Table Of Content

Certificates of Deposit (CDs) have long been a go-to for savers seeking to grow their wealth securely. Among the many online banking options, Capital One and Citi Bank can be a decent choice. Although both offer attractive rates and flexible terms, there are significant differences between the two.

In this piece, we'll examine the CDs provided by Capital One and Citi Bank, comparing rates, minimum deposits, early withdrawal penalties, and other features. By the end of this article, you'll have the information you need to determine which bank's CDs are the perfect fit for your savings goals.

Capital One | Citi Bank | |

|---|---|---|

CD Range | 3.50% – 4.00%

| 0.05% – 4.00%

|

Minimum Deposit | $0 | $500 – $2,500 |

Early Withdrawal penalty | 3-6 months of interest | 90 -180 days of interest |

Term | 6 – 60 months | 3 months – 5 years |

CD Rates Comparison

Both Capital One and Citi offers competitive rates compared to other banks. When comparing Citi and Capital One, Capital One offers higher rates for most terms, but there are specific terms when Citi is better.

For example, Citi CD rates are higher for 3-month and 9-months CDs. On the other hand, if you're looking for CD laddering or long-term CDs, however, Capital One may be a better bank. For example, if you're looking for a 5-year CD, Capital One rates are much better.

CD Term | Capital One APY | Citi Bank APY |

|---|---|---|

3 Months | N/A | 3.00%

|

6 Months | 3.50%

| 1.5% – 2%

|

9 Months | 3.50% | 2.5%- 3%

|

12 Months | 4.00% | 2.25% – 2.75%

|

18 Months | 3.80%

| 1.01%

|

24 Months | 3.60%

| 0.5% – 1.01%

|

30 Months | 3.60% | 0.10% |

36 Months | 3.60% | 2.00% |

48 Months | 3.60% | 2.00% |

60 Months | 3.60%

| 2.00% |

When It Comes to No Penalty CD - Citi Bank Wins

If you're looking for flexibility – no penalty CD can be a good option.

From both banks, only Citi offers a no-penalty CD. The rate is very competitive compared to other banks (0.05% APY, as of December 2025) and can be a good option for those who are looking for this feature.

Capital One | Citi Bank | |

|---|---|---|

12 Months | N/A | 0.05% |

Top Offers From Our Partners

![]()

CD Early Withdrawal Penalty: How They Compare?

Citi and Capital One have comparable early withdrawal penalties. Discover's penalty varies depending on the term of the CD. For CD terms up to a year, a penalty of three months of simple interest applies with Capital One (which is equivalent to 90 days with Citi).

In contrast, for terms ranging from one to five years, the penalty increases to six months of simple interest (which equals 180 days with Citi).

CD Term | Capital One | Citi Bank |

|---|---|---|

3 Months | N/A | 90 days of interest

|

6 Months | 3 months of interest | 90 days of interest |

9 Months | 3 months of interest | 90 days of interest |

12 Months | 3 months of interest | 90 days of interest |

18 Months | 6 months of interest | 180 days of interest |

24 Months | 6 months of interest | 180 days of interest |

30 Months | 6 months of interest | 180 days of interest |

36 Months | 6 months interest | 180 days of interest |

48 Months | 6 of months interest | 180 days of interest |

60 Months | 6 months of interest | 180 days of interest |

About Capital One Bank

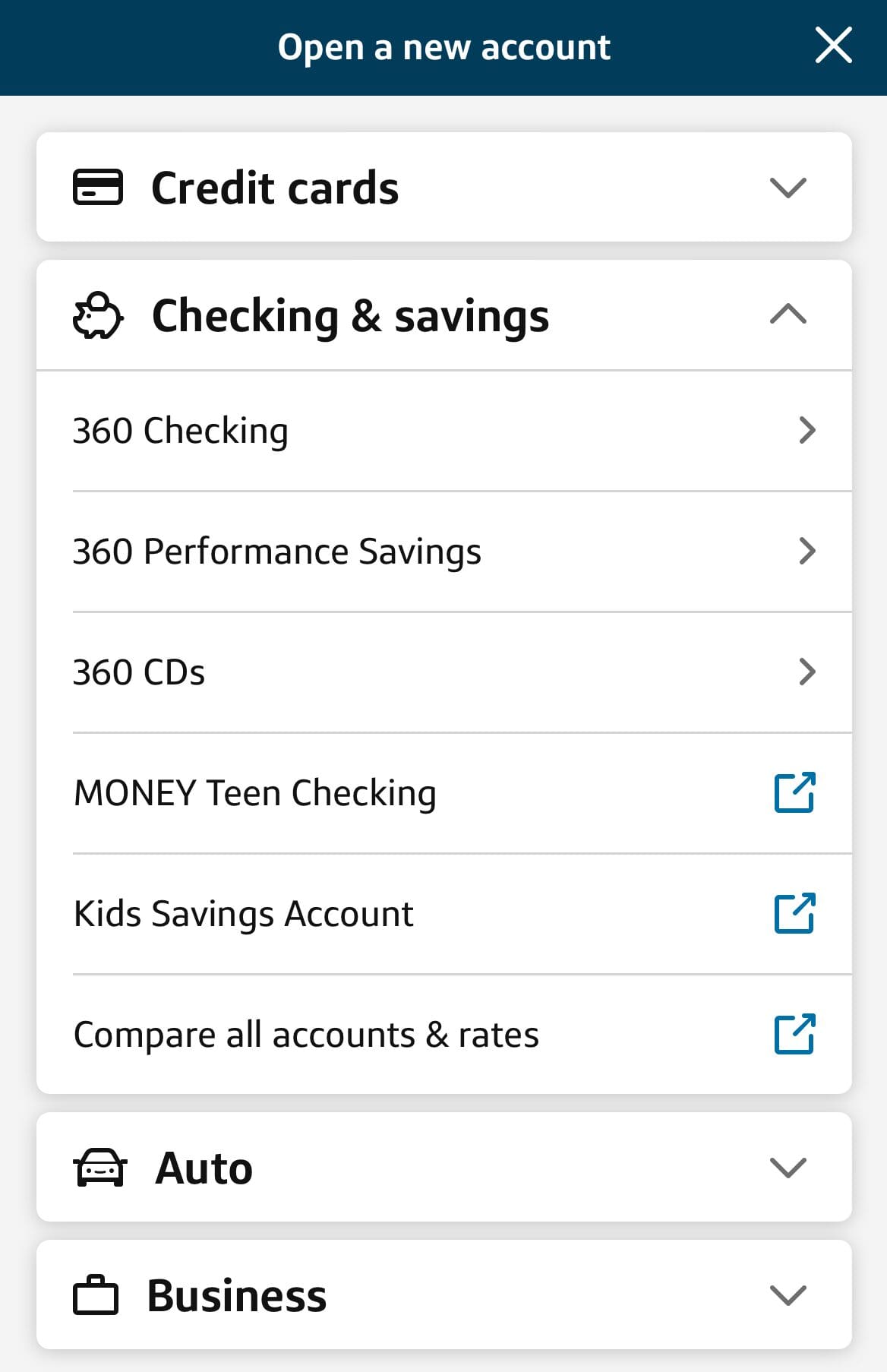

Capital One, primarily known for its credit card offerings, acquired online bank ING Direct in 2012 and rebranded it as Capital One. Since then, Capital One has expanded into a full-service online bank.

The bank provides a high annual percentage yield (APY) with its Performance Savings account, and its mobile banking options are among the best in the banking world. Capital One also has no monthly maintenance fees for its 360 Checking and Performance Savings accounts.

However, while the rates offered by Capital One 360 Performance Savings account are competitive, they are not the highest available in the market. Additionally, Capital One has only limited branches located in select U.S. states.

About Citi Bank

Citibank, a subsidiary of Citigroup Inc., is the fourth largest bank in terms of assets. The bank has established its reputation for credit cards and retail banking, catering to more than 110 million customers across the U.S., Mexican, and Asian markets.

Citibank has a comprehensive range of products that includes savings and checking accounts, CDs, investment products, as well as lending products such as mortgages and personal loans.

Compare Capital One Certificate Of Deposit (CDs)

Overall, Capital One CD rates are higher than Chase. Compare CD rates, minimum deposit, early withdrawal fees, and alternatives.

Discover and Capital One offer high CD rates on all terms. However, for each term there is a different winner – here's a full comparison: Capital One CDs vs. Discover CDs

Marcus offers higher CD rates than Capital One on most terms but not all of them. Compare CD rates, min deposit, and early withdrawal fees.

Compare Citibank Certificate Of Deposit (CDs)

Synchrony Bank offers higher CD rates than Citibank on most terms. Compare CD rates, minimum deposit and early withdrawal fees.

Citi Bank and Ally offer competitive CD rates, including no penalty CDs. Which one is the winner? Check out our full comparison: Ally CDs vs. Citibank CDs

While Citi Bank offers competitive CD rates on most terms, Wells Fargo offers high rates on specific terms. Compare rates and withdrawal fees.

While Citi Bank offers CD competitive rates on most terms, Bank Of America is the winner for specific terms. Citi also offers no penalty CD.