Table Of Content

When CIT Bank Wins?

CIT Bank has a banking product line that rivals high street banks. There are several saving account options, CDs, an eChecking account, home loans, and mortgages. The main gaps in this line up are a lack of personal loans and a credit card option.

CIT Bank can be a better choice than Citi one if:

You are looking for the best possible rates on your CDs

You are happy to link your checking account and savings for the best rates

You want to earn cash back on your mortgage

When Citi Bank Wins?

Citi bank has a background as a credit card company, but this doesn’t mean that it has a limited banking product line.

Citi provides access to home loans, personal loans, lines of credit, wealth management options and investments together with everyday and premium banking packages. This exemplifies Citi as a viable alternative to the conventional high street bank.

Citibank can be a better choice than CIT Bank if:

You want to have a savings account, checking account, and credit card with the same bank.

You want access to far more credit card options to better tailor your choice to your spending preferences.

You are confident that you can meet the requirements to have the account maintenance fees waived.

CIT Bank | Citi Bank | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

CIT Bank offers competitive savings options, including the Savings Connect account with a Up to 3.85% APY and the Platinum Savings account offering sc name=”cit_bank_savings_account_apy”][/sc] APY for balances over $5,000.

Both accounts feature no monthly fees and require a $100 minimum opening deposit.

CIT Bank | Citi Bank | |

|---|---|---|

APY | Up to 3.85%

| 0.03% – 1.18%

|

Fees | $0 | $4.50/$10 per month

Can be waived if you maintain an average combined monthly balance of $500/$1,500 in your eligible accounts, make one enhanced direct deposit or one qualifying bill payment per statement period

|

Minimum Deposit | $100 | $0 |

Checking Needed? | No | Yes |

Main Benefits |

|

|

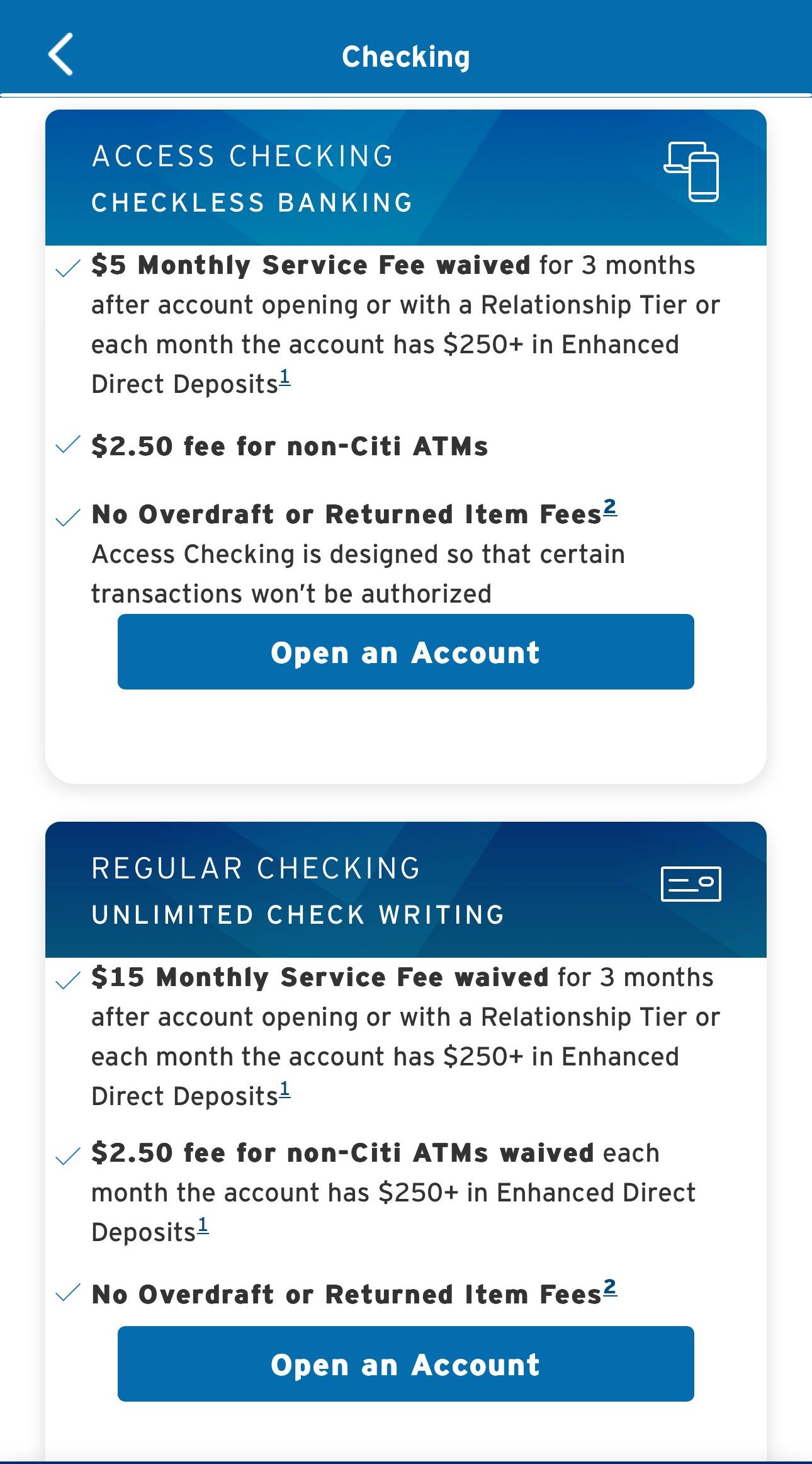

Checking Account

Citi checking accounts offer straightforward and convenient banking solutions. With features like online and mobile banking, direct deposit, and fee-free access to a large ATM network, managing your money is easy.

Citi Account | Monthly Fee | Avg Day Balance To Waive Fee |

|---|---|---|

Citi Access Checking | $5 | $30,000 |

Citi Regular Checking | $15 | $30,000 |

Citi Priority Account Package | $0 | $30,000 |

Citigold Account Package | $0

| $200,000 |

Citigold Private Client | $0 | $1,000,000 |

Citi provides various account options, such as Access Checking, Regular Checking, Priority, Citigold, and Private Client, each designed to suit different needs.

CIT Bank has an interesting eChecking account that offers low rates, depending on your balance. The account has virtually no fees, as the only charges are for returned items, wire transfers, or stopped payments.

CIT also offers fee free ATM use, and you’ll even get up to $30 in fee reimbursements each month if you get a charge when using another bank’s machine.

CIT Bank | Citi Bank | |

|---|---|---|

APY | 0.10% – 0.25% | 0.01% |

Fees | $0 | $12

Can be waived if you make one qualifying direct deposit and one qualifying bill payment per statement period, maintain a combined balance of $1,500 per month across your eligible accounts or if you’re aged 62

|

Minimum Deposit | $100 | $0 |

Main Benefits |

|

|

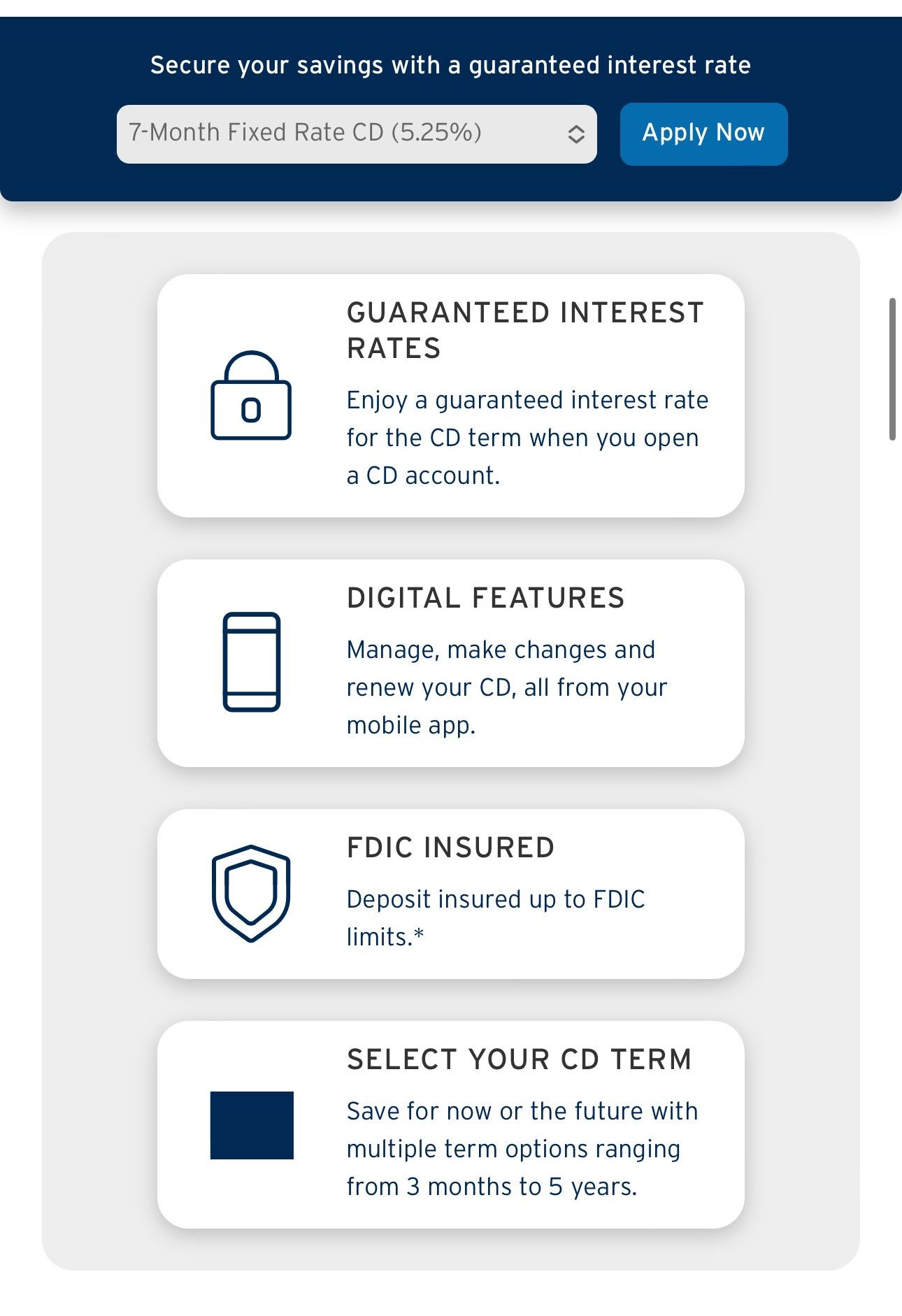

CDs

This area of comparison is a little more tricky. While Citi has no minimum deposit compared to CIT Bank’s $1,000 minimum, its rates are far lower. Citi only offers the potential to earn up to 0.15%, which is the rate for its five year CD.

On the other hand, you can earn double this rate with only a one year CIT Bank CD, with the potential to earn as much as 0.50% if you commit to a longer CD.

CIT Bank | Citi Bank | |

|---|---|---|

Minimum Deposit | $1,000 | $500 – $2,500 |

APY Range | 0.30% – 3.35%

| 0.05% – 4.00%

|

Mortgage Options

CIT Bank has a variety of mortgage products including fixed rate with a term of up to 30 years, and portfolio interest only deals. If you’re a qualified borrower, you may also be able to secure an interest only, fixed rate 30 year loan.

CIT Bank does offer customers up to $525 in cash back when you close on your loan and relationship discounts for up to 0.20%.

Citi also has several home loan options including to purchase a home, refinance or access home equity. Citi also offers potential cash back towards your closing costs. However, you can take the $500 credit or instead enjoy special pricing with a lower interest rate.

Loan Options

This is an area where there is little comparison. Although CIT Bank does not offer personal loans, Citi has loans for up to $30,000. You can access a term of up to 60 months. Citi aims to make its personal loans accessible and quick.

The application process is simple and upon approval, a check will be mailed to you within five business days. If you sign up for Auto Deduct payments, you can qualify for a lower rate and Citi offers Thank You points if your loan is linked to an eligible checking account.

Credit Cards

This is another area where there is no comparison. Citi has a vast selection of credit cards.

Many of the cards offer welcome bonuses for new cardholders, but these often have spending minimums and time limits to qualify.

Card | Rewards | Bonus | Annual Fee |

| Citi® Double Cash Card | 1% – 2%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

| N/A

$200 cash back after spending $1,500 on purchases in the first 6 months

| $0 |

|---|---|---|---|---|

| Citi Premier® Card | 1X – 10X

10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases

| 75,000 points

60,000 bonus ThankYou® points after spending $4,000 in purchases within the first three months of account opening

| $95 |

| Citi Simplicity® Card | None | None | $0 |

| Citi® Secured Mastercard® | None | None | $0 |

| Citi Custom Cash℠ Card | 1-5%

5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

| $200

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back)

| $0 |

Citi also partners with some popular brands including AT&T, American Airlines, Expedia, and Costco, so you access the best rewards with your preferred brands.

Customer Service

CIT Bank provides 24/7 automated telephone banking and online support, but live customer service is available only between 9 a.m. and 9 p.m. on weekdays and 10 a.m. and 6 p.m. on Saturdays.

Citi offers tailored phone lines for different products, a comprehensive help page, and app-based messaging.

However, customer reviews differ significantly—CIT Bank scores 3.8/5 on Trustpilot, while Citi lags with a 1.4/5 rating, reflecting mixed service quality experiences.

Online/Digital Experience

Both CIT Bank and Citi have apps to enhance the customer’s digital experience. CIT’s app is rated 4.6/5 on Apple and 4.2/5 on Google. The Citi mobile app is rated 4.9/5 and 4.7/5 on Apple and Google. Both apps allow you more control over your account, with 24/7 access to manage your transactions, make transfers, lock your card and receive notifications.

The bank’s websites are also very helpful and enhance the customer’s digital experience. You can browse the products and compare options if you’re not sure which is the best choice for you.

Which Bank is The Winner?

With both banks offering similar products, we need to look a little more closely at which bank is better.

If you’re looking for a more full service bank where you can have a savings account, current account, and credit card, then Citi is a better choice, since CIT Bank lacks a credit card option. However, CIT Bank does offer better CD rates if you have the minimum $1,000 deposit.

FAQs

How's CitiBank checking account bonus promotion?

CitiBank offers checking account bonuses and sign-up bonuses on many credit cards. As of November 2025 , if you open a new Citi Personal Checking, you can get $325, based on your minimum deposit.

Can I get a promotion with CIT Bank?

Unfortenately, as of November 2025, there is no promotion for opening a new bank account with CIT Bank. The main benefit you can get is the high rates on its savings accounts.

Does CIT Bank work for Joint Accounts?

CIT Bank does allow co-ownership of various accounts. You will need to go through the ID verification phase for both parties in order for the names to appear on the account. Once the joint account is open, either party will be able to action requests. This is a great feature as many banks make it difficult to open a joint account, so if you are looking to combine finances with your partner, CIT Bank is certainly worthy of consideration.

What documents are required to open a CIT Bank account?

You will need to provide some personal information, such as a valid home address, your Social Security number, and contact information, as with all major banks, whether they are online or have a physical branch network.

You'll also need to show a government ID, such as a passport, driver's license, or state ID, to prove your identity.

Is CitiBank is ready for an inflationary recession?

Although Citi has a long track record, it does have a history of struggling during tough economic times. After the 2007/2008 financial crisis, Citi received a massive $517 billion federal bail out loan. It took until 2013 for the Government to sell the last of the bail out bonds from this fund.

However, today, Citi has holdings of $74 billion, so it should be prepared to weather any adverse economic times. Of course, Citi is FDIC insured, so for its customers, even if the bank starts to struggle, deposits of up to $250,000 are protected.

Is Citi worth it if I have bad credit?

Citi does have some basic accounts if you want to take control of your finances and start working on rebuilding your credit. However, one of the best products for those with bad credit is the Citi Secured Mastercard. You’ll need a security deposit of at least $200 and this refundable deposit will be used to determine your credit limit.

You can then use your card and make regular payments. Your card activity will be reported to the major credit bureaus to help start rebuilding your credit report. The card has no annual fee and account ownership provides access to your FICO score online, so you can monitor your progress.

CIT Bank vs Citibank: Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked at CIT Bank and Citibank in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare Citibank Versus Other Banks

The Chase and Citi checking accounts both have no minimum deposit and a monthly account maintenance fee of $12. This can also be waived with a balance of $1,500 or more, or with qualifying deposits.

Furthermore, both have a very impressive selection of more than credit card options.

Read Full Comparison: Chase vs Citi: Which Bank Account Wins?

Capital One began as a credit card company, but it has recently expanded its banking product line. Capital One offers checking and savings accounts, children's accounts, auto finance and refinancing, in addition to an impressive selection of credit cards.

Citi offers a diverse range of banking products, including checking and savings accounts, CDs, credit card options, mortgages, personal loans, wealth management plans, IRAs, and investment options.

Read Full Comparison: Citi vs Capital One: Which Bank is Best For You?

The Citi checking account is a fairly standard product. The account does have a $12 monthly fee, but it is waived if you make a qualifying deposit or make a qualifying bill payment. Overdraft protection is also available, which automatically transfers funds from your savings account to avoid overdraft fees.

Because the American Express savings account has a high yield, the number of withdrawals or transfers you can make each month is limited to nine. It's also a nice touch that American Express allows you to choose paper statements if you prefer the old-fashioned way.

Read Full Comparison: American Express vs Citi: Where to Save Your Money?

Citi offers an excellent range of banking products that cover the majority of your financial needs.

Personal loans, mortgages, credit cards, investment options, IRAs, and wealth management plans are available in addition to savings and checking accounts. Barclays' product line is more streamlined. This bank offers credit cards, savings accounts, credit cards, and personal loans.

The most obvious product gap is the absence of a checking account. As a result, Barclays becomes more of a supplementary bank rather than your primary day-to-day financial institution.

Read Full Comparison: Citi vs Barclays: Which Bank Account Is Better?

Bank of America is a large banking institution, and its impressive banking product line reflects this. Aside from savings and checking accounts, there are home loans, auto loans, investment options, and a variety of credit cards. Citi also has a diverse product offering. Credit cards, CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and checking and savings accounts are all available.

As a result, if you want to switch from your current bank, either bank is a viable option because you won't have to make any compromises in terms of banking products.

Read Full Comparison: Bank of America vs Citi: Which Bank Suits You Best?

Discover began as a credit card company and has since expanded into banking services. As a result, it stands to reason that Discover would offer a diverse range of credit cards. Discover offers a simpler checking account. There are no account fees or minimum deposits, and you can earn 0.40 percent.

Citi offers home loans, personal loans, lines of credit, wealth management options, and investments, as well as everyday and premium banking services. This exemplifies Citi's viability as a viable alternative to the traditional high-street bank.

Read Full Comparison: Discover vs Citi: Compare Banking Options

Both banks offer a good selection of banking products, making it easier to switch from your current bank.

Citi offers CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and a variety of credit card options in addition to checking and savings accounts.

Wells Fargo provides savings and checking accounts, but it also provides mortgages, loans, and investment options such as IRAs, 401ks, and wealth management products.

Read Full Comparison: Citi vs Wells Fargo: Which Bank Account Is Better?

While U.S. Bank offers some better conditions when it comes to lending options, Citibank is our winner in this comparison. Here's why.

Citibank is our winner due to its checking account options, various credit cards, and better savings account rates than Truist Bank.

PNC Bank and Citibank are two big players in brick-and-mortar banking. Let's compare them side by side and see which is our winner: PNC Bank vs. Citibank

Citibank leads in credit cards, and TD Bank options for borrowers are broader. But what about the rest? Here's our comparison and winner: Citibank vs. TD Bank

We'll explore Citibank and M&T Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Citibank vs. M&T Bank

Citi is our winner for most consumers, but Ally is also a great option if you are willing to manage your account online. Here's why.

Banking Reviews

Aspiration Review

Alliant Credit Union Review