending options are superior. Here's our comparison: American Express Bank vs. Ally Bank

Chase Bank is our winner, while Amex and Chase offer great banking services and credit card portfolios. Here's our side-by-side comparison: American Express Bank vs. Chase Bank

While PNC Bank is a brick-and-mortar bank, American Express Bank's is an online bank. Let's compare their banking products side by side: American Express Bank vs. PNC Bank

U.S. Bank is one of the largest brick-and-mortar banks in the US, while Amex Bank is among the best online banks. Let's compare them: U.S. Bank vs. American Express Bank

Our preferred choice is American Express, which provides a comprehensive banking package that outshines Truist Bank. Here's how they compare: Truist Bank vs. American Express Bank

While TD offers a better selection of checking accounts and lending options, Amex is a great option for online banking. How do they compare? American Express Bank vs. TD Bank

American Express and HSBC focus on serving wealthier customers by providing services and features beyond the standard. How do they compare? American Express Bank vs. HSBC Bank (USA)

Amex comes out on top with a solid checking option (which Barclays doesn't have), an excellent savings account, and great credit cards.

Barclays Bank vs. American Express Bank: Which Bank Account Is Better?

American Express is our winner with a decent checking account, an impressive savings account, and a great selection of credit cards.

Synchrony Bank vs. American Express Bank: Which Bank Account Is Better?

Compare BofA With Alternative Banks

Since its inception as a credit card provider, Discover has come a long way.Of course, credit cards are available, but you can also get home loans, personal loans, and a variety of checking and savings products such as retirement accounts, CDs, and money market accounts.

Bank of America offers a far more comprehensive range of banking services. There are numerous credit card options, as well as various savings and checking accounts.

Bank of America also provides mortgages, auto loans, and investments. This makes switching from a traditional bank much easier because you won't have to compromise on your banking products.

Read Full Comparison: Discover vs Bank of America: Compare Bank

Bank of America is a nationwide network that offers deposit, loan, and credit card services. There are also increased daily limits on ATM and debit purchases, which is an excellent incentive to improve your financial situation. Aspiration's company was presented in a very different manner than their bank competitors.

One feature that sets them apart from their competitors is that they let their customers decide how much they want to pay for their services. The fee that the customer believes is fair or appropriate for the level of service they receive is set by the customer.

Wells Fargo's product offering is even more extensive. This bank offers checking accounts, a variety of savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management services. This makes switching from another bank even easier because you'll have access to all of your favorite banking products.

Bank of America offers a diverse range of banking services. Checking and savings accounts, auto loans, home loans, credit cards, and investment options are all available.

Read Full Comparison: Bank of America vs Wells Fargo: Which Bank Is Better?

Bank of America has an impressive line of banking products, as one would expect from a large banking institution. Aside from various checking and savings accounts, there are auto loans, home loans, a variety of credit cards, and investment options. This makes switching from your current bank easier because you'll find many familiar products.

Chase also has a good selection of banking products. There are checking and savings accounts, auto loans, home loans, and home equity options, as well as a fantastic selection of credit cards.

Read Full Comparison: Bank of America vs Chase: Where to Save Your Money?

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Bank of America offers a wide range of banking services. There are numerous credit cards available, as well as various checking and savings accounts, home loans, investments, and auto loans.

Read Full Comparison: Bank of America vs US Bank: Which is Best For You?

Bank of America is a large banking institution, and its impressive banking product line reflects this. Aside from savings and checking accounts, there are home loans, auto loans, investment options, and a variety of credit cards. Citi also has a diverse product offering. Credit cards, CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and checking and savings accounts are all available.

As a result, if you want to switch from your current bank, either bank is a viable option because you won't have to make any compromises in terms of banking products.

Read Full Comparison: Bank of America vs Citi: Which Bank Suits You Best?

Spend and Save is a SoFi savings and checking account hybrid. For the purposes of this comparison, we'll look at the savings features, of which there are a few. The most visible are the savings vaults. These enable you to set up separate funds to work toward different savings goals without the need for multiple accounts. This helps you organize your money, and you can even designate a vault for your round-up funds.

Bank of America offers a more traditional savings account, but it pays far less interest, ranging from 0.01 percent to 0.04 percent depending on your Preferred Rewards status, compared to SoFi's 0.25 percent. In addition, there is a $8 monthly maintenance fee that can be waived by keeping a balance of $500 or more in the account or linking your checking account. By linking your accounts, you can avoid going overdrawn with Balance Connect.

Read Full Comparison: SoFi Money vs Bank of America: Which Is Better For Your Needs?

Both banks have a decent selection of banking products, but there are some gaps in each line up. If you’re looking for the best returns, Capital One does have the edge in terms of CD and savings rates.

There is no clear winner as to whether Truist Bank or Bank of America is a better choice, but we prefer the latter. Here's why.

Truist Bank vs. Bank Of America: Which Bank Account Is Better?

Bank of America and PNC Bank offer various banking products, but which is a better fit for you? Let's compare and see our winner: PNC Bank vs. Bank Of America

We'll explore Bank Of America and TD Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: TD Bank vs. Bank Of America

BMO is the winner when it comes to savings products, while Bank Of America offers many more credit card options. Here's our winner: Bank of America vs. BMO Bank

There is no clear-cut winner, but we prefer Bank Of America. But, there are cases when Citizens is best. Here's our comparison: Bank of America vs. Citizens Bank

While Bank of America and Fifth Third Bank offer a range of banking services, Fifth Third is our winner in this competition. Here's why.

Bank of America vs. Fifth Third Bank: Which Bank Account Is Better?

We'll explore Bank of America and M&T Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Bank of America vs. M&T Bank

We believe Bank Of America is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Bank of America vs. KeyBank

While Regions Bank offers better checking accounts, Bank of America wins in credit cards and CDs. Here's our side by side comparison: Regions Bank vs. Bank of America

If you feel comfortable with online-only banking and depending on your needs – Ally may be a better option than Bank Of America. Here's why.

Ally Bank vs. Bank of America: Which Bank Account Is Better?