In today's digital age, online banks have gained significant popularity for their convenience and competitive offerings. Certificates of Deposit provide a safe and secure way to grow your savings, and online banks often provide higher interest rates compared to traditional brick-and-mortar institutions.

In this article, we will explore the top online banks that offer exceptional CD rates.

Ally Bank

APY Range

Minimum Deposit

Terms

Fees

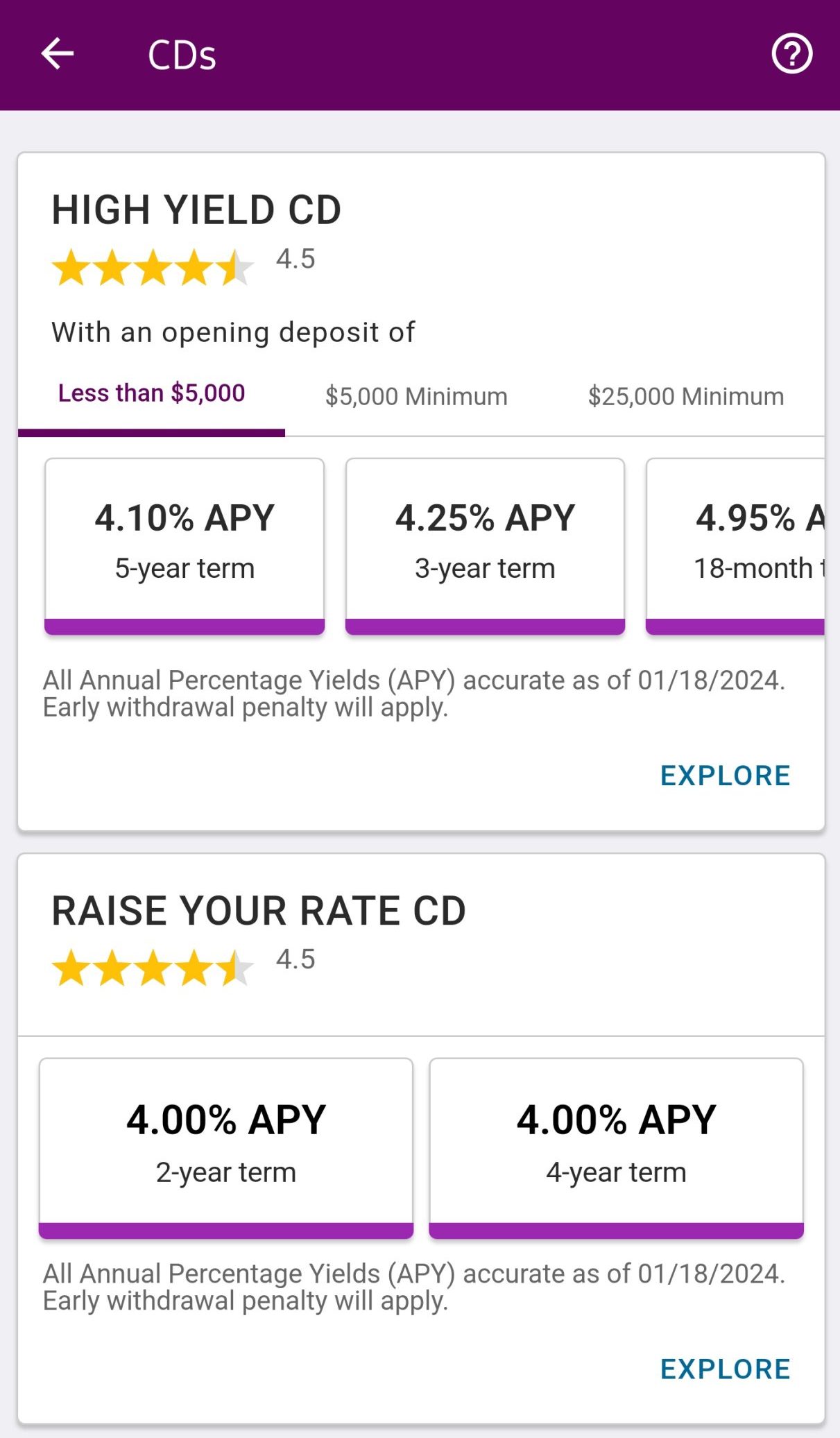

With a wide range of CD options spanning from three months to five years, Ally Bank provides flexibility to cater to your specific needs and circumstances. In addition to their traditional CDs, Ally offers a no-penalty CD that boasts a higher current rate compared to their shorter-term High Yield CDs while still allowing you the freedom to withdraw your funds before maturity without facing penalties.

Furthermore, Ally presents a “Raise Your Rate” CD, available in two-year or four-year terms, where the initial rate is the same for both options, albeit slightly lower than the average rate on their High Yield CD.

CD Term | APY |

|---|---|

3 Months | 3.00% |

6 Months | 4.40% |

9 Months | 4.45% |

12 Months | 4.50% |

11 Months – No Penalty | 4.00%

|

36 Months | 4.00% |

60 Months | 3.90% |

Despite being established in 2009, Ally Bank has quickly made its mark in the industry, offering a comprehensive suite of financial services including savings accounts, money market accounts, loans, mortgages, checking accounts, investments, and retirement services.

Synchrony Bank

APY Range

Minimum Deposit

Terms

Fees

Synchrony Bank provides a range of CDs with varying terms, spanning from three months to five years. The interest rates are primarily focused on longer-term CDs exceeding 12 months. While you can withdraw the accumulated interest on your CD without facing any penalties, a penalty will be applied if you need to withdraw the principal amount before maturity.

To address concerns about accessing your funds prior to the CD maturity date, Synchrony offers an 11-month No Penalty CD. Additionally, they provide a Bump Up CD, which allows you to take advantage of a higher APY rate if rates increase during the term. You can make a single rate adjustment during the term.

CD Term | APY |

|---|---|

3 Months | 0.25% |

6 Months | 5.15% |

9 Months | 4.90% |

12 Months | 4.80% |

11 Months – No Penalty | 0.25% |

18 Months | 4.50% |

24 Months | 4.20% |

36 Months | 4.15% |

48 Months | 4.00% |

60 Months | 4.00% |

Established in 2003, Synchrony Bank operates entirely online. Over the years, it has built a strong reputation for offering competitive rates on savings accounts, CDs, and money market accounts. While the bank provides a range of credit cards, it currently does not offer checking accounts.

Marcus

APY Range

Minimum Deposit

Terms

Fees

Marcus, a financial institution under Goldman Sachs, boasts a diverse array of products, particularly offering CDs with a wide range of terms. Amidst the multitude of online banks, Marcus stands out by providing some of the most competitive CD rates in the market.

Even if you choose the option of lower-rate no penalty CDs, you can still anticipate higher rates compared to what traditional banks offer.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

6 Months | 4.80% | 90 days interest |

9 Months | 4.90% | 90 days interest |

12 Months | 4.90% | 180 days interest |

13 Months – No Penalty | 4.15% | / |

18 Months | 4.60% | 180 days interest |

24 Months | 4.90% | 180 days interest |

36 Months | 4.15% | 180 days interest |

48 Months | 4.05% | 180 days interest |

60 Months | 4.00% | 180 days interest |

72 Months | 3.90% | 270 days interest |

As an exclusively online institution, Marcus does not have physical branches. However, you can conveniently access their customer support team through various channels such as online platforms, their dedicated app, or by phone.

Opening a CD with Marcus is a quick process that can be completed within minutes, and should you encounter any difficulties, their customer contact team is available seven days a week to assist you.

CIT Bank

APY Range

Minimum Deposit

Terms

Fees

CIT Bank stands out from other financial institutions by offering a diverse range of CD options tailored to meet your specific needs and preferences.

With CIT, you can choose from various types of CDs, including term CDs, no penalty CDs, Jumbo CDs designed for those looking to invest a substantial amount, and Ramp Up CDs exclusively available to existing customers.

CD Term | APY |

|---|---|

6 Months | 3.00% |

11 Months – No Penalty | 3.50% |

13 Months | 3.50% |

18 Months | 3.00% |

36 Months | 0.40% |

48 Months | 0.50% |

60 Months | 0.50% |

It's worth noting that CIT Bank operates as a division of First Citizens Bank, which boasts a rich and esteemed banking heritage tracing back to 1898. However, CIT Bank differentiates itself by being a fully online bank, eliminating the need for physical branches while still providing comprehensive banking services.

Capital One

APY Range

Minimum Deposit

Terms

Fees

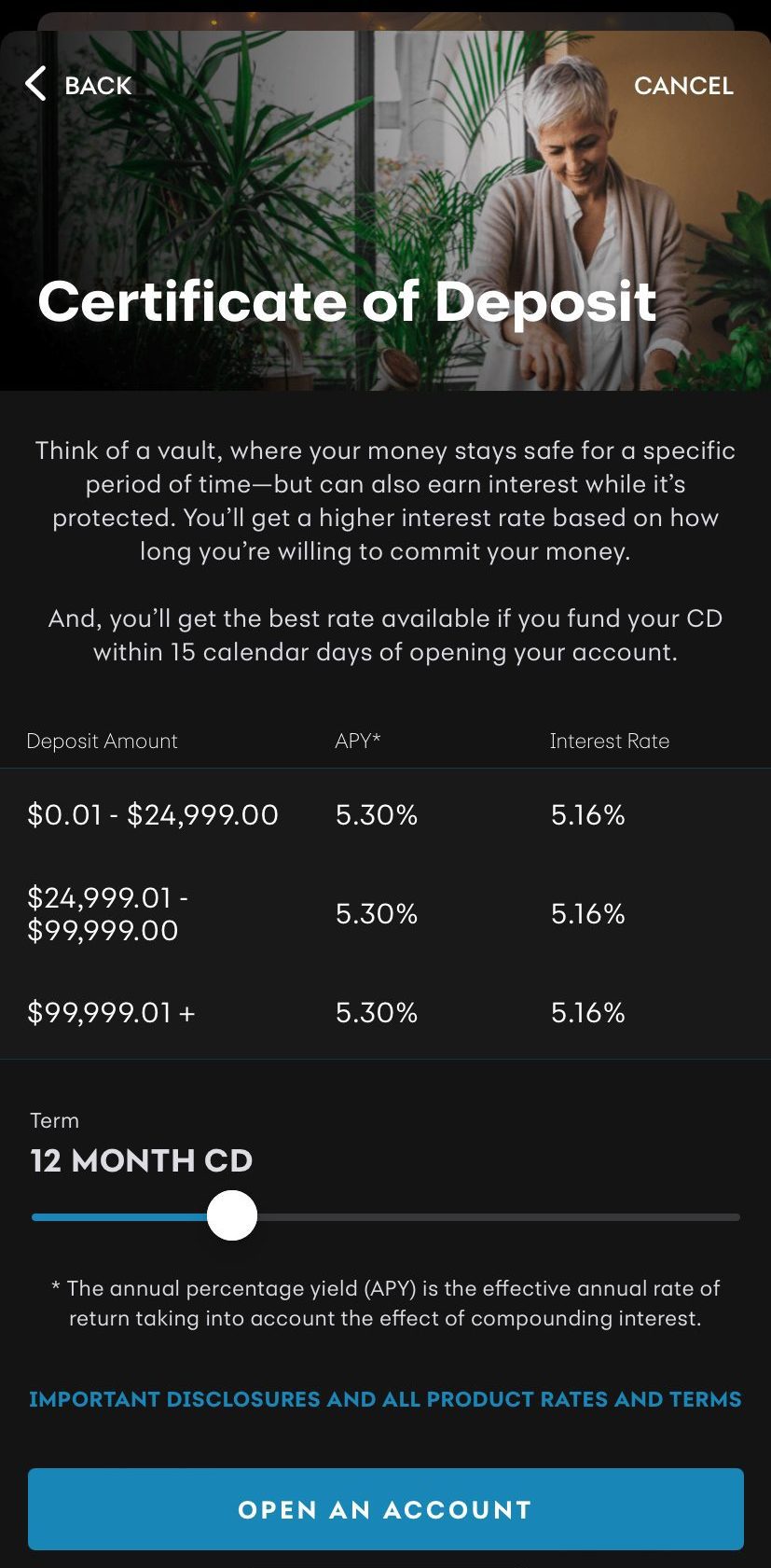

Capital One 360 provides a variety of CDs with durations ranging from 6 to 60 months. Like many other certificates of deposit options, the interest rate offered by Capital One 360 increases as the CD's term lengthens. Opening Capital One CD account is quick and easy.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

6 Months | 4.35% | 3 months interest |

9 Months | 4.35% | 3 months interest |

12 Months | 4.90% | 3 months interest |

18 Months | 4.50%

| 6 months interest |

24 Months | 4.20% | 6 months interest |

30 Months | 4.10% | 6 months interest |

36 Months | 4.10% | 6 months interest |

48 Months | 4.05% | 6 months interest |

60 Months | 4.00% | 6 months interest |

Capital One, a renowned credit card issuer, extends its services to online banking and Capital One Cafés. When it comes to early withdrawals from your CD, Capital One 360 imposes a comparatively low penalty, distinguishing itself from other banks. This means that if you opt to withdraw funds from your CD before its maturity date, you will face minimal charges.

Live Oak Bank

APY Range

Minimum Deposit

Terms

Fees

The Live Oak Bank offers a range of CD rates that vary depending on the term. Although the rates for most terms are not particularly high, we have included Live Oak Bank in our list because their rates for six-month and one-year CDs are higher compared to many other banks featured on this page.

It's important to note that regardless of the CD term, there is a minimum deposit requirement of $2,500, which must be met upon maturity.

CD Term | APY |

|---|---|

6 Months | 4.80% |

12 Months | 5.00% |

18 Months | 4.75% |

24 Months | 2.00% |

36 Months | 2.00% |

48 Months | 2.00% |

60 Months | 2.00% |

Operating since 2008, Live Oak Bank is a fully online financial institution that specializes in business checking and other business financial products. While their product line may not be extensive, they are known as one of the leading providers of small business loans in the United States.

Sign Up for

Our Newsletter

How To Choose A CD From An Online Bank?

When choosing a CD from an online bank, there are several factors to consider. Besides factors such as interest rate, terms and minimum deposit, here are some key factors to help guide your decision:

- Bank Reputation and Financial Stability: Research the reputation and financial stability of the online bank. Look for well-established banks with a solid track record. Consider factors such as customer reviews, ratings, and the bank's financial health. According to our savings and banking trends survey, choosing a reputable bank is one of the most important things for customers.

- Customer Service: Assess the quality of customer service provided by the online bank. Prompt and reliable customer service can be crucial when you have questions or need assistance. Look for banks that offer multiple channels of communication and responsive customer support

- Account Accessibility and Online Platform: Evaluate the online bank's user interface and account accessibility. A user-friendly online platform makes it easy to manage your CD and track your earnings. Ensure that the bank's website or mobile app provides the features and functionality you need.

- Additional Banking Services: Consider whether the online bank offers other banking services that align with your needs. If you require additional accounts or services, such as checking accounts or savings accounts, it may be convenient to have them with the same online bank.

- Early Withdrawal Penalties: It is important to comprehend the penalties that apply in case you need to withdraw funds from the CD before its maturity date. These penalties can diminish your earnings or, in some cases, even lead to a loss of the initial investment amount. It is crucial to be fully aware of these penalties and carefully consider the possibility of requiring access to your funds before the CD reaches its maturity date.

FAQs

Can I open an online bank CD if I don't have a bank account?

Yes, on most online banks you can open an online bank CD even if you don't have an existing bank account with that particular bank.

Are online bank CDs safe?

Online bank CDs are generally safe as long as you choose a reputable and FDIC-insured bank. FDIC insurance covers deposits up to $250,000 per depositor, per bank.

What are the advantages of choosing an online bank CD?

Online bank CDs often offer higher interest rates compared to traditional brick-and-mortar banks. They also provide the convenience of managing your account and tracking your earnings online.

How can I find the best online bank CDs?

To find the best online bank CDs, compare interest rates, terms, minimum deposit requirements, and any associated fees. Consider factors such as the bank's reputation, customer reviews, and additional banking services offered.