Table Of Content

Banks play a pivotal role in our modern economy, serving as intermediaries between depositors and borrowers, and providing a wide array of financial services. As institutions that handle our money, it's only natural to wonder: How do banks make money? What drives their profitability, and what mechanisms lie behind the financial engine that powers the banking industry?

In this article, we will explore the primary sources of income for banks, ranging from interest income and fees to investment activities and auxiliary services. We will delve into the role of deposits and loans, as well as the significance of net interest margin and credit risk management

8 Ways Banks Make Money

Banks generate revenue through various channels and activities. Here are ten primary ways banks make money:

-

Interest Income

Banks earn a significant portion of their revenue through interest income. Banks charge interest on loans when they lend money to individuals, businesses, or other entities. The interest rates vary based on factors such as the borrower's creditworthiness, loan duration, and prevailing market rates.

The interest charged on loans is typically higher than the interest paid on deposits, allowing banks to earn a margin known as the net interest income. This income is a result of the spread between the interest earned on loans and the interest paid on deposits.

-

Fees and Service Charges

Banks charge various fees and service charges for the services they provide. These fees can include account maintenance fees, ATM fees, overdraft fees, wire transfer fees, and credit card fees. Account maintenance fees are typically charged for the upkeep of a customer's bank account. ATM fees are charged when customers use ATMs that do not belong to their own bank's network.

Overdraft fees are levied when customers spend more money than they have available in their accounts. Wire transfer fees are incurred when customers send money electronically between bank accounts.

Bank/institution | Monthly Fee | Bank Type |

|---|---|---|

Bank of America Advantage Plus Checking | $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

| Traditional |

Chase Total Checking® | $12

Can be waived if you maintain a $1,000 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $2,500 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| Traditional |

Citi Checking Account | $12

Can be waived if you make one qualifying direct deposit and one qualifying bill payment per statement period, maintain a combined balance of $1,500 per month across your eligible accounts or if you’re aged 62

| Traditional |

PNC Standard Checking | $7 – $25 per month

can be waived if you maintain $500+/$2,000/$5,000 direct deposit per month, $500+/$2,000/$5,000 monthly balance in savings or age 62+/$10,000 in all PNC consumer deposit accounts/$25,000 in all PNC consumer deposit accounts/

| Traditional |

U.S. Bank Checking | $6.95

Can be waived by maintaining an average account balance of $1,500, have $1,000+ in direct deposits per month or be aged 65+

| Traditional |

Wells Fargo Everyday Checking | $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

| Traditional |

Capital One 360 Checking | $0 | Online Only |

Amex Rewards Checking | $0 | Online Only |

SoFi Bank | $0 | Online Only |

-

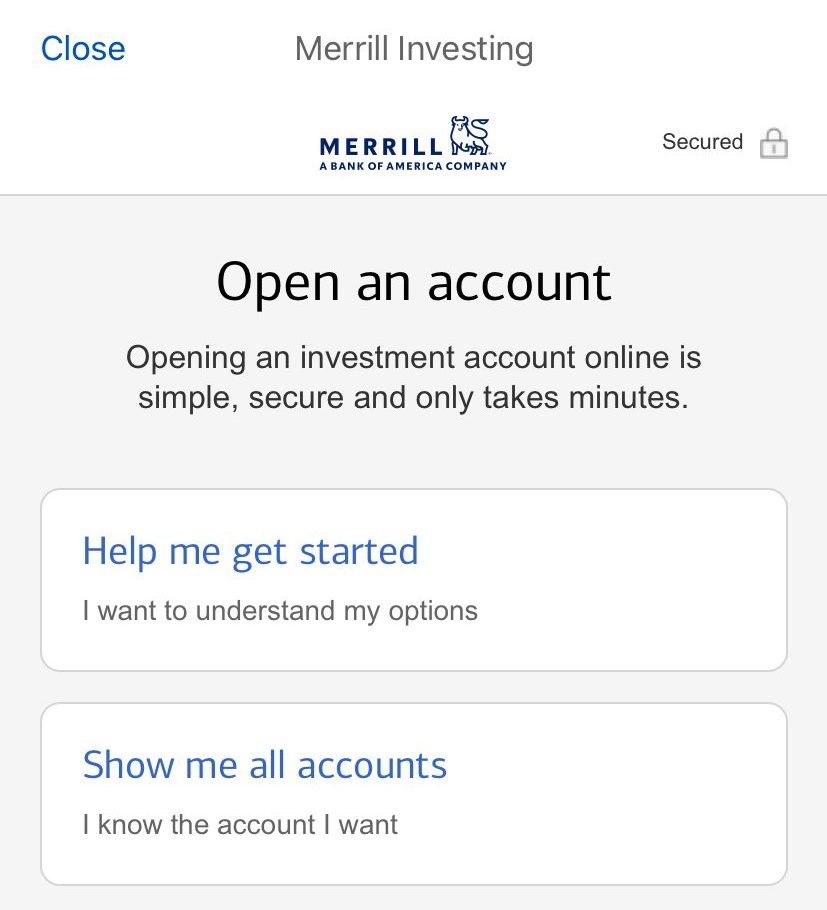

Investment and Wealth Management

Many banks offer investment services to individuals and businesses. They provide a range of investment options such as mutual funds, retirement accounts, and wealth management services. For example, exclusive reports such as Chase Private Banking or Citigold Private Client offer benefits, including access to a private client banker, investment advice, higher transaction limits, and priority customer support.

They charge management fees based on the assets under management, which are typically a percentage of the total investment value. Additionally, banks provide advisory services to clients, where they offer personalized investment advice and financial planning solutions for a fee.

Sign Up for

Our Newsletter

-

Credit Cards

Banks issue credit cards to individuals and businesses, allowing them to make purchases on credit. Banks earn revenue through credit cards in several ways. Firstly, they charge interest on the outstanding balances on credit cards when customers do not pay their balances in full by the due date. This interest is referred to as the annual percentage rate (APR).

Additionally, banks charge transaction fees to merchants for processing card payments. These fees, known as interchange fees, are usually a small percentage of the transaction amount. Banks also generate revenue through fees associated with late payments, cash advances, balance transfers, and foreign currency transactions made with credit cards.

-

Trading and Investment Activities

Banks participate in trading activities in financial markets, including stocks, bonds, commodities, and derivatives. They aim to profit from price movements by buying securities at a lower price and selling them at a higher price or vice versa.

This trading activity generates revenue through capital gains or losses on investments. Banks also earn income through trading fees or commissions charged to clients when executing trades on their behalf.

Additionally, banks may invest their own funds in various financial instruments, earning returns through dividends, interest, or capital appreciation.

-

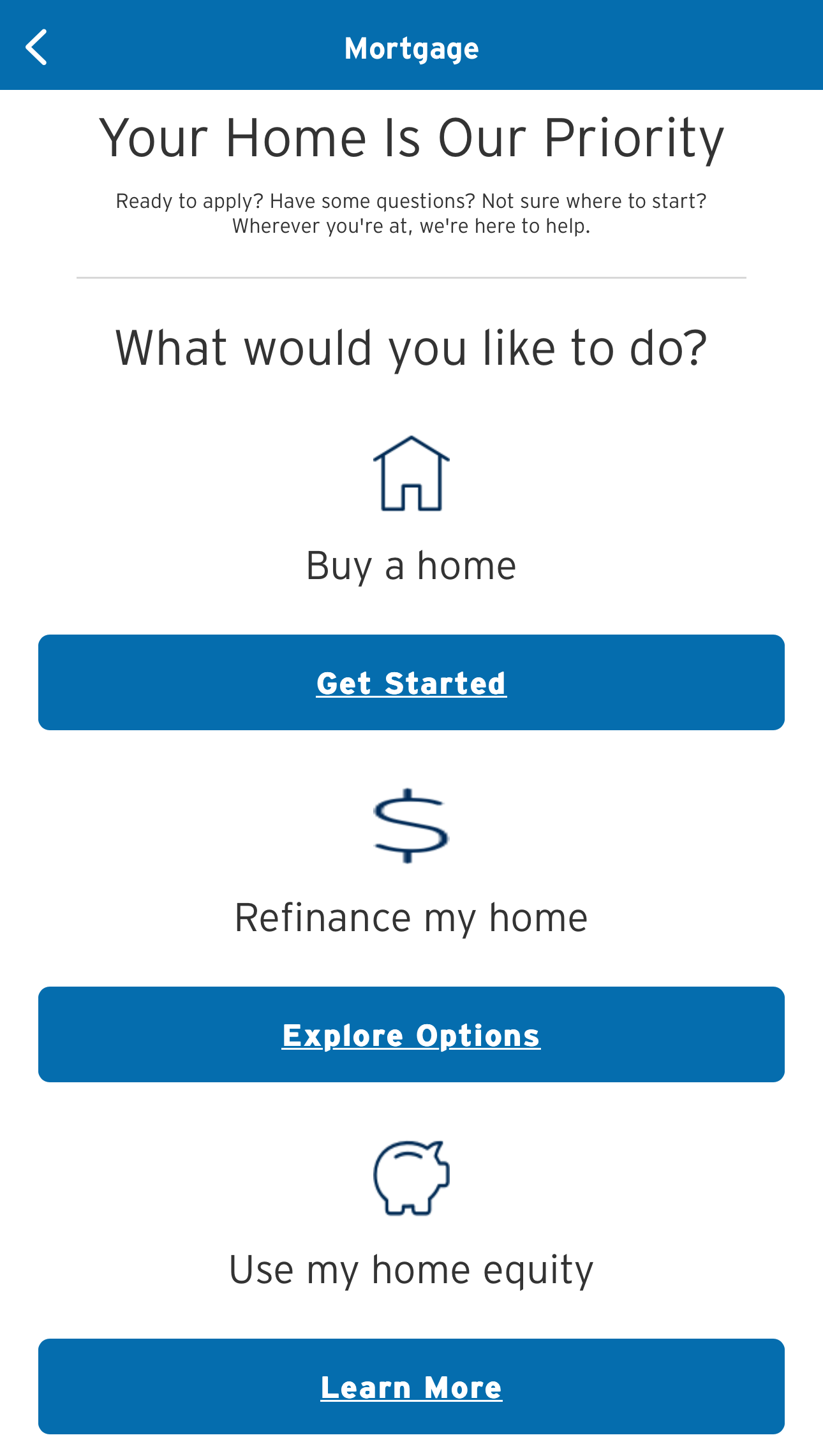

Mortgage Origination and Servicing

Banks play a vital role in the mortgage market by originating home loans for individuals and businesses. They provide funds to borrowers to purchase or refinance properties, earning revenue through various means.

Firstly, banks charge fees for originating mortgage loans, which cover the costs associated with processing and approving the loan application. These fees may include application fees, appraisal fees, and loan origination fees.

Secondly, banks earn money by servicing the mortgages. This involves collecting monthly mortgage payments, managing escrow accounts, and handling customer inquiries. Banks may charge borrowers a fee for servicing the loan, typically a percentage of the outstanding loan balance.

-

Interbank Operations

Banks engage in interbank operations as part of their liquidity management and to fulfill their short-term funding needs. In interbank lending, banks borrow and lend money to one another.

This activity is usually conducted in the interbank market, where banks with surplus funds lend to banks in need of liquidity. Banks earn interest income from the loans they extend to other banks.

-

Foreign Exchange

Banks provide currency exchange services to individuals and businesses. When customers need to convert one currency into another, such as when traveling or conducting international business, banks offer foreign exchange services.

They buy foreign currency at a lower rate and sell it at a slightly higher rate, thus earning a profit on the spread between the buying and selling rates. This spread, known as the exchange rate margin, represents the bank's revenue from foreign exchange transactions.

Do Bank Can Lose Money? How?

Yes, banks can indeed lose money. There are several ways in which banks can experience financial losses:

-

Investment Losses

Banks invest in various financial instruments, including stocks, bonds, and derivatives. If the value of these investments declines, the bank may incur losses. Factors such as market volatility, economic instability, or poor investment decisions can contribute to investment losses.

In 2012, JPMorgan Chase, one of the largest U.S. banks, incurred significant trading losses as a result of risky derivatives trades conducted by a trader known as the “London Whale.” The bank's complex trading positions resulted in massive losses, estimated to be around $6 billion.

-

Interest Rate Risk

Banks face interest rate risk, which refers to the potential impact of interest rate fluctuations on their profitability. If interest rates rise, it can increase the cost of funding for banks and reduce their net interest margin.

Conversely, if interest rates decline, it can compress the bank's interest income. These fluctuations can lead to losses if the bank's interest rate risk management strategies are inadequate.

-

Loan Defaults

One of the primary risks banks face is credit risk—the risk that borrowers may default on their loans. If borrowers fail to repay their loans, it can lead to significant losses for the bank. Economic downturns, changes in market conditions, or poor lending practices can increase the likelihood of loan defaults and subsequent losses for banks.

For example, Lehman Brothers, a prominent investment bank, filed for bankruptcy in 2008, marking one of the largest financial collapses in history. The firm suffered substantial losses due to its exposure to risky mortgage-backed securities, which plummeted in value during the subprime mortgage crisis.

-

Operational Risks

Banks are exposed to operational risks, which include internal errors, fraud, system failures, and cybersecurity breaches. These risks can result in financial losses for the bank, such as expenses related to remediation, legal actions, or customer compensation.

Wells Fargo, one of the largest banks in the United States, faced significant financial and reputational damage in recent years due to a series of scandals related to fraudulent practices. The bank admitted to opening millions of unauthorized customer accounts, charging customers for unnecessary services, and other deceptive practices.

-

Market Turbulence

Financial markets can experience significant volatility and disruptions due to factors such as economic crises, geopolitical events, or unexpected shocks. These market turbulences can lead to losses for banks, particularly if they have large exposures to volatile assets or if their risk management practices are insufficient.

-

Regulatory Compliance and Fines

Banks operate within a complex regulatory framework, and non-compliance can result in penalties and fines. Violations of anti-money laundering regulations, consumer protection laws, or market conduct rules can lead to substantial financial penalties, impacting the bank's profitability.

How To Know If My Bank Make Money?

As a customer or investor, there are several indicators and sources of information you can utilize to assess whether a bank is making money. Here are some ways to gauge a bank's financial performance:

Financial Statements: Banks are required to publish financial statements, including annual reports and quarterly reports. These reports provide comprehensive information about the bank's financial performance, including revenue, expenses, profitability, and balance sheet strength. You can review these statements to understand the bank's overall financial health and profitability.

Dividends: Banks that make profits often distribute a portion of those earnings to shareholders in the form of dividends. Tracking a bank's dividend payments can provide insights into its profitability. Regular dividend payments or increasing dividend amounts over time indicate a healthy financial performance.

Credit Ratings: Credit rating agencies assess the financial stability and creditworthiness of banks. These ratings can provide an indication of a bank's ability to generate profits and manage risks. Higher credit ratings generally reflect stronger financial performance.

Analyst Reports: Financial analysts and research firms often provide reports and analysis on banks. These reports may include assessments of a bank's financial performance, growth prospects, and profitability. Reviewing such reports can offer valuable insights into a bank's earnings potential. However, if we judge according to history, they usually don't spot and predict banks' failure or financial entanglements.

FAQs

Do banks make money from deposits?

Yes, banks make money from deposits by using them as a source of funds for lending and investing. The interest earned on loans and investments is typically higher than the interest paid to depositors, allowing banks to earn a spread or margin.

What is net interest income?

Net interest income is the difference between the interest banks earn on loans and other interest-earning assets and the interest they pay on deposits and borrowings. It represents a significant portion of a bank's revenue and is a key driver of profitability.

Do banks engage in trading activities to make money?

Yes, banks engage in trading activities in securities, commodities, and derivatives. They aim to profit from price fluctuations in these markets, which can contribute to their overall revenue.

What role do deposits play in a bank's profitability?

Deposits are a vital source of funding for banks. Banks use these deposits to lend money and invest in income-generating assets, allowing them to earn interest income and generate profits.

How do central banks impact a bank's profitability?

Central banks influence a bank's profitability through their monetary policies, including setting interest rates. Changes in interest rates can affect a bank's borrowing costs and net interest margin, thereby impacting their profitability.