Whether you're a seasoned local or a newcomer to the Golden State, finding the right bank is crucial for managing your finances.

From user-friendly mobile apps to competitive interest rates, these banks stand out for their reliability and customer satisfaction. In this article, we've compiled a list of the top banks when it comes to regional banks, national banks, and online banks.

Best California Regional Banks

You can find hundreds of regional and community banks in California, here are some of the best of them:

First Citizen Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

First Citizens Bank offers a diverse selection of checking and savings accounts, including both free and interest-earning options with added advantages.

Additionally, they provide a wide range of banking products, including special CDs with flexible terms. The bank boasts an extensive network with over 60 branches in California across 52 cities. Users have praised the highly-rated mobile app for iOS and Android.

However, the yields on CDs, savings, and money market accounts are lackluster. Certain customers may face challenges in waiving monthly service fees, and savings account holders are restricted to two free withdrawals or transfers monthly.

Furthermore, the bank recently acquired much of Silicon Valley Bridge Bank, successfully converting all 17 former SVB branches into First Citizens Bank branches.

Comerica Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Comerica provides a diverse array of banking services, encompassing deposits, loans, credit, investments, and insurance products. Being a traditional brick-and-mortar bank, certain services may require in-person visits to branch locations for account openings. Presently, Comerica operates over 90 branches in California across 70 cities. The bank's mobile app has received high praise from both iOS and Android users.

However, it's essential to note that, like other physical banks, Comerica offers low-interest rates on savings and charges various fees to cover expenses. Although some fees can be waived, customers may encounter charges eventually. Additionally, opening CD accounts online is not available, but savings and checking accounts can be opened digitally.

Despite having regular business hours, Comerica extends services to customers after closing time. They offer a 24/7 interactive voice-response service, accommodating different time zones, and live agents are accessible during office hours on weekdays.

Best California National Banks

When we picked the national banks we like in California, we calculated factors such as availability and number of branches, variety of products, and options to get high rates on deposits, usually via CDs and not via savings accounts.

Bank Of America

Checking Fees

Checking Promotion

Savings APY

CDs APY

Bank of America, a leading US bank, provides a wide array of financial services, including checking and savings accounts, credit cards, mortgages, loans, investment products, and wealth management services. Bank Of America operates over 750 branches in California across 340 cities, means you can find a branch easily.

The bank boasts an extensive branch network, ensuring easy access for customers and user-friendly online and mobile banking platforms for convenient transactions. Their credit card rewards programs offer attractive benefits to cardholders. The most popular checking is the Advantage Banking plus, but there are also Advantage Relationship (for advanced users) and Advantage SafeBalance (for starters).

Ob the other hand, potential drawbacks include fees and charges that might deter those seeking fee-free options. The bank has made strides in improving customer service but occasional responsiveness and support issues persist. Additionally, interest rates on savings accounts and certain loans may not always be the most competitive.

Chase Bank

Checking Fees

Checking Promotion

Savings APY

CDs APY

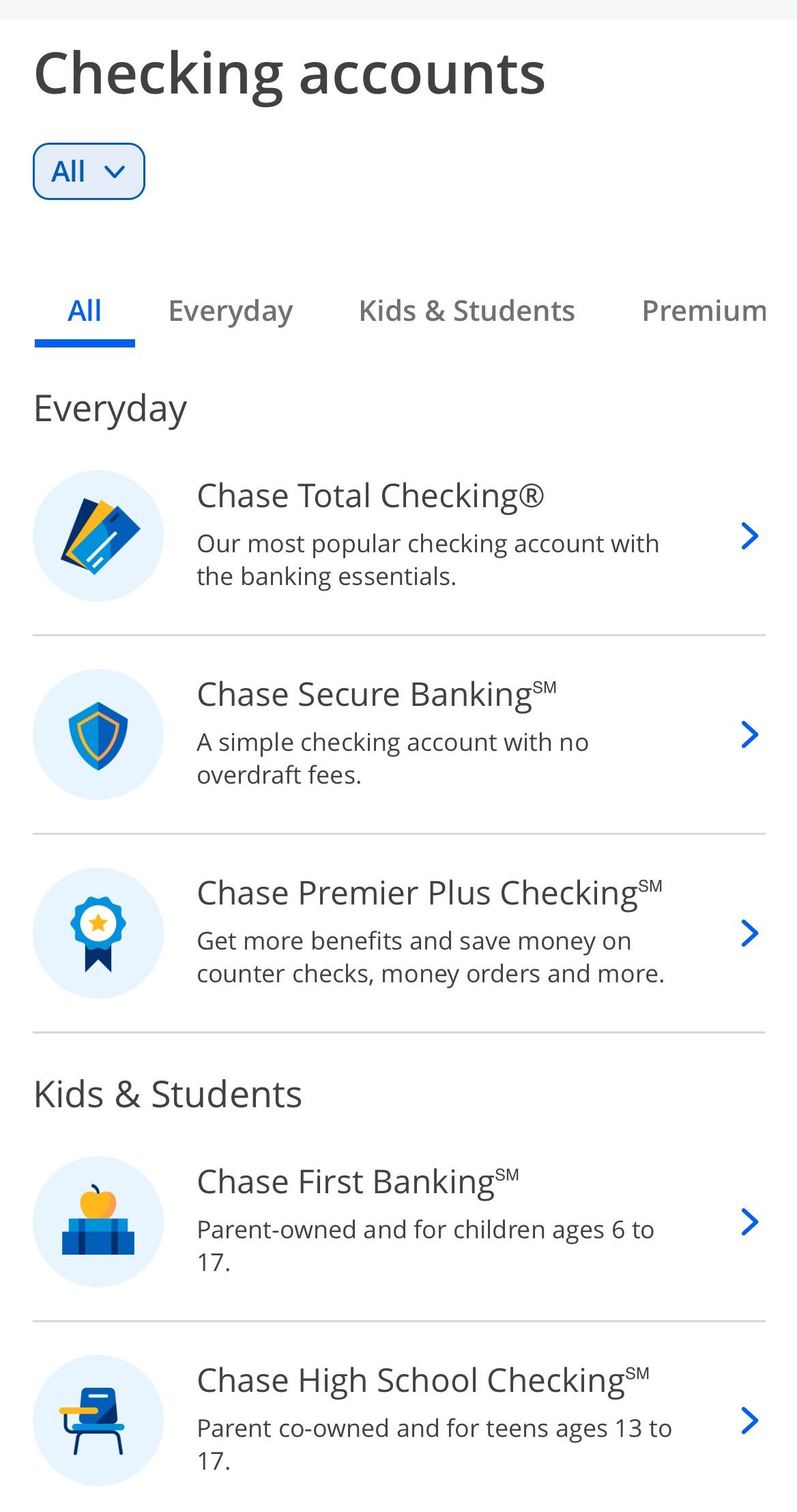

Chase Bank provides various banking solutions, including checking and savings accounts, credit cards, mortgages, personal and auto loans, investment services, and small business banking. Chase Bank operates over 880 branches in California across 350 cities, which means you can find a branch easily.

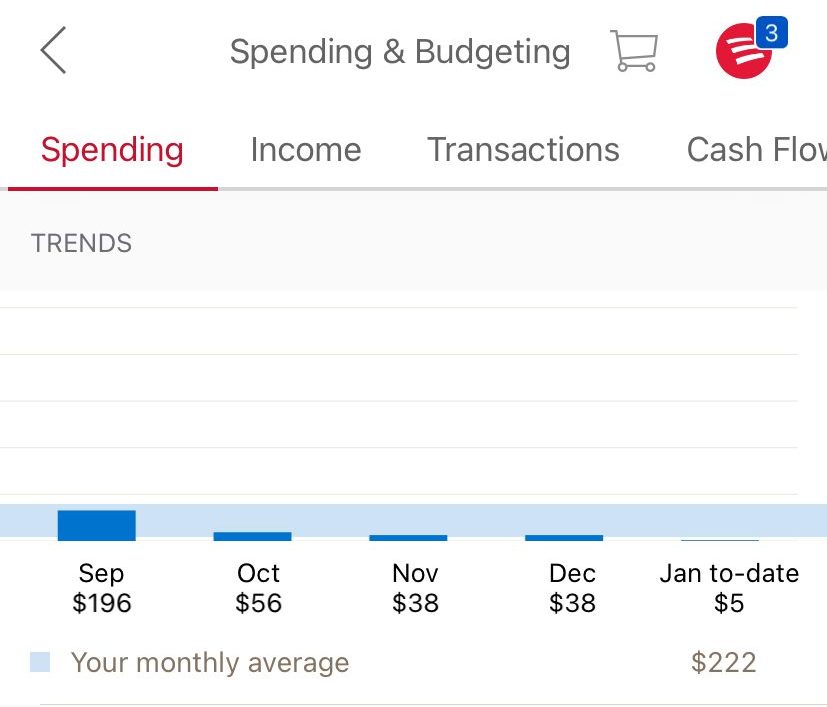

Chase Bank offers numerous advantages, such as a vast branch and ATM network, diverse financial products, robust online and mobile banking and a wide selection of credit cards. However, potential downsides include high monthly fees for certain accounts, relatively low savings rates, and out-of-network ATM fees with their basic accounts.

Chase Bank may be an ideal choice if you can fulfill the criteria for account fee waivers, find their credit card partners and deals attractive, and are interested in receiving a welcome bonus.

Citibank

Checking Fees

Checking Promotion

Savings APY

CDs APY

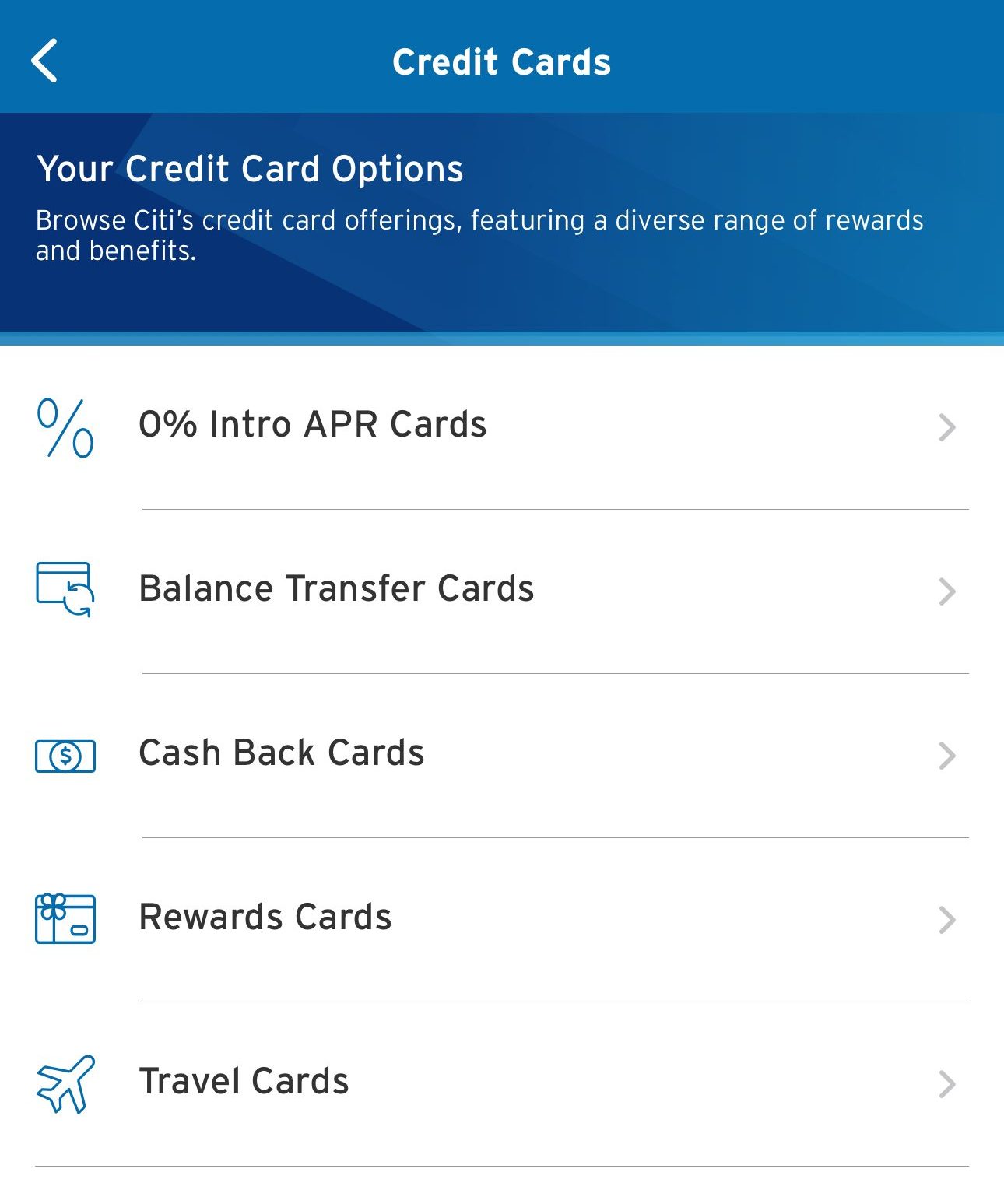

Citibank is a global financial institution that provides a wide range of banking and financial services. It offers products such as savings and checking accounts, credit cards, personal loans, mortgages, investment services, and wealth management solutions. As one of the major players in the banking industry, Citibank has a significant presence California with over 250 branches across 160 cities.

Citibank offers a wide range of products and services, competitive interest rates, and strong online/mobile banking platforms, providing convenience and options for customers. Additionally, Citi credit card selection, including rewards and travel cards, is appealing.

However, cons include high fees for certain services, minimum balance requirements for some accounts, and mixed customer service experiences, with occasional delays and communication issues reported by some customers.

Citibank is an ideal choice if you desire a credit card tailored to your preferred brands or spending habits, live in an area with numerous Citibank branches, and seek a comprehensive solution for managing your finances, all under one roof.

U.S. Bank

Checking Fees

Checking Promotion

Savings APY

CDs APY

U.S. Bank has a bunch of products and services for you to choose from, like checking and savings accounts, a money market account, and CDs. The bank has several notable advantages. Firstly, it boasts a widespread ATM network, ensuring convenient access to cash for customers. Secondly, it provides multiple checking account choices, catering to various needs.

Additionally, they offer a promotional CD with attractive high-rate options, which can be advantageous for those looking to grow their savings. Lastly, the mobile app receives high ratings from both iPhone and Android users, indicating its user-friendliness and efficiency.

On the other hand, the bank does have some drawbacks. The APYs on savings, CDs, and money market accounts are relatively low, potentially resulting in lower returns for customers. Another downside is that not all checking accounts grant fee-free ATM withdrawals and overdraft protection, potentially leading to additional charges for account holders.

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Best California Online Banks

When we picked the online banks available in California, we mainly focused on savings and CD rates, as well as the ability to provide a variety of financial products, including checking accounts, loans, and even credit cards and mortgages.

Ally Bank

Checking Fees

Checking Promotion

Savings APY

CDs APY

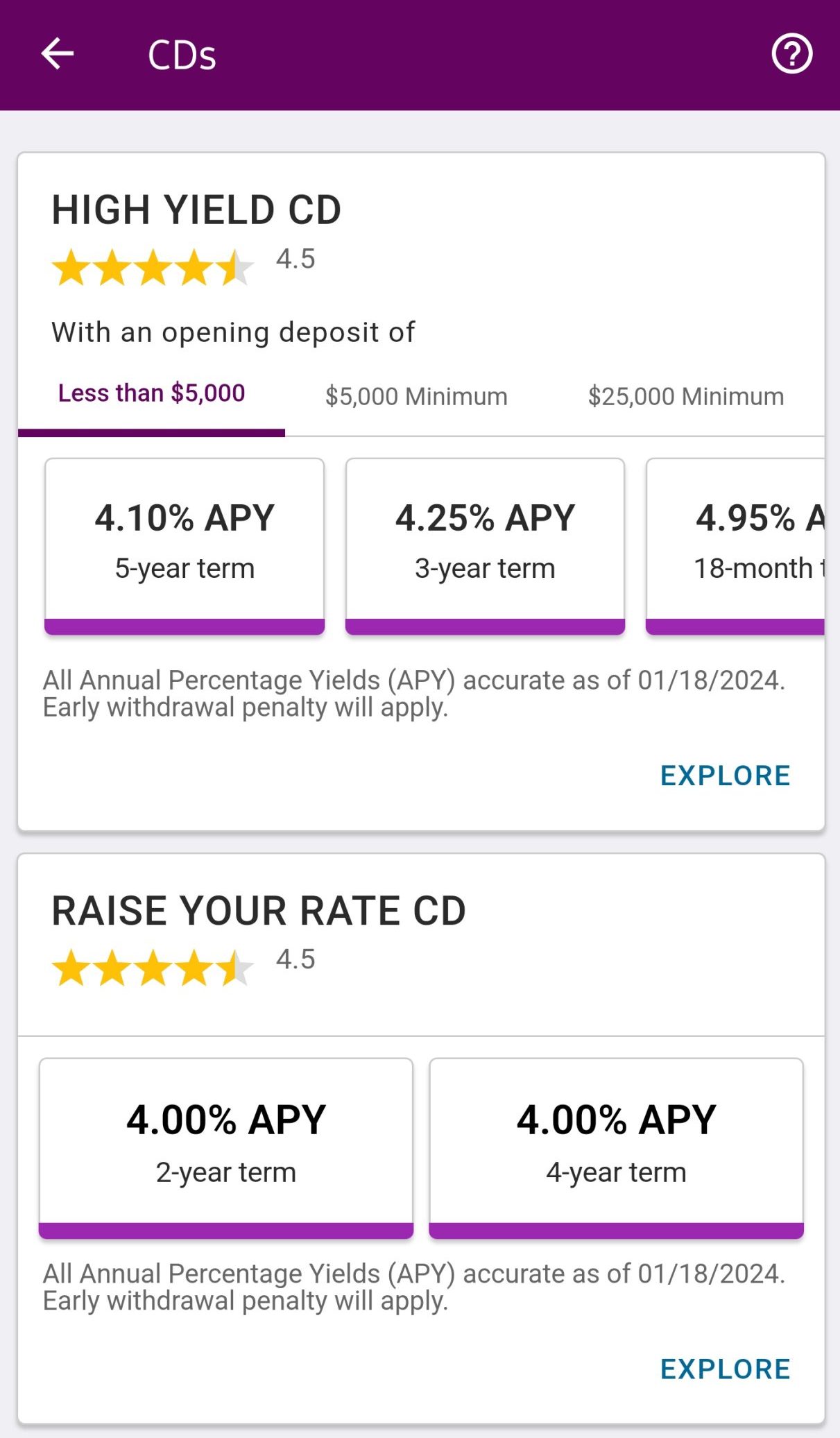

Ally Bank stands as a prominent online banking institution, providing a diverse array of financial products to its customers. These offerings include checking accounts, savings accounts, CDs, IRAs, mortgages, and auto loans. One of Ally's key advantages is the absence of monthly maintenance fees for most of its accounts, making it a cost-effective choice for its clientele.

Ally Bank is well-regarded for its competitive interest rates. Ally CD rates are quite high, and its savings accounts is one of the best in the nation. To enhance the banking experience, Ally offers a range of convenient features. Customers can benefit from 24/7 customer service, mobile banking, and online bill pay, streamlining their financial management.

However, it's essential to note that Ally Bank does not have physical branches due to its online nature, which may be a drawback for individuals who prefer in-person banking. Additionally, compared to traditional brick-and-mortar banks, Ally might not offer the same breadth of services.

CIT Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

CIT Bank operates as an internet-based financial institution, offering a diverse range of financial products and services. Its offerings encompass various deposit accounts, including savings accounts, checking accounts, money market accounts, and CDs. Notably, CIT Bank stands out for its competitive interest rates, particularly on savings products and CDs.

One of the most advantageous aspects of CIT Bank's accounts is the absence of monthly maintenance fees, providing customers with a fee-free banking experience. It proves to be an attractive option for those in search of a high-yield savings account and a seamless online banking journey.

However, it's crucial to bear in mind that CIT Bank lacks physical branches, necessitating comfort with online banking and ATM usage. For individuals who value convenience, high interest rates, and a fee-friendly experience, CIT Bank proves to be a favorable choice.

FAQs

Which banks have the most branches in California?

As of May 2024, Chase Bank, Wells Fargo Bank and Bank of America are the banks with most branches in California, with over 700 branches for each bank.

What is the best bank in California?

The best bank in California really depends on your needs and preferences – whether it's in person service, high deposit rates pr no fee checking accounts. In the list above, you can find our recommended banks, while each of them has its own speciality.

Which bank has the best CD rates in California?

The best CD rates in California changes between terms, as one bank can offer the best rates for 1 year while another one has the best rates for 6 months. Take a look on our recommended banks in California for high CD rates and compare between banks and credit unions.

Which bank has the best savings rates in California?

There are a couple of banks and credit unions which provide great savings rates across California. Here's our some of the best performers for high savings rates in California for 2024.

How We Picked The Best Bank In California: Methodology

The Smart Investor team conducted an extensive review to identify the best banks in California. We assessed them based on four main categories, each with specific features:

- Financial Products and Services (40%): We evaluated the range and quality of financial products and services offered by each bank, including checking accounts, savings accounts, CDs, loans, credit cards, and investment options. Banks offering a diverse array of financial products with competitive rates and terms received higher ratings in this category.

- Banking Features and Tools (30%): This category assessed the availability and functionality of banking features and tools, such as transfer options, the ability to set savings goals, account linking capabilities, mobile app usability, check deposit options, and other features important for banks. Banks offering a comprehensive suite of features and user-friendly tools earned higher scores.

- Customer Experience (20%): We closely examined the overall customer experience, including the ease of account opening, communication with customer service representatives, the usability of online banking platforms and mobile apps, and the responsiveness of customer support. Banks with user-friendly interfaces, efficient digital banking tools, and responsive customer service received higher ratings.

- Bank Reputation (10%): Our team analyzed each bank's reputation based on factors such as customer satisfaction ratings, JD Power scores, TrustPilot reviews, and any notable awards or recognitions received. Banks with positive reputations and a history of providing excellent service to customers in California received higher ratings.

Within each category, we assigned weights to various features and qualities to ensure a comprehensive evaluation of each bank.