Bank Of America and Citizens Bank offer a range of banking services, and sometimes, it's challenging to understand which is best for your needs.

In this article, we will compare their savings accounts, checking accounts, CDs, credit cards, and lending products.

Checking Accounts

Bank of America and Citizens bank present extensive checking account choices, each with distinctive features. However, Citizens stands out as the preferred choice for checking accounts, thanks to its diverse account options.

-

Account Types

Citizens Bank offers checking accounts like One Deposit Checking and Citizens Quest Checking, each catering to different needs:

Citizens Bank Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

One Deposit Checking from Citizens | $9.99 | Make one deposit each statement period |

Citizens Quest Checking | $25 | $25,000 |

Citizens Private Client Checking | $0 | $200,000 |

Citizens EverValue Checking | $5 | Can't be waived |

Citizens Student Checking | $0 | under 25 |

Bank of America has three personal checking account options and two for businesses. Although each has a monthly fee, customers can avoid it through different methods.

BofA Checking Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Safe Balance | $4.95 | $500 |

Advantage Plus | $12 | $1,500 |

Advantage Relationship

| $25 | $20,000 |

-

Features

Bank of America offers some great features for both individuals and businesses.

For personal accounts, you can get paper checks, overdraft protection, and they assure you won't lose money if your card gets stolen. They also provide online banking, allowing you to check your account whenever it suits you.

BofA Checking Account | Main Features |

|---|---|

Safe Balance | Digital banking, no overdraft fees, $0 liability guarantee |

Advantage Plus | Paper checks, overdraft protection, $0 liability guarantee |

Advantage Relationship

| Earns interest, no fees on select banking service ,overdraft protection |

Business Advantage Fundamentals

| QuickBooks® integration, Cash Flow Monitor, Erica, Mobile Check Deposit, Zelle® for business |

Business Advantage Relationship

| No fees for incoming wires, stop payments, electronic deposits & more |

Customers of Citizens Bank enjoy access to a network of over 1,000 branches and 3,000 ATMs. The Citizens Virtual Assistantadds to the convenience by allowing customers to have live conversations with a person for assistance.

To provide a safety net for overdrafts, Citizens offers solutions like Citizens Fee Relief and Citizens Peace of Mind, with no overdraft fee on the first occurrence each year.

Citizens premium accounts offer exclusive benefits and rewards that grow with your relationship. These perks include an investment match, better cash back rewards on credit cards, higher savings rates, and discounts on lending.

The relationship also brings fewer fees for checks, wire transfers, using other banks' ATMs, stop payments, and more, ensuring a cost-effective banking experience.

Citizens Bank Account | Main Features |

|---|---|

One Deposit Checking | Digital wallet, Zelle, overdraft solutions, Citizens paid early |

Citizens Quest Checking | CitizensPlus, no fee for additional services, personalized guidance |

Citizens Private Client Checking | CitizensPlus benefits, Dedicated team of advisors, preferred rates |

Citizens EverValue Checking | No overdraft fees, Reduced fees for Non-Citizens ATM |

Citizens Student Checking | No fees for Non-Citizens ATM, No overdraft fees, Free design checks |

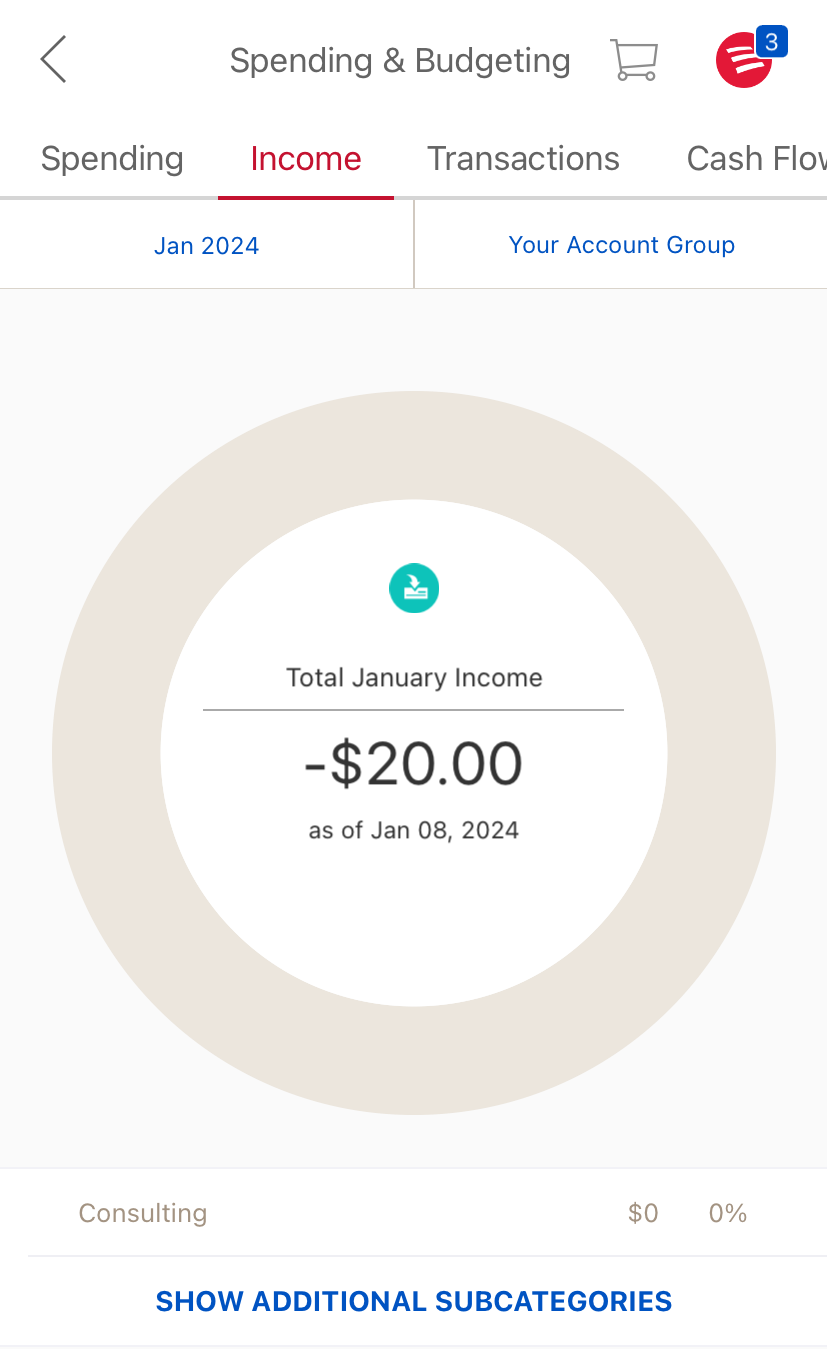

Savings Accounts

Bank of America's Rewards Savings account offers low rates. It has a cool feature called Keep the Change. It saves money for you by rounding up your purchases when you use a Bank of America debit card. Plus, the mobile app makes it easy to deposit checks into your savings account.

Citizens Bank savings account convenience with Automatic Transfers, allowing automatic deposits. Monthly fees are easily waived through simple methods. Safety is prioritized through 24/7 fraud monitoring and FDIC insurance. Its online division, Citizens Access, offers much better savings rates.

Also, unlike BofA – Citizens bank does offer a money market account, but the rates are low.

Citizens Access | Citizens Savings | BofA Savings | |

|---|---|---|---|

Savings Rate | 3.50% | 0.05% – 0.15% | 0.01% – 0.04% |

Minimum Deposit | $0.01 | $0 | $100 |

Fees | $0 | $4.99 per month

Can be waived if you maintain a $200 minimum daily balance, or under age 25 or 65 and older.

| $8 per month

Can be waived by maintaining a balance of $500+, becoming a Preferred Rewards member or linking to your B of A Advantage Banking account. Fees are also waived for enrolled students aged under 24

|

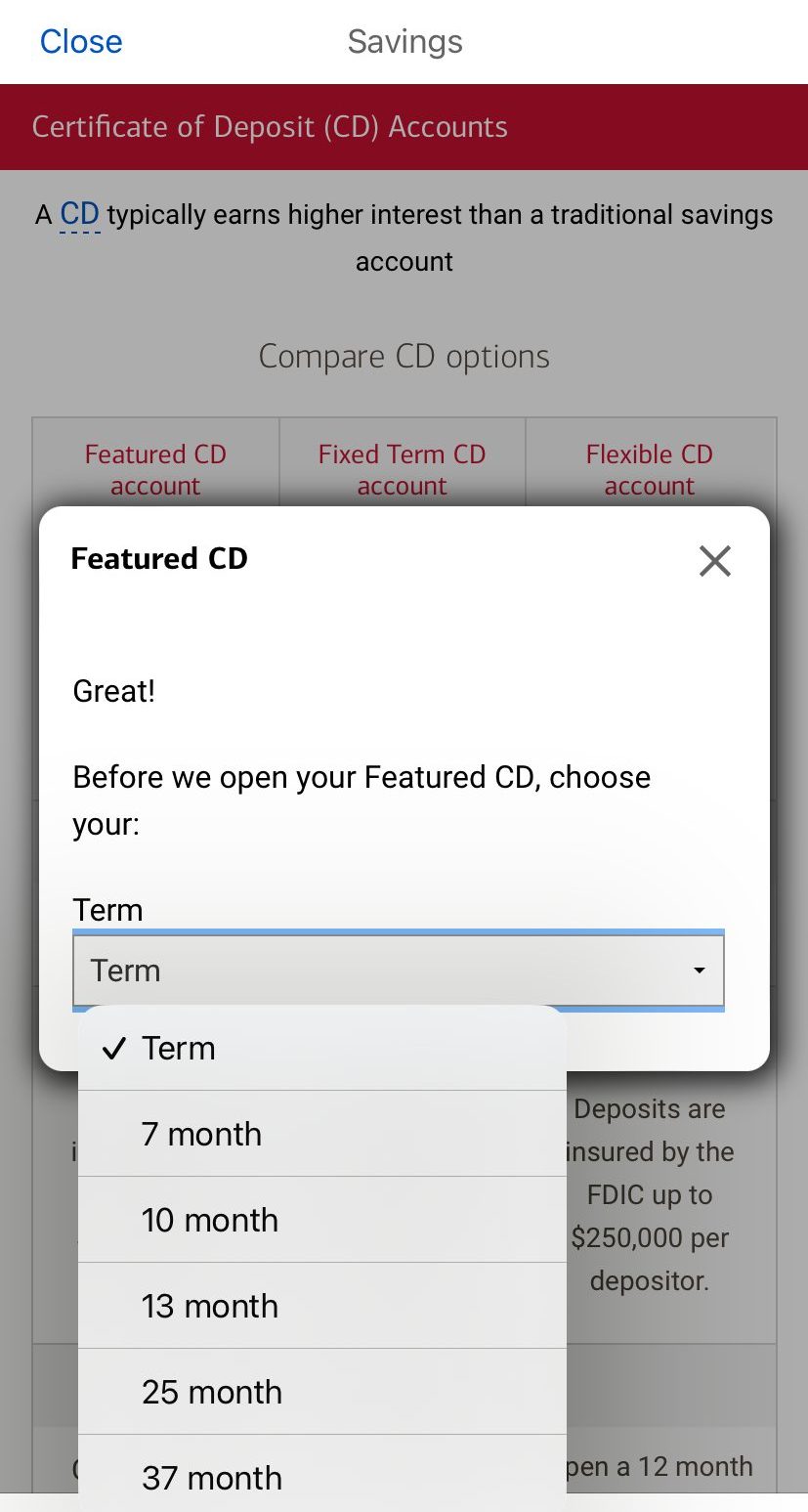

Certificate Of Deposits (CDs)

When it comes to CDs, Bank Of America is our winner.

It provides notably competitive rates, usually surpassing what is available with Citizens Bank, and offers additional term options.

-

Citizens Bank CD Rates

Citizens Bank offers two options for CDs. The initial option is a traditional fixed-term CD, available exclusively online for specific months, with no additional term variations.

CD Term | APY |

|---|---|

10 Months | 3.50% |

14 Months | 2.75% |

-

Bank Of America CD Rates

CD Term | APY |

|---|---|

3 Months | 3.51%

|

6 Months | 0.03% |

7 Months (Featured) | 3.75%

|

12 Months | 0.03% |

13 Months (Featured) | 2.50%

|

24 Months | 0.03% |

25 Months (Featured) | 2.00% |

36 Months | 0.03% |

Credit Cards

Bank of America stands out when it comes to credit cards.

They offer a variety of credit cards to suit different financial needs. If you want cash back on everyday purchases, the Bank of America Customized Cash Rewards card is a great option, allowing you to customize bonus categories. For frequent travelers, the Bank of America Travel Rewards card earns points for travel expenses and has no foreign transaction fees.

If you're after premium benefits, consider the Bank of America Premium Rewards Elite Credit Card. It provides significant rewards for travel and dining, along with statement credits for travel expenses.

Card | Rewards | Bonus | Annual Fee |

| Bank of America Unlimited Cash Rewards

| 1.5%

unlimited 1.5% cash back on all purchases

| $200

$200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

| $0 |

|---|---|---|---|---|

| Bank of America® Customized Cash Rewards credit card | 1-3%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

| $200

$200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

| $0 |

| Bank of America® Travel Rewards credit card | 1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

| 25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

| $0 |

| BankAmericard | N/A | 21 billing cycles on purchases and balance transfers made within the first 60 days | $0 |

| Bank of America® Premium Rewards® Elite | 1.5x – 2x

2 points for every dollar you spend on travel or dining purchases, with 1.5 points per dollar on all your other purchases | 75,000 points

75,000 bonus points if you spend $5,000 or more within 90 days of opening your account

| $550 |

| Bank of America Premium Rewards | 1.5X – 2X

Unlimited 2X points on travel and dining purchases. Unlimited 1.5X points on all other purchases | 60,000 points

60,000 online bonus points after spending $4,000 on purchases in the first 90 days.

| $95 |

Citizens Bank presents a trio of primary credit cards. The initial two options consist of a cashback card and a 0% intro card, both of which boast no annual fee. Each card offers distinct rewards, catering to varied preferences and spending habits.

The third card is a premium offering featuring an attractive cashback rate along with an array of travel perks. This premium card extends benefits such as TSA Pre-Check or Global Entry Fee Rebate, access to airport lounges at over 1,300 global airports, and comprehensive travel insurance covering accidents and baggage delays

Card | Rewards | Bonus | Annual Fee |

| Citizens Cash Back Plus World Mastercard

| 1.8%

1.8% cash back on everything you buy | 0% Intro APR: 15 billing cycles on balance transfers | $0 |

|---|---|---|---|---|

| Citizens Clear Value Mastercard | N/A | 0% Intro APR: 18 billing cycles on balance transfers | $0 |

| Citizens Private Client World Elite Mastercard | 2%

2% cash back on everything you buy | 0% Intro APR: 15 billing cycles on balance transfers | $195 |

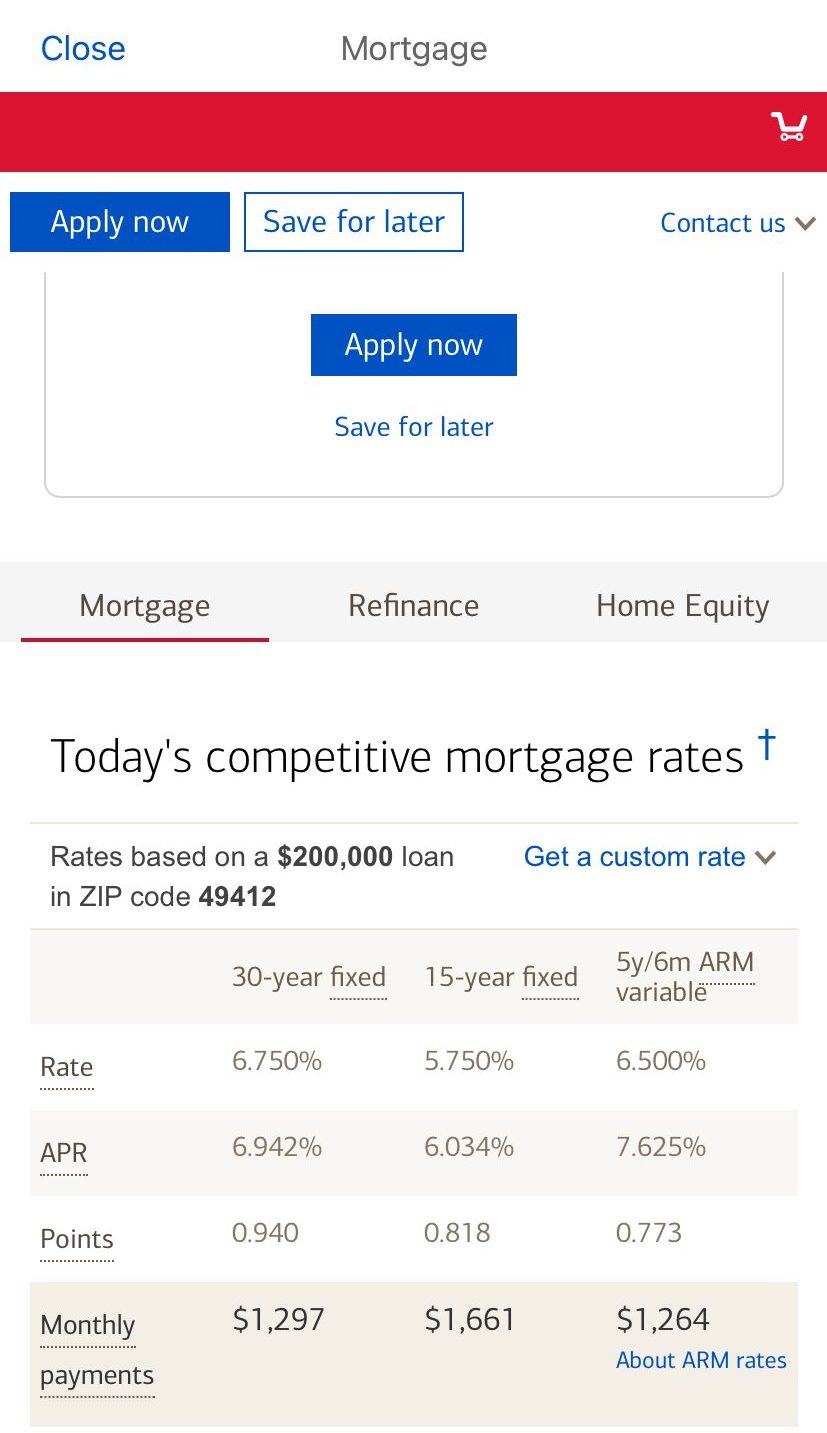

Mortgage And Loans

When it comes to lending products, both banks offer options for borrowers, but they do not include all types of loans.

Bank of America lending options include offers mortgages, mortgage refinancing, and home equity loans. Additionally, they offer auto purchase loans and auto refinancing options.

On the other hand, Citizens Lending Solutions offers mortgage options for homebuyers and HELOC, as well as student loans.

None of these banks offer personal loans, RV loans, or boat loans.

Which Bank Is Our Winner?

There is no clear-cut which bank is the winner, but we prefer Bank Of America because of its various credit card options, more CD terms with high rates, and decent features of their checking accounts.

However, it is crucial to assess various factors, primarily focusing on those significant for your specific considerations, such as banking services, overdraft assistance, frequent ATM usage, proximity to bank locations, and other elements that vary from person to person.

Comparing Bank Of America and Citizens Bank: Our Methodology

In our detailed banking comparison, The Smart Investor team thoroughly looked in five main areas in both banks and compare them side by side:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare BofA With Alternative Banks

Since its inception as a credit card provider, Discover has come a long way.Of course, credit cards are available, but you can also get home loans, personal loans, and a variety of checking and savings products such as retirement accounts, CDs, and money market accounts.

Bank of America offers a far more comprehensive range of banking services. There are numerous credit card options, as well as various savings and checking accounts.

Bank of America also provides mortgages, auto loans, and investments. This makes switching from a traditional bank much easier because you won't have to compromise on your banking products.

Read Full Comparison: Discover vs Bank of America: Compare Bank

Bank of America is a nationwide network that offers deposit, loan, and credit card services. There are also increased daily limits on ATM and debit purchases, which is an excellent incentive to improve your financial situation. Aspiration's company was presented in a very different manner than their bank competitors.

One feature that sets them apart from their competitors is that they let their customers decide how much they want to pay for their services. The fee that the customer believes is fair or appropriate for the level of service they receive is set by the customer.

Wells Fargo's product offering is even more extensive. This bank offers checking accounts, a variety of savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management services. This makes switching from another bank even easier because you'll have access to all of your favorite banking products.

Bank of America offers a diverse range of banking services. Checking and savings accounts, auto loans, home loans, credit cards, and investment options are all available.

Read Full Comparison: Bank of America vs Wells Fargo: Which Bank Is Better?

Bank of America has an impressive line of banking products, as one would expect from a large banking institution. Aside from various checking and savings accounts, there are auto loans, home loans, a variety of credit cards, and investment options. This makes switching from your current bank easier because you'll find many familiar products.

Chase also has a good selection of banking products. There are checking and savings accounts, auto loans, home loans, and home equity options, as well as a fantastic selection of credit cards.

Read Full Comparison: Bank of America vs Chase: Where to Save Your Money?

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Bank of America offers a wide range of banking services. There are numerous credit cards available, as well as various checking and savings accounts, home loans, investments, and auto loans.

Read Full Comparison: Bank of America vs US Bank: Which is Best For You?

Bank of America is a large banking institution, and its impressive banking product line reflects this. Aside from savings and checking accounts, there are home loans, auto loans, investment options, and a variety of credit cards. Citi also has a diverse product offering. Credit cards, CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and checking and savings accounts are all available.

As a result, if you want to switch from your current bank, either bank is a viable option because you won't have to make any compromises in terms of banking products.

Read Full Comparison: Bank of America vs Citi: Which Bank Suits You Best?

Spend and Save is a SoFi savings and checking account hybrid. For the purposes of this comparison, we'll look at the savings features, of which there are a few. The most visible are the savings vaults. These enable you to set up separate funds to work toward different savings goals without the need for multiple accounts. This helps you organize your money, and you can even designate a vault for your round-up funds.

Bank of America offers a more traditional savings account, but it pays far less interest, ranging from 0.01 percent to 0.04 percent depending on your Preferred Rewards status, compared to SoFi's 0.25 percent. In addition, there is a $8 monthly maintenance fee that can be waived by keeping a balance of $500 or more in the account or linking your checking account. By linking your accounts, you can avoid going overdrawn with Balance Connect.

Read Full Comparison: SoFi Money vs Bank of America: Which Is Better For Your Needs?

Both banks have a decent selection of banking products, but there are some gaps in each line up. If you’re looking for the best returns, Capital One does have the edge in terms of CD and savings rates.

There is no clear winner as to whether Truist Bank or Bank of America is a better choice, but we prefer the latter. Here's why.

Truist Bank vs. Bank Of America: Which Bank Account Is Better?

Bank of America and PNC Bank offer various banking products, but which is a better fit for you? Let's compare and see our winner: PNC Bank vs. Bank Of America

We'll explore Bank Of America and TD Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: TD Bank vs. Bank Of America

BMO is the winner when it comes to savings products, while Bank Of America offers many more credit card options. Here's our winner: Bank of America vs. BMO Bank

While Bank of America and Fifth Third Bank offer a range of banking services, Fifth Third is our winner in this competition. Here's why.

Bank of America vs. Fifth Third Bank: Which Bank Account Is Better?

We'll explore Bank of America and M&T Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Bank of America vs. M&T Bank

We believe Bank Of America is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Bank of America vs. KeyBank

While Regions Bank offers better checking accounts, Bank of America wins in credit cards and CDs. Here's our side by side comparison: Regions Bank vs. Bank of America

If you feel comfortable with online-only banking and depending on your needs – Ally may be a better option than Bank Of America. Here's why.

Ally Bank vs. Bank of America: Which Bank Account Is Better?

For most consumers, Bank of America may be a better option. American Express is a solid option for customers with higher wealth. Here's why.

American Express Bank vs. Bank of America: Which Bank Account Is Better?