If you're living in Ohio and looking for the right bank, you're likely aware of the abundance of options. There are small local banks, larger ones covering bigger regions or even national banks, not to mention the convenience of online banks.

In our selection process, we took various factors into account. We considered the number of physical branches available, the range of products they offer, the interest rates they provide for deposits, the quality of their online banking services, and their overall customer service and support.

Best Ohio Regional And Community Banks

Here are our top picks for regional and community banks in Ohio:

Huntington Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

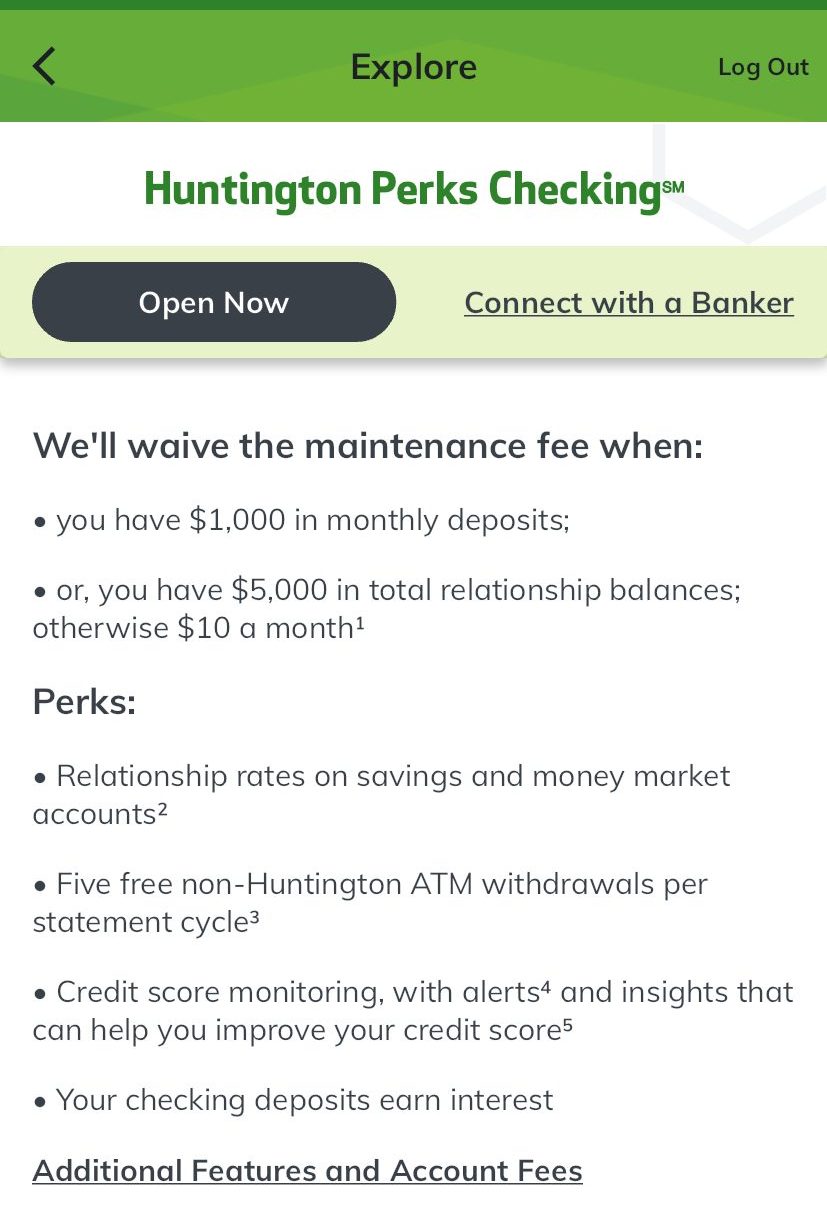

Huntington Bank is a well-known regional financial institution based in Ohio, with a wide-reaching presence of 300 branches in 180 cities.

One of its main strengths is providing a basic checking account without any fees, which helps customers manage their finances better. The bank's all-day deposit feature makes fund transfers quick and easy. Customers also appreciate the 24-hour grace period on overdrafts and the high rates on Huntington money market accounts on some CDs.

However, there are some drawbacks to consider. Huntington's interest rates on accounts are relatively low, so the earnings on deposited money might not be as significant. Additionally, some of their interest-bearing checking accounts require high minimum balances, making it challenging for individuals with limited funds to take advantage of such options.

Fifth Third Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

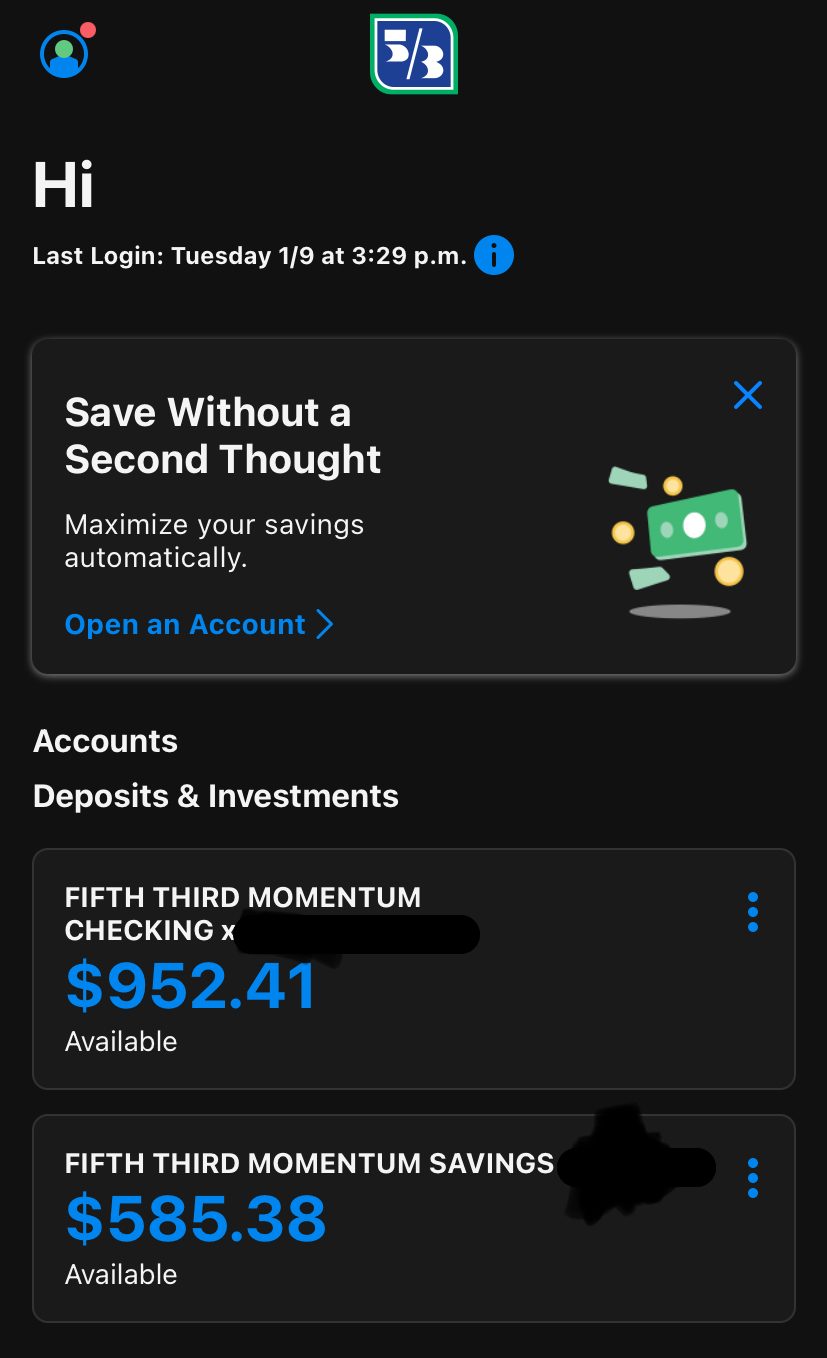

Fifth Third Bank is a financial institution that operates in Ohio and has a strong presence in 120 cities, with almost 240 branches in the state.

They offer various checking and savings accounts, loans, credit cards, mortgages, lines of credit, and investment options. The bank has the advantage of low or no monthly fees on checking accounts, low minimum deposit requirements, and access to a wide network of fee-free ATMs. Also, their customer service representatives may not be available 24/7, but you can still reach them even on weekends.

However, if you're looking for the highest interest rates, you might want to consider other banks since both money market accounts and savings accounts offer low rates.

key Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

KeyBank is a major bank in Ohio, boasting more than 150 branches spread across 110 cities across the country. One of the best things about them is that their checking accounts come with no monthly fees, which is pretty neat. On top of that, they offer a variety of financial products, such as credit cards, lines of credit, personal loans, and mortgages.

One of KeyBank's standout features is their excellent customer service. They're available 24/7 via phone assistance, they actively support customers on Twitter, and they offer chat support with extended hours. Plus, if you have multiple accounts with them, you can enjoy some extra benefits, similar to what you'd find at traditional banks with physical branches.

However, the drawback is that their savings account rates aren't very competitive, so you won't earn much interest on your savings with them. To get a promotional rate on their money market account, you'll need to have at least $25,000 in it.

Best Ohio National Banks

We thoroughly examined some of the top banks in Ohio, conducting a detailed comparison of their key features.

We began by evaluating the number and locations of their branches. Additionally, we carefully reviewed the range of products and services they provide. A particular focus of our analysis was on their deposit rates, with a special emphasis on how they compare for CDs and regular savings accounts.

Chase Bank

Checking Fees

Checking Promotion

Savings APY

CDs APY

Chase Bank provides a wide range of banking services to meet different needs, such as checking and savings accounts, credit cards, mortgages, personal and auto loans, investment services, and small business banking. They have a significant presence in Ohio, with over 200 branches in 130 cities, making it convenient for customers to access their services.

One of the bank's strengths is its extensive branch and ATM network, ensuring easy access to funds whenever required. They also offer a variety of credit cards, giving customers many options to choose from.

However, there are some drawbacks to be aware of. Certain accounts at Chase Bank have high monthly fees, so customers should be careful about that. Additionally, their savings account and CD rates may not be as competitive as those offered by other banks.

U.S. Bank

Checking Fees

Checking Promotion

Earn $250 for $2,000–$4,999.99 in direct deposits.

Earn $350 for $5,000–$7,999.99 in direct deposits.

Earn $450 for $8,000+ in direct deposits. needed. Expired on 12/30/2024

Savings APY

CDs APY

U.S. Bank offers a wide range of products and services, including checking and savings accounts, a money market account, and CDs. They have a significant presence in Ohio with over 180 branches across 110 cities, accompanied by a vast network of ATMs for easy cash access. The bank provides different checking account options to cater to diverse needs.

For those looking to grow their savings, U.S. Bank offers a promotional CD with attractive high-rate choices. Users praise their mobile app, which is rated highly by both iPhone and Android users, indicating its user-friendliness and efficiency.

However, there are some drawbacks to consider. The interest rates on savings, CDs, and money market accounts are relatively low, potentially leading to lower earnings for customers. Additionally, not all checking accounts offer fee-free ATM withdrawals and overdraft protection, which may result in extra charges for account holders.

PNC Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

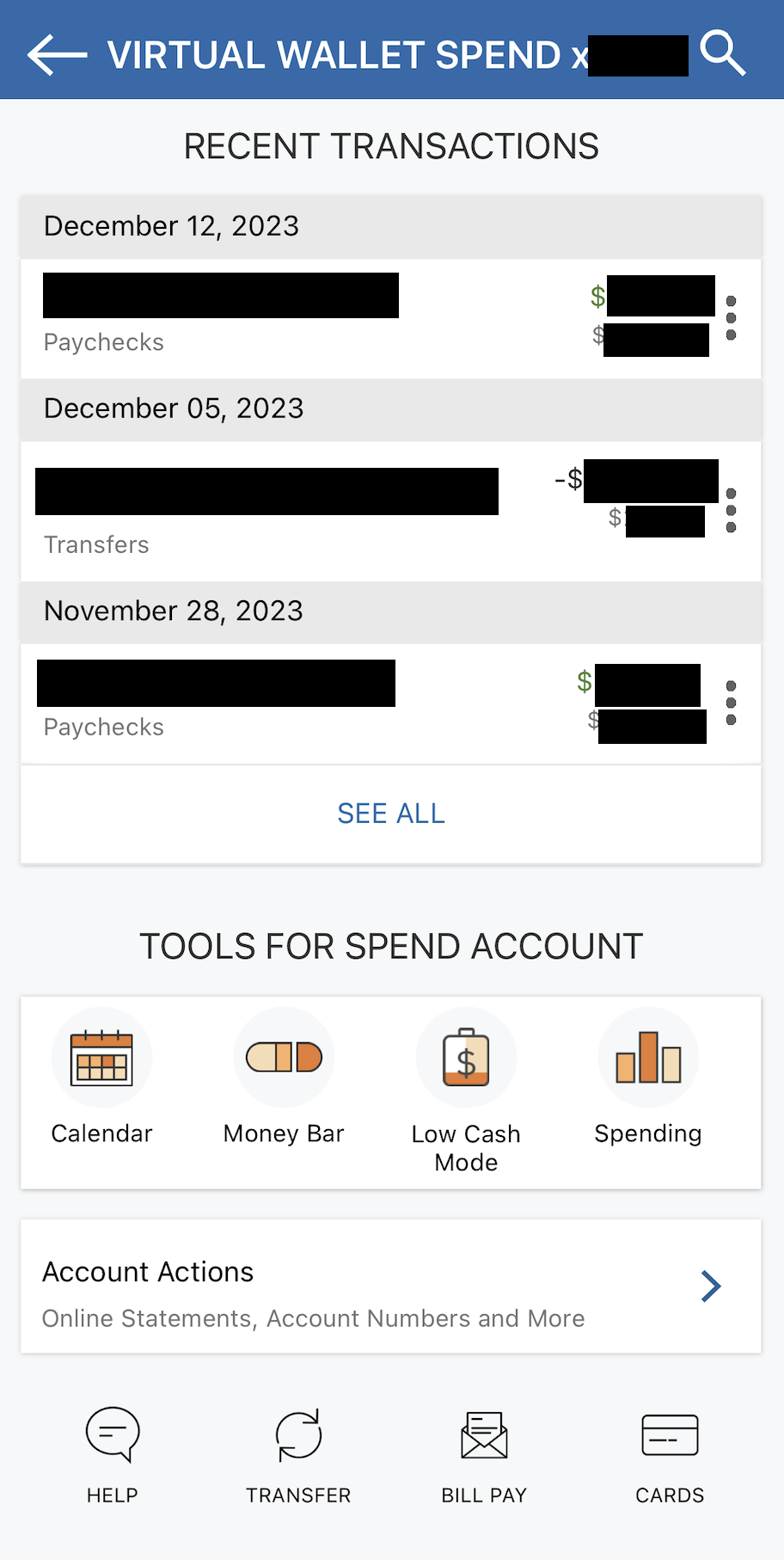

In Ohio, PNC Bank is a well-known banking choice, with over 210 branches scattered across 110 cities in the state. Their Virtual Wallet Spend checking account offers convenient mobile and online banking with no fees for bill payments. Moreover, they partially reimburse fees incurred when using non-PNC ATMs, although the ATM owners may charge separately.

PNC Bank has some appealing features. They provide a competitive interest rate for their online-only savings account, though it might be available only in specific states. Access to around 60,000 fee-free ATMs is another advantage.

However, there are drawbacks to consider. PNC has a relatively high overdraft fee of $36, ranking among the highest in the country. Opening a CD requires an in-person visit to a branch. Some accounts may have monthly fees, but these can be avoided by meeting certain conditions.

Best Ohio Online Banks

When we looked for online banks in Illinois, our main focus was on comparing their savings and CD rates. Additionally, we were interested in finding out if these banks offer other services such as checking accounts, loans, credit cards, and mortgages.

CIT Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

CIT Bank is an internet-based financial institution that offers a wide range of financial products and services. They have various deposit accounts, such as savings accounts, checking accounts, money market accounts, and CDs. CIT savings rates are very competitive as well as its CDs, making it a great option for people who want to earn more from their deposits.

One of the best things about CIT Bank is that they don't charge any monthly maintenance fees, so customers can enjoy banking without any extra costs. This makes it particularly appealing for those looking for a high-yield savings account and a smooth online banking experience.

However, it's important to note that CIT Bank doesn't have physical branches, so customers should be comfortable with online banking and using ATMs. For people who value convenience, high interest rates, and a fee-free banking experience, CIT Bank is definitely a favorable choice.

EverBank

Checking Fees

Money Market APY

Savings APY

CDs APY

EverBank (formerly TIAA Bank) is an online bank that offers deposit accounts with great interest rates and low minimum balances. They have many fee-free ATMs available for customers, but their physical branches are mostly in Florida. If you want an online bank with good interest rates on savings and CD accounts and no monthly fees, EverBank is a good option.

One cool thing is that you can deposit checks using their mobile app. They also have a large network of fee-free ATMs, and they reimburse ATM fees. However, there are some downsides. They don't offer a wide range of account types, and their branch locations are limited. Also, the high interest rate on their money market account is only for the first year.

FAQs

In Ohio, which banks boast the highest count of branches?

As of 2025, Ohio is dominated by Huntington Bank, Fifth Third Bank, and Chase Bank, with each of them operating an extensive network of over 200 branches.

What is the best bank in Ohio?

Selecting the right Ohio bank relies on your personal preferences – whether it's variety of financial products, high deposit rates, or no-fee checking accounts. Check out our suggested banks above, each offering something special.

Which bank in Ohio has the best rates for CDs?

The top CD rates in Ohio can vary with different terms. One bank might have the best rates for 3 year, while another offers the best rates for 3 months. Check out our recommended banks in Ohio for high CD rates and compare them with credit unions.

Where can I find the best savings rates in Ohio?

Finding high savings rates can be challenging, but Ohio has some top-notch options. Discover some of the best options among banks and credit unions in 2025.

How We Picked The Best Bank In Ohio: Methodology

The Smart Investor team conducted an extensive review to identify the best banks in Ohio. We assessed them based on four main categories, each with specific features:

- Financial Products and Services (40%): We evaluated the range and quality of financial products and services offered by each bank, including checking accounts, savings accounts, CDs, loans, credit cards, and investment options. Banks offering a diverse array of financial products with competitive rates and terms received higher ratings in this category.

- Banking Features and Tools (30%): This category assessed the availability and functionality of banking features and tools, such as transfer options, the ability to set savings goals, account linking capabilities, mobile app usability, check deposit options, and other features important for banks. Banks offering a comprehensive suite of features and user-friendly tools earned higher scores.

- Customer Experience (20%): We closely examined the overall customer experience, including the ease of account opening, communication with customer service representatives, the usability of online banking platforms and mobile apps, and the responsiveness of customer support. Banks with user-friendly interfaces, efficient digital banking tools, and responsive customer service received higher ratings.

- Bank Reputation (10%): Our team analyzed each bank's reputation based on factors such as customer satisfaction ratings, JD Power scores, TrustPilot reviews, and any notable awards or recognitions received. Banks with positive reputations and a history of providing excellent service to customers in Ohio received higher ratings.

Within each category, we assigned weights to various features and qualities to ensure a comprehensive evaluation of each bank.